An Ancient Solana Whale Just Moved 200,000 SOL to Coinbase Prime — Signal or Noise?

On October 30 (local time), an antiquated Solana whale address that on-chain analysts have watched for years pushed 200,000 SOL—roughly $40 million at prevailing prices—into an address cluster attributed to Coinbase Prime. The sender is notable: five years ago the wallet received approximately 222,000 SOL from a source labeled as non-circulating supply, when SOL changed hands near $1.68. With Solana up more than 100× from those early days, a transfer of this size immediately raises the same two questions every trader asks in milliseconds: is this going to market, and if it is, how much does it matter?

This deep-dive provides the context and the calculus. We reconstruct what can be asserted from the chain, explain why a Coinbase Prime destination does not automatically equate to imminent selling, quantify plausible market impact across liquidity venues, and offer a decision framework for investors who must operate in the fog of incomplete information. We also take a step back to examine what the move says about Solana’s evolving market structure: who holds, who supplies, and who absorbs in 2025.

TL;DR

- Fact pattern: A legacy SOL holder moved 200k SOL to an address widely attributed to Coinbase Prime. The whale originally received ~222k SOL from a non-circulating supply source ~5 years ago.

- Interpretation: A Prime deposit can precede spot selling—but just as often reflects custody, OTC settlement, collateralization, or operational reshuffling. It is a necessary, not sufficient, condition for on-exchange distribution.

- Market impact math: The realized price effect depends more on execution pathway (OTC vs. lit books vs. internalization) and time slicing than on raw notional. Under typical liquidity, $40M of immediate lit selling could move price visibly in thin windows; the same notional executed via VWAP or OTC blocks can be absorbed with modest slippage.

- What to watch: follow-through transfers from Prime to known hot wallets, changes in top-of-book depth on SOL pairs, borrow rates in perps/financing, and on-chain programmatic splits from the whale cluster.

1) What we actually know from the chain

Provenance. The sender wallet is on analysts’ ‘ancient’ watchlists because it received ~222,000 SOL from an address linked by multiple labeling providers to non-circulating supply—a catch-all that typically includes foundation, team, or early escrow allocations. That transfer dates back roughly five years, when spot SOL traded near $1.68. In other words, the address sits at the intersection of long-dated cost basis, early distribution, and modern liquidity.

The move. On October 30, the wallet dispatched 200,000 SOL to a destination commonly associated with Coinbase Prime. Tagging accuracy is never 100%, but clustering heuristics (shared spend patterns, memo usage, bidirectional flows with known Coinbase infrastructure) strongly support the attribution.

What the chain does not tell us. The ledger records movement, not intent. We do not know whether the beneficiary is gearing up to sell on lit order books, warehouse coins in institutional custody, or pre-position inventory for an over-the-counter (OTC) cross. We also don’t know whether the end-owner is the same as five years ago; early allocations sometimes sit behind shared operational wallets.

2) Why a Coinbase Prime destination isn’t synonymous with ‘sell’

Coinbase Prime is not an exchange account in the retail sense; it is a platform that bundles qualified custody, algorithmic execution, OTC block trading, settlement, and operational tooling for institutions. There are at least four reasons a whale would move large blocks to Prime without hitting the screen:

- Institutional custody. Regulatory, insurance, and operational mandates often require holding assets with a qualified custodian. Transfers to Prime can be defensive housekeeping after years in self-custody, particularly ahead of audits, bankroll re-allocation, or staking policy reviews.

- OTC settlement. Big holders routinely cross size with counterparties via RFQ desks. Prime then acts as the neutral settlement agent. On-chain observers see an inbound transfer; they do not see a simultaneous OTC match that avoids lit slippage.

- Collateralization and prime financing. Some institutions pledge crypto as collateral for USD credit lines or derivatives. Moving to Prime can precede financing, not distribution.

- Execution optionality. Even if the intent is to eventually sell, staging inventory at Prime gives the owner access to algorithmic slicing (VWAP, TWAP), internalization against Coinbase’s client flow, and cross-venue smart-order routing. All three dramatically reduce footprint.

3) The ‘why now’ question

Ancient addresses rarely wake up at random. Possible triggers include portfolio rebalancing after a parabolic SOL run, governance or tax deadlines, a desire to switch custody posture, or simple operational modernization: institutions often centralize fragmented wallets when compliance requirements tighten. Another plausible catalyst is pre-positioning for corporate activity—pledging assets for a structured product, lending desk operations, or even as part of an M&A-style token transaction. None of these require immediate selling pressure.

4) Market-impact math: from scary notional to realistic slippage

‘$40M of supply’ sounds alarming, but what matters for price is how that supply hits the market. A simple framework:

- Pathway A — Lit order books, fast: If 200k SOL cascaded via market orders into thin hours, impact would be visible. But exchanges enforce throttles, and sophisticated sellers avoid this path unless they want to move price.

- Pathway B — VWAP/TWAP over sessions: Slicing across liquid U.S. and Asia sessions compresses footprint. Impact becomes a small, persistent drift rather than a shock, often indistinguishable from normal two-way flow.

