Altseason isn’t a day of green candles; it’s a regime where ETH leads, BTC dominance eases, fresh stablecoin capital arrives, and breadth expands for weeks. Here’s a signal-driven framework to know when it’s starting—and when to stand down

Few phrases trigger more FOMO than altseason. In headlines it sounds like free money; in practice it’s a market regime—a multi-week stretch when capital rotates out of Bitcoin, Ethereum takes leadership, and a growing share of alts outperform on a relative basis. You don’t catch it with wishful thinking. You catch it by watching a small set of repeatable signals and acting only when they line up.

What Altseason Actually Is (and Isn’t)

- Sequence, not a spike: BTC rallies first and sets the range. ETH/BTC then turns higher. Only after that does breadth spread to large caps and, later, select mid-caps.

- Persistence over pop: A real altseason shows weeks of relative strength and participation, not a single squeeze day.

- Selective, not universal: Even in strong rotations, only a minority of alts deliver outsized gains; laggards remain laggards.

Where We Are Now

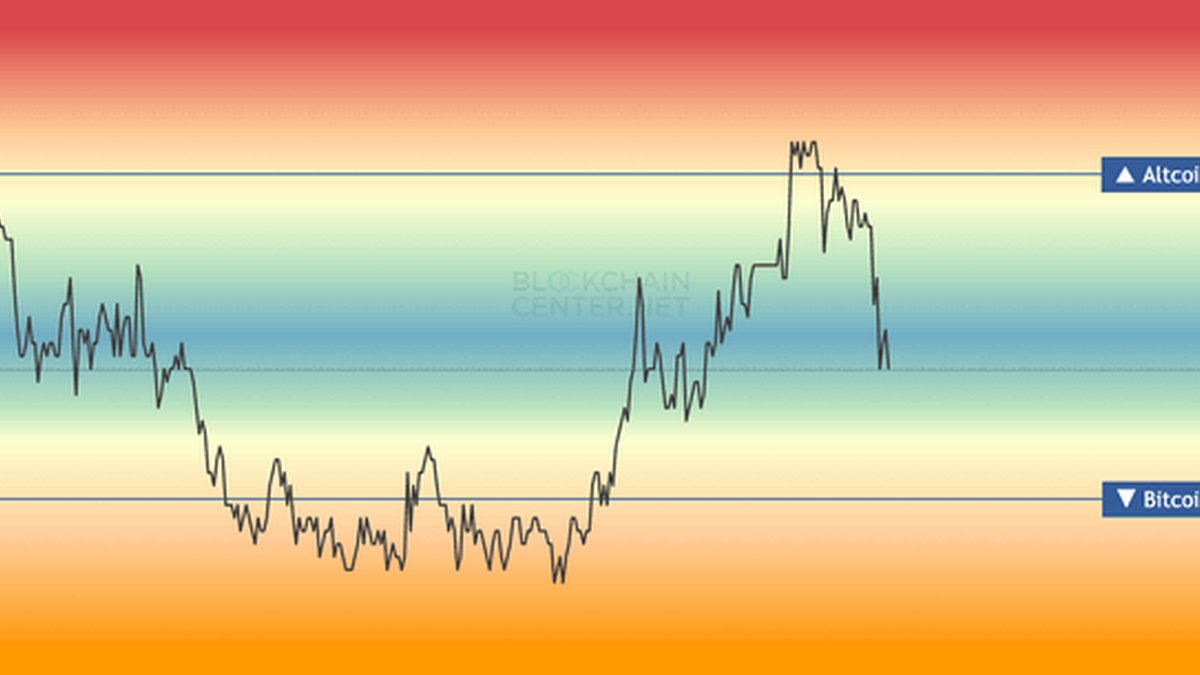

Across common dashboards, the Altcoin Season Index recently slipped from the upper band back toward mid-range. Translation: we’re in a transition zone—neither clear Bitcoin season nor a confirmed alt melt-up. That’s precisely where the next move is built. Whether it becomes altseason depends on four gatekeepers.

