Bitcoin and Equities: When the Correlation Breaks and Each Market Goes Its Own Way

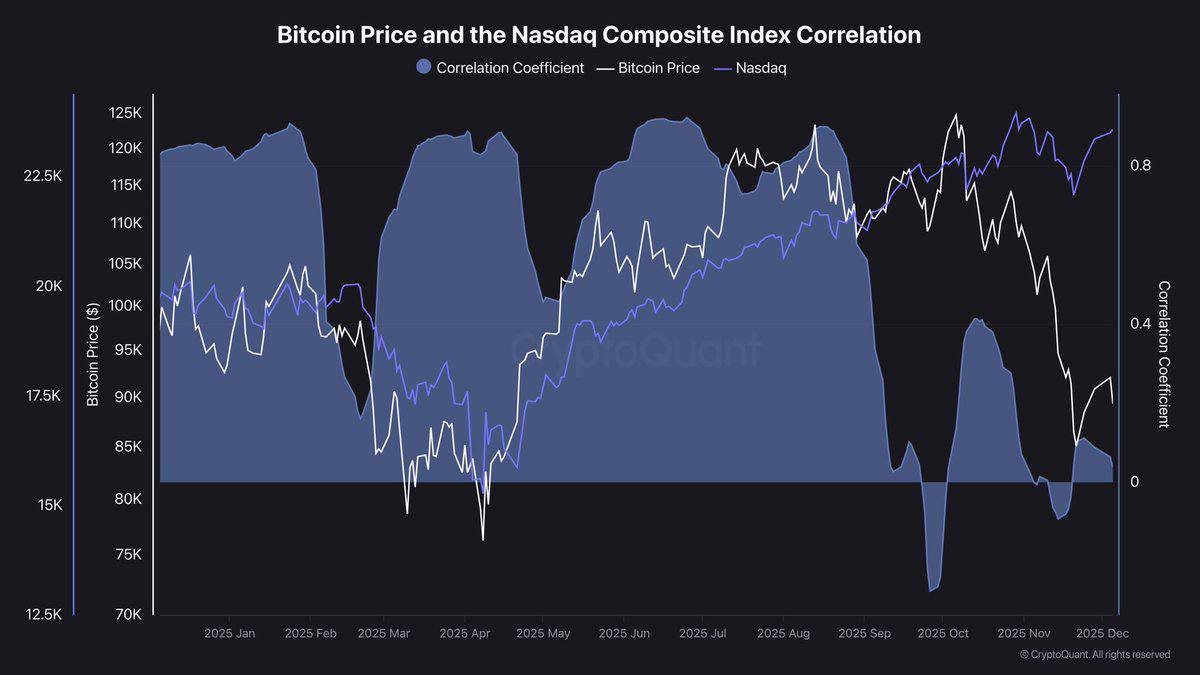

For a long stretch of the past decade, Bitcoin and major equity indices behaved like risk assets marching to the same drumbeat. When the S&P 500 or Nasdaq rallied, Bitcoin often followed; when stocks sold off, Bitcoin usually joined the move. That loose but visible relationship helped shape the narrative that Bitcoin was simply another high-beta expression of global risk appetite.

