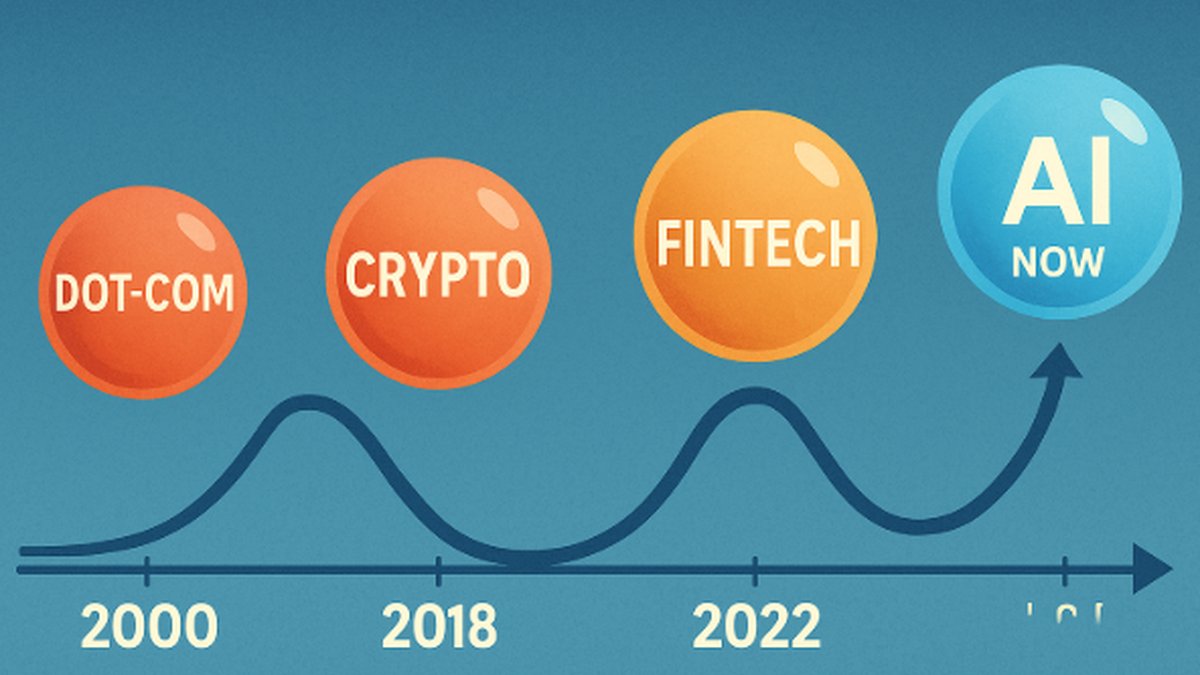

Record AI valuations, mega tie-ups, and thin margins fuel fears of a Dotcom 2.0. Meanwhile, Bitcoin ETFs keep printing historic inflows as investors tilt toward a scarce, rule-based asset. Are we rotating from FOMO to ‘digital gold’?

Markets are euphoric, headlines are breathless, and a familiar debate is back: Are we living through a sequel to the Dotcom bubble? The AI trade has driven major indices to highs, yet defensive flows and margin math are telling a more complicated story. At the same time, Bitcoin ETFs are attracting waves of capital as investors look for a scarce, policy-agnostic asset to hedge against both froth and macro instability. The crosscurrent is real: exuberant Big Tech prints on one side; rising safe-haven behavior on the other.

FOMO or Fundamentals? The AI Flywheel Under the Microscope

Optimists argue we’re finally monetizing AI at scale; skeptics see a closed money loop powering valuations — big checks funding bigger compute purchases in a self-reinforcing circle. The flagship example: Nvidia and OpenAI announced a strategic partnership under which Nvidia will invest up to $100 billion in OpenAI while also supplying the startup with vast new data-center systems — potentially millions of GPUs across at least 10 GW of capacity. The commitment is staggered and tied to deployment milestones, but the circularity is hard to miss: equity support on one flank, product sales on the other. It’s an industrial-scale flywheel that could supercharge both firms — or raise uncomfortable questions if demand expectations slip.

Meanwhile, OpenAI’s long-horizon financials highlight the extraordinary capital intensity of frontier AI. Internal forecasts aired in March signaled the company does not expect to be cash-flow positive until 2029 — even as projected revenue scales from the low double-digit billions in 2025 to a triple-digit run rate by decade’s end. That’s not a red flag by itself; it is a reminder that much of the current AI buildout is a spend-first, harvest-later model.

And margins? They’re thinner than the hype. A recent report based on internal figures suggested Oracle’s AI server rental business booked around $900M in revenue for a quarter with roughly $125M in gross profit — about 14 cents of gross profit per $1 of sales. Even if that unit economics improves with scale and newer platforms, it’s a reality check on the profitability of renting out high-end AI racks today.

Macro Signals: Euphoria Up Top, Hedging Beneath

Index-level gains mask a growing bid for downside insurance. September saw the largest inflows to short-bias ETFs in nearly three years as investors quietly positioned for a pullback — even while the S&P 500 and Nasdaq marched to records on AI enthusiasm. That divergence — prices up, hedges up — is classic late-cycle texture.

