Japan’s Planned Compensation Reserves Could Redraw the Rules for Crypto Exchanges

Japan has long been one of the most closely watched jurisdictions for digital-asset regulation. From the fallout of the Mt. Gox collapse a decade ago to strict licensing requirements for exchanges, the country has repeatedly acted as an early test case for how a major developed market might supervise crypto without banning it outright. The latest development in this story is a proposal that could once again set a new benchmark: regulators are preparing a legal framework that would oblige crypto-asset exchanges to maintain mandatory compensation reserves for their users.

The idea is straightforward in concept but far-reaching in impact. Under the proposal being drafted by Japan’s Financial Services Agency (FSA), licensed exchanges would need to set aside a dedicated reserve fund. That fund would exist specifically to compensate customers in the event of losses caused by cyberattacks, security breaches or other operational failures. In other words, the system would move away from a world where users bear most of the platform risk toward a model where exchanges pre-commit financial resources to cover at least part of that risk.

While the details are still being worked out and the proposal must pass through the political process before becoming law, the direction of travel is clear: Japan wants to tighten investor protection without shutting the door on digital-asset innovation. Understanding this evolution is important not only for Japanese users and businesses, but also for global market participants, because regulatory ideas that prove workable in Tokyo often influence reforms elsewhere.

1. Why Compensation Reserves Are on the Table Now

Japan’s current legal framework for crypto exchanges is relatively mature compared with many other countries. Platforms must register, follow strict custody rules and submit to supervision. Yet, as regulators have acknowledged, there is still a gap: existing laws do not explicitly require exchanges to hold a ring-fenced pool of assets dedicated to compensating users when things go wrong.

The FSA’s renewed focus on this issue is driven by several overlapping trends:

• Persistent security incidents worldwide. Even as infrastructure improves, high-profile security incidents, private-key compromises and bridge security vulnerabilities continue to make headlines. Japanese regulators are acutely aware that a single large incident on a domestic platform could undermine public confidence in the entire sector.

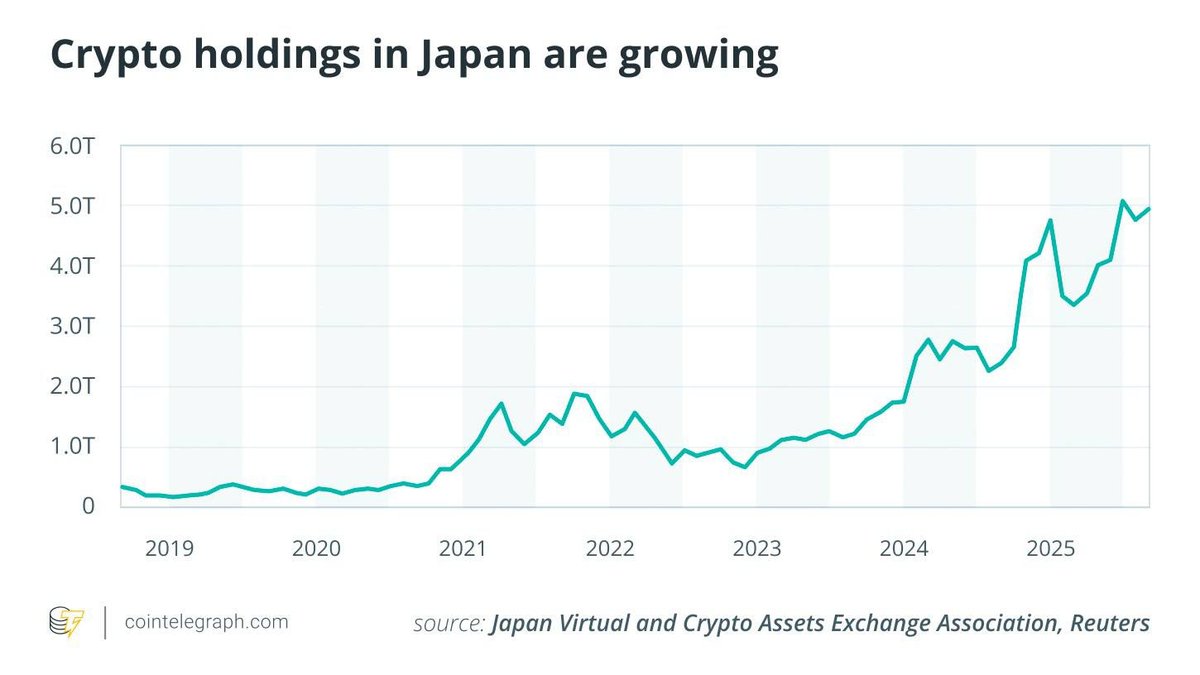

• Growing retail participation. Digital assets are no longer a niche hobby. In Japan, as elsewhere, a diverse mix of households, small businesses and institutional investors interact with exchanges. Regulators therefore feel pressure to align protections with what citizens expect from more traditional financial services.