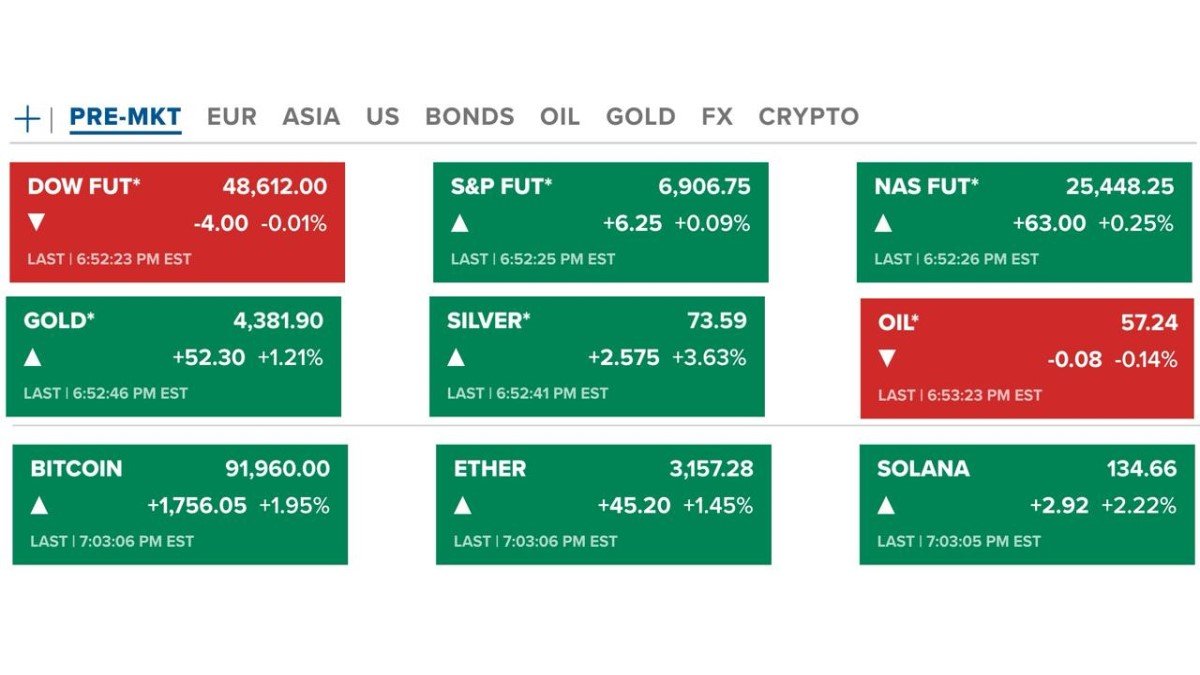

Today, that picture looks very different. While large stock indices are pushing toward or near new all-time highs, Bitcoin has already endured a drawdown of roughly one third from its peak and is still struggling to regain sustainable upward momentum. In other words, traditional equities are celebrating, while Bitcoin is working through a difficult phase of its own cycle.

This decoupling raises uncomfortable but important questions: Is Bitcoin still just a leveraged play on the stock market? Has it started to follow its own structural cycle? And most importantly for investors: what does it mean when “stocks up” no longer automatically translates to “Bitcoin up”?

In this article, we explore what it means when Bitcoin and equities go their separate ways, why the correlation can break down for long periods, and how to approach this divergence with a calm, analytical mindset instead of simple assumptions.

1. From close companions to “different paths”

For much of the post-2020 period, Bitcoin and US equities displayed a surprisingly tight relationship. Several factors contributed to this:

- Global liquidity was abundant, with policy rates near zero and central banks expanding their balance sheets.

- Both tech stocks and digital assets benefited from the same narrative: a search for growth and a willingness to pay up for future potential.

- Many investors treated Bitcoin as a high-volatility satellite play inside an equity-centric portfolio, rebalancing between the two as risk appetite changed.

In that environment, it made sense that Bitcoin would often move in the same direction as growth stocks. When money was flowing into speculative technology names, it tended to spill over into crypto as well.

Today, however, the picture is far more asymmetric. Equity indices are being driven by large, profitable companies with clear cash flows, especially those tied to themes such as artificial intelligence and cloud infrastructure. Bitcoin, by contrast, is digesting a prior rally, facing profit-taking pressure and a more cautious flow environment. The result is an unusual situation: traditional equities are near the top of their range, while Bitcoin sits much closer to the lower end of its recent trajectory.

2. Why the “lockstep” correlation broke down

The fact that Bitcoin and stocks moved together in the past does not guarantee they will do so in every regime. Correlation is not a permanent feature; it is the outcome of how different groups of investors position, how they are funded, and which risks dominate at a given time.

Several structural shifts help explain the current divergence:

2.1. Different buyer bases and different narratives

The equity rally is increasingly concentrated in a handful of very large companies with strong earnings, substantial buyback programs, and direct exposure to AI and digital infrastructure. These names attract capital from pensions, mutual funds, and systematic equity strategies that operate within well-defined mandates.

