Bitcoin Inflows Are Slowing—But the Market Isn’t “Running Out of Money.” It’s Changing Plumbing.

When a well-followed analyst says “new money into Bitcoin is drying up,” it lands like a punchline: the party is over, the music stops, and the next chapter must be a brutal drawdown. In older cycles, that interpretation often worked because the market had one dominant habit—capital arrived loudly, leveraged quickly, and left through the same narrow door.

But 2026 is not built on that same architecture. Bitcoin may be seeing slower visible inflows while still living inside a more mature system of ownership, custody, and credit. The market didn’t become “safe.” It became different. And when the system changes, the old “money in / money out” dashboard starts lying—not maliciously, but mechanically.

Realized Cap: The Most Honest “Money” Metric—And Why It Still Can Mislead

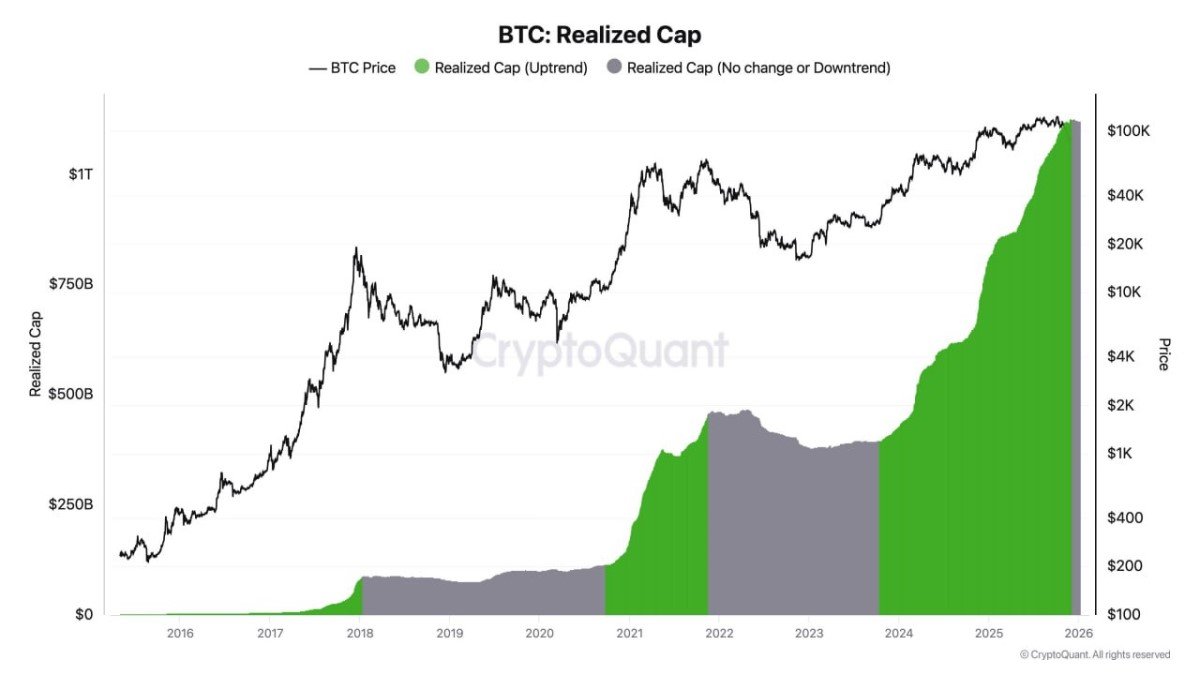

Realized Cap tries to measure Bitcoin’s market value based on the price at which each coin last moved, rather than today’s spot price. In plain English, it’s a proxy for the aggregate cost basis of the network. When Realized Cap trends up, it suggests coins are changing hands at higher prices—capital is being “accepted” by the network, not merely quoted on a screen.

So when Realized Cap momentum slows, it’s reasonable to say: fresh cost-basis expansion is cooling. But that does not automatically translate to “no demand.” It can also mean demand is being routed through channels that don’t immediately show up as simple on-chain accumulation—custodial rebalancing, derivatives exposure, or allocation through wrappers where coins move less frequently.

The Core Shift: Liquidity Is Now Fragmented Across Many Pipes

In earlier cycles, Bitcoin liquidity had a recognizable shape: spot exchange deposits rise, leverage builds, price spikes, then forced selling cascades. Today, capital can enter as ETF buying, as collateral in prime brokerage, as stablecoin credit that later converts into BTC, or as perpetual futures exposure that never requires a large spot transfer on-chain.

