How Large Bitcoin Holders Selling Call Options Are Quietly Capping the Rally

Bitcoin has pulled back from recent highs even as on-chain data shows strong accumulation and coins leaving exchanges. For many observers, the question is simple: if long-term conviction is so strong, why does price keep stalling every time it approaches key levels? Jeff Park, CIO of Procap, offers one explanation that is gaining traction among derivative traders: a growing group of large Bitcoin holders is systematically selling call options for yield. Instead of waiting passively for price appreciation, they are monetizing volatility — and in doing so, they may be limiting how far and how fast Bitcoin can rise in the short term.

This is not a conspiracy, and it does not mean Bitcoin has lost its long-term potential. It is, however, a reminder that the market is increasingly shaped by option flows and sophisticated risk management rather than only spot demand and supply. Understanding this dynamic is essential for any investor trying to read price action in the current cycle.

1. From pure spot exposure to options-based yield strategies

In earlier cycles, most Bitcoin investors either held their coins in wallets or traded spot on exchanges. Derivatives existed, but participation from long-term holders was limited. Today the landscape looks very different:

- There is a deep, liquid market for Bitcoin options on both centralized venues and institutional platforms.

- Large holders — from funds to corporates to early adopters — are increasingly comfortable using derivatives to manage risk or enhance returns.

- Implied volatility remains high relative to many traditional assets, which makes option premiums attractive for those willing to sell them.

Jeff Park notes that some of these large holders are not primarily seeking explosive upside anymore. They already hold substantial Bitcoin positions and would prefer a steady stream of income over the chance of a dramatic move higher. For them, selling call options against their holdings — a strategy often called a covered call — can be a rational choice.

In a covered call, an investor who owns Bitcoin sells the right, but not the obligation, for someone else to buy their BTC at a predetermined price (the strike) before a certain date (the expiry). In return, the seller collects an upfront premium. If Bitcoin stays below the strike at expiry, the seller keeps both the premium and the coins. If price moves above the strike, the seller's upside is capped: either they must deliver the coins at the strike or buy back the option at a loss.

2. How systematic call selling creates a soft price ceiling

When a few individual traders sell calls, the impact on the market is minimal. But when many large holders do this systematically and at similar strike levels, the combined effect can create a noticeable “ceiling” on price. There are three main mechanisms at work.

2.1. Profit-taking incentives at key strikes

Suppose a cluster of big holders has sold call options with strikes near a round number — for example, 100,000 USD. As Bitcoin's spot price drifts toward that region, these sellers face a clear trade-off:

- If price stays below the strike, they keep their entire BTC stack and the full option premium.

- If price breaks well above the strike, they either have to sell coins at a lower-than-market price or buy back the calls at a loss.

To avoid the second scenario, some may choose to reduce their spot exposure as BTC approaches the strike. In practice, that means selling part of their holdings into strength. Those sales add supply just when short-term traders are getting excited, making it harder for the market to push through resistance.

2.2. Dealer hedging and short gamma effects

A second layer of complexity comes from the firms that stand between buyers and sellers in the options market: market makers and dealers. When they are net short call options (meaning they have sold more calls than they have bought), they often hedge their risk by trading spot or futures. This is called delta hedging.

When Bitcoin price rises and dealers are short calls, their exposure becomes more sensitive to further upside moves. To keep their overall risk in check, they may sell spot or futures as price goes up. This behaviour is sometimes described as being short gamma: rising prices trigger more sell orders from hedgers, and falling prices trigger buy orders.

In an environment where large holders are consistently selling calls, dealers may frequently end up short gamma at popular strike regions. The result is that, near those levels, any attempt by the market to move higher runs into a wall of hedging-driven selling. Price can grind upward, but explosive breakouts become less likely unless the flow regime changes.

2.3. Psychological anchors and self-fulfilling ranges

Options sometimes create psychological anchors for spot markets. Once traders notice that price repeatedly stalls near certain strikes, those levels become self-reinforcing:

- Short-term traders take profits earlier, anticipating resistance.

