Altcoin Market Pulse – September 25, 2025

Summary. September 25 delivered a mix of signals across Ethereum, large-cap alternatives and speculative meme tokens. Ethereum’s intraday behaviour illustrated how the same chart can contain both constructive and cautious elements, while names such as XRP and 1000PEPE lagged. Rather than framing this as a playbook, this recap uses the day as a teaching example for how analysts think about trend, momentum and crowd behaviour.

The discussion below is observational and educational only. It is not a recommendation to take any financial position.

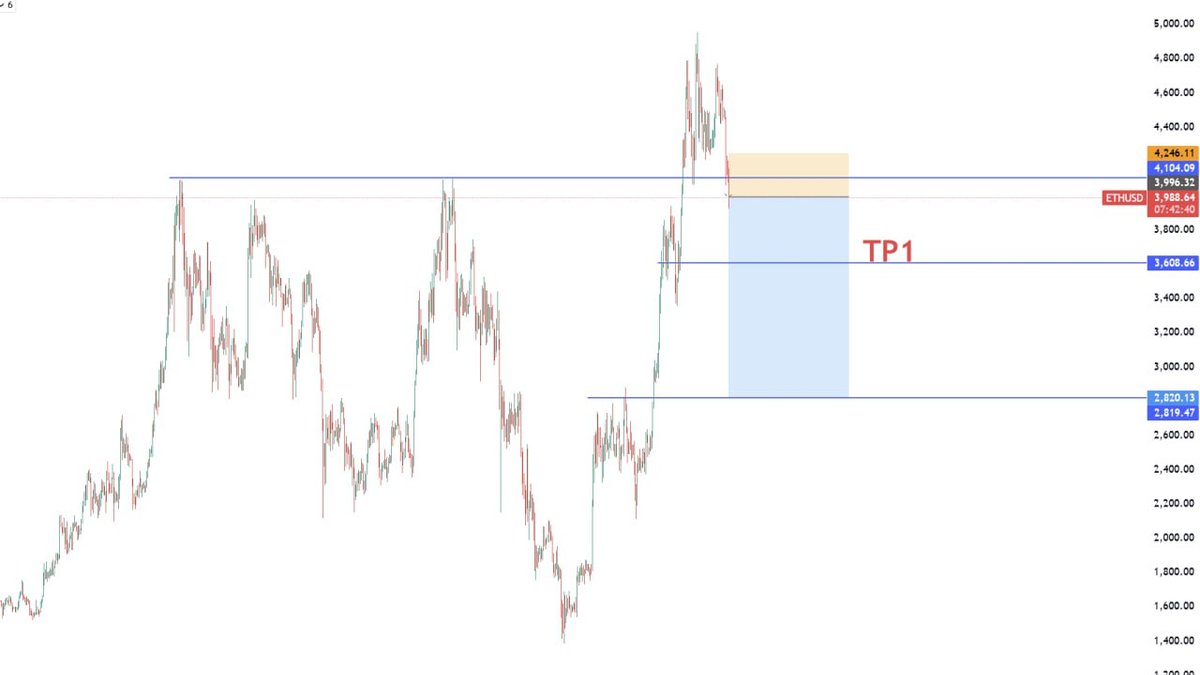

1) Ethereum: reading a mixed intraday structure

During the session, Ethereum briefly showed patterns that many technicians would recognise as potential reversal signals on shorter timeframes. At the same time, other features of the tape pointed to unresolved downside risk.

From a learning perspective, this highlights three important ideas:

- Multiple timeframes can disagree. A pattern that looks constructive on a 15-minute chart can coexist with a still-fragile structure on a daily or weekly chart.

- Context matters as much as shape. Reversals that unfold after extended trends, in thin liquidity or near important news events can behave differently from textbook examples.

- No signal is guaranteed. Classic formations sometimes fail, which is why risk management and scenario thinking feature so heavily in professional commentary.

Understanding these nuances helps explain why credible analysts can look at the same intraday move and arrive at different interpretations.

2) XRP, meme tokens and signs of fragile momentum

While Ethereum oscillated between cautious optimism and concern, several altcoins lagged. XRP and meme-linked tickers such as 1000PEPE displayed weak follow-through, muted volume and difficulties sustaining higher highs relative to major benchmarks.

Rather than being about any one asset, this is a window into how speculative segments often behave:

- Dependence on broader conditions. Highly narrative-driven tokens tend to perform best when major assets are clearly trending higher and liquidity is abundant.

- Sensitivity to funding and sentiment. Changes in derivatives funding, social-media activity or exchange incentives can quickly alter the tone around these names.

- Asymmetry between advance and retreat. Rallies in meme tokens can be rapid, but reversals can be equally sharp once enthusiasm fades.

These tendencies are important to recognise for anyone trying to understand why certain cohorts of coins appear repeatedly in both top-gainer and top-loser lists.

3) Bitcoin context and the role of consolidation

In the background, Bitcoin spent another day in what many observers would describe as a consolidation phase. Open interest and options metrics suggested that markets were still digesting earlier moves and recalibrating leverage.

Educationally, consolidation can serve several functions:

- Absorbing prior excesses. Periods of sideways trade often follow strong trends as positions are trimmed or transferred.

- Creating new reference points. Extended ranges can become areas that traders later watch as support or resistance.

- Influencing downstream assets. Many altcoins trade in the shadow of Bitcoin; when the benchmark is indecisive, flows into smaller names can be cautious or uneven.

4) What September 25 illustrates about market structure

Putting the pieces together, the day offers a compact illustration of how different parts of the market interact:

- Ethereum showed how the same asset can carry a constructive short-term pattern while still living inside a broader debate about trend durability.

- XRP and meme tokens showed how speculative segments can struggle when majors are not clearly trending.

- Bitcoin’s consolidation provided the backdrop that limited conviction across the board.

None of this guarantees what will happen next. The value lies in understanding the relationships so that future days with similar features are easier to interpret.

5) Key questions for observers to track

Instead of focusing on precise price points or short-lived chart patterns, readers who follow this space might ask:

- Does Ethereum eventually resolve its mixed structure into a clearer uptrend or downtrend on higher timeframes?

- Do volumes in XRP and meme tokens recover alongside any improvement in broader conditions, or do they continue to fade?

- Does Bitcoin remain in consolidation, break higher with renewed participation or revisit previous areas of support?

The answers to these questions will say more about the health of the current cycle than any single intraday move.

6) Educational conclusion and disclaimer

September 25, 2025 is best read as a case study in market structure rather than as an isolated opportunity. Ethereum’s mixed signals, underperformance in speculative altcoins and a consolidating Bitcoin together describe a cautious but still engaged environment.

This recap is for informational and educational purposes only. It does not provide market updates, price targets, entries, stop levels or position-sizing guidance. Digital assets are highly volatile and can result in losses. Always conduct your own research and consider consulting a qualified professional before making any investment or trading decisions.