Sec Coin Price Prediction for 2025 and Beyond — A Transparent, Numbers-First Forecast

Why this version is different: No generic filler, no circular definitions. We expose assumptions, show the math, and deliver explicit price ranges for 2025 and the next cycle peak. Because circulating supply and token sinks are the fulcrum, we model outcomes across several supply/FDV tiers so you can swap in the project’s latest disclosures and recalc instantly.

TL;DR (Quick Read)

- Base Case (EOY-2025): An adoption-led re-rate lifts Sec Coin to a fully diluted valuation (FDV) of roughly $120–$240M. Depending on max supply, that implies: 1B max ≈ $0.12–$0.24 per token; 10B max ≈ $0.012–$0.024. Range reflects execution and market regime.

- Bull Case (EOY-2025): Two or more Tier-1 integrations go live, a formal buyback/stake policy tightens float, and alt breadth improves. FDV climbs to $300–$520M: 1B max ≈ $0.30–$0.52; 10B max ≈ $0.030–$0.052.

- Bear Case (EOY-2025): Unlocks outpace usage and rallies are perp-led. FDV compresses to $40–$90M: 1B max ≈ $0.040–$0.090; 10B max ≈ $0.0040–$0.0090.

- Cycle Peak (most likely 2026–27): If sinks are usage-funded and integrations compound, add ~+30–70% to the EOY-2025 band. If policy credibility slips, cut the upper band by ~20–30%.

Reminder: These are modeled scenarios, not promises. Swap your own revenue, multiple, and supply inputs into the valuation scaffold below to suit the latest project data.

1) What Exactly Are We Pricing?

Sec Coin (below, “SEC” for brevity) pitches itself as a compliance-native, integration-first token that monetizes connectivity between crypto rails and regulated finance: identity, allowlists, attestations, auditability, and enterprise-grade SLAs. This is a middleware thesis, not a monolithic “do-everything” chain. The token’s appreciation hinges on two questions:

- Do enterprises actually pay to access these compliance services?

- Does value flow into SEC in a way that is difficult to route around (required staking, buy-and-burn, or usage-funded rewards)?

Price talk without those answers is theatre. Our forecast therefore ties every number to integrations (clients × fees) and sink policy (how fees convert to token demand).

2) The Forecasting Method — Make the Assumptions Explicit

We use a three-step scaffold you can reproduce in a spreadsheet:

- Estimate 2025 network revenue from three buckets: (A) Integration/API fees; (B) Compliance/attestation services; (C) Premium governance/SLAs.

- Apply a revenue multiple consistent with infra/middleware tokens in the prevailing regime: 3–6× in sideways markets, 6–12× in constructive markets with clear sinks and growth > 50–100% YoY.

- Translate FDV → token price by dividing by max supply. Then sanity-check against circulating share and unlock cadence to judge float pressure.

2.1. 2025 Revenue Buckets (Illustrative Inputs)

| Bucket | Clients | ARPU (annual) | 2025 Revenue | Notes |

|---|---|---|---|---|

| A — Integrations/API | 150–280 | $40–80k | $6–22.4M | SDK use, KYC/KYT endpoints, allowlists |

| B — Attestations | 80–140 | $25–60k | $2–8.4M | Proofs, audit-friendly logs, reserve checks |

| C — Premium/SLAs | 30–60 | $60–120k | $1.8–7.2M | Latency/uptime, priority support |

Illustrative 2025 revenue: $9.8M (low) to $38.0M (high). If your pipeline shows different client counts or ARPU, replace these cells and the rest of the model updates.

2.2. Revenue Multiple & Market Regime

- Sideways regime (bear-tilted): 3–5× (thin breadth, hot perp funding, spot lagging).