• Comparisons with existing safety nets. In banking and securities markets, Japanese investors already benefit from deposit insurance schemes and investor-protection funds. Against that backdrop, the absence of a similar mechanism for crypto stands out more clearly.

By pushing for mandatory compensation reserves, authorities are signalling that crypto exchanges increasingly resemble systemic financial market infrastructure rather than experimental technology companies. If users rely on these platforms to store value and access markets, the argument goes, then some form of structured backstop is essential.

2. What a Mandatory Reserve Might Look Like

The proposal is still under discussion, so any description at this stage is tentative. However, based on the public signals so far, a Japanese compensation reserve for crypto exchanges would likely have several defining characteristics:

• Ring-fencing. Funds designated for compensation would be segregated from the exchange’s operating capital and proprietary trading accounts. This reduces the risk that the reserve is accidentally drawn down or used as collateral for other activities.

• Clear eligibility criteria. The rules would have to spell out which incidents qualify for compensation. For example, losses caused by a breach of the platform’s own security systems could be covered, while losses from user-side mistakes (such as sending funds to the wrong address) might not.

• Minimum size requirements. Regulators may set thresholds based on client assets under custody, trading volume or other risk metrics. Larger exchanges could be required to maintain proportionally larger reserves.

• Liquidity and quality constraints. To ensure that compensation can be paid quickly, some portion of the reserve would likely have to be held in high-quality liquid instruments, such as yen-denominated bank deposits or government securities.

• Disclosure and audit. Exchanges would probably have to report the size and composition of their reserve regularly, potentially with third-party verification, enabling both regulators and users to monitor its health.

In effect, the compensation reserve would function as a first line of defence for users when technical or operational failures cause harm. It would not eliminate all risk—no fund can do that—but it would make the obligation to address damages more concrete than vague promises or discretionary gestures after the fact.

3. How This Differs from Traditional Deposit Insurance

At first glance, a mandatory reserve for exchanges might sound similar to deposit insurance for banks. In practice, there are important differences.

Deposit insurance schemes, such as those that protect savings accounts up to a certain limit, are typically administered by a central agency and funded by contributions from multiple institutions. The coverage framework is uniform, and in many countries it is backstopped by the sovereign. Crypto compensation reserves, by contrast, are more likely to be platform-specific: each exchange would maintain its own fund, tailored to its particular risks.

That distinction has several implications:

- If an exchange fails and its reserve is insufficient, there may be no central fund to automatically make up the difference. Users would still be exposed to residual risk.

- A platform that manages its risk prudently could potentially operate with lower long-run costs than one that repeatedly draws down its reserve, creating an incentive for better security and governance.

- Because the reserves are not pooled, regulators must pay closer attention to the individual solvency and risk management practices of each exchange.

In short, the Japanese approach seeks to import some of the discipline and reassurance of traditional investor-protection mechanisms without fully transforming exchanges into banks. That balance is delicate: too much regulatory burden could stifle innovation and push activity offshore; too little could fail to protect users when they need it most.

4. Potential Benefits for Users and the Industry

From an investor-protection perspective, the rationale for compensation reserves is intuitive. If platforms are required to hold assets earmarked for restitution, then:

- Users have a clearer sense of what might happen after a security incident. Instead of hoping the exchange "does the right thing," they can point to an explicit legal obligation.

- Exchanges face a tangible financial cost for operational failures, which heightens the incentive to invest in robust security, risk monitoring and contingency planning.

- The broader market benefits from greater confidence. Users who might previously have kept only small experimental balances on exchanges may feel more comfortable holding working capital there, knowing that a structured backstop exists.

Interestingly, the move could also benefit the industry’s long-term reputation. After a series of global scandals and collapses in recent years, some observers have concluded that crypto platforms are inherently unreliable. A well-designed reserve framework offers a counter-narrative: exchanges can be held to explicit standards, tested and audited just like other financial intermediaries.

For firms that already operate conservatively, the additional requirements may be manageable. Many leading exchanges maintain sizeable insurance policies, rainy-day funds, or self-funded "secure asset" programs. Aligning those practices with formal legal expectations could simply turn de facto commitments into de jure obligations.

