Avalanche Price Forecast 2025 — Scenarios, Catalysts, and the Metrics That Actually Matter

Executive summary: Avalanche’s investment case in late 2025 rests on three pillars: (1) a capped-supply asset (AVAX) that secures a rapidly evolving multi-chain network; (2) a roadmap emphasizing cross-subnet composability (Avalanche Warp Messaging, Teleporter) and enterprise/app-specific chains; and (3) rising usage on the C-Chain and notable spikes tied to consumer launches and gaming. Against that backdrop, we publish explicit end-of-year price bands for AVAX with the assumptions behind each band and concrete, public dashboards you can track to confirm or invalidate the thesis.

Where Avalanche Stands Right Now (Late 2025)

- Token supply: AVAX is capped at 720 million total supply; fees burn and staking rewards govern the issuance path. The cap is a stated design choice in Avalanche’s official documentation.

- Consensus & finality: Avalanche family consensus (Snowball/Avalanche) underpins the platform, with Snowman used for linear chains like the EVM-compatible C-Chain—combining repeated randomized sampling with metastability for fast, scalable finality.

- Cross-chain messaging: 2024’s Durango upgrade brought Avalanche Warp Messaging (AWM) deeper into the EVM stack and introduced the Teleporter toolset to simplify cross-subnet communication—key for app-chain composability. Mainnet activation occurred March 6, 2024, with prior Fuji testnet staging.

- Usage baselines: Neutral analytics report that in Q2 2025 the Avalanche C-Chain averaged ~1.4M daily transactions (up ~493% QoQ), and average daily active addresses rose ~57% QoQ to ~46k, with a one-day spike above 400k around major consumer/game activity in mid-May. Treat the spike as event-driven, not a durable steady state.

- TVL & flow: DeFiLlama shows Avalanche TVL broadly in the ~$1.9–$2.1B range in H2 2025 (chain page and coverage), with stablecoin float just over ~$2.3B and 24h transactions often in the low millions—evidence of renewed activity after spring.

How Avalanche Creates Value (and Why It’s Different)

Design: Avalanche’s core value proposition is fast, scalable finality and a network-of-networks model where Subnets allow specialized execution environments (finance, gaming, KYC’d enterprise) while still communicating via AWM/Teleporter. Unlike L2-centric models that fragment execution domains and settle elsewhere, Avalanche keeps the developer mental model close to a unified environment while letting teams provision their own blockspace and rules. That makes AVAX exposure a bet on blockspace demand + inter-subnet liquidity rather than purely L2 fee arbitrage.

Key 2024–2025 Upgrades and Why They Matter for Price

- Durango + AWM for EVM stacks: Makes cross-subnet calls more production-usable. If more consumer chains (games, high-frequency apps) settle on Avalanche subnets while remaining composable, you should see more organic cross-app flows rather than mercenary liquidity.

- Teleporter: Developer-facing tooling that abstracts the complexity of AWM. The more Teleporter-native apps ship, the more volumes cycle within Avalanche instead of leaking to external bridges—bullish for AVAX if usage requires staking, fees, and security participation.

- Subnet maturity: Reports across Q1–Q2 2025 highlight rising usage across individual Avalanche L1s, with DAAs up triple digits QoQ, and large event-driven spikes tied to gaming content. These patterns are consistent with a maturing app-chain strategy.

Data Snapshot (Indicative, Not Static)

| Metric | Latest Direction | Why It Matters | Source |

|---|---|---|---|

| TVL (all Avalanche) | ~$1.9–$2.1B in H2 2025 | Liquidity depth & stickiness | DeFiLlama overview + coverage. |

| Stablecoin float | ~$2.3B | Gas for DeFi & settlements | DeFiLlama chain page. |

| C-Chain daily tx | Avg ~1.4M in Q2 (QoQ +493%) | Throughput/UX improving | Messari Q2 2025. |

| DAA (C-Chain avg) | ~46k in Q2 (+57% QoQ), with 1-day spike >400k | Active users & event sensitivity | Messari Q2 2025. |

Note: Treat spikes (e.g., game launches) as volatility events, not new floors, until multiple cohorts stick around over several months.

Price Framework for 2025 — Three Scenarios with Triggers

We anchor AVAX’s 2025 valuation to usage × liquidity × confidence rather than pure narratives. Below are explicit bands with the dashboard signals that would push AVAX toward the top/bottom of each band.

