El Salvador’s “All-In” Bitcoin & AI 2026: A National Strategy Built on Two Very Different Kinds of Compounding

El Salvador is entering 2026 with a slogan that sounds like market talk—“all-in” on Bitcoin and AI—but behaves more like statecraft. The country is not merely repeating its 2021 shockwave (Bitcoin legal tender); it’s trying to turn that moment into a durable national narrative: Bitcoin as a reserve-like asset and AI as a productivity engine. The interesting question is not whether the message is bold. It’s whether the system behind the message can survive stress.

Most coverage will treat this as a single story: a small nation doubling down on two frontier technologies. But these are actually two separate bets with different clocks, different failure modes, and different ways of compounding. Bitcoin compounds as credibility (or controversy) around a treasury strategy; AI compounds as human capital if it’s deployed responsibly in education. If El Salvador is serious, the win condition is not a price chart. It’s a feedback loop where better skills improve economic resilience, which makes volatility easier to tolerate, which makes long-term strategy easier to maintain.

The “All-In” Message Is a Governance Tool, Not a Trading Signal

The phrase “all-in” is emotionally loaded because it belongs to poker tables and bull markets. In public policy, it functions differently: it’s a commitment device. When a government signals that a strategy is long-term and not price-chasing, it’s trying to shape expectations for citizens, investors, and institutions. El Salvador’s 2026 framing—Bitcoin + AI as strategic pillars—reads like an attempt to lock the country into a multi-year identity, not a quarter-to-quarter experiment.

There’s a subtle but important distinction here. A government can be “all-in” rhetorically while still operating with constraints in practice. In fact, that tension can be deliberate. A loud narrative attracts attention and aligns internal teams; a quieter operational posture manages downside. The gap between the slogan and the implementation is where credibility is earned or lost—because governance is ultimately judged by outcomes and guardrails, not slogans.

• Narrative as infrastructure: A clear national story can reduce policy whiplash. It also creates a reference point for ministries, regulators, and partners: “this is what we are building toward,” even if the rollout is incremental.

• Signaling to builders: Tech communities follow momentum. Declaring a long-horizon focus is a way to recruit entrepreneurs, educators, and infrastructure partners who prefer predictable direction over short-term incentives.

• A test of institutional maturity: “All-in” language forces the country to answer hard questions about governance, transparency, and public benefit. If those answers don’t arrive, the narrative can backfire by amplifying scrutiny.

The takeaway is simple: interpret the message as a governance instrument. It aims to coordinate behavior inside and outside the country. Whether that coordination becomes durable depends on how well El Salvador pairs ambition with operational restraint.

