24-Hour Crypto Market Brief: ETF Outflows, Trump’s Genesis Mission, and a New Wave of Token Governance

Over the last 24 hours, the crypto market digested three overlapping stories: (1) another heavy week of outflows from listed crypto investment products, (2) a sharp turn in the macro and policy narrative as President Trump formally launched the AI-focused “Genesis Mission” and Fed officials leaned more openly toward rate cuts, and (3) a dense cluster of token-specific headlines that say more about market structure and governance than about intraday price swings.

For investors who care about how this asset class is institutionalising, rather than just where spot prices closed, it was a revealing session.

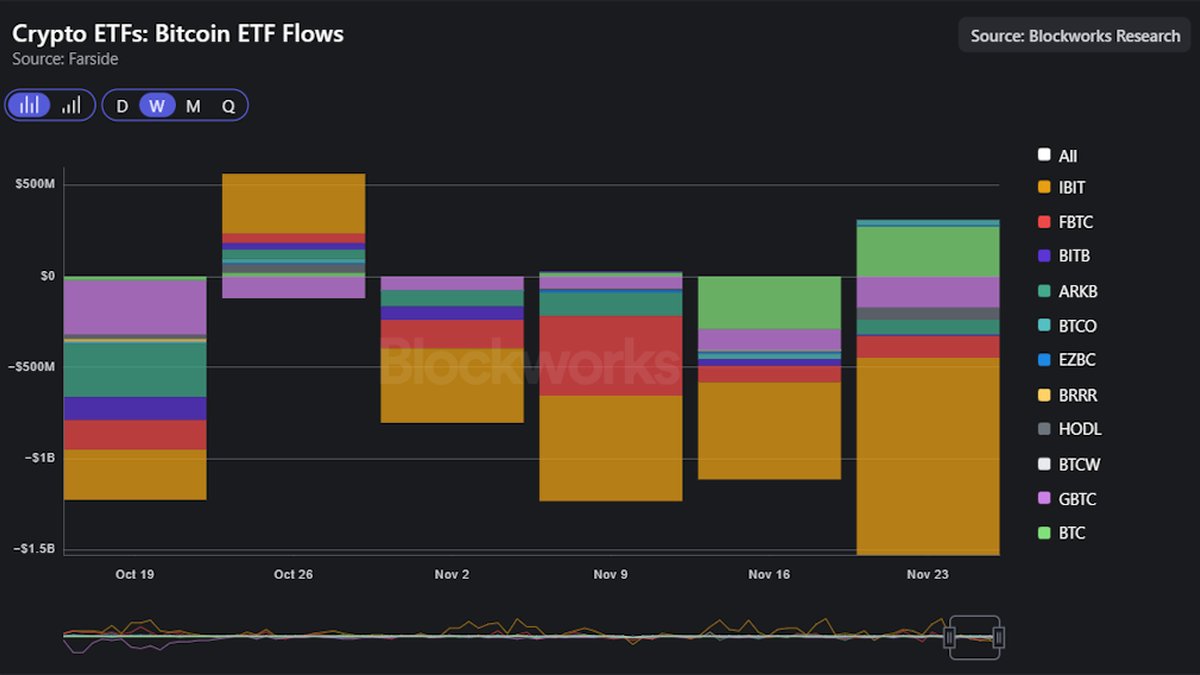

1. Four-Week ETF Outflows: Institutions Keep De-Risking

The cleanest high-level datapoint is the continued outflow from crypto exchange-traded products. Over the past week, crypto ETPs and ETFs saw roughly $1.9 billion in net redemptions, bringing the four-week cumulative outflow to around $4.9 billion. That makes this the third-worst withdrawal episode since 2018, with the bulk of the capital moving out of large, liquid Bitcoin and Ether funds.

There are two ways to read that tape:

- Classic risk reduction. After a multi-quarter run-up and growing concentration in a handful of large-cap assets, many institutional allocators are simply taking chips off the table, especially those who entered via spot ETFs earlier in the cycle.

- Portfolio rotation, not abandonment. Outflows from listed products do not automatically mean capital is leaving the ecosystem. Some of it is migrating toward direct custody, private vehicles, or cross-asset strategies that pair crypto exposure with AI, energy or real-world-asset (RWA) plays.

What matters for risk management is not the headline outflow number itself, but who is selling and on what timeframe. Long-only ETF redemptions are more compatible with a slow, grinding repricing than with a disorderly liquidation. Still, the message from the ETP complex is clear: big money is in a de-risking mood, even as the narrative heat around AI and macro easing intensifies.

2. Trump’s “Genesis Mission”: AI Policy as a Market Signal

On the policy side, President Trump’s formal launch of the national “Genesis Mission” — a multi-year initiative to supercharge U.S. artificial intelligence for scientific research and strategic industries — was the headline that dominated cross-asset conversations. The programme aims to mobilise national labs, universities and private-sector compute providers into what the administration openly frames as an “AI space race”.