Base Case (most likely): $32 – $48 EOY-2025

- Assumptions: TVL stabilizes in the $1.8–$2.5B area; C-Chain activity remains above the 2025 Q2 baseline (≥1.0–1.4M daily tx on average) with fewer failed tx during surges; at least two consumer-facing subnets hit consistent monthly actives; AWM/Teleporter usage becomes common in top apps.

- Why this matters for price: With AVAX capped at 720M and fees burned, steady usage and cross-subnet settlement make valuation more about durable fee flow and staking demand than episodic airdrop cycles.

- Signals to watch: (i) Messari/chain dashboards for sustained tx/DAA above Q2 baselines; (ii) DeFiLlama TVL holding gains through risk-off weeks; (iii) top subnets publishing AWM integration metrics.

Bull Case: $49 – $78 EOY-2025

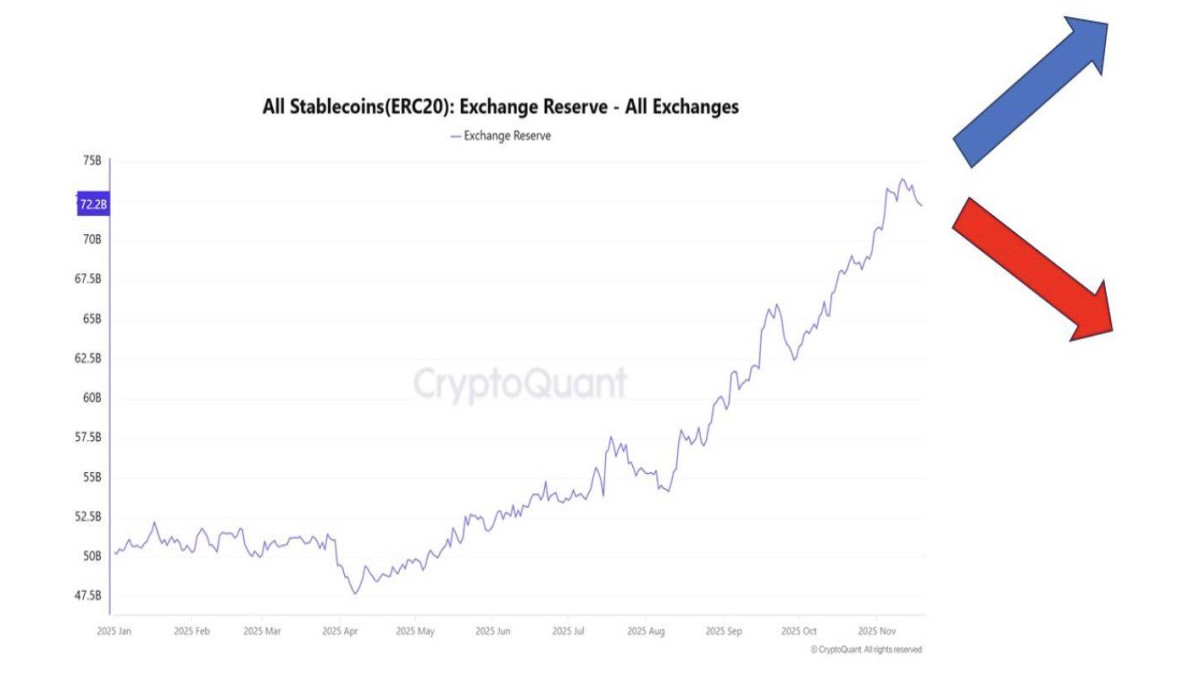

- Assumptions: TVL advances to $3–$4B (breadth across DeFi, perps, and RWAs); two or more high-DAU gaming/consumer subnets sustain cohorts; cross-subnet liquidity routing (AWM/Teleporter) becomes visible in volumes; stablecoin float rises decisively above $2.5B; fees and app revenue trend up Q/Q.

- Catalysts: flagship launches (games/RWA rails) choosing Avalanche and shipping with composable subnet designs; improved time-to-finality consistency during traffic spikes (a major UX win over prior cycles).

- Risk to the bull: liquidity migrates cross-chain due to incentives elsewhere; if TVL growth is mercenary (farms) not usage-led, the band compresses.

