Michael Saylor Hints at More Bitcoin Purchases — Daily News Summary, October 1, 2025

Michael Saylor’s Bitcoin strategy and the “Uptober” setup

Global markets entered Q4 with multiple catalysts. In crypto, attention centered on Michael Saylor — cofounder of Strategy (formerly MicroStrategy) — after he dropped a suggestive update implying the company could keep adding Bitcoin as the asset pushed toward new highs. In the early hours of 10/01, Saylor posted a chart of the firm’s BTC holdings on X with the caption: “The most important orange dot is always the next one.” The message was widely read as a hint that another sizable purchase may be underway. Historically, Saylor has often shared cryptic posts shortly before revealing large acquisitions of BTC for the corporate treasury.

As of now, Strategy is described as the largest corporate holder of Bitcoin, with an estimated ~640,000 BTC — roughly 2.5–3% of total supply — valued at more than $70B at early-October prices. Saylor’s unbroken “keep buying” stance signals a long-duration conviction in BTC’s role. Despite short-term volatility and criticism about risk, he continues to view Bitcoin as a strategic reserve asset. That posture resonated with crypto investors: it suggested that whales and large institutions have not lost faith and may even lean in on dips.

The timing dovetailed with seasonal tailwinds. Throughout September, BTC steadily advanced, and positioning indicators showed growing confidence. On prediction markets like Kalshi, over 78% of participants reportedly wagered that BTC would reach $125,000 in October, reflecting the colloquial “Uptober” pattern in which Q4—especially October—has historically skewed positive for crypto. On October 1, despite negative macro headlines (the U.S. government shutdown), Bitcoin held firm around the $120k region, at times pressing toward $122k. If Strategy were to add, fresh balance-sheet demand could quickly help BTC vault $125k and explore higher ranges. Community mantras like “never sell, only stack” circulated widely, capturing the buoyant hodler sentiment.

Even so, persistent accumulation by a single corporate actor raises concentration questions. If an entity controlling nearly 3% of supply were to sell, could it shock the market? Saylor has consistently stressed a 10–20 year horizon, making forced sales unlikely barring extraordinary circumstances. For now, markets interpreted his stance as a confidence anchor: Bitcoin still has heavyweight backers ready to support it through turbulence.

