Cardano Price Prediction 2025 — Targets, Triggers, and a Reusable Valuation Framework

This is not another generic explainer. Below we publish clear price bands for ADA in 2025, the assumptions behind them, and the network metrics that would move our targets up or down. We anchor the outlook to concrete developments—on-chain governance via Chang/CIP-1694, scaling with Hydra, and fast bootstrapping via Mithril—plus objective references you can track yourself.

Where Cardano Stands Entering Late 2025

- Roadmap eras: Cardano’s multi-year path (Byron → Shelley → Goguen → Basho → Voltaire) places current emphasis on governance and scalability.

- Chang upgrade (Voltaire): Introduces on-chain participatory governance as outlined in CIP-1694 (voting, dReps, constitutional processes), moving Cardano toward community-led decision-making.

- Hydra (L2): Cardano’s research-driven layer-2 stack designed to increase throughput via isomorphic state channels (“Hydra Heads”), targeting low-latency and cost efficiency without compromising base-layer security.

- Mithril: Stake-based multi-signature snapshots that let nodes and apps verify chain state quickly—important for lightweight clients, faster bootstrapping, and developer UX.

- Market context & history: ADA’s all-time high (ATH) is just over $3.10 in early September 2021; current circulating supply is ~36–36.0B ADA (≈80% of max 45B) per major trackers.

- DeFi/usage trackers: DefiLlama maintains Cardano’s TVL/volume dashboards; treat these as neutral sources for trend confirmation (we care more about direction than a single day’s print).

- Developer activity: Cardano’s repos regularly show high commit velocity; public trackers like CardanoUpdates aggregate weekly activity (useful for builder momentum).

Price Targets for End-2025 (EOY) — Base, Bull, Bear

These are scenario bands, not promises. We state our assumptions so you can swap in your own numbers.

1) Base Case (most likely)

- Assumptions: Chang mechanisms are live and used (governance participation trends up), Hydra adoption improves UX for a few flagship apps (DEX/lending/payments), Mithril continues reducing node/app friction, and macro is risk-on/neutral. DeFi activity trends sideways-to-up on Cardano per neutral trackers.

- EOY-2025 target band: $0.90 – $1.30.

- What would push ADA into the upper half: Rising monthly active addresses and sustained DEX volume growth while average fees remain tame; visible dRep participation under Chang; sustained builder commits on key repos.

2) Bull Case

- Assumptions: Two or more consumer-facing apps hit product-market fit on Cardano L2/sidechains and governance upgrades translate into faster parameter changes (e.g., resource limits, fee policies). External liquidity conditions favorable; cross-chain bridges into Cardano improve.

- EOY-2025 target band: $1.40 – $2.20.

- Stretch to reclaim ATH? A full retest of the $3 area would likely require broad crypto expansion plus multiple non-speculative Cardano use cases scaling at once—ambitious, but out of scope for base-year 2025.

3) Bear Case

- Assumptions: Governance features under-utilized; Hydra adoption stalls; DeFi activity remains thin vs. peers; macro risk-off leads to persistent outflows. Independent reports show falling transactions/fees Q/Q.

- EOY-2025 downside band: $0.40 – $0.65.

- Invalidation of this downside: two consecutive months of higher DEX volume and active addresses while spreads tighten—signal that usage, not just funding, is driving price.

Why These Bands? The Valuation Scaffold You Can Re-Use

Price ≈ sentiment × (usage + liquidity). Because Cardano does not route protocol revenue directly to ADA, we proxy value via activity, capacity, and confidence:

- Capacity: Hydra potentially scales throughput while keeping fees low, but the real tell is whether flagship apps commit to Hydra in production.

- Onboarding/bootstrapping: Mithril shortens sync times—reducing friction for new nodes, light clients, and app features that need fast verified state. This supports dev and user growth at the margin.

- Governance agility: Chang/CIP-1694 gives the community formal levers (dReps, on-chain votes). If parameter changes become measurably faster and safer, markets price a higher execution multiple.

