Trading Signals – September 18, 2025 Market Update

Macro volatility and market impact

September 18, 2025 featured pronounced volatility as macro policy decisions rapidly impacted both traditional finance and crypto. From the Federal Reserve’s rate cut to fresh signs of regulatory acceptance for digital assets, several major developments intertwined to create a busy trading day. Below is a detailed analysis of the key events, with context and implications.

In the early U.S. hours on 9/18, the Fed unexpectedly cut its policy rate by 25 bps — its first cut of the year — to support an economy showing signs of slowing. The move immediately ignited heavy swings across equities and crypto. Within just 30 minutes of the news, more than $105 million in crypto derivatives positions were liquidated as leveraged bets flipped on the rate-shock. The initial burst of euphoria faded, however, when Fed Chair Jerome Powell emphasized there was no urgency to deliver further cuts. He noted the U.S. labor market is no longer “overly solid” and is showing signs of weakening — a signal the Fed will be cautious with additional easing. That stance tempered risk appetite, as seen in the pause in many risk assets’ momentum.

At the same time, Powell’s acknowledgement that growth has “slowed” prompted some investors to rotate into Bitcoin as a value-preservation hedge. Flows into BTC picked up on his comments, helping Bitcoin retain appeal despite near-term chop. It’s clear that Fed decisions and guidance are steering crypto liquidity: they trigger short-term volatility by flushing leverage while also reinforcing the longer-term thesis of Bitcoin as “digital gold” against inflation and cyclical slowdowns.

