Tokenized Stocks: Is This What Stablecoins Looked Like in 2020?

In 2020, stablecoins were still considered a niche corner of the crypto universe. Their market value was small compared to the broader digital asset space, and many observers treated them as an interesting side story rather than a core pillar of market infrastructure. Fast forward to 2025 and stablecoins have become one of the most widely used building blocks in crypto and, increasingly, in cross-border finance.

Now a similar pattern seems to be emerging for tokenized equities. The total market value of tokenized stocks has climbed to roughly 1.2 billion USD, a modest figure compared with global equity capitalization but a meaningful jump within a single year. Industry participants are starting to describe tokenized stocks in the same way people once described early stablecoins: small in absolute terms, but large in potential.

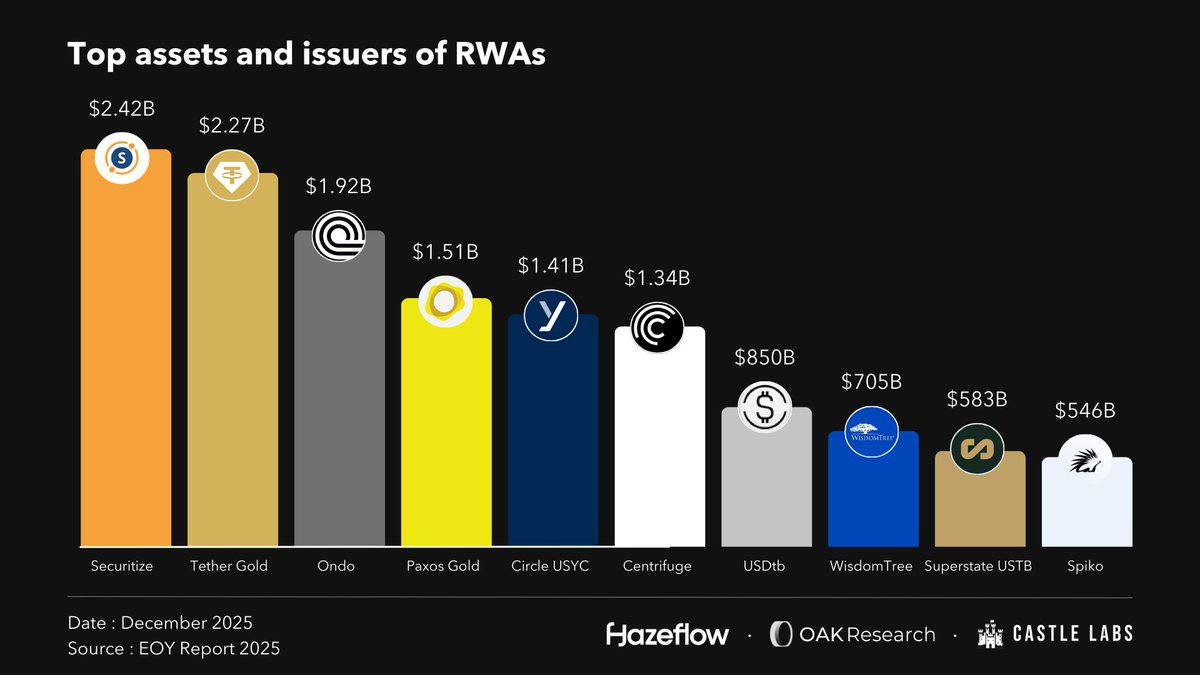

What makes this shift especially noteworthy is the cast of institutions that have decided to participate. Backed Finance is rolling out a suite of tokenized stock products on Ethereum; Securitize is working on compliant onchain equity trading; Ondo Finance is preparing tokenized U.S. stocks and ETFs on Solana; Coinbase openly talks about becoming an 'everything exchange' that could one day support regulated equity trading; and Nasdaq itself has filed to launch tokenized stocks as part of a long-term strategy.

Put together, these moves suggest that tokenized equities are no longer a speculative concept. They are becoming a contested frontier where traditional finance and onchain infrastructure begin to overlap in a serious way.

1. From Experiment to Emerging Asset Class

A market value of 1.2 billion USD sounds small in the context of global equity markets, which run into the tens of trillions. But the number matters less than the trajectory and composition of that value.

For most of the previous decade, 'equities onchain' meant either synthetic representations of stocks or small-scale experiments with private securities. The volumes were thin, the user base was limited and the infrastructure was fragmented. What has changed in 2025 is that tokenized stocks are starting to look like an asset class with a clear roadmap and institutional sponsors.

Several developments stand out:

• Backed Finance has launched its xStocks product line on Ethereum, bringing roughly 60 tokenized shares of major companies onto the chain and making them available through venues such as Kraken and Bybit. That means investors can hold representations of familiar names in the same wallets they use for other digital assets.

• Securitize is designing frameworks for legally compliant onchain trading of shares, aiming to bridge regulated securities markets and programmable infrastructure.

• Ondo Finance has announced plans to issue tokenized U.S. stocks and ETFs on Solana starting in 2026, using the chain as a high-throughput settlement and transfer layer.

