When a Bank Meets Solana: What Singapore Gulf Bank’s Stablecoin Bridge Really Signals

On the surface, Singapore Gulf Bank’s new feature sounds almost understated: verified account holders can now deposit fiat currencies such as USD or SGD and receive USDC or USDT on the Solana network, and later redeem those stablecoins back into their bank balances. It is presented as a convenient add-on for clients that already move money across Asia and the Gulf Cooperation Council (GCC) region.

But if we unpack what this actually means, the decision is far more significant than a simple “crypto integration.” Singapore Gulf Bank (SGB) is quietly turning itself into a two-way bridge between the regulated banking system and a high-speed public blockchain. Instead of watching from the sidelines while fintechs and exchanges experiment with stablecoin payments, the bank is stepping onto the same rail and offering it directly to corporate and individual customers.

In this article, we take a deeper look at SGB’s move: why the bank chose Solana, what mint–and–redeem functionality changes compared to traditional cross-border payments, and how this kind of integration might reshape liquidity flows between Asia and the GCC over the coming years. We will also explore the risks and open questions that still need careful management if banks want to use public networks without compromising regulatory standards.

1. From Bank Transfer to Token Mint: What Exactly Has Changed?

Before this launch, a business banking with SGB had a fairly standard toolkit. It could hold balances in different currencies, send wire transfers through correspondent banks, use SWIFT messages to settle invoices, and maybe access some domestic instant-payment schemes. All of those rails are mature, but they come with familiar frictions: cut-off times, weekend gaps, multi-day settlement windows and layered fees along the way.

With the new feature, a verified SGB customer can do something structurally different:

- Initiate a transfer from their SGD or USD account inside SGB’s online banking environment.

- Choose to receive the value as USDC or USDT on the Solana network.

- Specify a Solana wallet address – this might be a self-custodial wallet, a custody provider, or a business treasury address.

- Receive the stablecoins within seconds, usable immediately on-chain.

In the opposite direction, the client can send stablecoins back to SGB’s on-chain address and redeem them for fiat balances, credited to their account once the bank has confirmed finality on the network and performed its compliance checks.

From a user’s perspective, the experience feels like a hybrid of online banking and Web3: the safety, onboarding and documentation of a regulated institution, combined with the settlement speed and programmability of a public blockchain. For the bank, however, this is a deeper transformation. SGB is no longer just sending messages to other banks; it is interacting directly with a global settlement layer and treating tokenized dollars as a first-class instrument in its own product stack.

2. Why Solana, and Why Now?

SGB’s choice of Solana is not accidental. The network has positioned itself as a high-throughput, low-latency environment where transaction fees are a fraction of a cent and confirmation times are measured in seconds. For a bank that wants to position itself as a cross-border payment hub, those attributes matter.

Consider the corridor SGB explicitly targets: Asia to the GCC. Businesses in Singapore, Malaysia, Indonesia or Vietnam that trade with partners in the United Arab Emirates, Saudi Arabia or Qatar often face multi-step journeys for their funds. A payment might pass through several correspondent banks, incur multiple FX spreads and spend one or two business days in transit. If any piece of documentation is missing, the transfer can be delayed even longer.

By contrast, stablecoins on Solana offer:

- 24/7 settlement. There are no weekend cut-offs. A payment initiated on a Sunday evening in Singapore can reach a Solana wallet in Dubai within seconds.

- Transparent, programmable flows. Smart contracts can enforce conditions such as escrow, milestone-based releases or split payments to multiple suppliers.

- Low transaction cost. Stablecoin transfers on Solana are cheap enough that even small invoices can move on-chain without being eroded by fees.

For SGB’s clients, especially export-oriented small and mid-sized enterprises, the combination of speed, predictability and cost can be compelling. For the bank, it provides a differentiator in a region crowded with digital-first competitors.

The timing is also telling. Since 2023, regulators in many jurisdictions have shifted from viewing stablecoins purely as a novelty to seeing them as a legitimate piece of payment infrastructure, provided that issuers follow standards around reserves, transparency and risk management. In that environment, a carefully structured partnership between a commercial bank and established stablecoin issuers looks far more acceptable than it would have a few years ago.

3. How Mint and Redeem Changes the Nature of Stablecoin Use

Stablecoins have been circulating on public chains for years, but the on-ramps have usually been exchanges or specialised fintech platforms. Those on-ramps are useful, yet they often sit at one layer removed from traditional corporate banking. A finance team might have to move money from its main bank to an exchange, wait for the transfer to clear, convert it into stablecoins and then send them into its own custody setup.

By offering mint and redeem directly from SGB accounts, the bank compresses that process into a single step. That has several implications:

- Reduced counterparty hops. Clients no longer need to hold balances on trading platforms simply to access stablecoins, lowering operational risk.

- Simpler accounting. The same bank that manages fiat balances is now aware of the client’s tokenized flows and can provide integrated reporting.