This fragmentation makes timing “inflows” harder, and it changes what a stall actually means. A flat-looking inflow gauge can coexist with a market where positioning quietly rotates between venues. In that world, the question isn’t “Is money entering Bitcoin?” but “Which pipe is opening—and which one is silently closing?”

Why the Old Whale-to-Retail Script Breaks When Supply Becomes Sticky

One reason classic bear markets felt so violent is that supply was more available. Large holders could distribute into a thinner market, and a meaningful share of ownership was still reflexively price-sensitive. If big players sold, the path of least resistance was down—especially when retail held the most fragile hands.

In 2026, an increasing share of Bitcoin exposure appears structurally “less sellable” on short notice: long-term custodial allocations, institutional mandates, and corporate-treasury style holdings. When a large holder is constrained—legally, strategically, or reputationally—supply becomes sticky. Sticky supply doesn’t prevent drawdowns, but it can change their shape: fewer free-fall cascades, more grinding consolidations, and more abrupt squeezes when liquidity returns.

Capital Rotation Isn’t Bearish by Default—Sometimes It’s Risk Management

Another point in the commentary is that capital may be rotating into equities, gold, and precious metals. Many investors interpret that as “Bitcoin is losing the spotlight.” Yet rotation can be a sign of portfolio maturity. When macro uncertainty rises, allocators often rebalance toward instruments that behave differently under stress—especially if Bitcoin has already delivered substantial gains earlier in the cycle.

In other words, rotation can be the market exhaling, not collapsing. What matters is whether rotation is orderly (rebalancing) or disorderly (forced selling). Orderly rotation tends to slow Realized Cap growth without breaking the market. Disorderly rotation tends to show up as leverage liquidation, widening spreads, and sudden drops in liquidity depth.

“A -50% Crash Is Unlikely” Is Not the Same as “Downside Is Gone”

The claim that a classic -50% drawdown from ATH is less likely is plausible in a world with stickier supply and more institutional-style ownership. But probability is not protection. Bitcoin can still fall hard if the trigger is liquidity-related rather than belief-related—think sudden funding stress, collateral haircuts, or policy shocks that force deleveraging across venues.

The healthier framing is: the market may be less prone to the same kind of bear season. The new risk is not just panic—it’s plumbing. If the pipes clog (stablecoin credit tightens, basis collapses, options hedging becomes one-way), price can reprice quickly even when long-term holders remain calm.

What to Watch Next (If You Want Signal, Not Noise)

If you’re trying to read 2026’s Bitcoin tape, you need a dashboard built for a multi-venue market. The goal isn’t to predict a date; it’s to detect regime changes—when liquidity stops behaving like a cushion and starts behaving like a trap.

Realized Cap slope: not the absolute level, but whether the rate of cost-basis expansion is accelerating again or rolling over further. A gentle slowdown often implies consolidation; a sharp rollover can imply demand vacuum.

ETF/regulated wrapper flows (where relevant): these can express demand without visible on-chain churn. If price holds while wrapper flows weaken, it can mean supply is tight; if price falls while flows weaken, it can mean liquidity is fading.

Leverage temperature: funding rates, liquidation clusters, and basis behavior often reveal whether the market is climbing on spot demand or on borrowed conviction.

Stablecoin liquidity conditions: in modern crypto, stablecoins are the working capital. When they expand, risk appetite breathes; when they contract, even “strong narratives” can stall.

Conclusion: Bitcoin’s Next Chapter May Be Less Dramatic—and More Technical

Bitcoin doesn’t need nonstop fresh inflows to avoid a historic crash if supply is genuinely stickier and exposure is increasingly institutionalized. But it also doesn’t get a free pass. In 2026, the market is less about retail panic and more about liquidity architecture—where demand expresses itself through fragmented pipes, and where drawdowns are often a story of leverage, collateral, and cross-venue stress.

If you want an edge, don’t obsess over whether “money is coming in.” Ask a more modern question: Where is risk being warehoused right now—and how quickly can it be unwound? That’s how a mature market moves: not by screaming, but by shifting its weight.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment, legal, or tax advice. Nothing herein is a recommendation to buy, sell, or hold any asset. Digital assets are volatile and carry risk, including the risk of total loss.