A Bitcoin Treasury Is Less About Conviction—and More About Risk Accounting

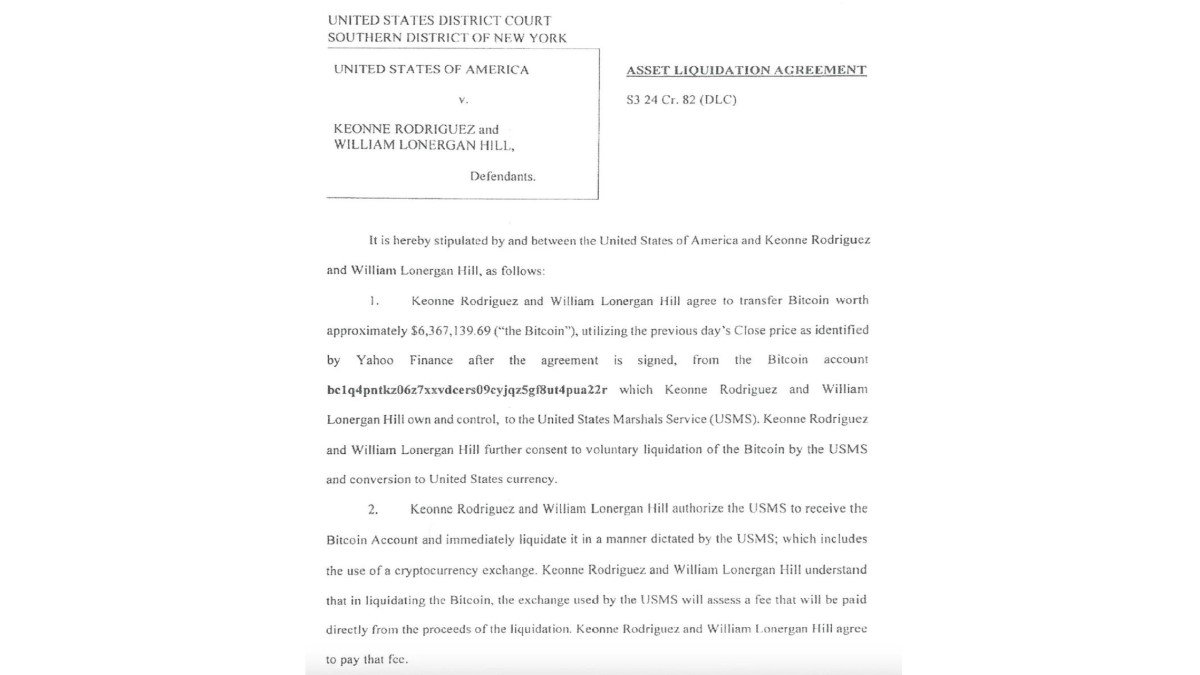

El Salvador has continued accumulating Bitcoin since 2021, including through difficult market periods. By late 2025, multiple reports cited holdings around the 7,500 BTC range—figures commonly associated with official tracking and public commentary. The number itself will fluctuate based on purchases and reporting cadence, but the policy posture is consistent: treat Bitcoin as a strategic reserve-style asset and accept volatility as an operating condition rather than a policy failure.

That framing is unusual in sovereign finance, where volatility is typically something to minimize, not absorb. But it’s not inherently irrational. The more precise question is whether the country has built the institutional machinery required for volatile assets: custody procedures, disclosure norms, budget separation, and clear rules for when (if ever) reserves are used. Without those, a reserve strategy can drift into a political symbol rather than a managed financial posture.

• Transparency as an asset: Reuters reported El Salvador planned to spread reserves across multiple addresses and publish a dashboard of combined balances, explicitly positioning transparency as part of the policy design. That is a meaningful step because it treats public trust as a measurable input, not a PR afterthought.

• Custody is policy: Splitting holdings across addresses sounds technical, but it’s governance. It reduces single-point risk and signals that the state is treating digital asset management like real treasury infrastructure.

• Volatility needs boundaries: A sovereign can “accept volatility,” but budgets still need rules. If reserves and fiscal operations blur, volatility stops being an operational risk and becomes a social risk.

If El Salvador wants its Bitcoin posture to look like strategy rather than spectacle, the next level is not buying more. It’s publishing clearer principles about custody, reporting frequency, and the relationship between reserves and public finance—so the country’s risk tolerance becomes legible.

The IMF Relationship Shows the Difference Between “Owning Bitcoin” and “Being Governable”

One of the most revealing elements of El Salvador’s path is how it has navigated institutional pressure. Reuters reported that, following the IMF’s approval of a multi-year program, El Salvador adjusted Bitcoin’s functional role: acceptance became voluntary and Bitcoin could not be used to pay taxes—changes that softened the original legal-tender mechanics. This is not a dramatic retreat; it’s a reconfiguration that keeps the symbol while adjusting the mandates.

That’s why the IMF angle matters more than headline conflict. It forces a distinction between exposure and governance. The IMF has emphasized limits around public-sector accumulation and clarity about how Bitcoin activity affects state balance-sheet risk. El Salvador, meanwhile, appears to be arguing that it can maintain a strategic reserve while still fitting within program conditions. The tension is less ideological than accounting-based: who carries the exposure, and how is it measured?

• Guardrails can be stabilizing: An IMF program can impose discipline that markets recognize. Even critics of conditionality admit that clear constraints often reduce uncertainty around fiscal direction.

• Policy symbolism is not policy utility: Keeping Bitcoin as a national symbol is one thing; designing it to improve payments, remittances, or financial access is another. The IMF pressure indirectly tests whether El Salvador’s Bitcoin approach has practical deliverables.

• Legibility is the real battleground: When institutions ask “what is your exposure,” they’re asking whether the country can be modeled, audited, and trusted. A strategy that cannot be measured cannot be defended for long.

In a strange way, the IMF constraint might strengthen El Salvador’s story—if it leads to better disclosure and clearer boundaries. The country doesn’t need universal applause. It needs a framework that can withstand skeptical audits.

Why Pair Bitcoin With AI? Because Reserves Don’t Create Skills—But Skills Can Justify Reserves

Bitcoin and AI are often lumped together as “tech-forward.” That’s superficial. The more interesting connection is that they represent two different kinds of national compounding. Bitcoin is a balance-sheet narrative: it can differentiate the country, attract attention, and potentially diversify reserves—while adding volatility. AI in education is a human-capital narrative: it aims to raise productivity, earnings potential, and institutional capability over time.

