New and Upcoming Crypto Apps to Watch in 2026

The year 2026 is shaping up to be a defining moment for crypto adoption worldwide. With increasing institutional participation, advancing blockchain technologies, and evolving regulatory clarity, new crypto apps are entering the market to solve problems that older platforms could not. These apps are not only improving user experience but also expanding the scope of what’s possible with decentralized finance, payments, and asset management. In this article, we’ll explore the most promising crypto apps on the horizon and analyze why they may define the next wave of digital adoption.

Why 2026 Will Be Pivotal for Crypto Apps

Since 2020, crypto apps have moved from niche trading platforms to mainstream financial tools. By 2026, several key drivers will further accelerate their importance:

- Regulatory Frameworks: More jurisdictions are finalizing clear crypto guidelines, boosting investor confidence.

- Institutional Entry: Banks, asset managers, and fintech firms are developing their own crypto-native solutions.

- Technological Upgrades: Advances in cross-chain interoperability and zero-knowledge proofs will make apps faster, safer, and more private.

- User Demand: Consumers expect seamless, mobile-first apps that combine ease of use with robust security.

Innovative Crypto Apps to Watch in 2026

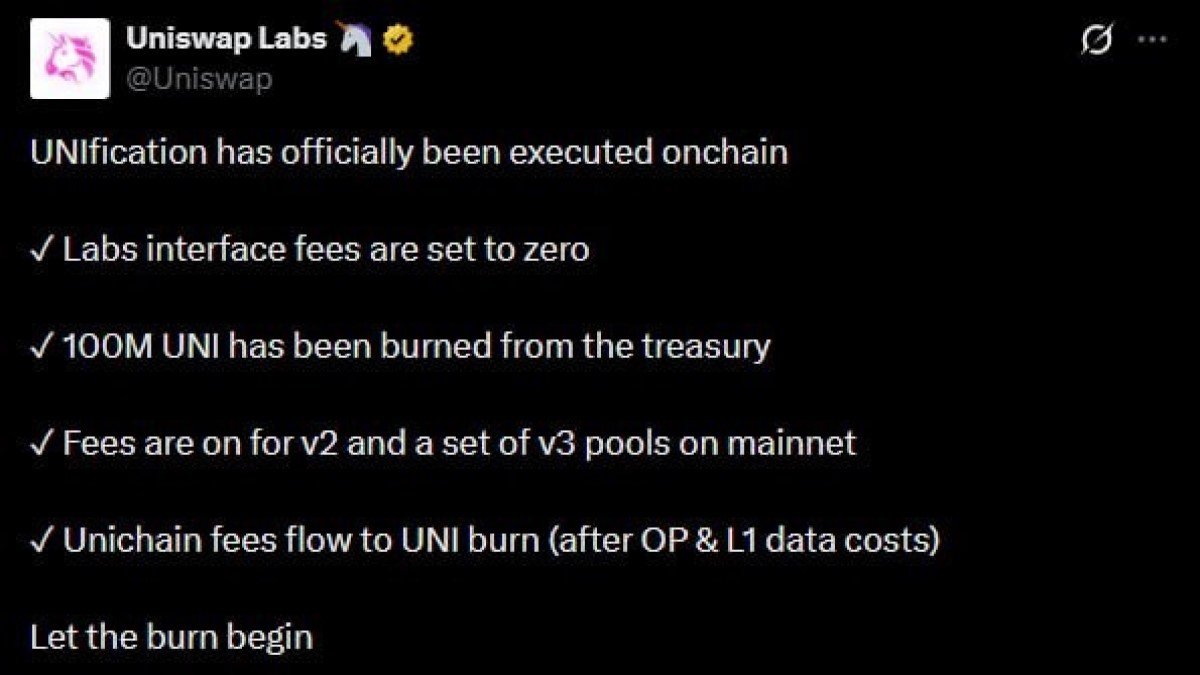

1. Cross-Chain DeFi Superapps

Next-generation DeFi apps will allow users to borrow, lend, and swap assets across multiple blockchains without relying on centralized exchanges. These apps integrate bridges, multi-chain wallets, and yield aggregation into one unified interface, reducing friction for mainstream adoption.

