Bybit’s Gradual Exit From Japan: What It Reveals About the Next Phase of Crypto Regulation

When an exchange as active as Bybit decides to withdraw from a major economy, it is rarely a simple business decision. It is a mirror held up to the regulatory climate of that market. Starting in 2026, Bybit will begin phasing out services for users identified as residents of Japan, introducing progressive restrictions because it is not registered with Japan’s Financial Services Agency (FSA).

On the surface, the announcement sounds technical: restrictions, residency checks, compliance with local rules. Underneath, it captures a deeper shift. Japan is one of the few jurisdictions that has consistently insisted on a clear rulebook for digital assets, while many regions spent years in a grey zone. Now that the global industry is moving from experimental to regulated, Japan’s approach is becoming a template, and exchanges that do not fully align must adapt their footprint.

This article looks beyond the headline to unpack three questions. First, what exactly is Bybit changing and why? Second, what does this say about Japan’s approach to digital assets? And finally, what can individual investors learn from the way this story is unfolding?

1. What Bybit Is Actually Doing in Japan

Bybit has communicated that, from 2026 onward, accounts identified as belonging to Japanese residents will be progressively restricted. The changes are framed as a compliance response, not as a judgement on the market itself. Japan requires any platform serving local users to be licensed by the FSA, and at this stage Bybit has not obtained that local registration.

The message contains several important elements:

• Gradual, not sudden, exit. Rather than cutting off access overnight, Bybit is moving to a phased model. That allows time for users to adjust, withdraw funds, and reorganize their activity instead of facing an abrupt disruption.

• Residence-based restrictions. The focus is on users classified as living in Japan. For those incorrectly tagged as Japanese residents, the exchange provides a path to clarify status through additional identity checks.

• Compliance-first framing. The announcement explicitly links the move to the fact that the platform is not registered with the FSA. In other words, this is less about business traction and more about aligning with a regulatory line that has become increasingly clear.

Even after withdrawing from Japan, Bybit remains a large global platform and continues to rank among the exchanges with the highest trading activity worldwide. For the company, the decision is not a retreat from digital assets, but a repositioning of which markets it can serve directly under its current structure.

2. Why Japan Is Such a Demanding Market for Exchanges

Japan is often described as having one of the strictest supervisory frameworks for digital assets anywhere in the world. That does not mean the country is anti innovation. Instead, it means that activity is expected to happen through regulated, locally supervised channels.

Several features define the Japanese approach:

• Mandatory local licensing. Any platform serving users in Japan must register as a digital asset exchange with the FSA, meeting requirements on governance, risk management and reporting.

• Custody and segregation rules. Client assets must be segregated from company funds and stored in ways that minimize operational risk. This includes strict policies on cold storage, internal controls and audits.

• Listing and leverage limits. Exchanges cannot simply list any asset they choose. Domestic frameworks often involve screening processes, and there are clear caps on leverage and margin exposure for retail clients.

• Advertising oversight. Promotion of digital asset services is treated similarly to financial advertising, with standards designed to avoid overstated claims or confusing language for retail users.

For a global exchange, this creates a fork in the road. Either invest heavily to build a licensed local presence that satisfies these conditions, or accept that serving Japanese residents directly is not compatible with the current model. Bybit’s decision to phase out services for Japan-based accounts aligns with the second path.

From the regulator’s perspective, the logic is straightforward. If citizens are using digital asset services, those services should operate under a recognizable legal framework. From the exchange’s perspective, the challenge is whether the cost and flexibility trade offs of a local license make sense relative to their broader global strategy.

3. What This Means for Japanese Users

For individuals living in Japan, the practical implications fall into three broad buckets: access, complexity and protection.

3.1 Access and product choice

As Bybit’s restrictions phase in, Japan based users will have fewer options to access products directly on that platform. Many will need to migrate trading activity to locally licensed exchanges or reorganize their portfolio approach. In some cases, the product sets on local platforms may be more curated, with a smaller list of assets and more conservative margin features.

At first glance, that looks like a reduction in flexibility. However, it is also a deliberate policy choice by Japanese authorities to prioritize stability and investor protection over unlimited product variety.

3.2 Added compliance steps

Users who are mistakenly flagged as Japanese residents are given the option to undergo additional identity verification to correct their account classification. This means more paperwork and documentation, but it also highlights a broader reality: in regulated markets, identity and residency status are central to how platforms can serve individuals.

