The “Identity Crisis” Token: Why Crypto’s Most Confusing Era Might Be Its Most Mature

Crypto used to be easy to caricature. Tokens were “not stocks,” governance was “community,” and value was “network effects” explained with a chart that always seemed to tilt upward. Today, that story is breaking—not because crypto is failing, but because it’s growing up. The line between a token and a traditional share is getting fuzzy in both directions: equity is drifting on-chain, and tokens are absorbing equity-like features through governance, fee capture, and increasingly explicit claims on economic activity.

That fuzziness creates what looks like a crisis of identity. Is a token a product coupon, a governance key, a marketing budget, a speculative instrument, or a quasi-share in a protocol’s cashflows? The honest answer is uncomfortable: sometimes it’s all of them—at different moments, for different people. And when one instrument tries to do five jobs, confusion becomes inevitable. But confusion is not always a bug. Sometimes it’s the sound of a design space becoming real.

1) The Identity Crisis Isn’t Confusion—It’s Convergence

Most “identity crises” in finance happen when an instrument travels across contexts faster than the rules and language around it. Tokens started life in a world that prized openness and experimentation; shares evolved in a world that prized disclosure and accountability. Now they’re moving toward each other. Equity is becoming programmable and portable, while tokens are becoming more explicit about governance rights, protocol economics, and the mechanisms that push value back toward participants.

Seen this way, the identity crisis is really a convergence problem: two design traditions colliding. The equity tradition says, “If people fund you, they deserve clarity on what they get.” The token tradition says, “If people use and govern the system, they should have influence and upside.” The future likely includes both—because users and funders increasingly overlap. The tension isn’t philosophical; it’s architectural: how do you express rights, rewards, and responsibilities without breaking either market integrity or the product experience?

One practical reframing helps: stop asking whether tokens are “like stocks.” Ask which functions are migrating. Governance is migrating. Cashflow participation is migrating. Distribution is migrating. And, perhaps most importantly, the measurement mindset of traditional business—unit economics, customer acquisition, retention—has started to migrate into crypto, even when the tools are unfamiliar.

2) When Equity Moves On-Chain, “Ownership” Starts Acting Like Software

Tokenized equity and on-chain capital markets are often described with a single promise: efficiency. Faster settlement, broader distribution, and programmable compliance. That’s real—but it’s not the most transformative part. The deeper change is behavioral: when ownership becomes software, it becomes composable. It can be embedded in products, used as collateral, bridged across platforms, and governed through rules that execute automatically rather than through paperwork that executes eventually.

That shift changes the expectations placed on tokens as well. If equity can be issued and managed with digital rails, then tokens can’t rely on “we’re not equity” as a permanent shield against questions of rights and accountability. Investors, regulators, and increasingly everyday users begin to ask the same question they ask in traditional markets: who captures value, and by what mechanism? On-chain equity doesn’t just compete with tokens; it raises the standard for clarity across everything on-chain.

This is where the maturity shows up. A mature financial instrument doesn’t win by being mysterious; it wins by being legible. If tokenization makes equity more legible in software form, it indirectly pressures token projects to become more legible as economic systems. That pressure is healthy. It forces designers to specify what the token is actually doing, rather than letting the market project whatever it wants onto the ticker.

3) When Tokens Absorb Equity-Like Features, Governance Stops Being a Vibe

Protocols like Uniswap popularized the idea that governance could be more than a forum—it could be a mechanism for changing the economics of a system. Fee switches, treasury decisions, and incentive programs bring the token closer to something that resembles an ownership lever: not necessarily a legal claim, but an operational handle that influences cashflows and value distribution. Whether those levers are turned on or left dormant, their presence changes the identity of the token.

That evolution creates a new obligation: governance has to behave like infrastructure, not theater. If governance can impact fees, incentives, or protocol parameters, then tokenholders are not just “community.” They are participants in economic design. That means decisions need defensible reasoning, conflicts need management, and incentives need evaluation. Mature governance is boring in the right places: it produces fewer fireworks and more stability.

Here’s the uncomfortable part: adding equity-like features doesn’t automatically create value for the token. It creates responsibility. If a token can influence fees, then the market will ask whether fee capture improves the protocol or harms users. If a token can direct incentives, the market will ask whether incentives produce real retention or just temporary volume. The identity crisis is partly the market learning to demand adult answers: “Show me the mechanism. Show me the trade-offs.”

4) CAC Tokens: Turning Dilution Into a Marketing Budget

The most interesting identity shift isn’t governance; it’s customer acquisition. In traditional companies, growth is funded with cash: advertising, sales teams, referral programs. In crypto, growth is often funded with tokens. That is the CAC token model in its simplest form: you pay for users with dilution. The cost doesn’t disappear—it’s simply denominated differently. Instead of spending dollars from a bank account, you spend token supply from the cap table.