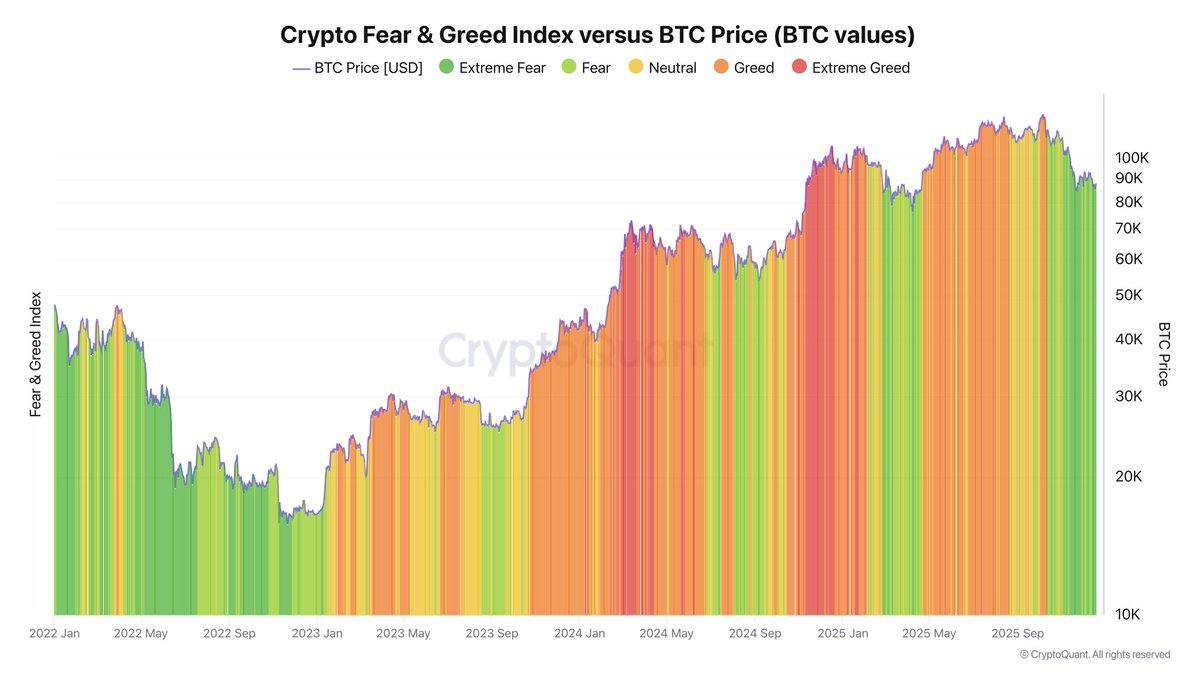

Bitcoin’s investor base is more fragmented. It includes long-term holders with multi-year horizons, exchange-traded products, trading firms, and a smaller but vocal group of individual participants. Their behavior is influenced not only by macro conditions, but also by on-chain metrics, halving cycles, and the psychology of prior drawdowns.

When the main story in equities is earnings growth and productivity, while Bitcoin’s story is about digestion of earlier gains, position unwinds, and the pace of new capital entering the ecosystem, it is not surprising that the two assets no longer move in perfect alignment.