For investors, the lesson is that jurisdiction matters. A user’s place of residence can determine which products are available, which investor protections apply, and which supervisory body has authority over disputes.

3.3 Clearer but narrower pathways

In the medium term, Japanese residents are likely to interact more with exchanges that hold domestic licenses. The upside is a clearer legal framework, stronger consumer safeguards and better integration with domestic banking rails. The downside is that some high risk or experimental products offered elsewhere may simply not be available locally.

For long term participants, that trade off can be acceptable. Restricting the more speculative end of the product spectrum may reduce short term excitement, but it can also lower the risk of severe losses for less experienced users.

4. The Strategic Calculus for Global Exchanges

Bybit’s move also illustrates the strategic choices facing large platforms as the regulatory environment matures. Broadly, they can choose between three models.

- Global first, selective exits. Focus on a unified global offering and withdraw from markets where local rules demand a fully separate licensed entity. This seems close to Bybit’s current approach regarding Japan.

- Multi hub licensing. Invest in regional hubs with strong licenses (for example, in the European Union, the Middle East or Asia), then use those as a base to serve nearby markets where cross border access is permitted.

- Full local integration. Build or acquire locally regulated entities in key countries, adapting product design, leverage, listing and marketing to each jurisdiction.

Each path comes with trade offs in terms of compliance cost, speed to market and product flexibility. Japan, with its demanding standards, naturally pushes exchanges toward the latter two options if they want sustained presence. Those that cannot or do not want to commit that level of resources may choose a gradual exit instead.

Importantly, a withdrawal from one market does not necessarily signal weakness in the overall business. It can simply mean that the company is drawing boundaries around where it can operate under a single unified framework.

5. Japan’s Role in the Global Regulatory Landscape

Japan’s stance on digital assets is often misunderstood. From a distance, emphasis on supervision and licensing can look like resistance. Up close, it is better described as a preference for onshore, regulated activity over offshore, lightly supervised models.

The decision to insist that exchanges obtain FSA approval if they wish to serve local users is part of a broader philosophy:

- Encourage domestic platforms and well supervised foreign entities rather than unregulated intermediaries.

- Apply financial sector standards such as capital buffers, disclosure, and clear segregation of client assets.

- Align digital asset activity with existing consumer protection norms instead of treating it as a separate, unregulated domain.

Bybit’s gradual exit is one visible outcome of that philosophy. At the same time, the same environment has allowed local platforms to grow under a clear rule set and has given policymakers a relatively structured view of how digital assets interact with the broader financial system.

As other countries move from high level statements to detailed regulations, Japan’s experience will likely serve as a reference point. It shows both the benefits of clarity and the potential for tension when global platforms and national frameworks do not fully align.

6. Educational Takeaways for Investors

For individual investors, especially those outside Japan who may see this story only as a headline about one exchange, there are several important lessons.

6.1 Regulatory risk is part of market risk

Price charts often dominate attention, but where and how an asset is held can be just as important as its short term price. Regulatory changes can alter which platforms you can use, how quickly you can move funds, or what types of products you are allowed to access in a given country.

A well diversified approach to platforms, combined with an understanding of your local regulatory environment, can be as valuable as diversification across tokens.

6.2 Residency status is not a trivial detail

The Bybit decision highlights how exchanges classify users by jurisdiction. Sometimes that classification can be incorrect, especially for people who travel frequently or have complex residency situations. It is in every user’s interest to ensure identity and address information is accurate and up to date.

Doing so reduces the risk of sudden restrictions or delays and makes it easier to navigate any changes in access that arise from new rules.

6.3 Regulation is not purely negative for innovation

It can be tempting to view any regulatory pressure as a barrier to innovation. In reality, clear, consistently applied rules can be a foundation for long term growth. Institutional capital in particular tends to prefer environments where the legal framework is stable, even if it is demanding.

