AMD’s Lisa Su Says AI Won’t Kill Jobs—It Will Replace the Hiring Playbook

Two statements can sound like they are fighting each other while actually describing the same reality from different altitudes. AMD CEO Lisa Su says AI isn’t reducing hiring at AMD; the company is growing and still recruiting. Minneapolis Fed President Neel Kashkari warns that AI is making large companies slower to hire because productivity is rising. People read those quotes as opposing narratives: “AI creates jobs” versus “AI destroys jobs.”

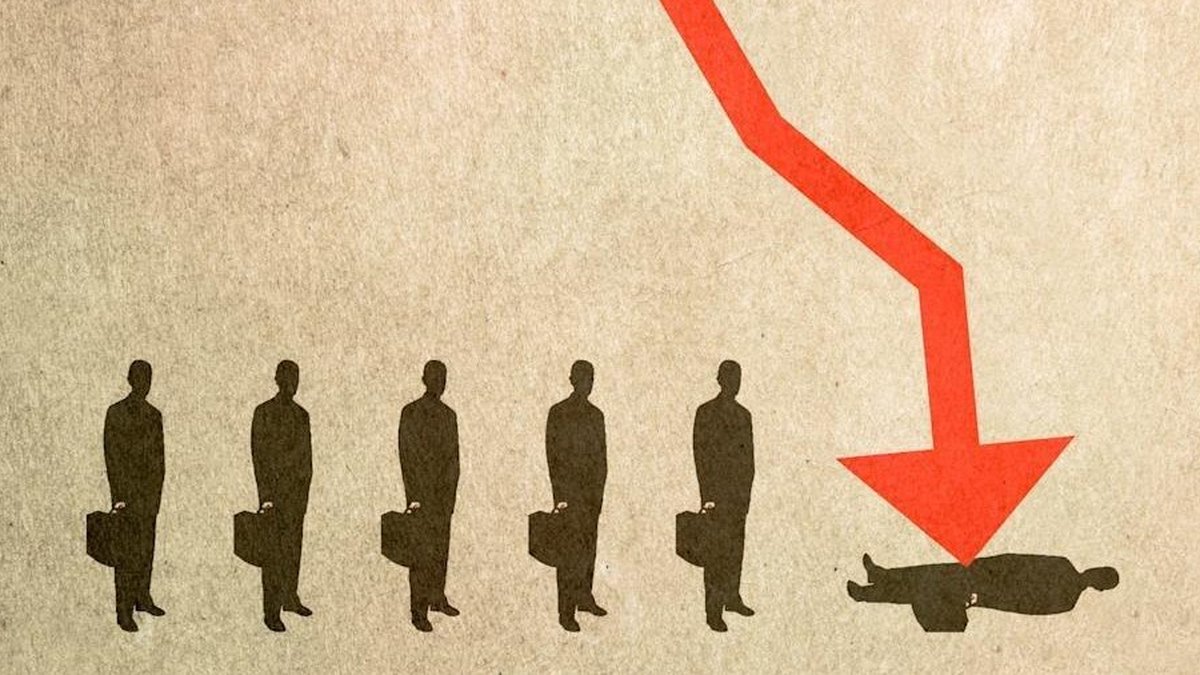

But the more interesting interpretation is this: AI is not mainly shrinking the labor market. It is rewiring the selection mechanism—who gets hired, what the company pays for, and what kinds of work are considered leverage. In that world, the unemployment story can be calm in aggregate while still feeling brutal at the individual level. That is what makes this cycle so confusing and so politically charged: macro stability can coexist with micro displacement.

Core idea: AI is not a universal “job killer.” It is a universal “job filter.” The labor market can remain tight, but the gate can become narrower.

The phrase that matters: “AI-forward” is not a vibe—it’s a competency test

Lisa Su’s “AI-forward” framing sounds simple, but it carries a quiet redefinition of merit. In older cycles, firms screened for experience, credentials, and domain expertise. In the AI cycle, they increasingly screen for something else: whether you can compound your output using machines. The new premium is not “knows everything,” but “knows how to ask, verify, and iterate fast.”

That has two immediate consequences. First, it rewards people who are comfortable with ambiguity and rapid tool adoption. Second, it penalizes people who were previously protected by process—those whose value was embedded in slow workflows, institutional memory, or gatekeeping roles where information moved only through them. AI removes friction, and friction used to employ a lot of people.

AMD is a useful example because it sits in the center of the AI buildout: chips, tooling, testing, design, manufacturing interfaces. If AI is being integrated “end-to-end,” it changes the shape of teams. You may still hire the same headcount, but you hire different mixes: fewer pure coordinators, more hybrid builders; fewer people who only execute tasks, more people who can define tasks and validate outputs.

Why Kashkari can be right even if AMD keeps hiring

Kashkari’s point is about a macro behavior: large firms can respond to productivity improvements by expanding output without expanding headcount. In practice, that means: fewer net new openings, longer decision cycles, and “do more with the same team” pressure. But that doesn’t require layoffs. It can show up as a labor market that looks stable on the surface—low firing, modest hiring—while becoming harder for job seekers to break in.