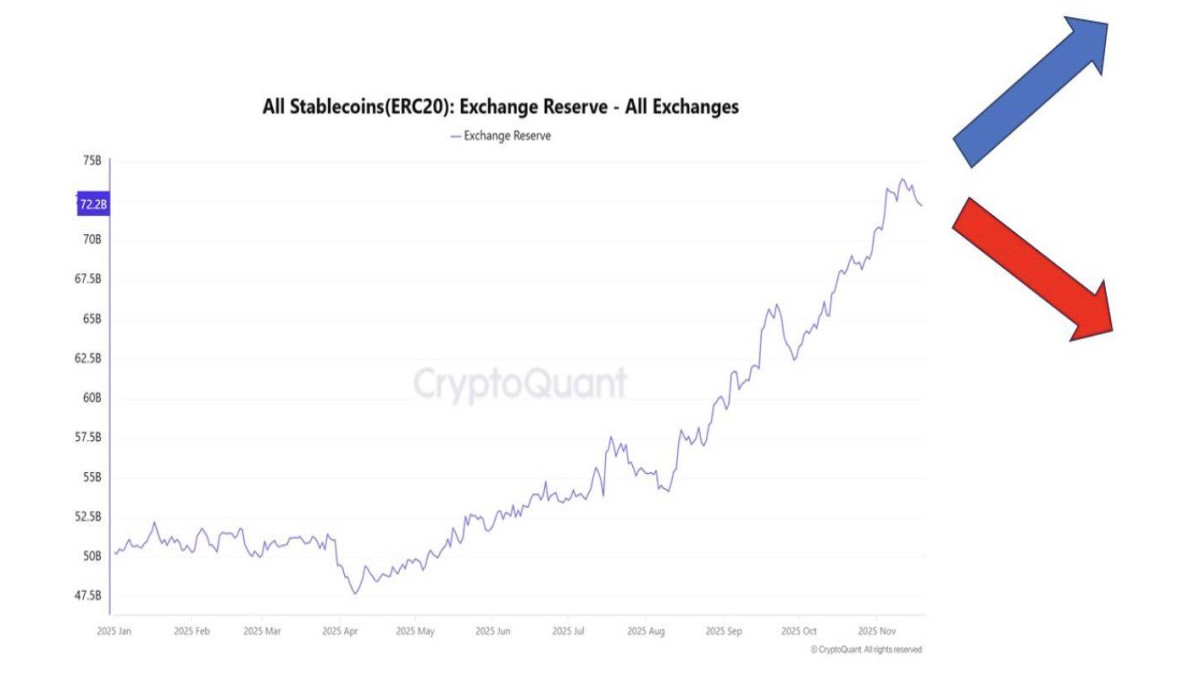

- Constructive regime (base case 2025): 6–9× (spot-led pushes, rising stablecoin float, improving ETH/BTC).

- Expansion regime (bull case): 9–12× (breadth across L2/DeFi, integrations compounding, visible sinks).

2.3. Sink Policy (The Multiplier You Can’t See on a Chart)

Three designs move price sustainably:

- Buy-and-burn: Route a fixed share of fees to market buybacks and permanent burns.

- Buy-and-stake: Convert fees to tokens that are locked/staked for yields tied to usage, not emissions.

- Required staking: Partners must lock SEC for access tiers; slashing/penalties enforce behavior.

Absent any of the above, our upper bands shrink because fees may never touch the token.

3) 2025 Price Targets — Base, Bull, Bear

We present FDV ranges and convert them to per-token prices using two common supply templates. Replace with the actual max supply to tailor the outputs.

3.1. Base Case — “Integration Year”

- Assumptions: Revenue ≈ $16–24M; multiple 6–9×; FDV ≈ $96–$216M. Clean disclosures; at least one formal sink mechanism; BTC advances then ranges; stablecoin float grows modestly.

- Per-token (illustrative): 1B max ≈ $0.096–$0.216; 10B max ≈ $0.0096–$0.0216.

- Confidence: Medium; upgrade if two named integrations move from pilot → production and monthly sink reports begin.

