Caroline Crenshaw Leaves the SEC: How the Loss of Washington’s Most Skeptical Crypto Voice May Reshape Policy

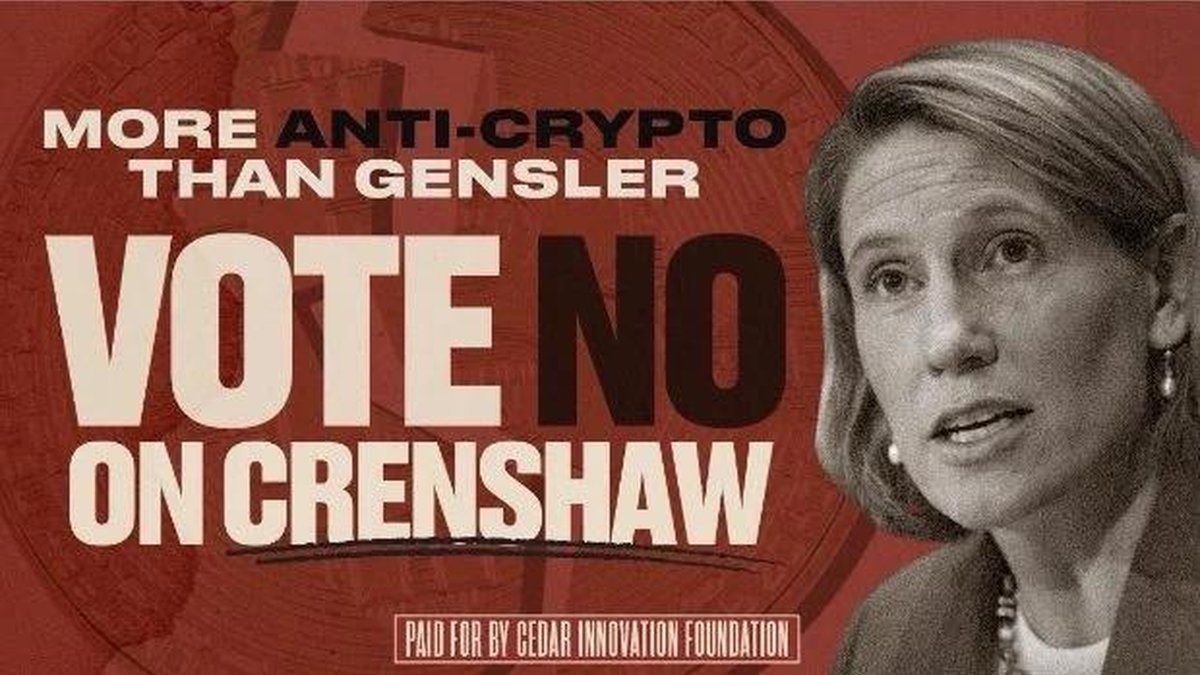

The US Securities and Exchange Commission (SEC) is entering 2025 with a very different internal balance. Commissioner Caroline Crenshaw, widely regarded as the most skeptical member of the agency on digital assets, will leave her post on 18 January. Her exit comes at a time when the United States is still trying to decide what kind of role cryptoassets should play in its financial system, and which regulator should be in charge of them.

For the digital asset industry, the headline is simple: the Commissioner who most consistently opposed special treatment for tokens is stepping away. But the deeper story is more nuanced. Crenshaw’s departure may moderate the tone of SEC statements on crypto, yet it does not magically turn the agency into a cheerleader. It does, however, open space for a recalibration of priorities, especially as the Commission transitions to a line-up dominated by Republican appointees and faces pressure from Congress, courts and markets at the same time.

1. Who Is Caroline Crenshaw and Why Did She Matter So Much to Crypto?

Caroline Crenshaw joined the SEC as a Commissioner in 2020 after years working inside the agency’s examination and enforcement arms. Her background was shaped less by Wall Street deal-making and more by day-to-day oversight work: reviewing how firms treated clients, whether disclosures were clear and whether market rules were being followed. That lens heavily influenced her views on crypto.

While several Commissioners over the past decade viewed digital assets as a promising technology in need of better rules, Crenshaw primarily approached the sector through the prism of investor protection. In speeches and dissents, she repeatedly argued that many token offerings looked very similar to traditional securities sales, but with fewer disclosures and weaker safeguards. She warned that retail investors often bore the brunt when projects collapsed or when platforms failed to meet basic compliance standards.

Because the SEC operates as a five-member Commission, individual voices matter. Dissenting statements shape how courts read the law, how Congress writes legislation and how future regulators interpret past decisions. Crenshaw’s written dissents became a kind of reference library for the skeptical case on cryptoassets inside the US regulatory state.

2. The Most Skeptical Voice on the Commission

Over time, Crenshaw became the Commissioner most closely associated with a cautious stance on digital assets. She publicly questioned whether the SEC was, in her view, lowering its standards when it came to crypto enforcement and settlements. When the agency decided to drop certain cases or reduce penalties, she argued that this could send the wrong signal about accountability in emerging markets.