El Salvador’s AI push is not theoretical. AP reported a partnership involving AI tutoring across thousands of public schools and personalized learning for a very large student population. The Salvadoran government’s own communications similarly described a nationwide rollout approach over the next two years. If implemented responsibly, this is a different class of initiative than “AI pilots” seen elsewhere—it’s an attempt to operationalize AI at national scale, where the risks (privacy, quality, oversight) are as real as the potential benefits.

• Education is the highest-leverage “infrastructure”: Roads and ports move goods; education moves capability. If AI tutoring genuinely improves learning outcomes, it can create resilience that makes any volatile treasury strategy easier to defend socially.

• Teachers must be partners, not replacements: Personalized tutoring can amplify good teaching, but only if teacher training, curriculum alignment, and classroom governance are treated as first-order work—not bolt-ons.

• Safety and evaluation are non-negotiable: Large-scale AI deployment needs rigorous monitoring, content safeguards, and independent assessment. Without that, the program risks becoming a political trophy rather than an educational upgrade.

This is where El Salvador’s combined strategy becomes coherent. Bitcoin might be the headline, but AI education could be the foundation. If AI initiatives raise human capital, the country’s “all-in” identity becomes less about a controversial asset and more about national competitiveness.

What Could Work—and What Could Break—In 2026

El Salvador is trying to do something difficult: turn global attention into domestic capability. That requires more than optimism. It requires execution quality under constraints—budget limits, institutional scrutiny, and the messy realities of deploying technology in public systems. The path forward is not binary (success or failure). It’s a spectrum of outcomes driven by implementation details that don’t fit cleanly in headlines.

To assess the strategy without hype, it helps to watch for practical signals rather than slogans: consistent transparency around reserves, clear educational KPIs, and governance that treats risk management as part of innovation. When a country scales AI and holds volatile assets simultaneously, the real indicator of seriousness is whether it publishes the rules that keep the project safe when things go wrong.

• Best-case scenario: Bitcoin remains a manageable, transparent strategic reserve while AI education measurably improves learning outcomes. The country becomes known less for shock value and more for operational competence.

• Middle scenario: Bitcoin stays symbolic and politically resilient, but AI implementation becomes uneven. The country gains branding benefits but struggles to convert them into broad-based productivity gains.

• Fragility points: Weak disclosure, unclear custody standards, or poor AI governance can trigger trust erosion. In public systems, trust loss compounds faster than technical progress.

The healthiest way to view 2026 is as a year of proof. Not proof that Bitcoin “worked” or AI “worked,” but proof that a state can run frontier technologies with adult supervision: transparency, measurement, and accountability.

Conclusion

El Salvador’s “all-in” Bitcoin & AI message is compelling because it tries to fuse two timelines: the immediacy of market narratives and the patience of human-capital building. Bitcoin can attract attention and signal differentiation, but it also imports volatility into the national story. AI in education can build capability, but only if it’s governed carefully and evaluated honestly.

If the country succeeds, it won’t be because it held Bitcoin through drawdowns or deployed chatbots in classrooms. It will be because it learned to operate like a long-horizon system: clear boundaries, transparent reporting, and public outcomes that justify the risk. That’s the rarest skill in both crypto and government—and it’s what 2026 will quietly test.

Frequently Asked Questions

Does “all-in” mean El Salvador is taking unlimited risk with Bitcoin?

Not necessarily. Political messaging can be stronger than operational reality. A responsible interpretation focuses on disclosure, custody practices, and budget separation—how the strategy is managed—rather than the intensity of the slogan.

Why would a country hold Bitcoin as a reserve-like asset?

Supporters argue it can diversify national assets, signal innovation, and align with long-horizon beliefs about digital scarcity. Critics point to volatility, governance risk, and opportunity costs. The educational takeaway is that any such strategy needs unusually clear risk boundaries and transparency.

What is the IMF’s role in shaping El Salvador’s Bitcoin policy?

Public reporting indicates IMF program conditions have encouraged changes that reduce mandated Bitcoin usage and clarify public-sector exposure. This pressure can function as a constraint—but also as a forcing mechanism for better reporting and governance.

Can AI tutoring improve education outcomes at national scale?

It can help, especially for personalization and teacher support, but success depends on implementation: teacher training, curriculum alignment, privacy safeguards, and independent evaluation. Without those, large-scale deployments can become inconsistent and hard to measure.