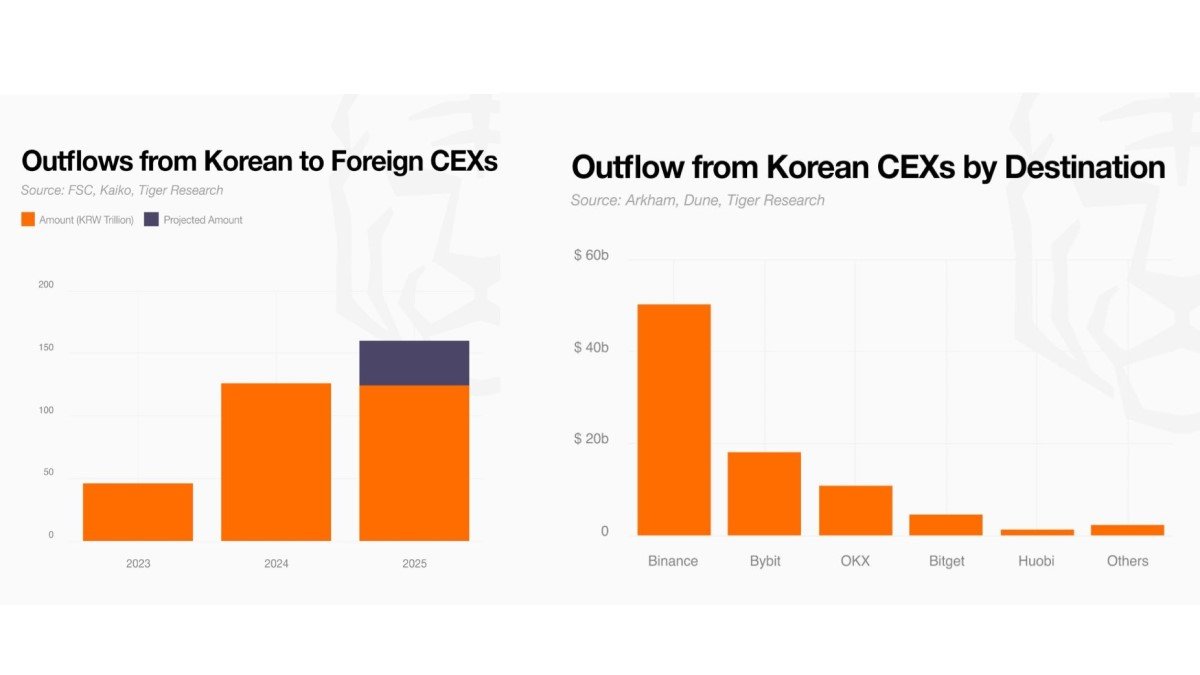

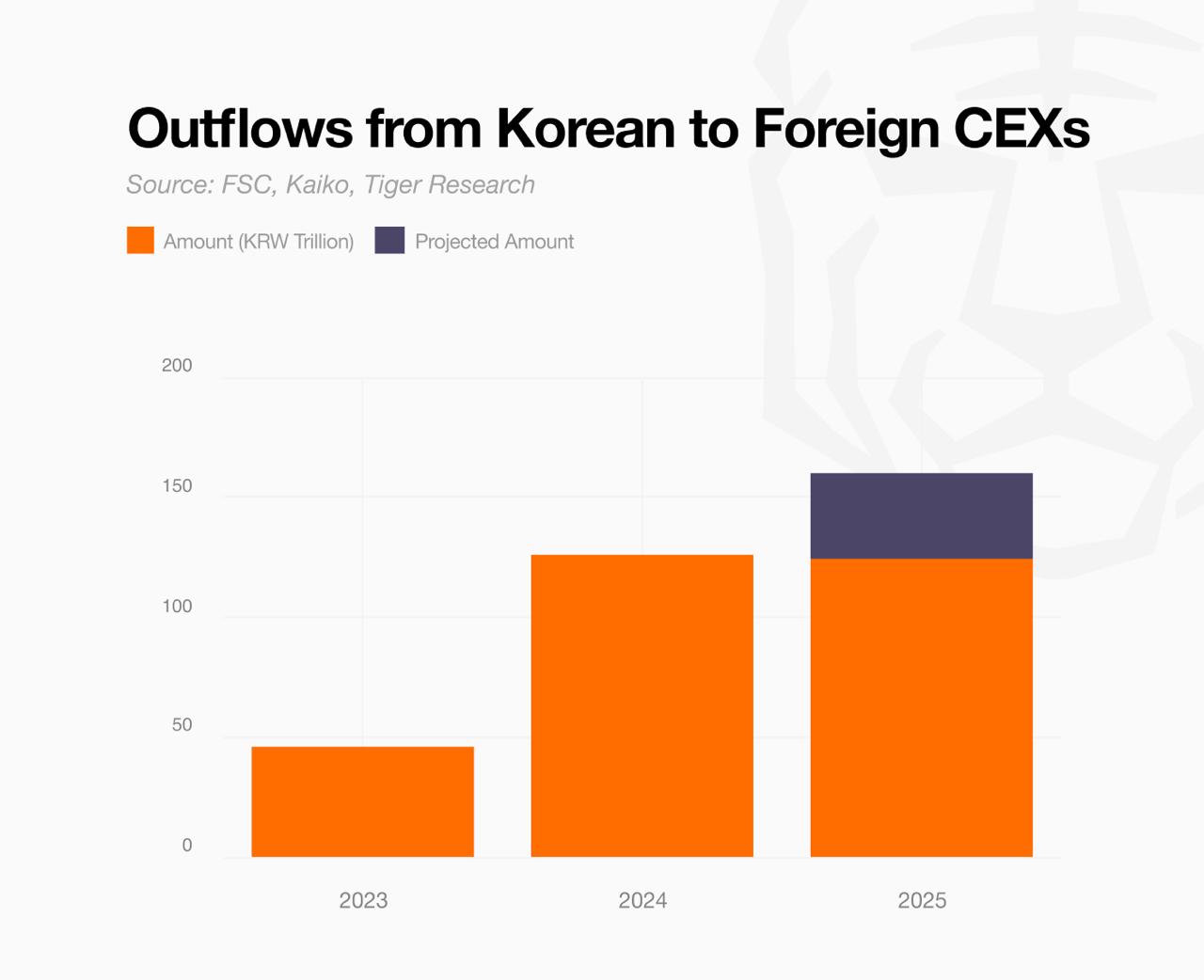

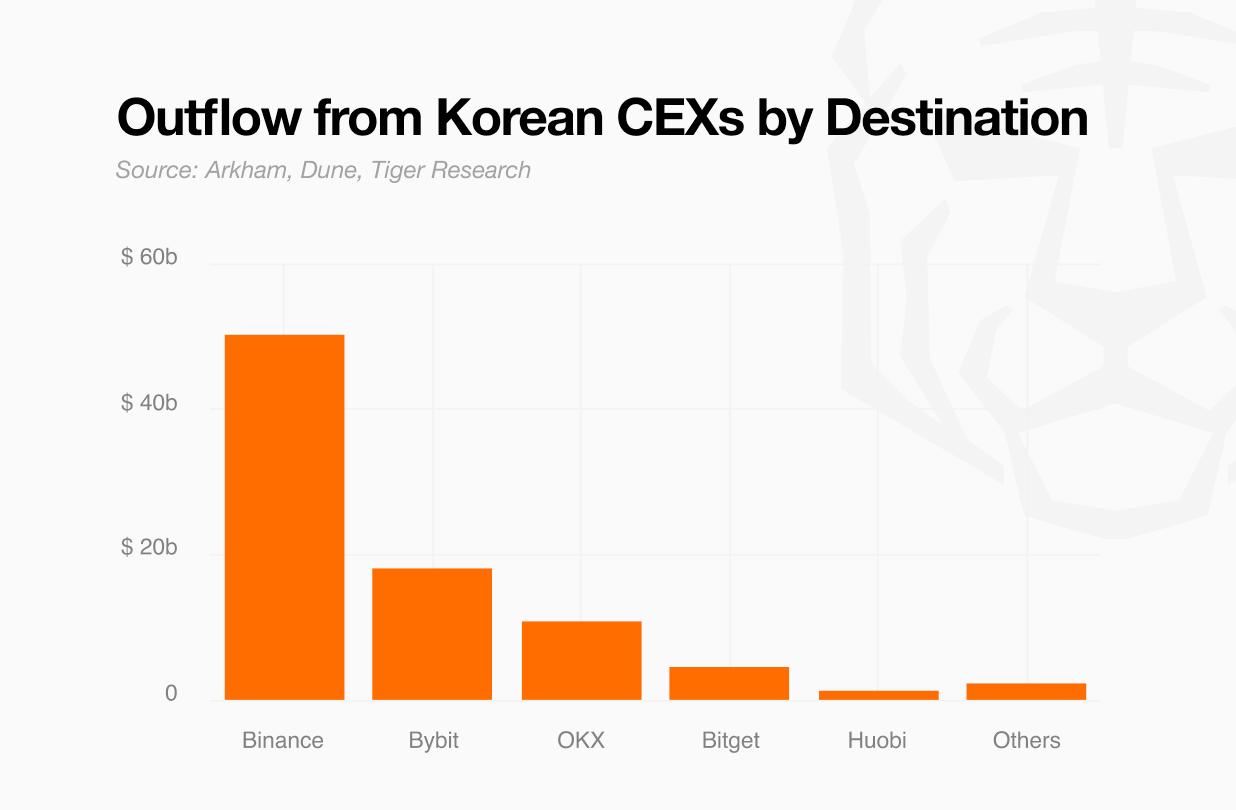

160 Trillion Won Leaves Korea for Foreign Crypto Exchanges: The Real Story Isn’t Capital Flight—It’s Product-Market Mismatch

When a large number hits the timeline—~160 trillion KRW moving from Korea to foreign crypto exchanges in 2025—it’s tempting to treat it as a moral narrative: domestic platforms “losing,” foreign platforms “winning,” and regulators “failing” to hold the line. But that reading is too emotional to be useful. What the data really suggests is a mechanical outcome: capital tends to migrate to the venue that offers the products people actually want to use.

In Korea, the domestic exchange ecosystem has been shaped around spot trading under tight banking and compliance constraints. Globally, crypto market structure has evolved into something else: derivatives-heavy, early-access-heavy, and increasingly designed around perpetuals, futures, and pre-market positioning. If one market is spot-only while the other market is a full-stack casino of instruments (not a judgment—just a description of breadth), then outflows aren’t a surprise. They’re the expected result of a mismatch between local guardrails and global opportunity.

1) What “160 Trillion KRW Outflow” Really Measures

It helps to clarify what this number is—and what it is not. An outflow estimate of ~160 trillion KRW (roughly $113–$118B) does not necessarily mean permanent wealth leaving Korea in the way a factory relocation would. Much of it can be cyclical: capital moves out to access instruments or early listings, then rotates back into domestic rails or local spending. But even if the flow is partly circular, the venue choice is still economically meaningful.