- New call sellers are encouraged to write options at the same strikes, attracted by rich premiums and recent history.

- Buyers become more cautious about chasing upside just below these levels.

Over time this can form a kind of range box where Bitcoin oscillates between areas of strong demand below and persistent hedging-driven supply above. In such a regime, price action can feel frustrating: macro news improves, on-chain metrics look constructive, but rallies keep failing around the same region.

3. Why large holders choose to sell calls now

If investors are bullish on Bitcoin in the long run, why would they accept capped upside by selling calls? Several structural reasons stand out.

3.1. Transforming volatility into yield

Bitcoin remains a highly volatile asset. Even in relatively calm periods, annualized implied volatility in options markets tends to be far higher than in major stock indices or bond markets. For holders with a multi-year horizon, short-term price noise can feel like a source of opportunity rather than risk.

By selling calls, these investors effectively turn volatility into a recurring yield:

- If Bitcoin trades sideways or rises only modestly, the call positions expire worthless and premiums become realized income.

- If Bitcoin drops, the call premiums can partially offset drawdowns in the underlying holdings.

For funds that report performance quarterly or annually, a visible, repeatable premium income stream can be attractive, especially when traditional fixed income offers moderate yields and clients expect some form of regular return.

3.2. Portfolio and risk management constraints

Institutional investors also operate under risk budgets and mandate constraints. They may have internal rules that limit exposure to extreme outcomes or require them to hedge part of their upside in exchange for income. Selling calls at levels well above current price can satisfy these constraints while still leaving room for a meaningful rally.

In some cases, call-selling programs are automated: a fund might systematically sell out-of-the-money calls every month or quarter against a portion of its holdings. Once such a program is in place, it can continue irrespective of short-term narratives, reinforcing the structural nature of the “ceiling” effect.

3.3. Mature market behaviour

There is also a philosophical shift. Early in Bitcoin's life, many participants approached it almost purely as a growth bet. Today, for some large holders, Bitcoin is starting to behave more like a productive balance-sheet asset. Instead of simply waiting for appreciation, they integrate it into option strategies, lending markets, and structured products. Call selling is one expression of this move from pure speculation to cash-flow generation.

4. The short-term impact: a heavy lid on breakouts

The practical effect of these flows is that Bitcoin can face persistent friction whenever it tries to break higher in the short term. Jeff Park's observation about a soft ceiling captures this well:

- As BTC rises toward key strikes where many calls have been sold, sellers become nervous about being forced to deliver at those levels.

- They may sell spot BTC to reduce risk, especially if implied volatility falls and the options themselves become harder to buy back at favourable prices.

- Dealers hedging their own books may add additional selling pressure through futures or spot, amplifying the effect.

