Best DCA Tools: Automating Smarter Crypto Investing

Dollar-cost averaging (DCA) is one of the most popular strategies for long-term crypto investors. Instead of trying to time the market, DCA involves investing a fixed amount of money at regular intervals, regardless of price fluctuations. This strategy reduces the impact of volatility and helps investors accumulate assets over time. With the rise of automation in finance, specialized DCA tools now make it easier than ever to implement this strategy in the crypto market.

What Are DCA Tools?

DCA tools are platforms or apps that automate recurring crypto purchases. They allow investors to set parameters such as frequency (daily, weekly, monthly), amount, and preferred assets. Once configured, the tool executes trades automatically, freeing investors from the stress of manual buying and emotional decision-making.

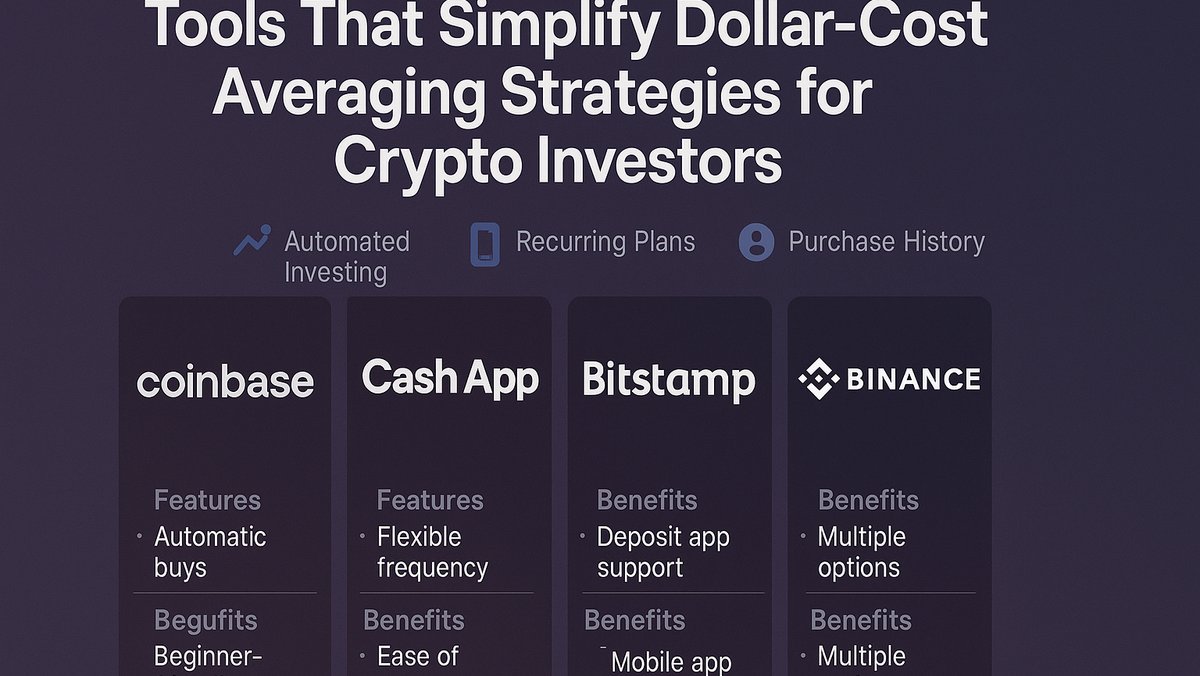

Top DCA Tools for Crypto Investors

1. Binance Auto-Invest

Binance offers a built-in auto-invest feature that lets users set recurring purchases for popular cryptocurrencies like Bitcoin, Ethereum, and stablecoins. It supports flexible investment schedules and integrates directly with the exchange’s ecosystem.

2. Coinbase Recurring Buys

Coinbase allows users to schedule recurring purchases starting as low as $10. It’s a beginner-friendly option, though fees may be higher compared to other platforms. Its simplicity and U.S. regulatory compliance make it a strong choice for new investors.

3. Kraken Recurring Orders

Kraken supports customizable recurring orders with a wide range of supported assets. It appeals to intermediate and advanced users who want more flexibility and lower trading fees compared to retail-focused exchanges.

4. Swan Bitcoin

Swan specializes in Bitcoin-only recurring purchases. It emphasizes education, long-term investing, and low fees. Investors seeking a Bitcoin-focused DCA experience may find this platform particularly useful.

5. Crypto.com Recurring Buys

Crypto.com allows recurring purchases of various assets with competitive rates. Its integration with the Crypto.com Visa card makes it attractive for investors who also want to spend their crypto seamlessly.

Benefits of Using DCA Tools

- Removes Emotion from Investing: Automated buys prevent panic-selling or fear-of-missing-out (FOMO) buying.

- Reduces Volatility Risk: By spreading out purchases, investors avoid putting all their capital at one price point.

- Long-Term Wealth Building: Regular contributions compound over time, building a larger portfolio.

- Customizable: Many tools let users adjust frequency, assets, and amount at any time.

- Hands-Off Strategy: Once set up, DCA requires little to no monitoring.

Risks and Considerations

While DCA tools provide automation and discipline, they are not risk-free. Prolonged bear markets may lower portfolio value despite consistent buying. Additionally, platform fees can erode returns over time, making low-fee exchanges more attractive. Regulatory uncertainty is another consideration, as laws may affect availability of recurring purchase features in certain regions.

Future of DCA Tools

As crypto adoption grows, DCA tools are expected to integrate with more advanced features such as portfolio rebalancing, multi-asset auto-invest strategies, and tax optimization. We may also see deeper integration with decentralized finance (DeFi), where smart contracts could automate DCA strategies without relying on centralized exchanges.

Conclusion

DCA remains one of the most reliable strategies for long-term crypto investors. By leveraging the right tools, investors can reduce risk, stay disciplined, and build wealth over time. Whether you’re just starting out or already building a diversified portfolio, automated DCA tools simplify investing and make the process more efficient.

Further Reading and Resources

Fidelity Crypto | Crypto | Crypto Insurance

Frequently Asked Questions

What are DCA tools? They are platforms that automate recurring crypto purchases, allowing investors to follow a dollar-cost averaging strategy without manual effort.

Which exchanges offer DCA features? Major exchanges like Binance, Coinbase, Kraken, and Crypto.com all offer recurring buy options.

Are DCA tools risk-free? No. While they reduce volatility risk, market downturns and fees still impact performance.

Who should use DCA tools? They are ideal for long-term investors who prefer steady accumulation over market timing.

Can DCA be used for assets beyond Bitcoin? Yes, most platforms allow recurring purchases of multiple cryptocurrencies, though availability depends on the exchange.