2.2. Liquidity channels are not identical

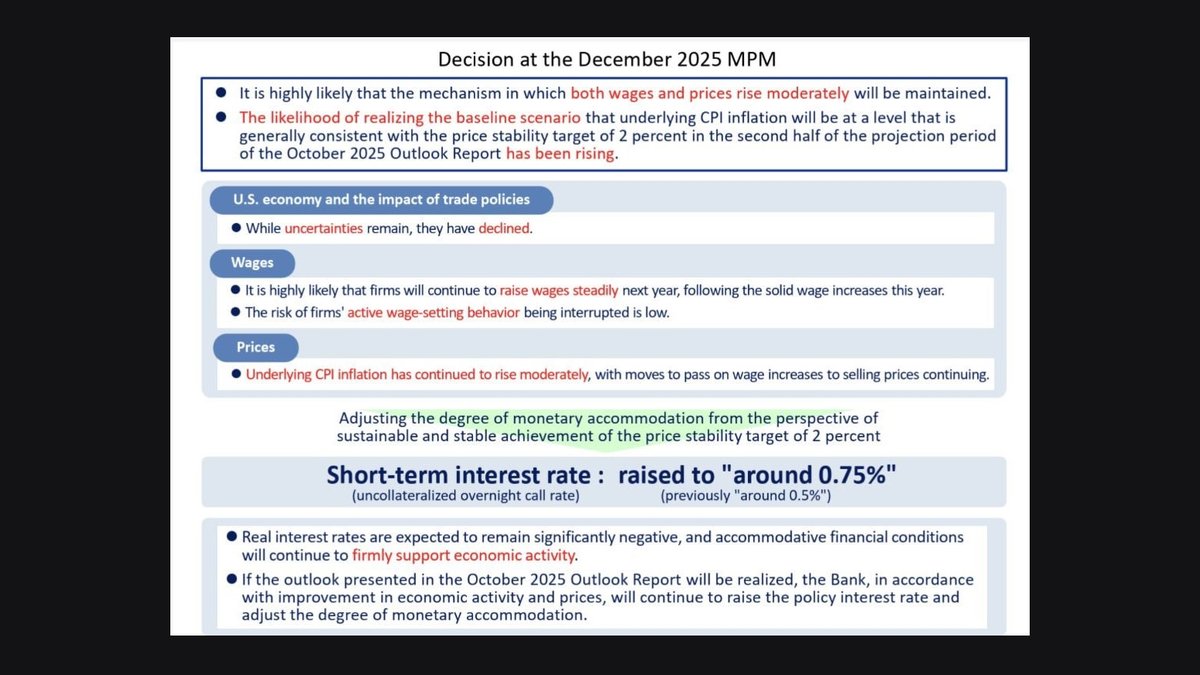

In previous cycles, both equities and Bitcoin were highly sensitive to broad liquidity conditions: changes in policy rates, quantitative easing or tightening, and the cost of leverage. While those forces still matter, their transmission is no longer symmetric.

Capital flowing into large equity funds, retirement accounts, and AI-themed vehicles does not automatically translate into additional demand for Bitcoin. Many of these investors operate under mandates that restrict their exposure to digital assets or require separate approvals. At the same time, some of the speculative capital that used to move quickly between tech stocks and Bitcoin is less active after experiencing large drawdowns in prior cycles.

The net effect is that liquidity conditions can now support equities more directly than they support Bitcoin, even when both are part of the broad “risk asset” universe.

2.3. Bitcoin’s own cycle is not synchronized with the business cycle

Bitcoin has always had a structural rhythm driven by its supply schedule, investor behavior, and the delayed reaction of broader markets. Its halving events, adoption milestones, and the entrance of new types of products or institutions can all create distinct phases that do not line up neatly with the traditional business cycle.

It is possible, for example, for equities to be in a late-cycle expansion, buoyed by strong earnings and optimistic growth forecasts, while Bitcoin is in the consolidation phase that often follows a prior surge. In that situation, a portfolio built on the assumption that Bitcoin will mirror the equity index can experience surprises in both directions.

3. The “phase mismatch”: stocks at highs, Bitcoin in a drawdown

Summarizing the current setup in simple terms:

- Equities are elevated: Major indices are trading close to their all-time highs, supported by solid earnings, productivity optimism, and large-scale capital flows into index products.

- Bitcoin is in a corrective phase: After a strong prior advance, the asset has declined by roughly one third from its peak and is working through a mix of profit-taking, position adjustment, and more cautious funding conditions.

From a distance, the chart looks like a pair of lines moving in opposite directions: one drifting upward, the other leaning downward. For some observers, that naturally triggers the idea of a future “catch-up trade” where Bitcoin will suddenly align with equities and race higher. The problem is that markets are not obligated to deliver this symmetry.

There are several scenarios in which equities could continue to grind higher while Bitcoin remains range-bound, or in which Bitcoin recovers even as equities pause. Assuming that one must copy the other is a shortcut that can lead to misplaced expectations and poorly timed decisions.

4. Why “stocks up, Bitcoin up” is a dangerous shortcut

The idea that rising equity markets should automatically lift Bitcoin is appealing because it simplifies a complex system into a single rule. Unfortunately, it also hides important differences:

• Different valuation frameworks: Equities are anchored, at least loosely, by earnings, dividends, and cash flows. Even when valuations stretch, there are reference points. Bitcoin, by design, does not produce cash flow; its value is inferred from scarcity, adoption, and its role in portfolios. That means the drivers of demand can diverge from those that support stocks.

• Different risk clusters: Risk models increasingly treat Bitcoin as its own bucket rather than as just a sub-component of equity risk. When institutions adjust their exposures, they may reduce or increase Bitcoin independently of what they do with stocks.

• Different regulatory and product paths: Equities trade in a mature, deeply regulated environment with a long history of standards. Bitcoin is still integrating with that system through exchange-traded products, custody arrangements, and evolving rules. This integration does not happen in lockstep with earnings seasons or stock market rotations.

For these reasons, using equity strength as a direct signal to increase or decrease Bitcoin exposure can be misleading. It ignores the possibility that Bitcoin is following its own, slower-moving structural story even while stock indices print new highs.

5. What this decoupling could mean for investors

The divergence between Bitcoin and equities does not automatically mean something is “wrong” with either market. Instead, it suggests that the relationship between them is more conditional than many narratives implied. Several implications follow.

5.1. Correlation is a moving target, not a law of nature

Historical data can show periods where Bitcoin and stocks moved together, but those windows are shaped by specific conditions: shared macro shocks, synchronized responses to liquidity, and overlapping investor bases. As those conditions change, so does the correlation.