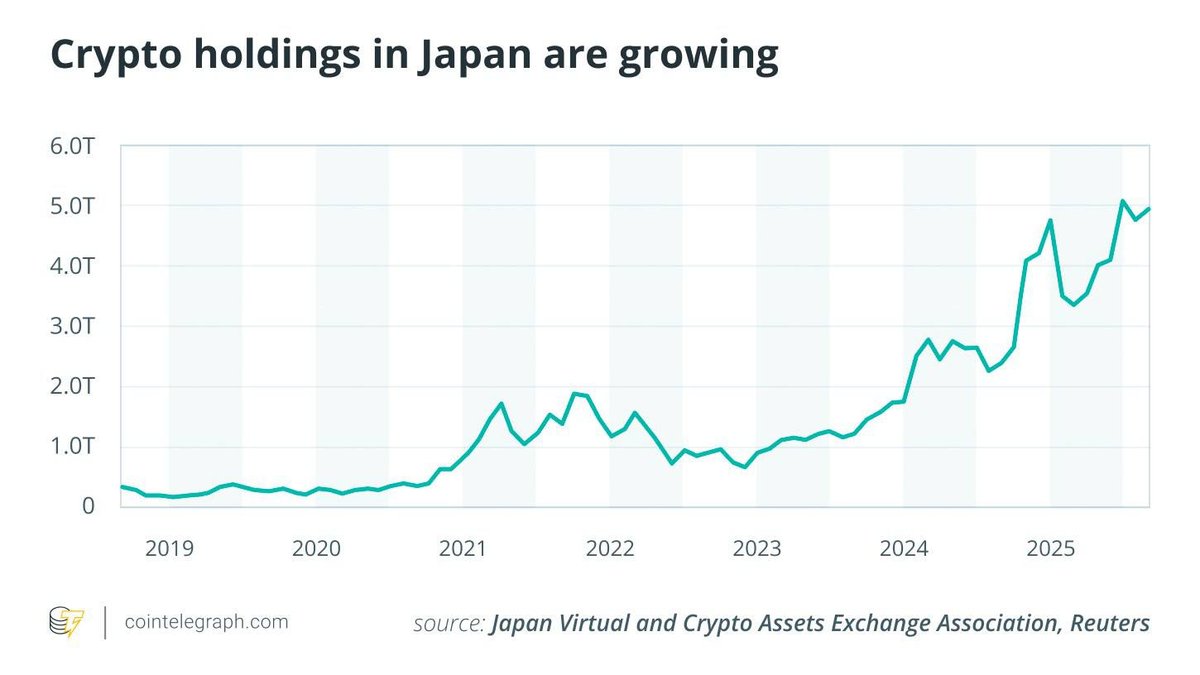

Japan’s insistence on licensing has undoubtedly limited certain types of speculative activity, but it has also encouraged the development of more robust, domestically aligned services. Over time, that can help digital assets move from niche speculation into the core of financial infrastructure.

7. What Comes Next

Looking forward, there are several plausible developments that could follow from Bybit’s announcement.

• More emphasis on local exchanges in Japan. As global platforms adjust their access policies, domestic exchanges and fully licensed foreign entities will likely play a larger role in servicing retail demand.

• Greater convergence between global and local standards. As the industry matures, large platforms may increasingly seek multiple regional licenses, narrowing the gap between what is offered in different jurisdictions.

• More informed users. Episodes like this can encourage investors to pay closer attention to custody, jurisdiction and the legal status of the platforms they use, not just to asset prices.

For Japan, the story reinforces its position as a jurisdiction that welcomes digital assets under defined conditions rather than as a borderless space without supervision. For global exchanges, it underlines the importance of deciding where to localize deeply and where to serve only indirectly.

8. Conclusion

Bybit’s decision to gradually withdraw services from Japan starting in 2026 is more than a company specific headline. It is a case study in how the digital asset industry is entering a new phase, one in which regulatory alignment and licensing are becoming as central as trading volume and product variety.

Japan’s insistence on local registration, tight oversight and clearly defined investor protections has created a demanding environment, but it has also produced a coherent framework. Platforms that choose not to operate under that framework will step back; those that do may gain long term credibility and deeper integration with the broader financial system.

For investors, the key message is educational rather than dramatic. Market cycles will come and go, but the structure of the platforms and jurisdictions through which you interact with digital assets can quietly shape your risk profile in powerful ways. Understanding that structure, and respecting the role of local rules, is now a core part of being a thoughtful participant in the digital asset economy.

Disclaimer: This article is for educational and informational purposes only and does not constitute investment, legal or tax advice. Digital assets carry risk and may not be suitable for every investor. Always conduct your own research and consult a qualified professional before making financial decisions.