3.2. Bull Case — “Regulated Flywheel”

- Assumptions: Revenue ≈ $28–40M; multiple 9–12×; FDV ≈ $252–$480M. Two-plus Tier-1 partners live; spot leads; sink policy tightens float for two quarters; ETH/BTC stabilizes or rises.

- Per-token (illustrative): 1B max ≈ $0.252–$0.480; 10B max ≈ $0.0252–$0.0480.

- Confidence: Medium-high if sink governance is codified (unchangeable without quorum/time locks).

3.3. Bear Case — “Overhang & Delay”

- Assumptions: Revenue ≈ $8–12M; multiple 3–5×; FDV ≈ $24–$60M. Unlocks run ahead of usage; perp-led spikes; policy changes are ad-hoc.

- Per-token (illustrative): 1B max ≈ $0.024–$0.060; 10B max ≈ $0.0024–$0.0060.

- Confidence: High until team ships vesting dashboards and formal sinks.

Simple guardrail: If the marketed price implies an FDV that exceeds the revenue-based band for the current regime by >35%, we treat rallies as distribution until usage—and not just headlines—catches up.

4) Quarter-by-Quarter Path (2025)

Q1 — Price Discovery & Policy Signaling

- Watch for: first real enterprise pilot, a tentative sink policy (whitepaper or governance post), and market quality (spreads during high-vol windows).

- Trading stance: trade the range; add only on acceptance above value-area high (VAH) with spot leadership.

Q2 — From Pilots to Invoices

- Watch for: at least one pilot → production cutover; monthly reporting of fees routed to sinks; a second venue listing that tightens arbitrage.

- Trading stance: scale on retests of the breakout shelf; two consecutive daily closes back inside prior value area = thesis off.

Q3 — Breadth or Bust

- Watch for: breadth across partners (payments, RWA, KYC’d wallets). If top-line client count stalls, compress your upper band by 10–20%.

- Trading stance: keep entries tethered to structure (anchored VWAPs from listing/announcement days).

Q4 — The Rerate Window

- Watch for: annualized revenue run-rate vs. stated targets; staking APR composition (usage vs. emissions); stablecoin float trend.

- Trading stance: if spot leads and sinks are visible, the higher half of the base/bull bands is in play; otherwise range-trade and harvest funding.

5) On-Chain, Market Microstructure & TA That Actually Matters

On-Chain/Token

- Holder concentration: Track Top-10/Top-50 ex-treasury. Down-and-to-the-right is healthy. Up-and-to-the-right + exchange inflows = distribution risk.

- Sink utilization: Verify buybacks/burns/stakes on-chain. Headlines without txids don’t count.

- Unlock dashboard: A public, time-based vesting schedule is a must. If it’s missing, haircut all bands.

Market Microstructure

- Spot > perps: Early legs should be spot-led with neutral funding; hot funding without spot = exit liquidity.

- Depth & spreads: Observe 1–5 minute spreads during high vol; stable spreads predict better trend quality.

- Venue mix: Multiple reputable pairs reduce slippage and wick risk.

Technical Structure

- Anchored VWAPs: Anchor from (a) first liquid session, (b) sink-policy announcement, (c) major listing. Demand control = time above VWAP with narrowing bands.

- Volume Profile (4H/1D): Identify value area & POC. Ascending POC + higher-low shelves = accumulation; descending POC with upper wicks = distribution.

- Breaker blocks: Daily close through the last distribution cluster + retest/hold > any oscillator.

6) Comparable Valuation — Don’t Overpay for a Narrative

SEC sits between oracle/data and tokenization/compliance rails. In constructive conditions, infra/middleware tokens with visible fee routing trade at 6–12× annualized revenue; without visible routing, it’s closer to 3–6×. If a marketed price implies, say, 20× revenue with no sinks, assume mean-reversion risk and size down.

