Altseason Isn’t a Mood—It’s Market Plumbing

Every few weeks, social feeds light up with screenshots and proclamations that “it’s starting.” A mid-cap pops 40%, a new airdrop farm launches, or a narrative (AI, RWA, privacy, gaming) goes vertical for a weekend. Yet, by the following Tuesday, liquidity feels thin again and bids vanish. If you’re sensing déjà vu, you’re not alone. After October’s forced deleveraging, the market-maker lens—captured in recent commentary from firms like Wintermute—has been blunt: external capital remains limited; the tape is recycling internal capital; and bitcoin and ether, not the long tail, are dictating risk budgets. In this kind of tape, altcoin spikes are rotations, not expansions.

What breaks the loop? Not an airdrop. Not a single listing. Not even a macro headline by itself. The historical tell that turns rotations into expansions is when ETH begins to outperform BTC on a sustained basis. That single relationship—the ETH/BTC cross—maps the handoff from digital-gold risk to platform risk. When it flips, breadth follows.

Why One Pair Can Gate an Entire Season

It’s tempting to think of altseason as hundreds of idiosyncratic stories. But structurally, altcoins live downstream from two reservoirs: (1) bitcoin, which anchors crypto’s perceived macro legitimacy and collateral quality; and (2) ethereum, which anchors developer activity, composability, and most of the token economy’s operating leverage (DEX volumes, staking flows, DeFi credit, NFT liquidity, L2 throughput). When ETH appreciates faster than BTC, it does more than print a nicer chart—it reprices platform optionality. Suddenly, the cash flows, fees, and governance rights tied to that platform (and its L2s and app-layer tokens) get a beta upgrade. Capital doesn’t just rotate; it chains.

This is why the most durable altseasons tend to appear after two conditions are met:

- BTC proves the ceiling is glass. Approaching or registering a new all-time high drains the “existential risk” premium and compresses volatility. The market starts to perceive BTC as structurally scarce, not just cyclically hot. That stabilizes collateral and makes risk managers comfortable with rotating a portion of gains.

- ETH/BTC flips regime on weekly timeframes. When ether stops underperforming and pushes into a sustained advance versus BTC, we don’t just see one-off pumps—we see breadth. Historically, that breadth expresses first in L2s and high-velocity DeFi, then into quality mid-caps, and only later into the deepest tail.

Plenty of traders obsess over bitcoin dominance (BTC.D). It’s useful, but noisy. BTC.D can drift lower for reasons that don’t help you (e.g., a single large-cap alt rally on a news shock), and it can rise even as many altcoins quietly base. In contrast, ETH/BTC captures the risk budget pivot in a compact, high-liquidity signal that’s hard to manipulate on higher time frames.

The One Signal—Technically Defined

So what exactly is the “one signal”? Here is a pragmatic, falsifiable definition you can copy to your playbook:

Altseason ignition signal: A weekly ETH/BTC close above the prior multi-month range high, accompanied by a positive 12-week rate of change and a 20-week moving average curling up through the 50-week moving average, while BTC trades at or within a high-volatility’s-width of its prior cycle high (and realized BTC volatility is contracting, not expanding).

That sounds like a mouthful, but it compresses three essential truths into one line:

- Timeframe discipline: Lower-timeframe breakouts in ETH/BTC have repeatedly failed this year. On a weekly basis, “noise” becomes “structure.”

- Momentum confirmation: A positive 12-week rate of change tells you this isn’t a single candle—it’s a trend.

- Carry & plumbing alignment: BTC’s volatility contraction reduces the opportunity cost of moving down the risk curve; when whales and desks don’t fear a $10k–$15k BTC shock, they will sponsor more alt risk.

If you want a minimal variant: weekly ETH/BTC higher high + higher low + close above range with BTC near cycle highs. That’s the distilled essence.

Common False Positives—and How to Avoid Them

Markets are generous with head-fakes. Here are the most common ones:

- News-led ETH spikes without follow-through breadth. Perhaps a gas-price tweak, staking narrative, or ETF headline pops ETH. ETH/BTC ticks up for two to three sessions, CT declares victory, and then the cross rolls over because DEX volumes and L2 activity don’t respond. The fix: demand breadth confirmation within one to two weeks—rising share of total crypto volume from spot DEXs, L2 gas persistence, and mid-cap participation that lasts beyond event half-lives.

- BTC mini-panic rallies. If ETH/BTC lifts while BTC is selling hard, that’s often just beta math (ETH falling slower than BTC). Altseason needs BTC to be strong-to-stable, not weak.

- Funding-led squeezes. Perp funding flipping negative and a brief short squeeze can produce an ETH/BTC wick. Watch the cross on the weekly close, not intraday fireworks.