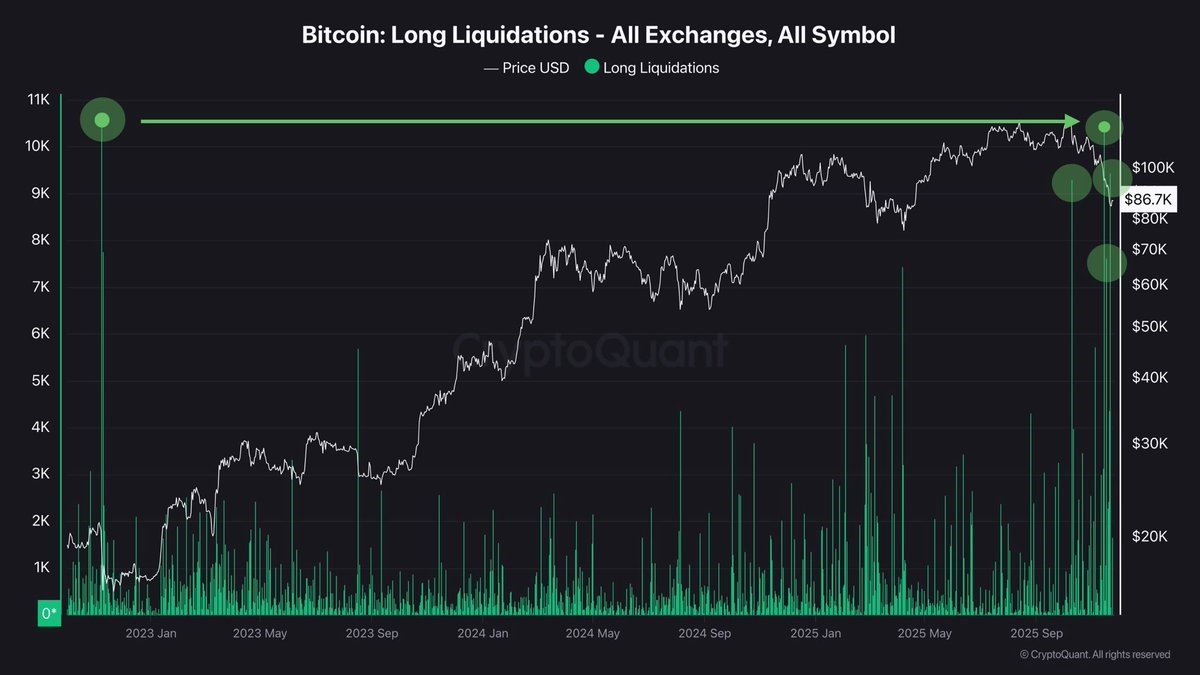

The result is a pattern where sharp pushes higher are followed by equally rapid reversals. From the outside this can look like “mysterious selling” or “hidden resistance,” but in many cases it is simply the mechanical outcome of how option books are managed.

For short-term traders, this environment is challenging. Breakouts fail more often, momentum signals can whipsaw, and it is easy to overestimate the importance of individual news headlines when the main driver is actually positioning.

5. What could break the call-selling ceiling?

Soft ceilings created by call writing are not permanent. Several developments can weaken or reverse them:

• New inflows overpower option flows. If fresh capital — from spot ETF demand, corporate treasury allocation, or macro-driven rotation into Bitcoin — becomes strong enough, it can simply absorb hedging-related selling and push price through the crowded strike zone.

• Shift in implied volatility. A sharp rise in implied volatility can make call selling less attractive or even painful for existing sellers, prompting them to hedge differently or close positions earlier.

• Change in risk appetite of large holders. If long-term holders decide that the next leg higher could be structurally different (for example, due to regulatory clarity or a macro turning point), they may stop selling upside and instead keep full exposure to potential new highs.

• Market repricing of the “fair ceiling.” Over time, once a level has been tested and broken decisively, option strikes migrate upward. New call selling may still occur, but at higher prices, shifting the ceiling further out.

Historically, Bitcoin has gone through extended periods where derivatives positioning appeared to constrain price, only for a powerful impulse — macro or crypto-specific — to reset the range. Understanding this history can help investors avoid assuming that current ceilings are immutable.

6. How individual investors can interpret this environment

For individual market participants, the takeaway is not that Bitcoin has lost its potential. Rather, it is that price action is increasingly shaped by derivative flows that may not be visible on a simple spot chart.

Some practical implications:

• Do not rely solely on equity indices as a guide. Even if stock markets push to new highs, Bitcoin can lag if call selling and hedging flows are heavy around specific levels.

• Be cautious about chasing rallies near crowded strikes. When price approaches well-known psychological levels that are also popular option strikes, there is a higher chance of supply emerging from both holders and dealers.

• Focus on time horizon and risk tolerance. Large holders selling calls often operate with a very different profile from retail participants. Their strategies are designed around multi-year holdings and institutional mandates; copying them without understanding the risks can lead to frustration.