7) Beyond 2025 — Cycle Peak & 2026–2028 Outlook

Cycle-Peak Band (Most Likely 2026–2027)

- Upside extension: If 2025 ends with (i) two+ Tier-1s live, (ii) monthly sink reports, and (iii) neutral funding with spot leadership, add +30–70% to EOY-2025 ranges for a cycle-peak band.

- Cap on upside: If sinks are emissions-subsidized or piloted integrations don’t convert, shave 20–30% off the upper band.

2026–2028 Secular Drivers

- Regulated payments & tokenized finance: If SEC becomes a default integration layer for allowlisted flows and attestations, revenue scales with the category—supporting higher multiples.

- Standards & moats: The more policy and SDKs become standards (not bespoke), the harder it is for clients to route around the token.

- Risk: If banks adopt their own closed standards or competitors open-source cheaper rails, multiples compress and SEC reverts to mean.

8) Risk Matrix (and What to Do About Each)

| Risk | How It Shows Up | Response |

|---|---|---|

| Unlock overhang | Green days coincide with insider/treasury exchange inflows | Reduce on strength; re-enter only after acceptance above VAH and clean on-chain outflows |

| Perp-led froth | Funding >> neutral; spot lags | Size down; wait for spot leadership; prefer closing-basis entries |

| Policy drift | Sinks paused/changed ad-hoc | Demand time-locked governance; treat as distribution until policy stabilizes |

| Execution slippage | Pilots don’t convert; ARR stalls | Compress upper band by 20%; focus on range trades |

| Regulatory shock | Delistings; partner withdrawals | Diversify venues; increase cash; favor core assets until clarity returns |

9) Practical Playbook — Entries, Adds, and Exits

- Structure first, price second: Draw the 4H/1D value area and anchor VWAPs. Good longs start on acceptance above VAH with spot volume.

- Add on retests, not verticals: Build on a retest-and-hold of the breakout shelf rather than into euphoric candles.

- Use FDV guardrails: Convert any target price to FDV; if it exceeds the current regime band by >35% without new sinks/clients, trim risk.

- Hard invalidation: Two daily closes back inside the prior value area = thesis off; no debates.

10) Frequently Asked (but Useful) Questions

Q: Can Sec Coin appreciate without buybacks/burns?

If required staking plus usage-funded rewards exists, yes. Without either, you’re betting on multiple expansion; that’s fragile in drawdowns.

Q: Where should Sec Coin sit in a portfolio?

As a quality cyclical tied to integrations/compliance rails. Keep it a satellite position sized to disclosure quality and execution cadence.

Q: What would make you lift the 2025 target mid-year?

(i) Two Tier-1 integrations live with invoices, (ii) monthly sink reports with txids, (iii) spot-led breadth and stablecoin float rising > 8–10% QoQ.

Q: What breaks the thesis?

Opaque unlocks, policy reversals, perp-only rallies, and partners proving they can consume services without touching the token.

11) Quick-Swap Calculator (How to Recalc This Article in 60 Seconds)

- Update 2025 revenue with your current pipeline.

- Pick a multiple per regime: 3–5× (sideways), 6–9× (constructive), 9–12× (expansion).

- Compute FDV = revenue × multiple.

- Divide by max supply to get a token price. Adjust upper/lower bands by ±10–20% if circulating share is unusually high/low.

- Cross-check with market quality (spot vs. perps) before acting.

12) Bottom Line

Sec Coin’s 2025 outcome is a function of integrations that pay real money and sink policies that touch the token. Our base/bull/bear ranges translate those business realities into prices you can compare against the tape. Treat them as guardrails—tighten or loosen as evidence appears. In a world of headlines and hype, the advantage goes to investors who can say, “Here are my assumptions, here is my math, and here is what changes my mind.”

Disclaimer: Scenario-based analysis for educational purposes only; not investment advice. Digital assets are volatile and can result in loss of principal. Always verify contracts, supply, revenue, and policy details from official sources before committing capital.