In speeches, she likened parts of the crypto ecosystem to a high-risk game environment where prices were driven more by enthusiasm and complex incentives than by fundamentals. In her view, this made it easier for inexperienced investors to take on risks they did not fully understand. She worried that special exemptions or bespoke treatment for crypto could allow that risk to spill over into the broader financial system, particularly as banks, brokers and large asset managers deepen their involvement.

One of her recurring themes was consistency. If a token functioned like a security, she argued that it should meet the same basic requirements any other security must meet: clear disclosures, fair dealing, and channels for redress when things go wrong. To her, the idea of creating a lighter, parallel regime for digital assets raised concerns about creating a two-tier market where protections depended on which technology a project used rather than what risks it posed.

3. Why Crenshaw Opposed Regulatory “Shortcuts” for Crypto

Understanding Crenshaw’s stance is useful because it highlights the fault lines that will still exist after she leaves. Her core arguments rested on three pillars: investor protection, market integrity and systemic risk.

3.1 Investor protection came first

Crenshaw frequently reminded audiences that the SEC’s mission is to protect investors, maintain fair and efficient markets and facilitate capital formation. In her reading of that mission, crypto markets raised specific challenges: tokens launched without audited financials, platforms offering yield products that resembled investment contracts without clear risk disclosures, and complex tokenomics that could dilute existing holders.

From that perspective, she saw strict enforcement not as an attempt to suppress innovation, but as a way to ensure that experimentation took place within boundaries that had been tested over decades in traditional markets.

3.2 Market integrity and the role of exchanges

Crenshaw also focused on trading venues. She was skeptical of platforms that combined multiple roles at once: listing tokens, acting as broker, market maker and custodian under one roof. In conventional securities markets, these functions are often separated to reduce conflicts of interest. Her concern was that, without similar safeguards, pricing and order execution in digital asset markets could be harder for outsiders to understand or monitor.

3.3 Systemic risk and legal exceptions

Finally, Crenshaw repeatedly warned against carving out sweeping exceptions for crypto. She argued that giving this sector broad exemptions from existing securities laws could create channels through which risk might migrate into banks, money market funds or pension portfolios. In that sense, her skepticism was not just about individual projects, but about the possibility that a poorly supervised digital asset ecosystem might interact in unexpected ways with the rest of the financial system.

4. What Changes When She Leaves?

With Crenshaw stepping down, the Commission will temporarily consist of four members: three Commissioners plus the Chair, all aligned with the current Republican administration. That configuration matters. Although the SEC is meant to be independent, party alignment influences how aggressively the agency writes new rules, how it chooses cases and how it balances innovation against enforcement.

A Commission without its most skeptical member may be more open to experimental approaches such as tailored disclosure regimes for token issuers, pilot programmes for on-chain settlement or broader recognition of tokenised instruments as eligible collateral. It may also be more willing to coordinate with the Commodity Futures Trading Commission (CFTC) and banking regulators to define clearer borders between different types of digital assets.

However, there are constraints. Many enforcement actions are already in motion and follow legal standards set by courts, not by individual Commissioners. Staff inside the agency still have a duty to apply the law as it stands. And until Congress passes comprehensive market structure legislation, the SEC will continue to interpret existing statutes rather than writing an entirely new rulebook from scratch.

5. The Near-Term Regulatory Path: Continuity With a Different Tone

In the short term, the most visible change may be one of tone rather than substance. Without Crenshaw’s sharply worded dissents, official SEC statements on digital assets could sound less hostile. Public communications may emphasise themes like innovation, competitiveness and responsible experimentation alongside investor protection.

We are likely to see continued approval of products that sit closer to the traditional securities framework, such as exchange-traded products tracking large assets, tokenised versions of government securities, and on-chain representations of traditional funds. At the same time, platforms that mix brokerage, custody and complex yield features may still face intense scrutiny, especially where retail investors are involved.

Another area to watch is coordination with global regulators. As Europe rolls out MiCA, the UK refines its own regime and jurisdictions in Asia compete to attract digital asset businesses, the US has an incentive to avoid appearing either overly permissive or overly restrictive. A Commission without Crenshaw might tilt slightly toward the “competitive” side of that spectrum, but it will still be shaped by international standards on anti-money-laundering, market abuse and systemic stability.

6. Why the Industry Should Not Assume a Free Pass

Some market participants may interpret Crenshaw’s exit as a sign that the SEC is about to pivot decisively in favour of digital assets. That would be an overstatement for several reasons.

• The statutory framework is unchanged. Core securities laws from the 1930s remain in force. Unless Congress rewrites them, the SEC must continue to apply tests such as the Howey standard when assessing whether a token is a security.

• Court decisions set binding precedents. Federal judges have already weighed in on several major token-related cases. Those decisions constrain what the Commission can and cannot do, regardless of internal politics.