So Lisa Su’s world and Kashkari’s world can coexist. One company in a growth segment (AI compute) can be hiring aggressively, while the average large firm in a mature segment slows hiring because AI lifts productivity. In other words, the labor market becomes bimodal: expansion in AI-adjacent sectors, caution elsewhere.

This is why people argue past each other. They are sampling different parts of the economy. AI is a shockwave, not a uniform blanket.

The hidden shift: from “labor shortage” to “fit shortage”

One of the most under-discussed outcomes of AI adoption is that companies can say “we can’t find talent” even while unemployment rises. That sounds contradictory until you realize the definition of “talent” is changing. The shortage is no longer purely about the number of workers. It is about the number of workers who can operate effectively in AI-shaped workflows.

In earlier eras, firms trained people into processes. In this era, firms increasingly want people who can train the process—design prompts, build internal tools, evaluate model outputs, write guardrails, and convert prototypes into reliable systems. When a company says “AI won’t replace humans,” what it often means is “AI won’t replace the humans who can direct it.” That’s a very different promise.

From a worker’s perspective, this can feel like the rules changed mid-game. You didn’t become worse; the scoreboard changed. The job is still there, but it now requires a different interface layer: AI literacy plus domain expertise.

History rhymes, but the tempo is different

The First Industrial Revolution is the right comparison—up to a point. Mechanization displaced artisans and manual labor, created harsh transition costs, and fueled backlash (including the Luddite movement between 1811 and 1816). The key lesson wasn’t that technology permanently eliminates work. The lesson was that technology permanently eliminates specific bargaining positions. People who adapted early benefited first; people who adapted late paid the transition tax.

However, there is a crucial difference now: the speed of diffusion. In the 18th and 19th centuries, adoption took decades because capital deployment and infrastructure scaled slowly. AI adoption can spread in months because it is software-like, cloud-delivered, and increasingly embedded into consumer tools. That compresses the adjustment window. The economy may still ultimately create new categories of work, but the time between “old work declines” and “new work stabilizes” can feel shorter and more violent.

That’s why the social anxiety can be higher even if the long-term outcome is similar. People don’t fear change; they fear change that arrives faster than re-skilling pathways can absorb.

What “AI-forward” hiring really implies for wages and inequality

When companies prioritize AI-forward candidates, they are effectively placing a premium on workers who can multiply their output. That tends to widen wage dispersion. The top performers become more valuable because they can produce more and manage more complexity. Meanwhile, mid-level roles that used to serve as stepping stones—basic analysis, routine reporting, entry-level coordination—risk being thinned out.

This matters because stepping-stone jobs are how labor markets stay healthy. They are how new graduates build experience and how career switchers re-enter. If AI reduces the number of “learning jobs,” you can end up with a paradox: high demand for skilled workers and weak mobility for everyone else. That can look like a stable unemployment rate paired with growing frustration, because opportunity becomes less accessible.

In that sense, Kashkari’s “slower hiring” warning is also a warning about mobility. It’s not only about total jobs; it’s about the ladder into better jobs.

What to watch next: signals that hiring is changing, not collapsing

If you want to understand this cycle without relying on slogans, watch for these practical signals:

• Job postings quality, not quantity: roles increasingly ask for AI tool usage, automation experience, or “workflow building.”

• Longer time-to-hire at large firms: not because firms can’t hire, but because they are being selective about AI-forward fit.

• Stable employment with slower job switching: fewer layoffs, fewer new hires, fewer jumps—people stay put while companies retool internally.

• Training as a competitive moat: firms that build internal AI enablement programs will out-hire others, because they can convert non-perfect candidates into productive employees faster.

These are the mechanics of a transition economy. The surface can look calm while the internal wiring is being replaced.

Conclusion

Lisa Su and Neel Kashkari are not delivering opposing truths. They are describing different layers of the same transition. At the firm level—especially in AI-adjacent growth sectors—AI can be a hiring accelerant because it expands what a company can build and how quickly it can compete. At the macro level, AI can slow hiring because it allows output growth without proportional headcount growth, especially at large firms that already have scale.

The synthesis is simple but uncomfortable: AI is not removing the need for humans. It is removing the need for humans who cannot work with AI. That means the most important question in 2026 is not “Will there be jobs?” It’s “Will the path into those jobs remain open?”

Disclaimer: This article is for educational and informational purposes only and does not constitute investment advice or career/legal guidance. Labor market dynamics vary by country, industry, and individual circumstances.

Frequently Asked Questions

Is AI causing unemployment right now?

AI can create displacement in specific roles, but broad unemployment outcomes depend on how quickly new roles form, how fast firms adopt AI, and how effective re-skilling pathways are. It’s possible to see stable unemployment alongside painful transitions in certain job categories.

What does “AI-forward” mean in practical terms?

It typically means you can use AI tools proactively to improve speed and quality, validate outputs, automate routine tasks, and communicate clearly about tradeoffs and risks—rather than treating AI as a novelty.

Why would AI slow hiring if companies are growing?

Because growth can come from productivity. Firms may expand output without expanding headcount, especially if AI lets existing teams do more. Growth and slower hiring can coexist.

Who benefits most in the AI labor market?

Workers who combine domain expertise with AI workflow skills—those who can define problems, leverage tools, and verify results. Over time, organizations that invest in training can broaden who benefits by turning more employees into AI-forward contributors.