Because where trading happens determines who earns the fees, who controls the user relationship, and who collects the most informative data about market behavior. That’s why the fee leakage estimate matters as much as the notional outflow: if foreign venues captured around ~4.77 trillion KRW in fees from Korean traders (roughly $3.4–$3.5B) and that figure is cited as ~2.7× the combined revenue of the top domestic exchanges in the prior year, the implication is strategic: the margin pool is migrating with the flow.

In plain terms: it’s not only money moving—it’s an ecosystem losing its monetization layer.

2) The True Driver: Korea Is Spot-First, the World Is Derivatives-First

Most commentary stops at “Koreans want leverage.” That’s simplistic. The deeper point is that derivatives markets aren’t just a leverage toy—they’re where price discovery often happens first, where hedging happens efficiently, and where structured strategies live. If domestic venues can’t offer these tools, sophisticated (and even semi-sophisticated) participants will use offshore venues to execute basic risk management and timing strategies.

The pre-market angle matters too. Foreign exchanges increasingly offer pre-listing products—pre-TGE markets, early futures, points markets, and various forms of “price discovery before spot.” In a fast-moving altcoin culture, early access isn’t a luxury; it’s the entire edge. If tokens frequently move significantly on global venues before appearing domestically, local traders face a frustrating choice: arrive late or go abroad. Many choose abroad—not because they love foreign brands, but because timing is the product.

This is why the outflow chart is less a story about patriotism and more a story about market design. When the opportunity set is asymmetric, the flow becomes inevitable.

3) Fee Leakage Is More Damaging Than Capital Leakage

Capital can move and come back. Fees, however, are captured and retained by the venue. That matters because fees fund everything downstream: compliance budgets, security teams, local hiring, product development, marketing, and—critically—liquidity programs that keep spreads tight. When fee revenue migrates, the domestic ecosystem can enter a slow disadvantage loop: less revenue means fewer resources to innovate, which makes domestic products less competitive, which encourages more outflows.

There’s also a subtler effect: when high-frequency or sophisticated flow leaves, domestic order books become more retail-weighted. That can increase volatility in smaller names and widen spreads, which further reduces the attractiveness of staying local. Over time, domestic markets risk becoming “listing endpoints” rather than “price discovery engines.” That is not a collapse scenario—it’s a competitiveness scenario.

If Korea wants to remain a meaningful venue in global crypto—not merely a consumer of prices formed elsewhere—fee retention is a strategic priority, not just a business metric.