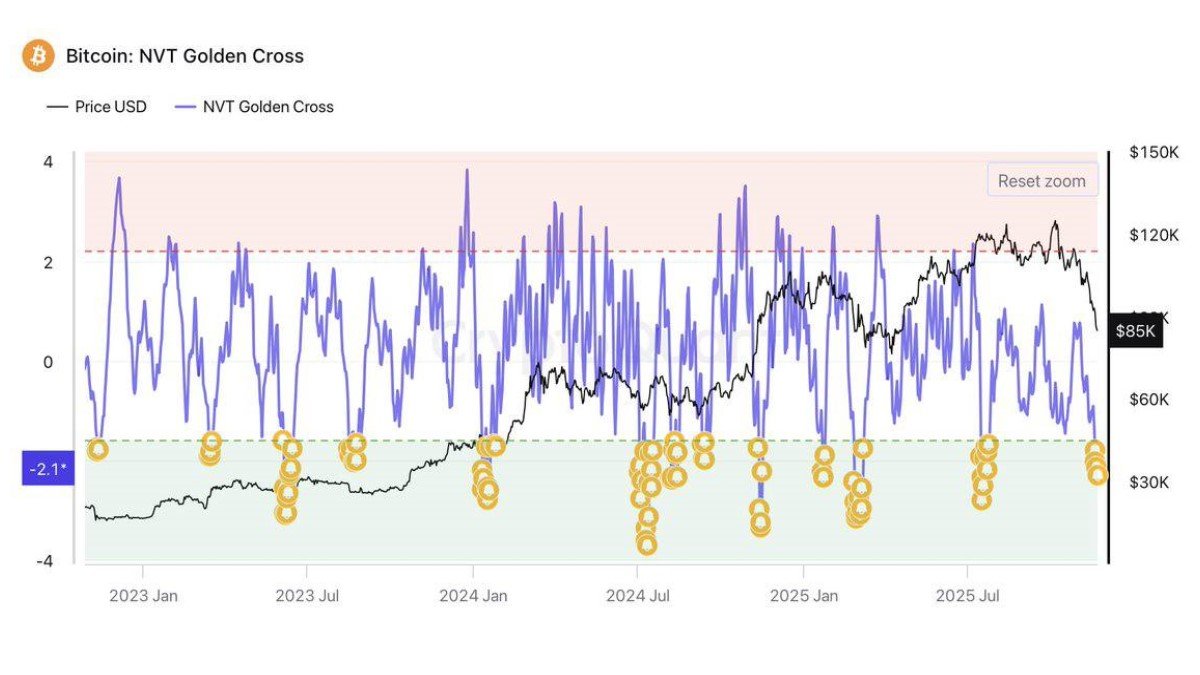

• Treat option activity as one signal among many. On-chain trends, macro policy shifts, ETF flows and stablecoin issuance all interact with derivatives positioning. No single indicator provides the full story.

7. Key takeaways

• Jeff Park points to rising call-selling activity by large Bitcoin holders as a key reason why BTC has struggled to extend recent rallies.

• Systematic call writing can create a soft price ceiling because sellers and dealers hedge by reducing spot exposure when price nears certain strikes.

• This behaviour reflects a broader evolution of Bitcoin from a purely directional bet into a yield-generating asset in institutional portfolios.

• The ceiling is not permanent: powerful new inflows, changes in volatility or shifts in risk appetite can all push the market into a new regime.

• For investors, understanding option flows helps explain why Bitcoin can appear disconnected from traditional equity indices and why some rallies stall without an obvious news trigger.

In short, Bitcoin's long-term story is still being written, but the cast of characters has changed. Alongside miners, retail buyers and long-term believers, there is now a growing class of sophisticated holders who are willing to sell part of the upside for steady income. Their decisions do not determine Bitcoin's destiny, but they do shape the path it takes to get there.

Disclaimer: This article is for educational purposes only and does not constitute financial, investment or legal advice. Derivatives trading involves significant risks and is not suitable for all investors. Always conduct your own research and consult qualified professionals before making investment decisions.