For equity markets, some investors are reading Genesis as the moment the “AI bubble” narrative gives way to an “AI industrial policy” regime: instead of asking whether AI valuations are a bubble, the question becomes which companies and sectors will be plugged into subsidised infrastructure, procurement pipelines and regulatory fast lanes.

For crypto markets, the implications are more second-order but still material:

- Compute and infrastructure tokens may see their narratives re-anchored around the real-world demand for AI compute, data storage and networking, rather than purely speculative cycles.

- On-chain AI experiments — from inference marketplaces to data-sharing protocols — could find new talking points when they can plug into a national AI roadmap instead of marketing themselves as isolated science projects.

- Regulatory convergence. As AI policy hardens, expect more overlap between AI and crypto rule-making, from data-governance and privacy to cyber-security and sanctions enforcement.

None of this guarantees sustainable value creation for AI-adjacent tokens, but it does shift the conversation from “is AI real?” to “who gets to build the rails?” — a healthier framing for long-horizon allocators.

3. A Dovish Turn from the Fed’s Waller

Macro traders also latched onto comments from Federal Reserve Governor Christopher Waller, who signalled support for cutting interest rates in the coming months. Waller emphasised a cooling labour market, a path for inflation to resume trending lower, and the view that the impact of recent tariffs on prices is likely to be a largely one-off adjustment rather than a persistent inflation engine.

Rates markets wasted little time repricing. The implied probability of a rate cut at the December FOMC meeting moved toward ~80%, reinforcing a backdrop where real yields have less room to grind sharply higher. For crypto, the link is not mechanical, but the playbook is familiar: easier policy lowers the “opportunity cost” of holding non-yielding or volatile assets, while also compressing discount rates on long-duration growth stories like AI and, by extension, the more speculative ends of the digital-asset spectrum.

From a risk-management perspective, however, the mix of easing expectations and ETP outflows is a reminder that macro tailwinds do not automatically translate into sustained inflows. Positioning and time horizon still matter more than a single dot-plot.

4. Trump–Xi Diplomacy: De-Escalation, Not a Grand Reset

On the geopolitical front, President Trump described a “very good call” with Chinese President Xi Jinping. The two leaders are expected to exchange visits over the next several months, with President Xi reportedly planning a U.S. trip later this year and Trump signalling an intention to visit China in April 2026.

Markets tend to react less to the symbolism and more to the policy follow-through. For crypto, the main channels are:

- Trade and tariff risk. A more predictable U.S.–China relationship lowers the probability of sudden tariff shocks or export controls that could hit global growth, risk sentiment and liquidity.

- Capital-flow architecture. Cross-border payments, stablecoin corridors and tokenised-asset platforms are easier to build when the geopolitical climate is warm, not frigid.

Investors should treat the Trump–Xi thaw as a mild volatility suppressant, not as a structural guarantee. The strategic competition narrative is very much intact.

5. CZ, Pardons and the Politics of Enforcement

The regulatory subplot remains as noisy as ever. Despite having received a presidential pardon, Binance founder Changpeng “CZ” Zhao is still facing public allegations that Binance infrastructure facilitated multi-million-dollar transactions later linked to Hamas following the 7 October 2023 attacks. The current White House has framed parts of its enforcement agenda as a continuation of a tough stance on illicit finance in crypto; critics counter that the sector is being selectively targeted.

For market participants, the key takeaway is less about any single individual and more about the politicisation of enforcement. When legal risk becomes a partisan talking point, it raises the cost of operating exchanges, custodians and stablecoin issuers, and it complicates institutional due-diligence processes. That tends to favour:

- Players with deep compliance budgets and multi-jurisdiction licences.

- Clear, well-documented governance and risk-management frameworks.

- Conservative treatment of sanctions, KYC/AML and high-risk jurisdictions.

In other words: the more headlines revolve around personalities, the more the market quietly re-prices in favour of infrastructure that looks and behaves like regulated financial plumbing.

6. Bitcoin and Ether: Institutional Flows, Not “Hero Trades”

Against that backdrop, two flow stories stood out:

• Bitcoin: A strategy vehicle associated with Michael Saylor reportedly raised around $21 billion in 2025 with the goal of accumulating additional BTC. That kind of scale reinforces Bitcoin’s status as the core collateral and balance-sheet asset of choice for corporates and funds that want directional exposure, even as ETP flows wobble.

• Ether: Institutional player BitMine continued its dollar-cost-averaging approach, adding roughly $190 million of ETH despite sitting on an unrealised loss of about $4.1 billion. Its holdings now exceed 3.63 million ETH, with an average cost basis close to $4,000 per coin.

