“Impossible to fake energy”: Musk’s frame sets the tone as ETFs, tokenization, and policy headlines flood the tape

Elon Musk reiterated a simple thesis: Bitcoin is “based on energy”—governments may print money, but, in his words, it’s “impossible to fake energy.” That energy/ scarcity framing synched with a session where spot Bitcoin ETFs roared out of the gate, BlackRock executives talked up rapid crypto expansion and full-stack tokenization, and macro officials suggested policy nerves might ease. Beneath the marquee quotes: liquidations flared again, enforcement news hit, and builders kept shipping.

Tape & flows: fast pain, faster pipes

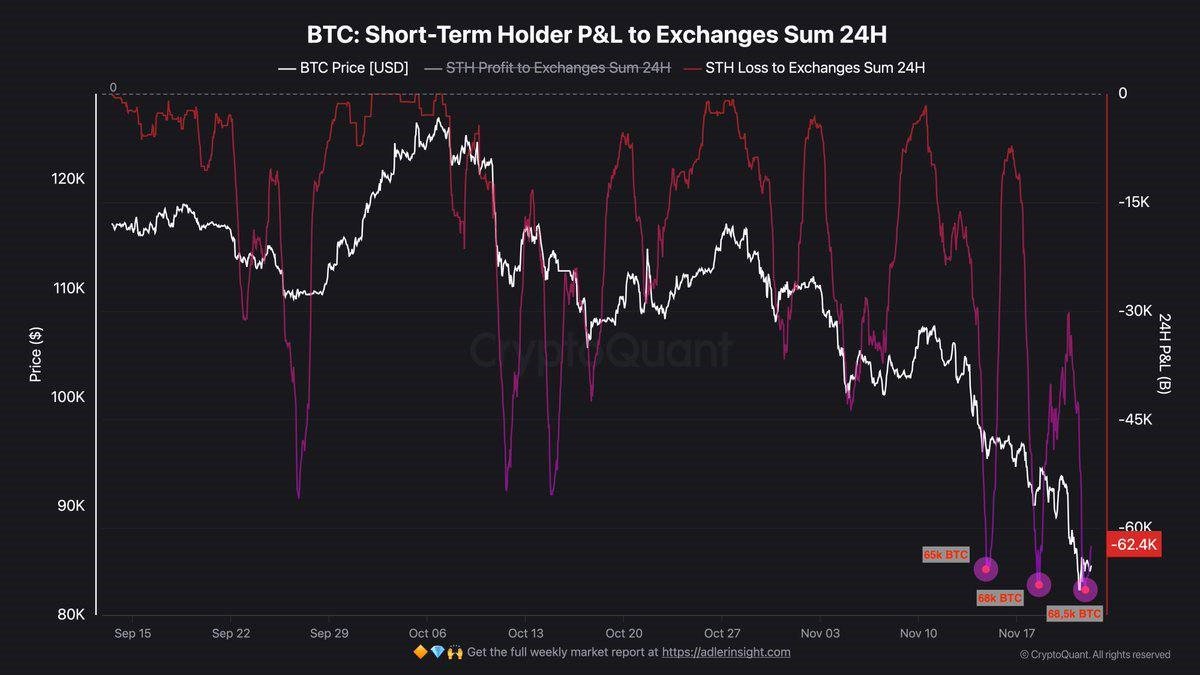

- $200M in crypto positions liquidated over the last 4 hours — a reminder that leverage remains elevated even after the weekend’s clean-out.

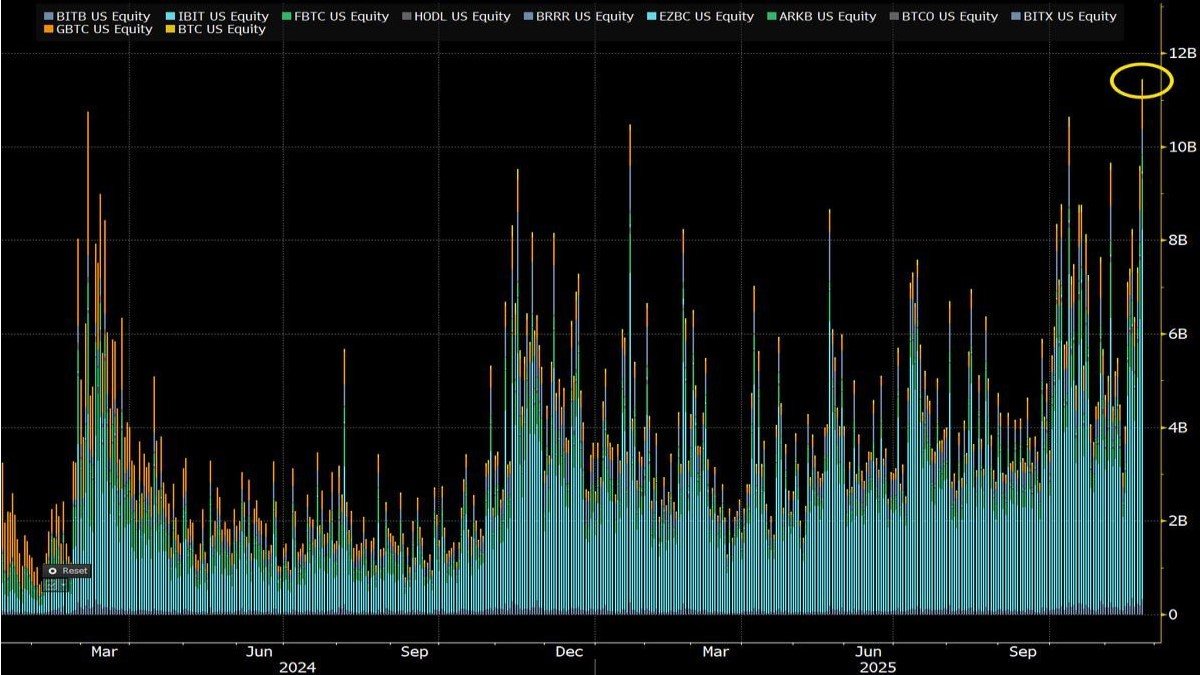

- Spot Bitcoin ETFs cleared $1B in aggregate trading volume within the first 10 minutes of the U.S. session; BlackRock’s iShares Bitcoin fund surpassed $100B AUM, the fastest-growing ETF in history.