5. Costs, Trade-Offs and Open Questions

Mandatory reserves are not free. Setting aside capital for potential compensation has several potential side effects that regulators, exchanges and users will need to consider carefully.

First, there is an opportunity cost. Funds parked in a reserve cannot be used for product development, market expansion or other investments. Smaller exchanges may feel this more acutely than larger ones, potentially accelerating consolidation if margins are thin.

Second, design details matter. If minimum reserve levels are calibrated too high relative to actual risk, or if eligible assets are defined too narrowly, exchanges could be pushed towards low-yield holdings that strain their business models. If the rules are too loose, by contrast, the reserve could exist mostly on paper without providing meaningful protection.

Third, moral hazard must be managed. A poorly designed compensation scheme could create the impression that all user losses will be reimbursed, regardless of how they arise. To avoid this, policymakers will need to communicate clearly about what the reserve does and does not cover. For example, speculative trading losses, leverage mismanagement or exposure to unlisted tokens are unlikely to fall within its scope.

Finally, there is the question of cross-border coordination. Many exchanges serve both Japanese and international clients, and digital assets can move quickly across platforms. How will reserves handle incidents that span multiple jurisdictions? Will foreign entities need to establish local subsidiaries with Japan-specific reserves to serve domestic users? The answers will influence how global players structure their presence in the Japanese market.

6. How This Fits into Japan’s Broader Regulatory Philosophy

Japan’s willingness to contemplate such a reform is consistent with its broader regulatory philosophy toward digital assets: cautious openness. Rather than pushing activity into unregulated channels, authorities have historically tried to bring crypto inside the perimeter, subjecting it to familiar forms of supervision.

After the Mt. Gox incident, Japan introduced one of the world’s earliest registration schemes for exchanges. Later, it clarified rules around custody, leverage and stablecoins. Throughout these steps, the FSA has emphasised three themes:

- Protection of users, especially retail investors who may not have the resources to evaluate complex technical risks.

- Market integrity, including measures against illegal deception, wash trading and unfair practices.

- Financial stability, ensuring that crypto-related shocks do not propagate uncontrollably into the broader financial system.

The proposed compensation reserves can be seen as the next logical iteration of this framework. If exchanges are going to hold large amounts of customer assets, list leveraged products and act as gateways to tokenised financial instruments, then they need a safety net that is transparent, well-funded and enforceable.

7. What Market Participants Should Watch Next

The legislative process in Japan typically involves consultation, drafting, submission to the Diet (parliament) and, if approved, a phased implementation. Regulators have indicated that the proposed reforms could be brought before lawmakers in the coming year, but the exact timeline and final form may change as stakeholders provide feedback.

For now, there are several developments worth monitoring:

• Public consultation documents. Draft guidelines or discussion papers will reveal how the FSA is thinking about key parameters such as reserve size, asset composition and triggers for compensation.

• Industry responses. Comments from exchanges, industry associations and consumer groups will help clarify which aspects of the proposal are most contentious or difficult to implement.

• Comparisons with other jurisdictions. If other regulators begin exploring similar mechanisms, it could signal the start of a broader shift toward treating exchange reserves as a standard feature of digital-asset supervision.

For individual users, the key takeaway is not to treat the potential reserve as a reason to ignore risk. Instead, it should be seen as one more factor to consider when assessing platforms—alongside security practices, transparency, governance and compliance history.

8. A Step Toward More Mature Market Infrastructure

Digital-asset markets are still evolving from experimental systems into mainstream financial infrastructure. Along the way, the question has never been whether risks exist; it has been how they are allocated, disclosed and managed. Japan’s exploration of mandatory compensation reserves is an attempt to rebalance that allocation in favour of end users, while still leaving room for innovation and competition among exchanges.

There is no guarantee that the final legislation will match the initial proposal in every detail, nor that it will eliminate losses from future incidents. But if implemented thoughtfully, the framework could achieve two important goals: giving users a clearer sense of their rights when something goes wrong, and nudging exchanges to treat security and risk management as central pillars of their business rather than as afterthoughts.

Other jurisdictions will be watching closely. If Japan manages to strengthen investor protection without driving activity into opaque channels, its approach may offer a template for regulators who want to support responsible digital-asset markets rather than trying to wish them away.

This article is for informational and educational purposes only and does not constitute financial, investment, legal or tax advice. It is not a recommendation to use any specific exchange or digital-asset service. Regulatory proposals discussed here may change before they are enacted, and their impact may vary depending on individual circumstances. Readers should conduct their own research and consider consulting qualified professionals before making decisions related to digital assets or financial regulation.