• Coinbase has openly discussed its ambition to become an 'everything exchange', a platform where, subject to regulation, investors could eventually trade both digital assets and tokenized traditional securities.

• And perhaps most symbolic, Nasdaq has filed to launch tokenized equities, signaling that it views onchain representations not as a passing trend, but as a component of its long-term strategy.

None of these initiatives alone would be enough to say that tokenized stocks have 'arrived'. But together, they form a pattern: large, regulated institutions are devoting time, capital and regulatory effort to building this market. That is exactly what transformed stablecoins from experimentation into infrastructure.

2. The Stablecoin Parallel: Why 2025 Feels Like 2020

Industry insiders often say that tokenized equities today look like stablecoins did in 2020. That analogy is not just rhetorical; it captures several concrete similarities.

2.1 Small base, steep growth curve

In 2020, stablecoin market value was still relatively low compared to where it would be a few years later. What mattered was not the absolute number, but the fact that growth was compounding quickly and that usage was spreading across more platforms and geographies. Tokenized stocks in 2025 are in a similar position: their aggregate value is small, but the pace of growth, particularly over the past year, is noteworthy.

2.2 Clear product–market fit emerging

Stablecoins found traction because they solved obvious problems: smoother movement of funds between exchanges, easier access to dollar-like exposure in regions with restricted banking access and a simple unit of account for digital asset markets. Tokenized equities are beginning to surface their own use cases:

- 24/7 transferability of equity exposure without waiting for traditional settlement cycles.

- Potentially lower barriers for international investors who want exposure to U.S. or European shares.

- Integration with onchain collateral frameworks, where tokenized stocks can be used in structured products, lending markets or risk management tools.

These are early-stage uses, but they hint at the same kind of transition from 'interesting demo' to 'everyday tool' that stablecoins underwent.

2.3 Institutional buy-in as the turning point

Stablecoins reached a different level of legitimacy when major exchanges, custodians and payment providers standardized on them. Tokenized equities seem to be approaching a similar turning point. Backed Finance, Securitize, Ondo, Coinbase and Nasdaq are not experiments from hobbyist teams; they are institutional efforts with reputational stakes.

In both cases, the story is not that onchain technology created demand out of nowhere, but that it provided a more flexible way to meet existing demand for familiar exposures – dollars in the case of stablecoins, and listed shares in the case of tokenized equities.

3. Who Is Building What: A Closer Look at the New Stack

To understand where this market might go next, it helps to examine the roles different institutions are playing across the stack.

3.1 Backed Finance and xStocks: Bringing public names onchain

Backed Finance’s xStocks suite positions itself as the front line of tokenized equity exposure on Ethereum. By listing around 60 tokenized shares and facilitating access through exchanges like Kraken and Bybit, Backed is effectively translating traditional tickers into onchain instruments. The technical foundation is relatively straightforward – tokens backed by underlying shares held via custodial arrangements – but the strategic implications are deeper:

- Ethereum becomes a ledger for equity exposure, not just native digital assets.

- Exchanges that support these tokens bridge two universes: traditional equity ecosystems and decentralized infrastructure.

- Developers gain programmable access to representations of major companies, opening the door to new structured products.

3.2 Securitize: Compliance as a core feature

Securitize is operating closer to the regulatory core. Its goal is less about listing a large number of tickers and more about ensuring that onchain trading complies with existing securities law. That includes investor accreditation checks, transfer restrictions where required and auditability.

Their work matters because tokenized equities do not exist in a legal vacuum. Unlike many digital-native tokens, equities already have mature regulatory frameworks. Bridging them into an onchain environment requires careful coordination between technology, law and market structure – and Securitize is positioning itself in that intersection.

3.3 Ondo Finance on Solana: High-throughput settlement for U.S. stocks and ETFs

Ondo Finance’s plans to issue tokenized U.S. equities and ETFs on Solana in 2026 reflect another dimension: performance and scalability. Solana’s high-throughput environment allows frequent updates, tight spreads and near-instant settlement, which can be useful for products that mirror active public markets.

If successful, this approach could illustrate a multi-chain reality for tokenized stocks: Ethereum as a general-purpose settlement and composability layer, Solana as a high-speed venue for active trading and other chains specializing in specific jurisdictions or asset types.

3.4 Coinbase and Nasdaq: Convergence of exchanges

Coinbase’s ambition to become an 'everything exchange' and Nasdaq’s filing to launch tokenized stocks both point toward a future in which the distinction between 'crypto exchange' and 'securities exchange' becomes less rigid.

- For Coinbase, integrating tokenized equities would allow clients to manage digital assets and representations of traditional securities under one roof, with unified custody and potentially unified collateral management.

- For Nasdaq, bringing tokenized stocks into its strategic roadmap is a statement that onchain representations are not a threat to traditional exchanges, but a new format they can adopt.

Together, these perspectives hint that the future may not be 'onchain platforms versus traditional exchanges' but rather traditional exchanges using onchain rails where it makes sense.