That sounds like a clever hack until you remember what CAC really is: a bet on retention. Spending to acquire customers is only rational if those customers stay long enough to produce future value. CAC tokens therefore force a brutally honest question that crypto used to avoid: are you buying usage, or are you renting it? If you’re renting it, the token becomes an expensive coupon. If you’re building retention, the token becomes a growth engine that can outlive the subsidy.

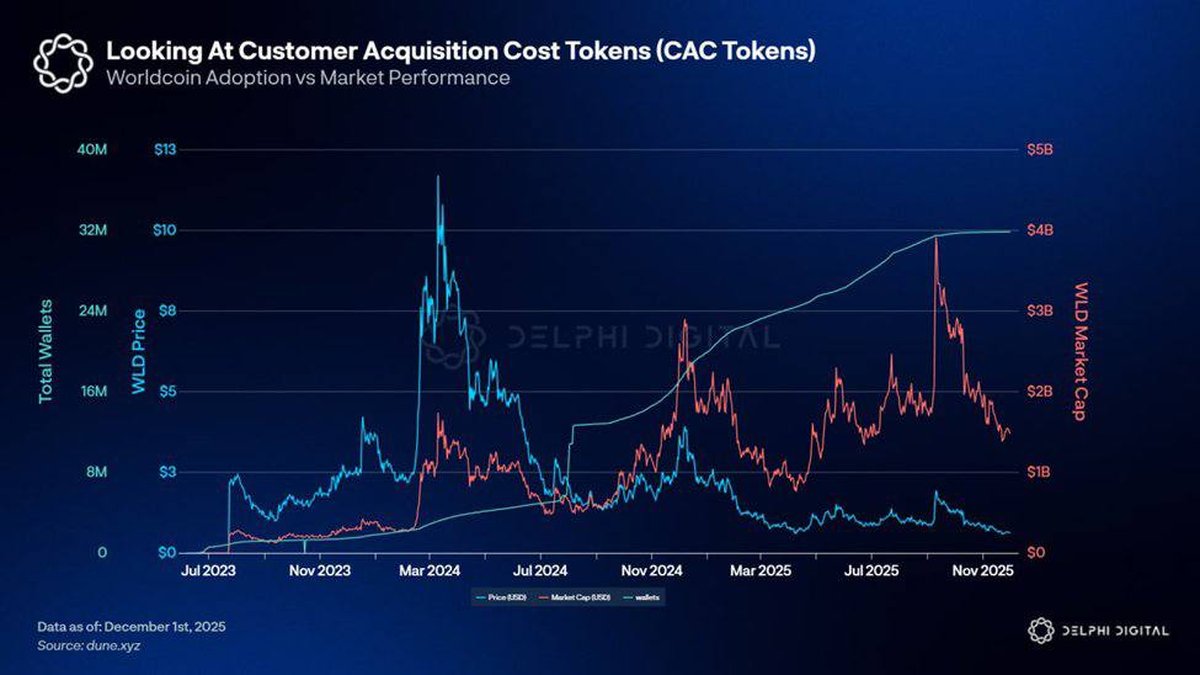

Worldcoin’s WLD distribution is a vivid example of how CAC tokens feel at national scale. The strategy uses token allocation as a way to bootstrap participation—creating a measurable adoption curve even through market drawdowns. Conceptually, this is marketing spend that happens on-chain: a distribution program that produces user counts and activity as outputs. The ethical and operational debates around identity systems and access are separate conversations; the economic point is simpler: distribution can manufacture adoption, but adoption only becomes durable value if the system can capture and reinvest it.

5) Reading the Chart: Why Adoption Can Rise While Price Doesn’t

The chart shared above (Worldcoin adoption versus WLD market performance) is a useful “identity crisis” artifact because it looks contradictory on purpose. One line—the wallets/adoption curve—rises steadily into the tens of millions. The other lines—price and market cap—swing violently. People see this and assume something is broken: “If adoption is up, why isn’t price up?” The better answer is: because adoption is an input, not a payout.

CAC tokens can generate adoption even when the token struggles, because the distribution itself is the incentive. In other words, the system can keep “buying” users. That makes adoption partially independent from market sentiment—especially early on. But for price to reflect adoption, the system needs a bridge from usage to value capture. If users arrive because they’re paid to arrive, the market will wait to see whether they stay when payments shrink, whether they transact in ways that generate sustainable fees, and whether those fees benefit the token in a clear, credible way.

There are at least three reasons the divergence is rational, not paradoxical:

• Adoption can be subsidized. If tokens fund onboarding, wallet counts can rise regardless of price performance.

• Value capture can lag. A product can scale users before it scales revenue, especially if monetization is intentionally delayed.