For portfolio construction, this means it is risky to rely on a single correlation estimate derived from a narrow time period. A better approach is to consider multiple environments—crisis, recovery, expansion, tightening—and ask how Bitcoin behaved in each. That exercise often reveals that the asset sometimes amplifies equity risk, sometimes diversifies it, and sometimes follows its own path entirely.

5.2. Diversification is real, but not always comfortable

One of the reasons investors add uncorrelated or partially correlated assets to a portfolio is to reduce overall volatility and concentration risk. However, true diversification also means accepting that not all holdings will perform well at the same time. When equities are strong and Bitcoin is consolidating, or the other way around, the portfolio may feel “laggy” compared to whichever asset is currently leading.

From a long-term perspective, that is exactly the point: diversified portfolios sacrifice some upside in the best-performing asset in exchange for a smoother journey across cycles. The current divergence is a reminder that diversification is not free; it requires psychological tolerance for periods where certain allocations are out of favor.

5.3. Bitcoin’s independent cycle cuts both ways

When Bitcoin rises faster than stocks, its unique cycle is celebrated. When it stalls while equities climb, the same independence can feel frustrating. The key is to recognize that a separate cycle can create both opportunity and discomfort:

- If Bitcoin eventually benefits from a different set of catalysts—such as changes in regulation, broader adoption, or a shift in how institutions treat it as collateral—it may outperform during periods when equities are less exciting.

- If those catalysts arrive later than expected, Bitcoin may remain in a prolonged consolidation even as stocks advance, testing the patience of holders who assumed a quicker alignment.

In both directions, the core message is the same: an asset with its own structural drivers will not always mirror the rest of the portfolio.

6. A framework for thinking about the current environment

Rather than asking whether Bitcoin “should” follow equities higher, it can be more helpful to ask a series of structured questions about the present divergence:

• Positioning: Who currently holds Bitcoin—short-term traders, long-term holders, or a mix—and how stressed are their positions at recent prices?

• Flows: Are new inflows from products such as exchange-traded vehicles growing, stable, or slowing relative to prior months?

• Macro sensitivity: Is the main story for equities about earnings and productivity, while the main story for Bitcoin is about internal factors such as prior profits being realized or on-chain indicators of fatigue?

• Time horizon: Over what time frame is the divergence being judged—a few weeks, a quarter, or a full halving cycle?

Answering these questions does not produce a simple buy/sell signal, but it does shift the conversation from expectation (“Bitcoin must catch up”) to analysis (“what is actually driving each market right now?”). That shift is more in line with a professional, risk-aware approach.

7. Practical considerations for portfolio builders

For investors who include both equities and Bitcoin in a diversified portfolio, the current phase suggests several practical considerations:

• Avoid anchoring on a single relationship: Do not assume that because Bitcoin and stocks moved together in one period, they will always behave that way. Design risk limits that withstand multiple correlation regimes.

• Define the role of Bitcoin clearly: Is it intended as a long-term store of value candidate, a high-volatility satellite, or an optional exposure to a new asset class? The answer influences how patient you can be during divergences.

• Rebalance with rules, not impulses: If you use fixed allocation bands (for example, 5–10% of portfolio in digital assets), then both sharp rallies and deep drawdowns can trigger disciplined rebalancing instead of reactive decisions.

• Stress test for multiple scenarios: Consider outcomes where equities remain strong while Bitcoin lags, and vice versa. A resilient plan does not depend on a single scenario materializing.

8. Conclusion: Bitcoin and equities are learning to walk on separate paths

The recent divergence between Bitcoin and major stock indices is not just a curiosity on a chart. It is a real-time reminder that correlations evolve, cycles can desynchronize, and simple rules of thumb such as “stocks up means Bitcoin up” are not reliable guides for serious decision-making.

Equities are currently driven by earnings, productivity stories, and large pools of institutional capital following established benchmarks. Bitcoin is navigating its own phase: absorbing earlier gains, responding to the pace of new inflows, and being repriced as investors reassess its role in portfolios after several volatile years.

For thoughtful investors, the key takeaway is not to abandon either market, but to treat them as distinct risk streams that sometimes overlap and sometimes diverge. That requires clearer goals, stronger risk management, and a willingness to accept that diversification will occasionally feel uncomfortable.

In short: the fact that Bitcoin and equities are no longer moving in perfect lockstep does not invalidate either asset. It simply confirms that Bitcoin is now important enough—and independent enough—to be analyzed on its own terms instead of being seen only as the shadow of the stock market.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or trading advice. Digital assets and equities can be volatile and may involve a high degree of risk, including the possible loss of principal. Always conduct your own research and consider consulting a qualified financial professional before making investment decisions.