4. Why Institutions Care: Efficiency, Reach and Optionality

It is worth asking why large institutions, which already have established equity infrastructure, would invest effort in tokenized stocks at all. Several motivations stand out.

4.1 Operational efficiency and settlement flexibility

Onchain representations can simplify certain operational processes:

- Transfers and settlements can be automated through smart contracts.

- Corporate actions (such as distributions or splits) can be encoded and executed programmatically.

- Custody, pledging and rehypothecation can be tracked more transparently on shared ledgers.

While these efficiencies do not appear overnight – and must be balanced with regulatory and technological constraints – they are attractive to institutions that handle large volumes of repetitive processes.

4.2 Access to new investor segments

Tokenized stocks also offer a way to reach global, digitally native investors who are already comfortable with wallets, onchain transactions and 24/7 markets. For them, the ability to hold both BTC, ETH, stablecoins and representations of listed companies in a single interface is a natural extension of their existing toolkit.

From the perspective of exchanges and issuers, this is a way to broaden distribution channels without dismantling existing structures. Tokenized equities act as a bridge between public markets and onchain ecosystems.

4.3 Strategic optionality in a changing landscape

Finally, there is a strategic angle. Financial infrastructure is in the middle of a long transition toward more programmable, interoperable systems. By experimenting with tokenized stocks now, institutions such as Nasdaq, Coinbase and others gain optionality: they learn how onchain rails work, test real-world products and position themselves for a scenario where a meaningful share of securities activity moves to tokenized formats.

5. Opportunities and Constraints for Investors

For investors and builders, the rise of tokenized equities raises both opportunities and important constraints to keep in mind.

5.1 What tokenized stocks make easier

On the opportunity side, tokenized equities can:

- Offer more flexible access to familiar exposures, especially for investors outside the home jurisdiction of the underlying shares.

- Enable new kinds of onchain products where equity exposure is combined with yield strategies, risk transfers or automated rebalancing.

- Provide a single, programmable interface to manage a mix of digital-native assets and representations of traditional securities.

5.2 What remains unchanged

At the same time, tokenization does not change several fundamental realities:

- The economic risk is still linked to the underlying company or fund, not to the token itself.

- Regulatory obligations around disclosure, investor protection and market integrity still apply, even if the representation lives on a blockchain.

- Operational and counterparty risks must still be evaluated: who holds the underlying shares, how the token is issued and redeemed, and under what legal framework.

For that reason, tokenized stocks should be seen less as 'a new category of high-growth assets' and more as a new wrapper around exposures that investors already understand. The wrapper can create new possibilities, but it does not remove the need for careful evaluation.

6. Where This Could Be Heading

With a 1.2 billion USD market value today, it is reasonable to ask what tokenized equities might look like in a few years if they do follow a stablecoin-like trajectory.

Several scenarios are plausible:

• Steady integration into existing venues. Exchanges like Coinbase, Kraken and Nasdaq gradually expand their onchain equity offerings, while traditional brokers experiment with custody and transfer via tokenized rails.

• Multiple specialized chains. Ethereum, Solana and possibly other networks share the load, each hosting specific product categories or investor segments, connected through bridges and standardized messaging.

• Deeper use in onchain finance. Tokenized stocks become ingredients in structured products, portfolio management tools and risk-transfer mechanisms that live entirely onchain.

None of these paths are guaranteed, and there are many open questions about regulation, interoperability and market demand. But the fact that major institutions are already preparing for such scenarios is what makes 2025 feel so similar to the stablecoin environment of 2020: the infrastructure is still small, yet the building blocks are clearly being put in place.

7. Conclusion: Early Days, Serious Builders

The rise of tokenized equities to a total market value of around 1.2 billion USD in 2025 does not, by itself, transform global finance. What makes this moment worth watching is the combination of early-stage scale, accelerating growth and heavyweight participants like Backed Finance, Securitize, Ondo Finance, Coinbase and Nasdaq.

For now, tokenized stocks resemble stablecoins in their formative years: still small in absolute size, but increasingly central to conversations about how finance will be delivered in the future. They offer a way to bring familiar assets into programmable environments, to widen access for global investors and to experiment with new forms of settlement and product design.

At the same time, they are not a shortcut around fundamentals. The value of a tokenized share ultimately depends on the company or fund it represents; the quality of the structure depends on legal, operational and custody arrangements; and investors still need to apply the same level of caution they would in traditional markets.

If history is any guide, the most significant impact of tokenized equities may not be immediate price movements, but the gradual way they reshape expectations. Just as stablecoins normalized the idea that dollars could move natively on digital rails, tokenized stocks may normalize the idea that securities themselves can be held, moved and integrated into financial products in a fully programmable way.

Whether this market in 2030 looks ten times larger or remains a specialized niche will depend on regulation, infrastructure and user behavior. What is already clear, however, is that some of the most important institutions in global markets have decided that this is a direction worth committing to.

Disclaimer: This article is intended solely for educational and analytical purposes and should not be viewed as financial, investment or legal advice. Tokenized assets and digital securities carry risks and may not be suitable for every investor. Always conduct your own research and consider speaking with a qualified professional before making financial decisions.