2. Decentralized Social Finance (SocialFi) Platforms

SocialFi apps blend social media with decentralized finance. By tokenizing attention and influence, creators will monetize content directly through crypto rewards, NFTs, and DAO-based communities. 2026 may mark the year SocialFi apps rival traditional networks like Instagram and TikTok.

3. AI-Driven Trading and Portfolio Apps

Artificial intelligence is being integrated into crypto trading apps to provide predictive analytics, automated rebalancing, and personalized investment strategies. These AI-powered apps can adapt to market conditions in real time, making crypto investing smarter and more accessible to retail and institutional players alike.

4. Crypto-Powered Remittance Apps

Remittance apps using stablecoins and CBDCs (Central Bank Digital Currencies) will continue to disrupt the $700+ billion global remittance industry. By 2026, transaction times will drop to seconds, and fees will be close to zero, making cross-border payments more inclusive and affordable.

5. Metaverse and NFT Integration Apps

As metaverse ecosystems mature, apps will emerge that integrate NFTs for identity, ownership, and commerce. These apps will allow users to buy, sell, and lend digital assets within virtual worlds while seamlessly connecting to real-world financial systems.

Key Features Driving the Next Generation of Crypto Apps

The upcoming apps of 2026 will stand out due to specific innovations:

- Interoperability: Apps that work across Ethereum, Solana, Cosmos, and emerging blockchains without requiring manual bridging.

- Embedded Compliance: Built-in KYC/AML solutions that satisfy regulators without compromising decentralization.

- Enhanced Security: Multi-party computation (MPC) wallets and biometric authentication to reduce conducting a security breach risks.

- Financial Inclusion: Apps designed for emerging markets where traditional banking remains inaccessible.

Comparisons with Existing Platforms

When compared to established apps like Coinbase, Binance, and MetaMask, upcoming 2026 apps will prioritize scalability and user experience. While current apps often face congestion, high fees, or limited features, next-gen solutions will emphasize fluid cross-chain operations and AI-enhanced analytics. The biggest differentiator will likely be integration with real-world finance and compliance, bridging the gap between decentralized systems and traditional institutions.

Risks and Considerations

Despite their promise, new crypto apps carry risks:

- Regulatory Shifts: Sudden legal changes could disrupt operations, especially in sensitive areas like stablecoins or SocialFi.

- Security Threats: Sophisticated security incidents remain a challenge, particularly for cross-chain bridges and DeFi apps.

- Overhyped Projects: Not all new apps will succeed; investors must distinguish real utility from marketing hype.

- User Education: Many apps assume a level of crypto literacy that may still be missing among mainstream users.

Investment Outlook for 2026 Apps

The investment potential of new crypto apps will hinge on solving real-world problems and achieving scalability. Institutional investors are expected to back apps that integrate compliance and generate sustainable revenue models. Retail investors may flock to apps offering high APYs in staking, lending, and liquidity pools, but risk management remains crucial. By 2026, the apps that balance innovation with regulation will be the ones to dominate.

Conclusion

2026 promises a new era of crypto adoption powered by apps that merge advanced technology, user-centric design, and compliance. From cross-chain DeFi platforms to AI-driven portfolio managers and SocialFi ecosystems, these apps are redefining how individuals and institutions interact with digital assets. For investors and users alike, identifying the apps with genuine utility, strong teams, and regulatory readiness will be the key to long-term success in the evolving crypto economy.

Further Reading and Resources

Crypto Exchanges | Altcoins | Best Crypto Apps

Frequently Asked Questions

1. What are crypto apps? Crypto apps are mobile or web platforms that allow users to trade, stake, lend, borrow, or manage digital assets easily.

2. Why are 2026 apps different from existing ones? They emphasize interoperability, AI integration, and compliance, solving issues of scalability and regulation that older apps struggled with.

3. Which crypto app sectors will grow fastest in 2026? Cross-chain DeFi, SocialFi, and remittance apps are expected to lead adoption globally.

4. Are upcoming crypto apps safe? While security is improving with MPC and advanced audits, users should still research teams, check audits, and avoid overhyped projects.

5. Should I invest in early-stage crypto apps? Early adoption can yield high rewards but comes with elevated risks. Diversification and thorough due diligence are essential.