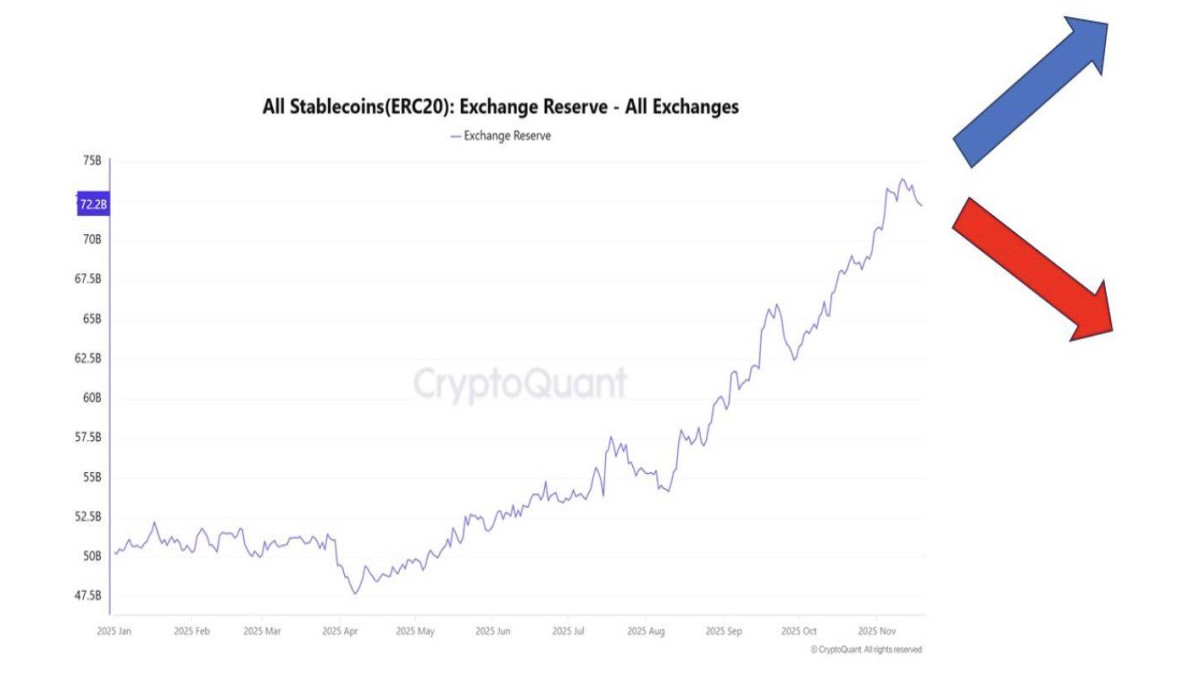

- Liquidity: Track TVL/volumes and stablecoin presence on Cardano versus peers. Rising liquidity with stable fees is the healthiest re-rating setup.

Metrics & Dashboards to Watch (and Why)

| Metric | Why it matters | Where to track |

|---|---|---|

| Active addresses, transactions, DEX volumes | Confirms usage-led demand vs. speculation | DefiLlama Cardano pages; neutral analytics sites |

| Hydra adoption (production apps) | Validates L2’s role beyond demos; signals future throughput headroom | Cardano docs, project announcements |

| Mithril snapshot usage | Lower friction for nodes/light clients → faster time-to-use | Cardano.org/IOG blog |

| Governance participation (dReps, votes) | Early proof that Chang moves decisions on-chain | Chang/CIP-1694 resources; ecosystem dashboards |

| Developer velocity | Sustained commits correlate with shipping cadence (with a lag) | CardanoUpdates; public dev trackers |

| Supply/market structure | ATH memory ($3.09–$3.10), circulating vs. max, exchange liquidity | CoinMarketCap/Kraken/Coinbase stats |

Technical Map for 2025 (Structure Before Price)

- Anchored VWAPs: Anchor from (a) Chang launch milestones, (b) major dApp releases that use Hydra/Mithril. Acceptance above value-area highs (VAH) with spot-led volume is the cleaner long trigger.

- Volume profile (1D/4H): Look for ascending POC and higher-low shelves; fade upper wicks into thin liquidity.

- Invalidation: Two daily closes back inside prior value area → thesis off; reassess at next structural shelf.

Risk Map (and What Would Change Our Minds)

- Governance under-utilization: If dRep participation is anemic and parameter changes don’t accelerate, compress the base/bull bands by ~15–20%.

- L2 adoption stalls: If few production apps adopt Hydra by mid-2025 H2, trim the top of the bands; treat spikes as distribution until usage shows up.

- Usage slippage: Multiple Q/Q declines in transactions/fees/DEX volumes per neutral trackers; stay in lower half of the band until reversal.

- Macro/liquidity shocks: Outflows from risk assets or cross-chain bridge incidents can widen spreads and delay re-rating regardless of Cardano-specific progress.

Putting It All Together — Our 2025 Outlook

If Cardano turns governance from rhetoric into measurable agility (Chang), onboards users with smoother clients (Mithril), and proves L2 throughput matters in production apps (Hydra), then ADA has a credible path to the $0.90–$1.30 base band by EOY-2025, with scope to press into $1.40–$2.20 on a cleaner bull tape. If adoption and participation lag, a $0.40–$0.65 outcome remains on the table. The dials are public—watch them, size accordingly, and let usage—not headlines—lead your decisions.

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Digital assets are volatile and can result in loss of principal. Always verify network metrics, governance timelines, and app adoption from primary sources before committing capital.