4) Why Blocking Foreign Exchanges Is a Weak Tool in 2026

The instinct to “block offshore” is understandable. It’s also structurally limited. When access is constrained, flows rarely vanish; they reroute. If centralized routes are blocked, users migrate to on-chain routes: spot DEXs, bridges, and increasingly perp DEXs that replicate derivatives access with fewer centralized chokepoints. That migration is not inherently good or bad—but it does change enforceability and visibility.

In other words: heavy-handed restriction can push activity into places that are harder to supervise, while also reducing the ability of compliant domestic players to compete. The result can be a policy own-goal—less oversight, not more. This is exactly why many jurisdictions eventually move from “attempted prohibition” to “controlled inclusion”: the goal becomes to pull activity into supervised lanes rather than pretend the activity can be eliminated.

The real question isn’t “Can Korea stop outflows?” It’s “Can Korea design a safer domestic alternative that is good enough that people choose it voluntarily?”

5) What a Controlled Opening Could Look Like (Without Importing Systemic Risk)

“Open derivatives” can sound like “invite reckless leverage.” That’s not the only design. A controlled opening can mean allowing innovation inside risk constraints—similar to how mature financial markets separate professional access from retail protections. The point is not to copy global venues. The point is to offer enough product completeness that Korean capital doesn’t need to leave for basic tools.

Possible controlled levers (conceptual, not prescriptions):

• Tiered access: derivatives for qualified participants with clear suitability checks, while retail remains protected by stricter limits.

• Conservative leverage and margin rules: lower max leverage, stronger liquidation protections, clearer disclosures.

• Regulated pre-market frameworks: structured, supervised mechanisms for early price discovery that don’t rely on informal markets.

• Cross-venue surveillance: better monitoring for manipulation and wash trading, especially in smaller tokens.

• Transparent listing standards: faster but safer listing processes to reduce the “always late” problem without lowering safeguards.

These tools won’t satisfy every camp. But they shift the debate from ideology (“ban vs free-for-all”) to engineering (“what rules create competitive access with acceptable risk?”).

6) The Bigger Picture: Korea Isn’t Losing Interest—It’s Losing Optionality

Korea has historically been one of the world’s most active retail-driven crypto markets, often with strong altcoin turnover and short-horizon trading culture. The outflow trend doesn’t imply that interest is dying. It implies that optionality is being constrained domestically while expanding globally. And markets respond to optionality the way water responds to gravity.

There’s also a narrative trap worth avoiding: “Koreans are leaving because foreign exchanges are better.” Better at what? Mostly better at offering the instruments the global market has normalized. If Korea keeps a spot-only posture indefinitely, it may still have a thriving domestic spot market. But it will increasingly outsource the high-value layers—derivatives, early discovery, structured liquidity—to elsewhere. That’s a strategic choice, whether intentional or accidental.

Conclusion

The estimate that ~160 trillion KRW flowed from Korean exchanges to foreign CEXs in 2025 is not just a dramatic number—it’s a mirror reflecting market structure. Korea’s domestic rails are built for a spot-first world. The global crypto arena has become derivatives-first and early-access-first. Where product access diverges, capital routing follows. And once routing shifts, fees—and competitiveness—tend to follow too.

If policymakers and industry leaders want to retain capital, the path is unlikely to be “block the outside.” The more durable approach is to build a controlled opening: supervised innovation that provides enough optionality at home while keeping guardrails that protect users and market integrity. In 2026, the winning regulatory posture may not be the strictest or the loosest. It may be the one that is most realistic about how capital behaves when markets are global and switching costs are low.

Frequently Asked Questions

Does “outflow” mean Korea is permanently losing money?

Not necessarily. Some flows can be cyclical—capital moves out to access instruments or early markets, then returns. However, venue choice still matters because fees, market data, and ecosystem development benefits are captured where trading happens.

Why are derivatives such a big driver?

Derivatives aren’t only about leverage. They also enable hedging, structured strategies, and often contribute to faster price discovery. If domestic venues can’t offer these tools, users seeking them tend to migrate offshore.

Would blocking foreign exchanges stop the behavior?

It may reduce some direct access, but it often leads to rerouting into on-chain alternatives like DEXs and perp DEXs, which can be harder to supervise. That’s why many analysts argue for regulated domestic options rather than pure restriction.

What is a “controlled opening” in this context?

It means allowing more product breadth under defined safeguards—tiered access, conservative leverage limits, stronger disclosures, and robust surveillance—so innovation happens inside a supervised perimeter rather than outside it.

Disclaimer: This article is for educational purposes only and does not constitute financial, legal, or investment advice. Crypto markets involve risk, including volatility, liquidity constraints, leverage-related losses, custody risk, and regulatory changes. Always do your own research and consult qualified professionals regarding your circumstances.