- Clearer compliance posture. Customer due diligence, monitoring and screening are anchored at the bank layer, which is already subject to strict regulatory oversight.

In practice, this turns stablecoins into a near-native instrument inside the banking relationship. Instead of being something you obtain “outside” the system and later reconcile manually, they become an alternative way to hold and move balances, with the bank acting as a trusted facilitator between fiat and on-chain environments.

4. Cross-Border Payments: From Correspondent Chains to Real-Time Stablecoin Rails

To appreciate the potential impact, it helps to compare the old and new models for a typical cross-border transaction.

Traditional flow

- A Singapore-based importer initiates a USD transfer from its local bank to a supplier’s account in the GCC.

- The payment message passes through one or more correspondent banks, each taking a fee and applying its own compliance checks.

- The funds arrive one or two business days later, sometimes with deductions that differ from the amount expected due to intermediary charges.

Stablecoin-enabled flow via SGB and Solana

- The importer mints USDC or USDT on Solana directly from its SGB account.

- The tokens are sent to the supplier’s Solana wallet, or to their bank/fintech in the GCC that supports the same rail.

- The supplier can hold the stablecoins, convert them into local currency, or route them into yield-bearing or treasury solutions, often within minutes.

The difference is more than just speed. Real-time settlement changes how businesses manage working capital. Instead of holding large precautionary cash buffers to compensate for slow and unpredictable payments, they can run leaner balance sheets and use on-chain transfers as just-in-time liquidity. Over hundreds of transactions, the combined effect of reduced float, lower FX slippage and fewer operational delays can be meaningful.

SGB’s internal statistics – more than 7 billion USD processed since launch – suggest that demand for this kind of connectivity is far from theoretical. While the absolute figure is modest compared to global payment volumes, it is substantial for a bank that only recently embraced blockchain rails. It indicates that clients are not merely experimenting; they are using the infrastructure for real economic activity.

5. What This Means for Solana and the Stablecoin Landscape

For Solana, a partnership with a regulated bank in a major financial centre is strategically valuable. It demonstrates that the network is not only a home for on-chain applications, but also a viable settlement layer for bank-grade flows.

The presence of real corporate payment volume on Solana can have several second-order effects:

- Deeper liquidity in stablecoin pairs. Regular payment activity encourages market makers to maintain tighter spreads and larger order books, benefiting all users.

- More robust infrastructure. As institutions demand consistent uptime and predictable performance, network operators and service providers have strong incentives to maintain high standards.

- Broader integration. Other banks may be more willing to explore similar programs once they see live usage and a tested compliance framework.

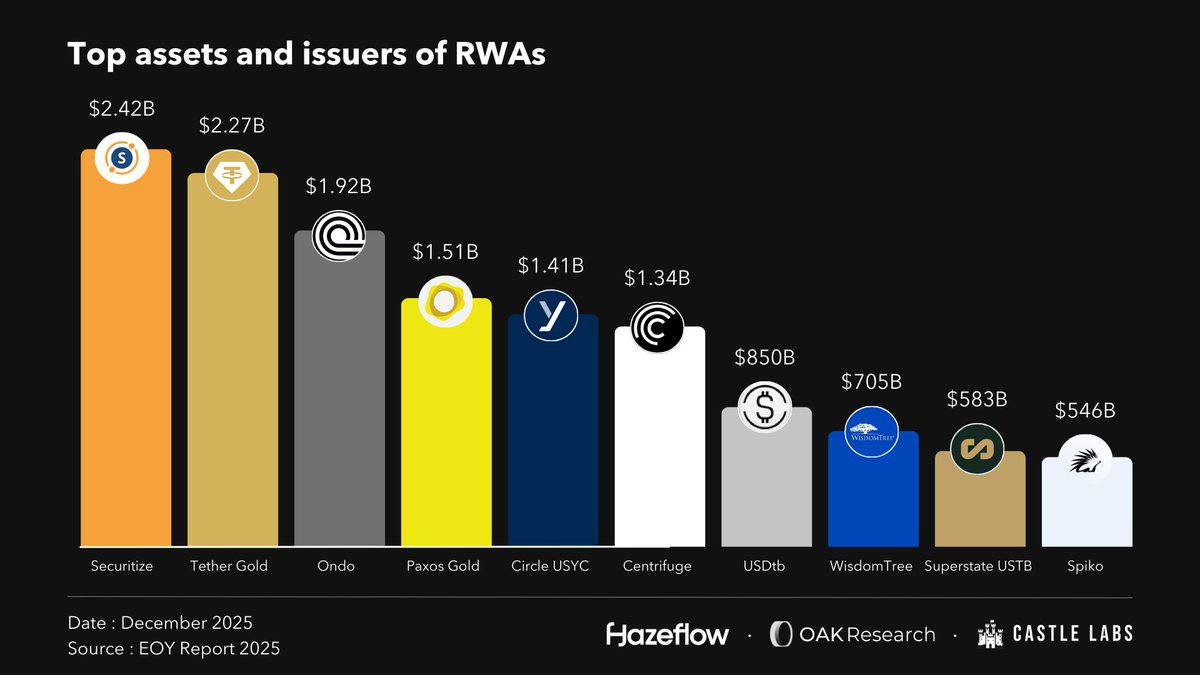

For the stablecoin ecosystem, SGB’s program reinforces a trend: tokenized dollars and other fiat currencies are becoming everyday plumbing rather than speculative instruments. When a bank allows clients to treat USDC or USDT as simply another way to hold and send value, stablecoins start to resemble a new digital layer on top of traditional money rather than a parallel universe.