These examples are useful not because they are blueprints to copy, but because they illustrate how large actors actually behave. Big allocators rarely move in and out on perfect entries; they define a thesis, size it over time, live with drawdowns and keep their risk committees informed. For smaller investors, the educational point is simple: institutional time horizons and risk tolerances are very different from social-media timeframes, and neither guarantees a particular outcome.

7. From Memes to Wrappers: DOGE and LINK Edge Toward the ETF Era

In product-design land, Grayscale’s announcement of the first U.S. spot Dogecoin ETF marks another step in the evolution from meme culture to mainstream wrappers. Listing DOGE via a regulated ETF on a major U.S. exchange does not change the underlying asset’s volatility, but it does change who can access it and under which suitability frameworks.

On a similar note, Chainlink representatives highlighted that Grayscale’s proposed GLNK ETF — a vehicle referencing LINK — could become effective automatically after a 20-day period under Section 8(a), assuming the SEC does not intervene, with a target listing date in early December 2025 on the NYSE. That auto-effectiveness mechanism is a reminder that much of the ETF pipeline is governed by process and timelines as much as by headlines.

For all of these products, the brand-safe takeaway is straightforward: ETFs change the wrapper, not the risk profile. Volatility, drawdown risk and fundamental uncertainty do not disappear simply because an asset now lives in a brokerage account instead of a self-custodied wallet.

8. RWAs and Tokenised Equities: Sui and TON Expand the Design Space

On the infrastructure and RWA front, two developments are worth flagging:

- Sui’s rcUSD and rcUSDp: New yield-bearing RWA tokens appeared on the Sui network, backed by an off-chain portfolio of real-world assets. These instruments add a second “RWA leg” to Sui beyond pure DeFi, effectively offering on-chain exposure to off-chain credit and rates markets.

- Telegram’s TON wallet: The Telegram Wallet team moved to integrate trading in tokenised U.S. equities on the TON network, further blurring the line between social messaging, retail brokerage and on-chain settlement layers.

Both developments point to the same structural trend: blockchains are slowly becoming interfaces to traditional financial assets and cash flows, not just venues for native tokens. That creates new opportunities but also new layers of legal, custodial and disclosure risk that regulators are only beginning to map.

9. Governance, Transparency and Insider Risk: Berachain, FLUID/WMTX and SPK

Three governance-heavy headlines rounded out the day’s token newsflow:

• Berachain and Brevan Howard Nova: Berachain faced allegations that it granted Brevan Howard Nova a contractual right to redeem a $25 million Series B investment under certain conditions, without clearly communicating those terms to other investors. Even if the legal documentation ultimately checks out, the episode underscores how critical disclosure and equal-treatment norms are becoming in late-stage crypto fundraises.

• FLUID and WMTX on Coinbase: Tokens FLUID and WMTX were listed on Coinbase, with trading firm Wintermute identified as market maker and on-chain data showing it accumulated more than $500,000 of FLUID ahead of the public listing. Market-making inventories are not inherently problematic, but they do raise familiar questions about information asymmetry, inventory risk and how early liquidity is seeded.

• Spark DAO’s SPK buyback proposal: Spark DAO floated a proposal to direct more than $10 million of protocol profits into treasury-driven buybacks of its governance token SPK, starting with a 10% target and flexing higher when surplus capital is available. Voting is scheduled to conclude on 27 November 2025.

Taken together, these stories show a market rapidly importing corporate-finance concepts — redemption rights, authorised market makers, capital-return policies — into on-chain governance. The challenge is to do so with the same level of disclosure and investor protection that public-market participants are used to, rather than re-learning old lessons the hard way.

10. How to Read a Day Like This

For readers trying to make sense of a news-heavy 24 hours without getting lost in the noise, a simple framework can help:

- Flows: ETP redemptions and large institutional moves in BTC and ETH tell you how capital is rotating.

- Policy: Genesis Mission and Fed commentary shape the cost of capital and the policy regime for years, not days.

- Plumbing: ETFs, RWAs and tokenised equities determine who can access what, through which channels.

- Governance: Deals like Berachain’s, buyback debates like SPK’s and market-making structures for FLUID/WMTX define whether on-chain finance grows up or repeats the same mistakes.

None of these strands on their own dictate where prices will trade tomorrow morning. But together they show a market transitioning from a purely speculative arena into a complex, policy-sensitive, institutionally relevant part of the global financial system. For a crypto niche publication with a brand-safe mandate, that slow maturation is the real story.

This article is for informational and educational purposes only and does not constitute financial, investment, legal or tax advice. Digital assets are volatile and may not be suitable for all investors. Always conduct your own research and consider speaking with a qualified professional before making financial decisions.