• Staff culture evolves slowly. Thousands of career lawyers, examiners and economists within the SEC have spent years building expertise on digital assets. Their risk assessments will not flip overnight because one Commissioner leaves.

The more realistic expectation is that the SEC may become somewhat more predictable and pragmatic in how it interacts with firms that pursue registration, seek no-action relief or launch products through established channels. Companies that can demonstrate strong compliance, transparent disclosures and robust risk controls are likely to find the door more open than in the past. Those hoping for a complete relaxation of standards are still likely to be disappointed.

7. Market Reaction: Sentiment vs Fundamentals

For traders, the immediate question is what Crenshaw’s departure means for prices. In the very short term, it may support a modest improvement in sentiment. Removing a high-profile skeptic can be interpreted as a symbolic victory for the industry, especially after years of tense hearings and enforcement battles.

Yet over longer horizons, the impact on fundamentals is more subtle. The most important drivers of digital asset valuations remain macroeconomic conditions, adoption trends, technological progress and the health of key market infrastructures such as exchanges and stablecoins. A single personnel change at the SEC does not alter those forces. What it does change is the set of voices in the room when new rules and settlements are drafted.

From that angle, investors should pay as much attention to who replaces Crenshaw as to her departure itself. A successor with a balanced view could help the Commission design clearer, more durable rules. A replacement at either extreme—uncritically enthusiastic or reflexively hostile—could prolong uncertainty by inviting court challenges and political pushback.

8. The Role of Dissenting Voices in Regulation

It is also worth recognising the constructive role that skeptical Commissioners can play, even when their views frustrate industry participants. Dissenting opinions surface risks that might otherwise be overlooked. They force majority Commissioners to sharpen their reasoning and can provide roadmaps for future reforms.

Crenshaw’s record illustrates this. Many of her statements emphasised real issues: opaque token distributions, conflicts of interest on trading venues, and the challenge of ensuring that disclosures keep up with rapidly evolving technology. Even if the market ultimately moves in a more permissive direction, those concerns remain relevant. They will shape how institutional investors evaluate counterparties and how policymakers design safeguards for custody, leverage and market transparency.

For the crypto ecosystem, engaging with these critiques rather than dismissing them outright is often the most productive path. As digital assets become more deeply integrated into mainstream finance, the standards applied to them will increasingly resemble the standards applied elsewhere. Understanding the reasoning behind skeptical voices can help builders anticipate regulatory expectations instead of reacting only when enforcement arrives.

9. What to Watch in 2025

With Crenshaw’s departure set for mid-January, several developments in 2025 will reveal how much the SEC’s approach is truly changing:

• Appointment of a successor. The identity, background and public statements of the new Commissioner will send the clearest signal about future priorities.

• Implementation of any new crypto-specific legislation. If Congress advances market structure or stablecoin bills, the SEC’s rulemaking choices will matter even more than enforcement cases.

• Treatment of new registrations and product filings. How quickly the SEC responds to applications for tokenised securities platforms, custody services or exchange-traded products will show whether internal attitudes are shifting.

• Coordination with the CFTC and banking regulators. Joint guidance on topics such as tokenised treasuries, collateral frameworks and stablecoin reserves could reduce fragmentation and provide more certainty to market participants.

In parallel, the global landscape is moving. Jurisdictions that offer clear, balanced frameworks are attracting both issuers and infrastructure providers. If the United States wants to remain central to the evolution of digital asset markets, its regulators will need to provide clarity without sacrificing the protections that make US markets attractive in the first place.

10. Conclusion: A Symbolic Turning Point, Not the End of Scrutiny

Caroline Crenshaw’s decision to step down from the SEC closes a chapter in the agency’s relationship with cryptoassets. For industry participants, her exit feels like the departure of the Commission’s most consistent critic, a figure who often framed digital assets as an area where risks outweighed benefits.

But regulatory systems are bigger than any one individual. The laws that govern securities offerings, market conduct and custodial responsibilities remain in effect. Courts, Congress and other regulators continue to shape the boundaries within which digital assets can grow. What changes with Crenshaw’s departure is the balance of perspectives at the top of the SEC and, potentially, the tone of its engagement with innovators.

For builders and investors, the most constructive response is not to assume that oversight will fade, but to treat this moment as an opportunity to demonstrate that well-designed crypto infrastructure can meet the same high standards that apply elsewhere in finance. Clear disclosures, robust risk management, tested security practices and respect for market integrity are not obstacles to innovation—they are the foundation on which sustainable adoption is built.

Crenshaw may be leaving the Commission, but the questions she raised will continue to shape the debate: How do we protect investors while allowing experimentation? How do we integrate new technology into existing rules without creating blind spots? And how do we ensure that the benefits of open, programmable finance are not overshadowed by avoidable risks? The answers will define the next stage of the digital asset journey in the United States.