6. Risk Management: The Quiet Work Behind the Scenes

None of this comes without challenges. If banks are going to adopt public blockchain rails, they have to solve a series of risk and governance questions that are less visible than the headline about “fast payments.” Among them:

• Operational resilience. The bank needs procedures for handling network congestion, smart-contract issues, or disruptions to infrastructure providers such as node operators and custodians.

• On-chain compliance. Even though KYC and monitoring are anchored at the bank level, on-chain flows still have to be screened for links to sanctioned addresses or high-risk activity. That requires analytics, policies and dedicated teams.

• FX and accounting treatment. When clients hold balances as stablecoins rather than fiat deposits, the bank must clarify how those positions are reported, what fees apply, and how FX exposure is managed.

• Network concentration. Relying heavily on one chain can create a single-point dependency. Over time, we may see banks diversify across multiple networks or use interoperability layers to mitigate that risk.

SGB’s move suggests that the bank believes these challenges are manageable with the right controls and partnerships. It also signals a broader shift in mindset: rather than treating public blockchains as something to be kept at arm’s length, some banks now view them as infrastructure they can learn to operate safely.

7. A Glimpse of the Future: Bank Accounts That Speak Native On-Chain

If we extrapolate from this launch, a possible future begins to emerge. Bank accounts might become multi-format by default: one balance reflected as traditional deposits, another as tokenized liabilities on several blockchains, with seamless conversion between them.

In that world:

- An exporter might receive part of an invoice as SGD in a domestic instant-payment system and part as USDC on Solana, depending on what is most convenient for the counterparty.

- Corporate treasurers could use automated rules: for example, automatically mint stablecoins when idle balances exceed a threshold, or redeem them when on-chain yields compress.

- Banks could offer white-labelled wallets where end users hold assets directly on public chains while the bank provides security tools, analytics and dispute-resolution procedures.

Singapore Gulf Bank is not there yet, but enabling mint and redeem on Solana is an early step along that trajectory. The bank is effectively acknowledging that for a growing share of its clients, value no longer lives exclusively inside traditional banking ledgers. It also lives on public networks, in wallets and smart contracts – and banks that want to remain central to commerce need to interface with that reality.

8. What Investors and Builders Should Watch Next

For investors and builders in the digital-asset ecosystem, SGB’s initiative offers several practical signals:

• Institutional adoption is shifting from pilot to production. Processing more than 7 billion USD through blockchain-connected channels means the system is already being used for day-to-day business, not just experiments.

• Regional corridors matter. Asia–GCC trade is large, but under-served by legacy payment rails. Where there is friction and fragmented infrastructure, stablecoins can fill a genuine service gap.

• Banks want programmable, not just faster, money. Real benefits will come when payment flows are tied directly to supply-chain events, digital invoices and on-chain documentation, rather than simply replacing wires with tokens.

At the same time, observers should remain realistic. Stablecoins and public blockchains are powerful tools, but they do not eliminate the need for strong governance, sound risk management and careful regulatory dialogue. SGB’s approach looks promising precisely because it builds on those foundations instead of bypassing them.

9. Conclusion: A Small Step in UX, a Large Step in Market Structure

To a casual user, Singapore Gulf Bank’s new feature may look like a minor upgrade in the banking app: a few extra options, a new tab reading “Mint on Solana,” and a quicker way to move value around the world. Underneath, however, it represents a shift in how banks relate to digital assets.

By allowing verified customers to convert fiat balances directly into USDC or USDT on Solana and back again, SGB is accepting that public blockchain rails are not a temporary trend but a durable component of global finance. It is choosing to participate as an orchestrator of those flows rather than watching from the sidelines.

If more banks follow this path – with sensible safeguards, transparent partnerships and a focus on real economic use cases – the line between 'traditional' and 'on-chain' money will continue to blur. For businesses that trade across borders, that could mean faster settlement, better capital efficiency and a wider range of financial tools. For the crypto ecosystem, it could mean that the next wave of adoption arrives not just through consumer apps, but through the very institutions that have long defined the financial landscape.

In that sense, Singapore Gulf Bank’s integration with Solana is more than a new button in a user interface. It is a signal that the architecture of global payments is slowly being rewired – one mint, one redemption and one cross-border transfer at a time.