- Pathway C — OTC crosses/internalization: Desk pairs the seller with buy-side demand (funds, market makers, corporates) and settles via Prime. On-screen prints appear only as hedging residue (delta-neutral desks offload basis), typically far smaller than the principal notional.

Back-of-the-envelope. If we abstract from exact volumes and assume a representative market where top-of-book depth on major venues supports low-single-digit millions with minimal slippage, then $40M executed as VWAP over 2–4 sessions is unlikely to inflect price by more than a handful of basis points beyond noise—unless the market is already stressed. Conversely, dumping the same notional in a single thin window will move screens; the difference is execution, not notional.

5) Reading the tape: signals that separate custody from distribution

Because ‘deposit to Prime’ is ambiguous, traders should track follow-through evidence:

- Subsequent splits from Prime to hot wallets. If the coins fan out to known exchange hot wallets (not custody vaults), the likelihood of imminent spot prints rises.

- Borrow/financing pressure. Elevated funding rates and borrow fees on SOL perps around the transfer window can imply desks shorting to warehouse risk—a tell for OTC hedging rather than pure custody.

- Order-book microstructure. Sudden, repeated top-of-book replenishment at slightly lower prices, especially across multiple venues, often indicates algorithmic distribution. By contrast, stable depth with no unusual replenishment suggests passive warehousing.

- Netflow context. A single whale deposit is less meaningful if aggregate exchange netflows remain negative (more withdrawals than deposits). The market digests idiosyncratic supply far better when the broader flow is tightening.

- Derivatives basis. If spot weakens modestly while perps basis stays firm or strengthens, desks may be absorbing via basis trades rather than panic supply hitting the screens.

6) What this says about Solana’s market structure in 2025

Solana’s investor base has matured. Early-era allocations seeded a long tail of ‘ancient’ addresses; 2023–2025 pulled in funds, corporates, and market makers who can warehouse size. Liquidity is no longer single-venue or single-timezone; SOL enjoys 24/7 two-way markets across centralized exchanges, perps venues, and an increasingly vibrant on-chain DEX/perps landscape. That matters because whales now have real choices in how they monetize inventory. The path of least slippage is no longer ‘hit the biggest CEX book’; it is a blend of OTC, crossing networks, and algorithmic slicing.

On the supply side, programmatic emissions are not the dominant story they once were. Unlock calendars are better understood; staking participation shapes float; and ecosystem grants increasingly vest against performance rather than time alone. The upshot: single-address sightings, while flashy, represent a shrinking share of net new supply pressure compared to macro flows like stablecoin expansion, ETF product demand (where available), and cross-chain capital rotation.

7) Scenario map: four ways this could play out

| Scenario | Path | Price effect (near-term) | Tell-tales to confirm | Our take |

|---|---|---|---|---|

| A. Custody only | Coins move to cold custody at Prime; no lit selling | Minimal | No outflows from Prime hot wallets; stable depth | Plausible if owner is institutionalizing operations |

| B. OTC cross | Desk pairs buyer; settle via Prime; hedge residue on screens | Small and spread out | Basis/borrow wiggles, modest spot drift, blocks reported | Common for blocks of this size |

| C. Algorithmic distribution | VWAP/TWAP across sessions and venues | Measured, persistent ask pressure | Order-book replenishment patterns; negative exchange netflows pause | Possible if owner de-risks with care |

| D. Fire-sale | Market orders into thin books | Sharp downtick, then mean reversion | Spiky prints in off-hours; social sentiment shock | Least likely for sophisticated early holder |