Enter Bitcoin: The Scarcity Pivot

Against that backdrop, Bitcoin ETFs have been on a tear. In the week ending October 4, global crypto funds saw a record $5.95B of inflows, with U.S. vehicles leading the charge as BTC pushed to new all-time highs above $125,000. It’s not just retail exuberance; asset allocators are leaning into a simple thesis: if AI equities embed execution risk and duration risk, then a fixed-supply, bearer-style asset offers a different kind of portfolio ballast.

There’s also the hard comp. The debut year for U.S. spot Bitcoin ETFs (2024) banked roughly $36B in net inflows. Several issuers now suggest 2025 could beat that tally, pointing to a sprint of Q4 demand and an expanding shelf of retirement-plan access. Whether that happens is path-dependent — but the intent is visible in their public commentary this week.

Framed this way, the crypto-as-digital-gold narrative is less about price targets and more about design: credible scarcity and a known issuance schedule versus an AI capex cycle whose cost curves, competitive moats, and incremental ROIC are still evolving. Some banks have even floated the possibility that, by 2030, bitcoin could sit on central-bank balance sheets alongside gold — an idea that would have sounded fringe a few years ago.

Are We in a Dotcom 2.0?

History doesn’t repeat; it rhymes. The Dotcom era was marked by equity-funded burn rates, thin or negative operating margins, and a “build it and users will come” mantra. The AI cycle features massive pre-profit investment — but routed through hardware, power, and supply chains as much as through software seats. That makes the failure modes different: flexing capex in data centers and memory/accelerators, or under-earning cloud leasing, rather than banner ads and eyeballs. The result is a market where valuation risk coexists with industrial execution risk — and where a lot needs to go right, quickly, for projected cash flows to arrive on schedule.

But the AI Boom is Not Fiction

Even skeptics concede the demand curve for inference is real. The Nvidia–OpenAI pact lays out an explicit multi-gigawatt roadmap for next-gen clusters; if the software monetization catches up (agents, copilots, verticals), the revenue flywheel could validate today’s capex. Bulls will note that once-in-a-generation platform shifts often look bubble-like until use cases break out of the lab. The risk, of course, is timing: if the harvest phase takes longer than markets have priced, multiples can compress violently.

Why Bitcoin Is the “Other Trade” in an AI Mania

In a world where equity upside increasingly hinges on execution at scale, bitcoin’s proposition is almost quaint: a finite supply, programmatic issuance, and neutrality to any single corporate P&L. That contrast is powering flows. In early October, U.S.-listed spot ETFs drew multi-billion-dollar weekly inflows as BTC printed fresh highs during a U.S. government shutdown — a reminder that macro uncertainty can channel capital toward assets perceived as outside the discretionary policy loop.

Issuers think there’s room to run. Bitwise’s team, among others, has telegraphed confidence that Q4 inflows can eclipse 2024’s annual record, citing a broadening advisor pipeline and expanding platforms that now support spot-crypto allocations in managed accounts. Whether or not they nail the exact number, the direction is clear: the ETF wrapper solved distribution, and investors are using it.

Risk Factors: Why ‘Bitcoin as Lifeboat’ Isn’t Bulletproof

- Volatility & correlation: Bitcoin behaves like a high-beta macro asset in liquidity shocks; it can draw down hard when the dollar rips or real yields jump.

- Policy regime: ETF wrappers lower frictions, but regulatory resets (or delayed approvals in other assets) can sap momentum.

- Positioning froth: If flows front-run narratives, even good news can lead to “sell the fact” air pockets — a lesson from every crypto cycle.

How to Read the Tape from Here

- AI unit economics: Watch reported margins on AI cloud leases (Oracle’s 14% gross margin datapoint is a baseline to beat) and disclosures around capex efficiency per incremental dollar of AI revenue.

- Deal structure & antitrust chatter: Nvidia’s up to $100B OpenAI stake, paid in stages as deployments land, will be a litmus for “circular” capital concerns — and for any regulatory pushback.

- ETF flow velocity: Weekly crypto ETF flows recently hit a record near $6B; sustaining even half that pace would keep a structural bid under BTC into year-end.

Scenarios (Next 1–3 Months)

Base Case — Two-Speed Market

AI leaders keep printing top-line growth but face scrutiny on margins and ROI; hedging stays elevated. Bitcoin grinds higher on ETF demand and macro hedging, with deeper pullbacks bought.

Bull Case — Execution Meets Liquidity

Early AI deployments surprise to the upside; cloud rentability improves; Nvidia/OpenAI milestones hit on time. Risk appetite broadens while BTC benefits from record ETF inflows that surpass the $36B 2024 tally.

Bear Case — Dotcom Echo

Margins disappoint, financing tightens, and short-bias flows accelerate. AI equities de-rate; bitcoin initially sells off with beta, then stabilizes as ‘digital gold’ demand reasserts.

Bottom Line

The AI story is immense — and expensive. Tying up to $100B in supplier-linked investment, pushing data-center buildouts to multi-gigawatt scale, and running negative free cash flow until late decade is a recipe for both breakthroughs and icebergs. That duality is precisely why a parallel trade is emerging: Bitcoin via low-friction ETFs as a finite-supply counterweight to AI’s open-ended capex cycle. If ETF momentum keeps breaking records, the market’s message will be simple: in a world of ambitious promises and circular funding loops, scarcity still sells.