Crypto market adds over $130 billion in market capitalization today — Here are the hottest headlines for October 4, 2025.

The global cryptocurrency market saw a massive surge today, with over $130 billion added to total market capitalization within 24 hours. Bitcoin, Ethereum, and several major altcoins rallied strongly amid renewed investor confidence and growing institutional inflows. In today’s roundup, we highlight the hottest market trends, top-performing assets, and the key headlines shaping the crypto landscape on October 4, 2025.

• [00:34 AM] JUST IN: Binance Founder CZ meets with Kazakhstan's President to discuss crypto.

• {01:35 AM] JUST IN: $3.6 trillion JPMorgan says Bitcoin is undervalued compared to gold.

• {02:13 AM] JUST IN: $4,500 $ETH

• [02:54 AM] JUST IN: $121,000 Bitcoin

• [03:01 AM] JUST IN: Total spot Bitcoin ETF volume surpasses $5 billion today.

• [03:23 AM] JUST IN: S&P 500 closes at new all-time high of 6,715.

• [03:55 AM] JUST IN: Michael Saylor says 'our journey began with $0.25 billion in Bitcoin.' 'Today, we closed at a new all-time high: $77.4 billion.'

• [04:19 AM] JUST IN: President Trump says he is considering $1,000 - $2,000 stimulus checks for all taxpayers using tariff revenue.

• [05:32 AM] JUST IN: Over $130,000,000,000 added to the crypto market cap today.

• [05:55 AM] JUST IN: $BNB reaches new ATH of $1,100

• [06:45 AM] JUST IN: $4,330,000,000 worth of Bitcoin & Ethereum options expire today.

• [07:32 AM] JUST IN: Coinbase partners with Samsung to offer users access to crypto through Samsung's wallet app.

• [08:05 AM] JUST IN: Russia's largest stock exchange calls on regulators to lift retail Bitcoin trading ban.

• [08:56 AM] JUST IN: $3.5 trillion Goldman Sachs says they are seeing increased 'institutional participation' in Ethereum $ETH.

• [09:32 AM] JUST IN: $122,000 Bitcoin

• [10:12 AM] JUST IN: $100,000,000 worth of Bitcoin & ETH shorts liquidated in the past 60 minutes.

• [10:49 AM] JUST IN: Michael Saylor says 'I hope you kept the Bitcoin.'

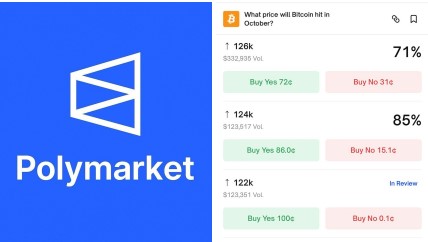

• [11:23 AM] JUST IN: 71% chance Bitcoin hits $126,000 this month, according to crypto prediction platform Polymarket.

• [12:11 PM] JUST IN: El Salvador says its Strategic Bitcoin Reserve is designed to go up 'forever.'

• [12:56 PM] JUST IN: US Treasury plans to mint $1 coins with President Trump's face.

• [13:32 PM] JUST IN: Satoshi Nakomoto now holds over $134,000,000,000 worth of Bitcoin.

• [15:49 PM] BREAKING: Bitcoin reaches new all-time high of $124,200.

• [16:34 PM] JUST IN: $80,000,000 worth of crypto shorts liquidated in the past 60 minutes.

• [17:35 PM] JUST IN: President Nayib Bukele posts El Salvador's Bitcoin reserve, showing $475 million unrealized profit.

• [22:55 PM] BREAKING: Bitcoin reaches new all-time high of $125,000.

• [23:00 PM JUST IN: German government's decision to sell 50,000 Bitcoin at $54k cost them $3.57 billion in missed profits.

• [23:05 PM] JUST IN: Bitcoin surpasses $2.5 trillion market cap.

• [23:56 PM] JUST IN: $4,600 $ETH

• Today’s sharp rebound underscores renewed optimism across the crypto sector. With over $130 billion flowing back into the market, major assets are regaining momentum after recent volatility. Analysts remain cautiously bullish, noting that sustained inflows and positive regulatory signals could pave the way for further gains in the weeks ahead. However, traders are advised to stay alert as short-term corrections remain possible amid shifting macroeconomic conditions.