Bear Case: $18 – $28 EOY-2025

- Assumptions: TVL fades back toward ~$1.2–$1.5B; DAA stagnates below Q2 baselines; cross-subnet UX remains niche; macro is risk-off. Event-driven spikes fail to convert into sticky usage.

- Invalidation: two consecutive months of rising DEX volume/fees on Avalanche while stablecoin float climbs—signals usage-led recovery underway.

Why These Bands? A Simple, Reusable Valuation Scaffold

1) Capacity & composability = ceiling. Durango (AWM/Teleporter) and subnet maturity determine how composable Avalanche’s app-chain world is. If cross-subnet calls become mundane, the network behaves more like a single economy, letting liquidity stay local and compounding fee burn/staking demand.

2) Usage = floor. Messari’s 2025 reports show meaningful QoQ lifts in tx and DAAs; whether those translate into retained cohorts is what sets the price floor. Your watchlist: average daily tx, DAAs, and failure-rate distributions on high-traffic days.

3) Liquidity = momentum. DeFiLlama’s TVL and stablecoin metrics are crude, but good directionally. Organic growth with fewer incentive cliffs is the healthiest re-rating pattern for AVAX.

How Avalanche’s Tech May Convert Into Price

- Shared story, local specialization: Subnets let a game or RWA platform control its economics while still tapping Avalanche’s messaging layer. If those apps attain PMF, AVAX benefits via staking, fee burn, and broader mindshare—less visible than emissions charts, more durable when incentives fade.

- Fast finality under load: Avalanche’s consensus (and Snowman for EVM) aims to keep confirmations fast even as traffic grows. Event-day behavior (spikes around launches) will decide whether the UX delta is real.

Investor Playbook — What to Track Weekly

- Usage: Messari’s Avalanche portal plus chain explorers for daily tx/DAAs and app-level volumes. We’re looking for higher lows vs. Q2 baselines.

- Liquidity: DeFiLlama TVL, stablecoin supply, and DEX/perps volume on Avalanche; avoid reading one-day spikes as trend.

- Composability: AWM/Teleporter adoption notes in dev blogs/release notes; cross-subnet swaps and messaging patterns emerging in wallets.

- Event cadence: Game and consumer-app milestones—Q2’s DAAs megaspike shows Avalanche is sensitive to launches; judge conversion to retention across 30–90 days.

Risks & How They Show Up in the Data

- Mercenary TVL: If TVL rises without matching user metrics or fees, expect mean reversion. Watch TVL composition and app revenue, not just totals.

- Cross-chain leakage: If AWM/Teleporter fails to become standard, value accrues to external bridges and other ecosystems; you’ll see it in dwindling intra-Avalanche volumes.

- Macro beta: In risk-off regimes, even strong on-chain trends re-rate lower. The bear band assumes a prolonged drawdown with stablecoin float slipping.

Frequently Asked (and Useful) Questions

Q: How does AVAX supply impact valuation?

AVAX’s hard cap at 720M means the supply side is bounded; net issuance is a function of staking rewards minus fee burn. In rising usage regimes, burn improves the asset’s scarcity dynamics at the margin.

Q: What exactly did Durango change for developers?

Durango advanced AWM and introduced Teleporter to make cross-subnet messaging more practical for EVM-based environments—an important step for app-chains that still want composability.

Q: Are the daily address/tx spikes sustainable?

Messari attributes Q2’s huge one-day DAA spike (419k) to a launch window for a major consumer title; treat spikes as demand tests. The thesis improves if 30–90 day retention follows.

Bottom Line

AVAX’s 2025 price path is less about finding a single killer app and more about proving that many subnets can thrive together through AWM/Teleporter while the C-Chain remains fast and usable under load. Our base band ($32–$48) assumes today’s usage becomes sticky and TVL holds near the ~$2B area. The bull band ($49–$78) requires multi-app product-market fit with visible cross-subnet flows and a decisive TVL/liquidity expansion. The bear band ($18–$28) shows up if growth stalls and liquidity rotates out. All three scenarios are falsifiable from neutral dashboards you can check in minutes.

Disclaimer: This article is for educational purposes only and does not constitute investment advice. Digital assets involve risk, including the risk of total loss. Always verify network metrics and roadmap timelines from primary sources before investing.