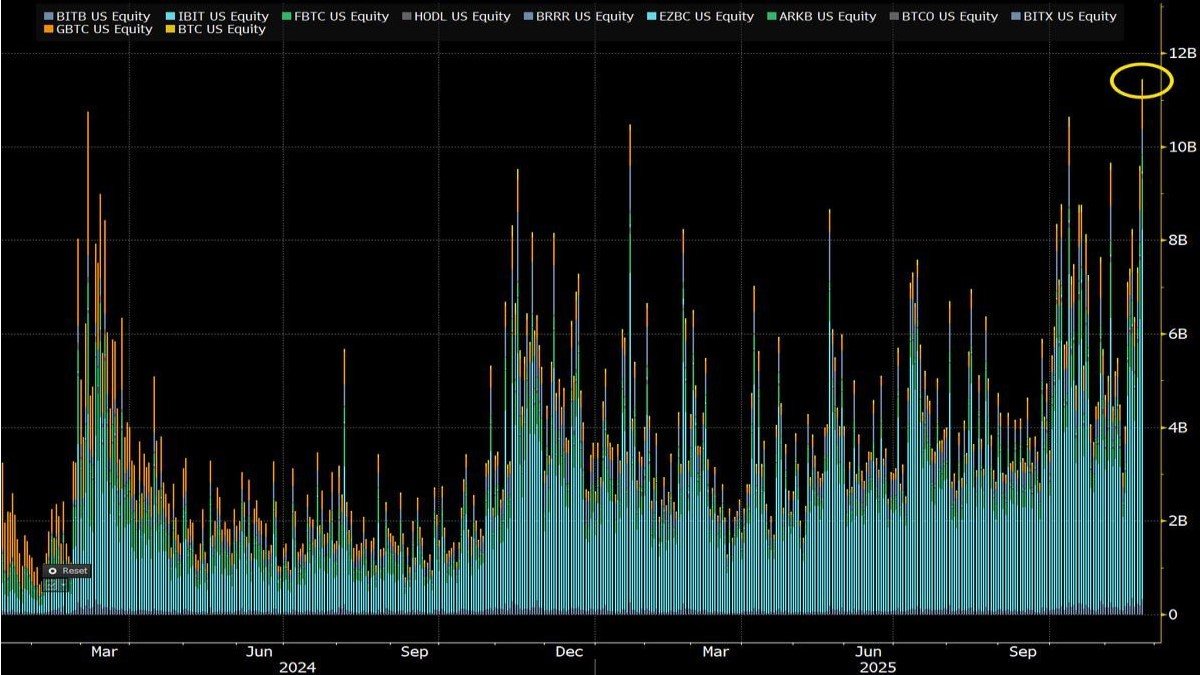

More broadly, the “Saylor signal” reinforced a trend of public companies and ETFs adding BTC to balance sheets or mandates. Through October, several Bitcoin ETFs continued to absorb inflows, reducing liquid float and increasing scarcity—what Saylor often calls “buy and lock up supply.” In today’s phase of a more “mature uptrend,” Saylor’s strategy remains a market-shaping force.

Politics & economy: U.S. shutdown risk vs. strong Q3 equities

The U.S. government shutdown added a layer of uncertainty to the macro backdrop. In the near term, a shutdown can delay key data releases (e.g., jobs and inflation), leaving the Federal Reserve with less real-time information for policy decisions. Some Fed officials warned that if the shutdown drags on, the FOMC might have to make choices “in the dark,” i.e., without fresh data—potentially increasing policy caution (and delaying hikes or cuts until visibility improves). For crypto, that’s a double-edged sword: fewer policy surprises could damp volatility, but investor hesitancy might rise as everyone waits for clarity.

Offsetting the shutdown negativity, the U.S. equity market ended Q3 2025 with striking strength. Notably, September 2025 was the best September in 15 years for the S&P 500, which rose about 3.7%. For the quarter, both the S&P 500 and Nasdaq posted robust gains, extending an impressive year-to-date run. Drivers included resilient earnings, cooling inflation, and an increasingly credible “soft landing” narrative. Because the BTC–equities correlation has often been meaningfully positive in recent years, a strong stock tape tends to spill over into crypto risk appetite. With equities entering Q4 on solid footing, investors were more willing to allocate to Bitcoin as part of a broader risk basket.

Indeed, on October 1—despite the shutdown—major U.S. equity indices (Dow, S&P, Nasdaq) closed in the green, and the VIX drifted to multi-month lows. Crypto benefited from the constructive tone: BTC held above $120k and Ether hovered around the $4,200 area without panic selling, suggesting investors were prioritizing the favorable medium-term setup over the short-term policy noise.

Conclusion

October 1, 2025 captured a market at the crossroads of large opportunities and tangible challenges. On the opportunity side, crypto drew new oxygen from heavyweight participants like Michael Saylor—investors who act, not just opine—alongside a standout Q3 for equities and the seasonal tailwind often seen in Uptober. A $125,000 BTC target no longer felt far-fetched given the alignment of conviction and flows.

On the challenge side, macro and political variables—most notably the U.S. government shutdown—reminded everyone that exogenous shocks can still upset the glide path. A prolonged shutdown could dent growth and indirectly weigh on all risk assets. Even so, most analysts considered it a temporary stumble likely to be resolved near-term. The broader economy looked healthy, inflation appeared manageable, and the Fed retained policy flexibility. Ironically, criticism of the Fed in the political arena can even strengthen the crypto thesis: when trust in central banks wavers, Bitcoin’s non-sovereign design tends to shine brighter.

Bottom line: with structural support from institutions, a sturdy equity backdrop, and the psychological boost of Uptober, crypto entered Q4 with momentum. The task for investors is to balance excitement with discipline—embracing the upside of a maturing uptrend while respecting the macro unknowns that can still buffet the path forward.