Why Wintermute’s Read Matters Right Now

Wintermute’s message (summarized): the market has cleansed leverage; sentiment has stabilized from fragile to neutral; but external inflows are still shy. In that world, every pump needs a sponsor—and the only entities with balance sheets large enough to sponsor multi-week expansions are bitcoin profits and ETF-driven BTC inflows, not long-tail alt speculation. That’s why the one signal lives on the ETH/BTC chart. It tells you when BTC-derived capital is comfortable leaving base camp and when the market’s “sponsors” are stepping down the risk ladder.

Micro-Structure Tells That Should Appear Around the Flip

Charts don’t live in a vacuum. When the ETH/BTC weekly breaks out and holds, you typically see a cluster of micro-structure changes within days to weeks:

- Spot share rises on ETH venues. More ETH turnover migrates away from perps toward spot and fiat rails, reflecting real allocation rather than levered punts.

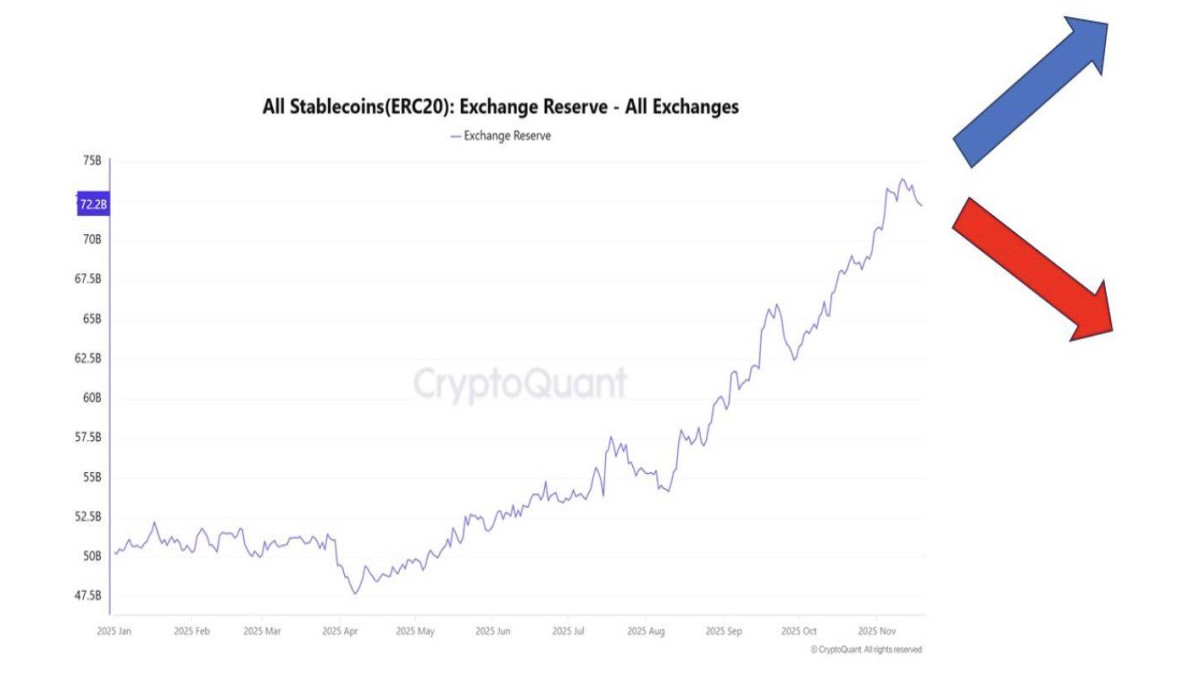

- Stablecoin net issuance tilts positive. Not all new stablecoins are new dollars—but sustained net issuance is a decent proxy for fresh capacity to take risk across DeFi and L2s.

- Perp basis normalizes upward for mid-caps. Funding rates move modestly positive but not overheated, implying maker comfort inventorying alt risk.

- Options skew softens on ETH. Demand for downside insurance eases, consistent with allocators moving from hedged to unhedged exposures.

- L2 gas has a floor. Instead of “spike-and-die,” baseline activity steps up and stays up—an important sign that users aren’t just chasing emissions.

Rotation Map: What Usually Moves First

Once the ETH/BTC ignition signal is in, altseason typically follows a sequence. It isn’t perfect, but it’s repeatable:

- ETH and L2 blue chips. The first wave is boring: core L2 tokens, major DEXs, robust perps venues, staking derivatives. These absorb flows because they’re liquid and institutionally tolerable.

- Quality infra and oracles. Market makers and smart retail then lean into the “picks and shovels” (indexers, bridges, oracles) that benefit from rising on-chain throughput.

- High-beta DeFi and selective new L1s. Lending markets, structured yield, and capital-efficient AMMs rally as spreads compress. If a new L1 has credible throughput and TVL momentum, it can catch a second wind here.

- Long tail and memes. Only after liquidity is deep do you see durable beta in the tail. If you see memes flying before steps 1–3, that’s usually a blow-off, not a beginning.

‘But BTC Is Still Below the Old High—Isn’t That Bearish?’