Crypto and policy highlights

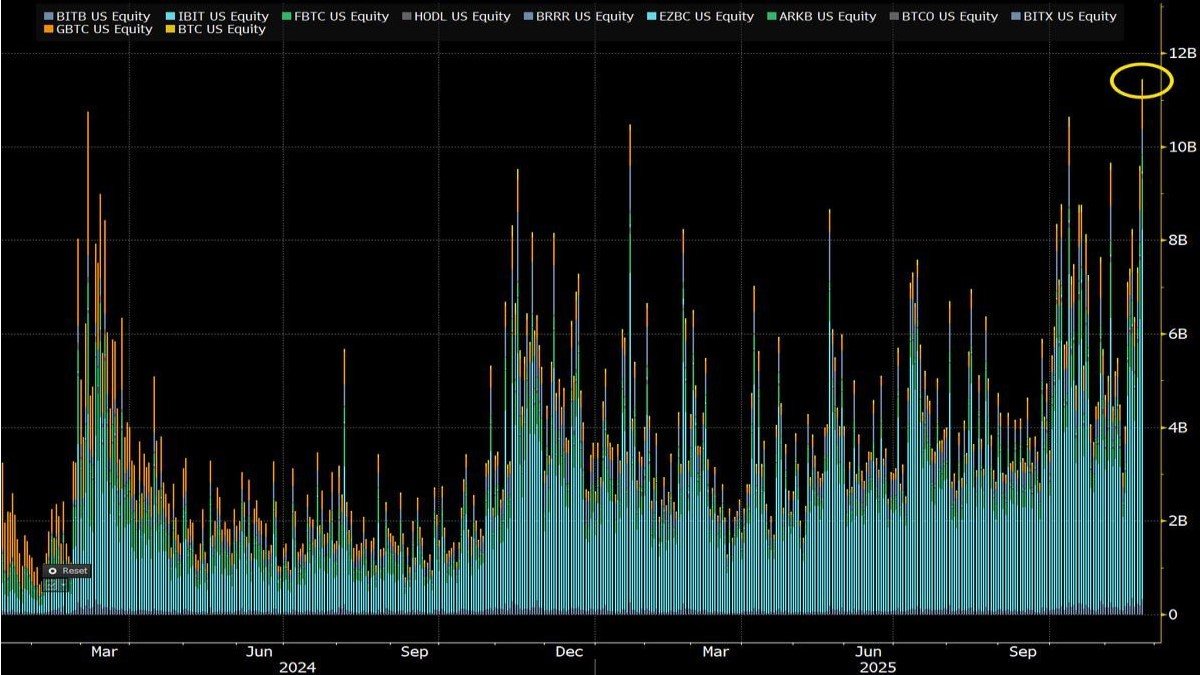

Despite near-term caution, confidence in crypto’s future was reinforced by industry leaders and policymakers throughout the day. Binance CEO Changpeng Zhao (CZ) stated that “crypto improves lives,” underscoring a constructive view that blockchain and digital assets deliver real-world value. On the regulatory front, the U.S. SEC approved a simplified standard for listing crypto-linked ETFs — a step widely seen as opening the door for more products and drawing additional institutional capital into the space. Also during the day came another positive sign: the Grayscale Digital Large Cap Fund (a basket including BTC, ETH, XRP, SOL, ADA) received approval for inclusion among managed investment products. Beyond legitimizing leading assets, it marked further integration of crypto into traditional finance. Trading in the Grayscale basket is slated to begin on September 19, and analysts expect it to attract notable institutional flows.

Advocacy also picked up: Coinbase CEO Brian Armstrong was spotted in Washington, D.C., participating in discussions with lawmakers on crypto policy. The presence of the largest U.S. exchange’s chief in the capital signals the industry’s proactive approach to achieving regulatory clarity and encouraging innovation-supportive rules.

Price action: standout winners and pressure points

Markets were split across asset classes as macro headlines arrived in quick succession. Notably, Binance Coin (BNB) ripped to a fresh all-time high near $1,000 — its first ever four-digit print — reportedly driven by institutional demand recognizing the Binance ecosystem’s scale. The move suggests investors are seeking opportunities beyond Bitcoin and Ethereum and reallocating to networks with large, active user bases.

Likewise, Solana (SOL) surged toward the $250 area late in the session. The SOL rally coincided with signs of rotation out of the largest assets following BTC’s prior run, with some institutions taking profits in Bitcoin and positioning into high-throughput chains to front-run a new altcoin phase. BNB and SOL’s strength signals a “pivot phase,” where attention broadens from BTC into projects with strong, practical technology and usage.

Traditional markets also printed key headlines. Nvidia announced a plan to invest $5 billion into Intel in a collaboration to develop AI-focused chips. Analysts immediately highlighted the complementary strengths: Nvidia’s AI chip leadership and Intel’s advanced manufacturing. The tie-up bolsters both in AI and hints at future compute applications for blockchains that increasingly rely on performance. Equity markets reacted positively, fueling broader tech optimism and, indirectly, a better tone for crypto risk.

Separately, President Donald Trump unveiled a never-before-seen investment plan totaling $17 trillion aimed at boosting U.S. growth. The sheer scale fanned risk-asset optimism — from stocks to crypto — on the prospect of large liquidity support. U.S. equities rallied after his comments, and risk appetite improved across digital assets. Trump added that “the stock market will do even better over time,” reinforcing bullish macro sentiment. Late in the day came confirmation that Grayscale’s basket fund would begin trading the next session — another potential incremental demand source.

Conclusion

Overall, September 18, 2025 illustrated the tight interplay between macro variables and crypto’s development path. The Fed’s rate cut confirms a policy pivot toward growth support — a tailwind for risk assets — while also reminding investors of short-term volatility as capital rotates. Concurrently, regulatory wins — from the SEC’s ETF listing standard to Grayscale’s approval — elevated crypto’s standing in traditional finance. Eye-catching rallies in BNB and SOL show “smart money” broadening its hunt for returns into high-potential projects rather than concentrating solely in BTC/ETH. Still, vigilance is warranted: macro commentary and rates policy can invert conditions quickly. Staying close to Fed guidance and policymaker signals remains key to risk management and opportunity capture as finance and crypto become ever more intertwined.