The Four Gatekeepers of Altseason

1. ETH/BTC Uptrend (Leadership Flip)

Altseason doesn’t persist without ETH leadership. The tell is a weekly ETH/BTC trend of higher highs and higher lows, with closes reclaiming long-term moving averages. No ETH/BTC break, no broad rotation.

2. BTC Dominance & Volatility (Room to Rotate)

Capital moves down the risk curve when Bitcoin volatility cools and BTC dominance trends lower. A calm, range-bound BTC is the best backdrop for alt outperformance.

3. Fresh Fuel (Stablecoin and ETF Flows)

Rotation needs new chips, not just reshuffling. Rising net supply of USDT/USDC and steady spot ETF inflows signal real dollars arriving to fund alt bids.

4. Breadth (Participation)

Track how many top-caps outrun BTC over rolling windows and how many trade above their 200-day. Sustained breadth is the difference between a narrative pump and a regime.

Confirmation vs. Invalidation

- Confirming cluster: ETH/BTC trending up on the weekly; BTC dominance rolling over while BTC ranges; stablecoin supply expanding; breadth improving for several weeks. When all four print together, you’re looking at the real thing.

- Walk-away cluster: ETH/BTC rolls back to new lows; BTC dominance rises alongside higher BTC vol; stablecoins contract; breadth narrows to a handful of narratives. Three of four = stand down.

Can ETH Realistically Lead Toward a New High?

A credible ETH advance requires three pillars: (1) persistent ETF demand over months, not days; (2) on-chain revenues that keep net issuance tight or negative during busy periods; and (3) an ETH/BTC uptrend. A path into the high single-digit thousands is compatible with these conditions. Stretch targets far above that likely demand a friendlier macro backdrop and a longer leadership window.

How Alt Rotations Unfold When They Work

- Structure first: Weekly downtrends break, price accepts above the line, and supply becomes support.

- Compression next: A few tight candles form just under horizontal resistance while volume dries—classic fuel-gathering.

- Expansion only after acceptance: The breakout sticks, buyers defend the retest, and momentum continues without giving back the entire move.

Names that check those structural boxes—broken diagonal, accepted retest, tight flag—are your early-stage candidates. The ticker matters less than the pattern and the presence of real catalysts (integrations, product launches, liquidity programs).

Macro Still Sets the Weather

Rotation regimes live inside the larger macro tape. Export controls, tariff threats, shutdown headlines, or a jump in real yields can flip risk appetite in a day. That’s why confirmation matters: when the four gatekeepers align, the market can absorb more noise; when they don’t, headlines dominate.

A Playbook You Can Repeat

- Use weekly closes. Intraday wicks are noise; regimes are decided by bodies.

- Enter in tranches. Retest add → breakout add → post-retest add. Force the market to earn your size.

- Favor spot or low leverage until ETH/BTC and breadth both confirm.

- Pre-plan scale-outs. Set measured-move targets and lighten gradually; altseason ends faster than it begins.

- Protect the downside. Invalidation is where the thesis is wrong on a closing basis, not where it feels uncomfortable.

Scenarios for the Next Quarter

- Bull Rotation: BTC ranges, ETH/BTC trends up, stablecoins grow, breadth broadens. Large caps lead; mid-caps with real catalysts follow. This is the early altseason lane.

- Selective Chop: Conflicting signals create a stock-picker’s market. A few sectors rip; most chop. Patience and position sizing trump predictions.

- Re-Risk-Off: Macro shock lifts vol and dominance; alts revert to supports. Rotation deferred, not denied.

Bottom Line

Altseason isn’t a meme; it’s a measurable state where leadership, dominance, liquidity, and breadth move in sync. Today’s readings sit in the middle—fertile ground for setups, but not a guarantee. Watch the gatekeepers: a rising ETH/BTC, easing BTC dominance with calmer BTC, expanding stablecoin supply, and improving breadth. When they align, you don’t need to guess; the tape will invite you in. Until then, prepare your lists, respect your invalidations, and let signals—not slogans—decide when you rotate.

Further Reading

Crypto & Market | Exchanges | Apps & Wallets

Disclaimer: This article is for educational purposes only and is not investment advice. Digital assets are volatile; manage risk.