We’re close to a circular argument many traders fall into: “Altseason only starts when BTC is at highs; we’re not there; therefore, no altseason.” The better reading is path dependency. BTC doesn’t need to be at a weekly close ATH for the ignition signal to trigger; it needs to be near enough that its volatility regime is contracting, not exploding. If BTC is whipping $7k–$12k per day, desks will not warehouse tail risk. If BTC is grinding in a $2k–$4k daily range near the top of its distribution, they will.

How to Trade (or Not Trade) the Signal

Here’s a disciplined three-stage approach:

- Stage 0 — Watchlist + Rules. Before the flip, curate two baskets: (A) liquidity leaders (ETH, top L2s, top DEXs, core perps), (B) high-beta, high-conviction mid-caps with real revenues or network growth. Pre-commit position sizing and invalidation for each. Decide now which assets you will not touch (low-float farm tokens, unsound tokenomics, governance without product).

- Stage 1 — Confirmation Week. ETH/BTC weekly breakout + BTC vol contraction: scale into Basket A only. The goal isn’t to nail the bottom; it’s to catch the regime. If the cross fails on the very next weekly close, cut and revert to BTC/ETH.

- Stage 2 — Breadth Week. If DEX share, L2 gas, and stablecoin net issuance confirm, start adding Basket B over multiple sessions. Prefer names with on-chain cash flows, rising MAUs, and deep liquidity pairs.

Risk management doesn’t get less important in altseason; it gets more important. Use volatility budgeting (size positions so that a 2–3 standard deviation move equals a fixed portfolio-% loss), time stops (if breadth doesn’t confirm in two weeks, exit), and liquidity stops (if book depth collapses or slippage breaches your threshold, step aside).

Macro Isn’t a Cheat Code—It’s a Backdrop

Yes, falling policy rates, friendlier liquidity, and a softer dollar help. They expand the set of portfolios willing to own BTC, which in turn funds the ETH/BTC flip. But macro alone doesn’t start altseason. We’ve seen supportive macro weeks where ETH/BTC still couldn’t break out because crypto’s internal plumbing wasn’t ready (ETF flows choppy, exchange reserves not falling, perps too crowded). Treat macro as a tailwind, not a trigger.

What Could Invalidate the ‘One Signal’ This Time?

Three edge cases to watch:

- ETH-specific shock. A protocol-level incident or a staking contagion would depress ETH/BTC regardless of BTC’s posture and delay altseason even with benign macro.

- BTC supercycle move. If BTC rips in a low-float melt-up, the opportunity cost of holding anything else skyrockets. ETH/BTC can then underperform for longer than logic says it should, postponing breadth.

- Regulatory surprise on key venues or stablecoins. Anything that crimps fiat rails or stablecoin liquidity throttles DeFi throughput and dampens breadth even if ETH/BTC nudges up.

How This Plays Out From Here: A Probabilistic Map

Given current conditions (range-bound BTC ~the high 90k to low 100k band in recent sessions, ETH oscillating in the mid-3k zone, and alt breadth failing to persist), the base case is that we are still in the “pre-ignition” zone. That’s not bearish; it’s preparatory. The moment ETH/BTC clears its range on the weekly and holds for a full candle while BTC’s realized volatility is compressing near highs, the clock starts. From that print, the first 7–14 days matter disproportionately. If breadth metrics don’t respond, treat it as a false start and step back. If they do, that’s your green light to execute Stage 2 of the playbook.

Why This Framework Beats Vibes

Most investors lose altseasons in one of two ways: they arrive too early (bleeding basis and fees while waiting for a vibe to become a regime) or too late (chasing tails after breadth has already peaked). Centering your decision-making on a single, falsifiable trigger eliminates both errors. An ETH/BTC weekly breakout with BTC stability is rare enough to avoid overtrading and robust enough to survive the weekend. It’s not perfect—no signal is—but it has captured the essence of prior cycles: BTC earns trust, ETH earns beta, and then everything else earns a chance.

Practical Dashboard You Can Build in 10 Minutes

- Chart 1: ETH/BTC, weekly, with 20/50/200 WMA. Alert: price crossing prior range high; 20WMA curling up through 50WMA.

- Chart 2: BTC realized 1m volatility and distance from prior ATH. Alert: vol falling into the 30–50th percentile of its one-year range as price sits within a few percent of the top quartile.

- Table: DEX share of total spot crypto volume, stablecoin net issuance (7-day rolling), median L2 gas, perp funding for ETH and a mid-cap basket.

- Heatmap: 7-day breadth—% of top 200 tokens above their 20- and 50-day moving averages.

Put those four visuals on one screen. When all four turn, the market has told you, in plain language, that the season is real.

Bottom Line

Everyone wants a date. What you need is a trigger. The only one that has consistently signaled a true altseason across cycles is an ETH/BTC regime flip on weekly time frames while BTC sits near its high with calming volatility. Everything else—funding squiggles, one-off pumps, narrative du jour—is theater. When the cross breaks out and holds, liquidity extends, depth returns, and breadth becomes self-reinforcing. Until then, treat spikes as rotations, not revolutions.