• Supply dynamics matter. If distribution increases circulating supply faster than demand increases, price can remain pressured even with rising adoption.

The mature lesson is not “adoption doesn’t matter.” It’s that adoption is only bullish when it changes the economics of the system—either by raising willingness to pay, increasing retained usage, or strengthening the protocol’s competitive moat.

6) The Maturity Test: Separating Subsidy, Utility, and Value Capture

Crypto’s design space is maturing because it’s learning to separate roles that were previously mashed together. Early token models often asked a single asset to do everything: reward users, fund development, govern the protocol, and appreciate in price. That’s like asking one tool to be a hammer, a thermometer, and a bank account. It sometimes works in bull markets, but it collapses under scrutiny.

A more mature approach treats token economics as a set of linked modules: a distribution module (CAC), a utility module (what users actually do), and a value capture module (how economic output flows back to stakeholders). When these modules are explicit, you can evaluate trade-offs without moral panic. You can say, “Yes, we subsidize onboarding—but here is how the subsidy shrinks, and here is the mechanism that converts retained usage into sustainable economics.” That’s the language of real businesses, translated into on-chain systems.

Practical signs of maturity tend to look unglamorous:

• Retention metrics that matter. Not just “wallets created,” but cohorts that keep using the product without constant rewards.

• A credible glide path for incentives. Clear plans for reducing subsidies without collapsing usage.

• Transparent value capture. Fees, revenues, or economic benefits that are measurable—and a clear policy for how they’re used.

• Governance that can say “no.” Mature systems resist the temptation to bribe growth forever.

Notice what’s missing: none of this requires a promise of outsized returns. It’s simply unit economics—made visible.

7) Regulation Isn’t the Enemy of This Convergence—It’s the Referee

The “token vs equity” blur triggers understandable regulatory tension, but it also signals why the space is becoming more serious. A market that wants to be a dominant financial framework can’t rely on ambiguity forever. Clearer legal corridors—around disclosures, market integrity, consumer protection, and the line between product and investment—will shape which designs survive. That can feel restrictive, yet it also reduces the cost of trust, which is often the biggest barrier to mainstream adoption.

Importantly, regulation doesn’t need to decide whether every token is a stock. It needs to decide whether users and buyers are protected from manipulation, whether disclosures are honest, and whether the economic claims made by a project match the mechanisms it actually operates. In a mature design environment, that kind of scrutiny is not a threat; it’s feedback. It rewards teams that build legible systems and punishes systems that rely on confusion as a business model.

For CAC tokens, the regulatory lesson is especially clear: if distribution is effectively marketing, then marketing standards start to matter. Clarity about incentives, eligibility, risks, and token mechanics becomes part of responsible growth. When the rules become clearer, the identity crisis may calm down—not because tokens become simple, but because the market gets better at naming what each token is actually for.

Conclusion

The “identity crisis” token is not crypto losing its way—it’s crypto becoming accountable to reality. Equity is learning to move like software, and tokens are learning to justify themselves like financial instruments. CAC tokens, in particular, expose crypto’s unit economics in public: they turn dilution into marketing spend and force the hardest question in growth—are you buying customers, or building them?

If there’s a quiet optimism here, it’s this: a design space that can survive scrutiny is a design space that can become infrastructure. As legal clarity improves and market participants demand legibility, the tokens that endure will be the ones that can separate subsidy from utility, and utility from value capture—without relying on hype. That looks like an identity crisis only if you expect adolescence to last forever.

Frequently Asked Questions

What is a “CAC token” in simple terms?

A CAC token is a token used as a substitute for cash marketing spend. Instead of paying dollars to acquire users, a project distributes tokens (rewards, airdrops, incentives) to attract and retain users. The cost shows up as dilution and supply expansion rather than as a line item in fiat expenses.

Why can adoption metrics rise while token price falls or stagnates?

Because adoption can be subsidized. Distribution programs can increase wallets and activity even when market sentiment is weak. Price typically responds when adoption translates into durable value capture—through retained usage, fees, or other measurable economic mechanisms that reduce the need for continued subsidies.

Are tokens becoming “the same as stocks”?

Not exactly. But some token designs incorporate stock-like features (governance influence, fee participation), and tokenized equity makes shares behave more like programmable assets. The key is to evaluate specific mechanisms and legal structures rather than relying on labels.

What’s a healthy way to evaluate token economic maturity?

Look for modular design: clear incentive programs with a phase-down plan, retention that persists beyond rewards, transparent value capture, and governance processes that can make disciplined trade-offs. These traits matter more than headlines or short-term price moves.

Disclaimer: This article is for educational purposes only and does not constitute financial, legal, or investment advice. Crypto assets and token-based incentive programs involve risks, including volatility, changing regulations, and uncertainty around value capture. Always do your own research and consider consulting qualified professionals for guidance relevant to your situation.