- Jim Cramer quipped that the “crypto/spec tail is wagging the S&P dog,” then said he hopes flows rotate from crypto back into “real economy stocks.”

Institutional stance: BlackRock turns the dial up

- CEO Larry Fink said the Bitcoin and crypto market will expand rapidly, adding that BlackRock is building its own tokenization technology and that the U.S. must accelerate regulatory clarity and public-private investment in digital-asset infrastructure.

- Fink again emphasized: “we’re just at the beginning of tokenization of all assets.” Expect more pilots where fund shares, cash instruments, and private-market exposures are represented as programmable tokens with embedded compliance.

Policy, geopolitics & the Fed: risk dial inching lower — for now

- The White House confirmed President Trump and President Xi have scheduled a meeting on trade; Trump also labeled BRICS an “attack on the US dollar,” and posted he is considering ending certain China-linked commercial ties in areas like cooking-oil trade (post).

- Fed Chair Jerome Powell said growth prior to the shutdown may prove stronger than expected, avoided commenting on Bitcoin/Gold, and reiterated that inflation reflects fundamental supply/demand forces.

- Separate Fed chatter signaled QT is nearing an end, with a shift toward neutral balance-sheet settings and optionality to ease if the economy weakens — a backdrop that historically supports duration assets and, by extension, risk conditions.

Enforcement & market plumbing

- The U.S. government seized ~$15B in Bitcoin tied to a Cambodia-based “pig-butchering” ring — a milestone in scale that underscores how forensic tooling and court cooperation have advanced.

- Binance will distribute about $300M to users liquidated during last week’s crash, part restitution and part reputational repair after venue-level stresses magnified wicks.

Builders keep shipping: infra, payments, and Web3 UX

- Stripe added stablecoin checkout for subscriptions — a practical bridge for SaaS and creator economies.

- MetaMask to integrate prediction-market leader Polymarket, streamlining access to on-chain event markets inside the most widely used Web3 wallet.

- Tether shipped WDK, an open-source Wallet Development Kit, and separately paid $299.5M to Celsius Network as part of bankruptcy resolution — two very different signals (dev tooling & legacy cleanup) from the sector’s largest stablecoin issuer.

- S&P Global × Chainlink: risk-rating data for stablecoins is headed on-chain, a notable crossover between traditional credit analytics and decentralized oracles.

Tokens & listed products: breadth beyond BTC

- Solana (SOL): VanEck filed an updated prospectus for a Staking Solana ETF with a 0.30% fee — staking mechanics inside a U.S. fund wrapper remain a hot policy topic to watch.

- Stellar (XLM): WisdomTree launched a physical XLM ETP in Europe, reflecting regional appetite for single-asset exposures.

- Chainlink (LINK): gets an enterprise catalyst via the S&P collaboration noted above.

- Tao/Bittensor (TAO): TaoFI set a new daily volume record (≈$3M) with fees around $9.5K, reportedly aided by the SN10 upgrade — a datapoint in the AI-crypto throughput story.

- Monad (MON): airdrop portal live with allocations targeting DEX, DeFi, and NFT users across EVM and Solana — expect cross-ecosystem sybil filters to matter.

- Enso Network (ENSO): mainnet shipped, offering “Shortcuts” — higher-level API actions that compress multi-step DeFi workflows.

Exchanges, venture & regional expansion

- Coinbase invested in CoinDCX and is expanding in India and the Middle East, continuing a multi-region strategy as local rulebooks mature.

Narrative checks: what matters vs. what’s noise

- Musk’s energy lens and Fink’s tokenization roadmap rhyme: Bitcoin as engineered scarcity; capital markets as programmable ledgers. That alignment is drawing ETF capital and infrastructure investment at the same time.

- Liquidations remain the near-term hazard; the healthiest up-moves keep spot-led and leave funding neutral to mildly positive — not crowded.

- Policy calendar (Trump–Xi, Fed) is the macro metronome. Softer rhetoric + clearer rulemaking = wider risk windows; surprise tariffs or geopolitics = narrower ones.

What to watch in the next 24–72 hours

- ETF flow persistence: do creations keep pace after the hot open? Watch premiums/discounts and two-way depth.

- Powell follow-through: any minutes/speeches reinforcing a pause in QT or leaning toward neutral will matter for duration-sensitive assets.

- Trump–Xi agenda: headlines around scope (tariffs, export controls) will set the risk tone; any delay/discord likely re-prices volatility higher.

- Stablecoin rails: Stripe’s rollout cadence and WDK adoption — both pull real-economy payments toward crypto UX.

- On-chain product traction: Polymarket’s MetaMask funnel, Enso “Shortcuts” usage, TAO throughput, and the MON airdrop’s anti-sybil design.

Bottom line

Energy-anchored scarcity, institutional pipes, and programmable markets all advanced in the same 24-hour span. That’s why the tape could handle $200M of fast liquidations while ETF flows stayed hot and builders kept shipping. The path of least resistance improves when policy nerves cool and tokenization rails deepen — but it remains a headline market. Trade the ranges, respect leverage, and keep one eye on the macro clock.