8) A practical playbook for traders and allocators

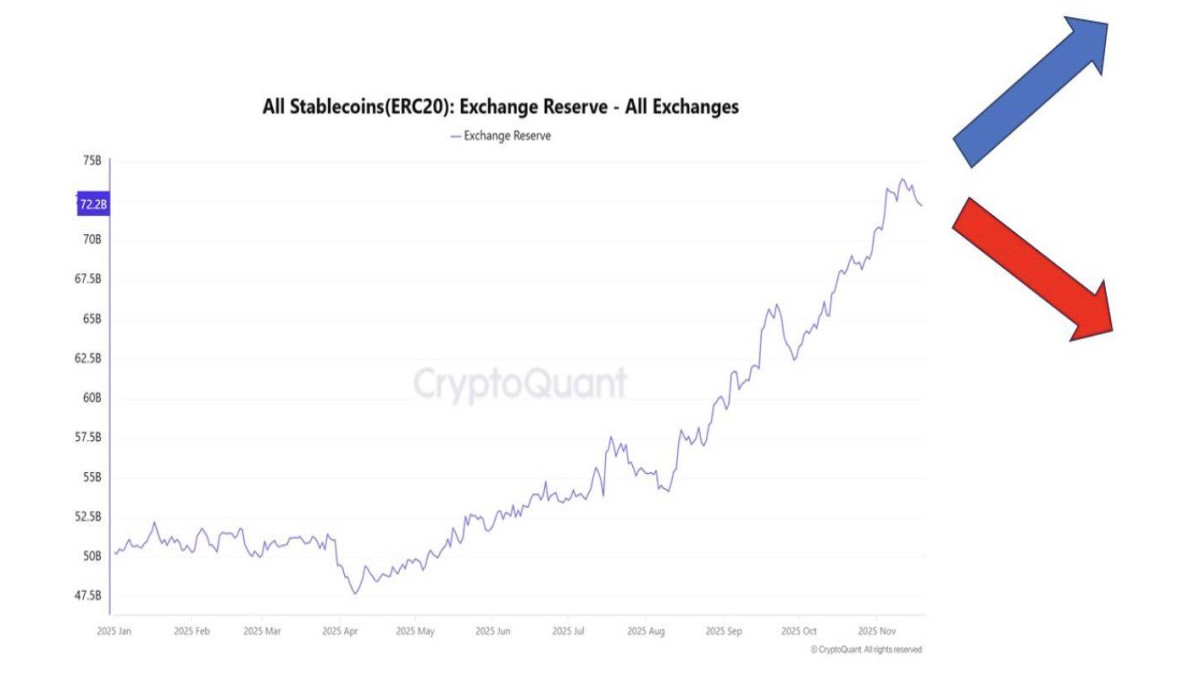

- Focus on flow, not headlines. Track net exchange flows and per-venue depth. A single whale deposit matters far less if aggregate supply is tightening and stablecoin inflows are rising.

- Watch the derivatives triangle. Spot, perps funding, and basis should rhyme. Divergences around the event can reveal whether desks are warehousing via basis or whether shorts are pressing a narrative.

- Respect time-of-day microstructure. If you must risk around the event, prefer windows with deeper books (U.S. and early Asia for SOL), and avoid chasing thin prints during illiquid hours where a single slice can distort your read.

- Use ‘patient’ orders. For entries, rest bids at identified liquidity pockets rather than lifting. For exits, stage with discretion; let the algos work for you, not against you.

- Stress-test exposure. Ask what happens to your P&L if a routine 3–5% air-pocket occurs on narrative overreaction. If the answer is ‘I get liquidated’, your sizing is the problem, not the whale.

9) Reading the psychology: why whale moves loom larger than they should

Crypto remains story-driven. A big, easy-to-visualize number (200k SOL) and a famous venue (Coinbase Prime) create a crisp narrative of ‘smart money cashing out’. But sophisticated actors know that visibility is a cost. If the goal were to dump, the worst plan is to telegraph it. The best plan is to distribute quietly or cross OTC—exactly the workflows Prime is built to facilitate. In short: the scarier the headline, the lower the odds that the scary version of the workflow is the real one.

10) What this means for Solana beyond the next 48 hours

Zoomed out, the episode is a healthy sign of institutional rails doing what they should. Early-era supply is migrating from bespoke self-custody into regulated, auditable infrastructure that can interface with pensions, corporates, and funds. That maturation tends to reduce long-run volatility, not increase it, because it broadens the buyer base and professionalizes execution. It also supports the thesis that Solana’s market is no longer beholden to a handful of early wallets; depth now resides across a network of desks, funds, and on-chain liquidity programs.

11) Limits and caveats

- Tagging fallibility. Attributions are probabilistic. While the Prime cluster is among the better mapped, false positives can occur. Always triangulate with multiple providers when sizing risk.

- Ownership opacity. A ‘whale’ wallet may represent an entity while assets could be beneficially owned by different counterparties today than at genesis. Treat ‘intent’ inference cautiously.

- Correlation ≠ causation. A drawdown following a whale deposit doesn’t prove causality; macro headlines or cross-asset rotations often dominate intraday moves.

12) For builders and treasurers: governance lessons from an ancient wallet

For protocols and foundations, the presence of long-dormant addresses that periodically awaken underscores the need for clear vesting disclosure, post-vesting communication norms, and treasury execution standards. The market prices predictability. When large, known wallets signal their operational posture (custody upgrades vs. distribution) in advance, price impact shrinks. For treasurers, staging inventory at institutional venues with pre-arranged OTC lines and algorithmic playbooks is best practice.

13) Our bottom line

A 200,000 SOL move into Coinbase Prime is interesting but not inherently bearish. It expands the set of possibilities rather than narrowing them to ‘sell now’. The burden of proof rests with follow-through data: subsequent Prime outflows to hot wallets, order-book behavior, and derivatives funding. Absent those confirms, the higher-probability read is custody or OTC positioning. Either way, Solana’s 2025 market structure—denser liquidity, deeper buyer base, more sophisticated rails—means even real distribution can be handled without structural damage if executed professionally. Trade the flows, not the fear.

Disclosure: This article is independent market commentary for educational purposes only and does not constitute investment advice. We did not rely on non-public information and we do not assert control over the accuracy of third-party address labels. Always do your own research and manage risk responsibly.