Reporting Crypto Taxes with Fidelity: A Comprehensive Guide for Investors

The rapid growth of cryptocurrency investment has brought significant attention to regulatory compliance, particularly in the area of taxation. Reporting crypto taxes accurately is critical for investors to avoid legal complications and maximize financial efficiency. Fidelity, as one of the leading financial service providers, offers structured solutions for managing crypto tax obligations. This guide delves deeply into the processes, tools, and best practices that investors can leverage when reporting their cryptocurrency holdings through Fidelity.

Understanding the Importance of Crypto Tax Reporting

Unlike traditional financial assets, cryptocurrencies operate in a decentralized environment with complex transaction types, including spot trading, staking rewards, and decentralized finance (DeFi) interactions. These transactions often generate taxable events, which must be accurately captured for reporting purposes. Fidelity’s platforms aim to simplify this process by integrating transaction histories, cost basis calculations, and reporting templates that comply with IRS guidelines and other regulatory bodies worldwide.

Proper tax reporting not only ensures legal compliance but also provides investors with a clearer understanding of portfolio performance, helping them make informed decisions regarding reinvestment and portfolio diversification.

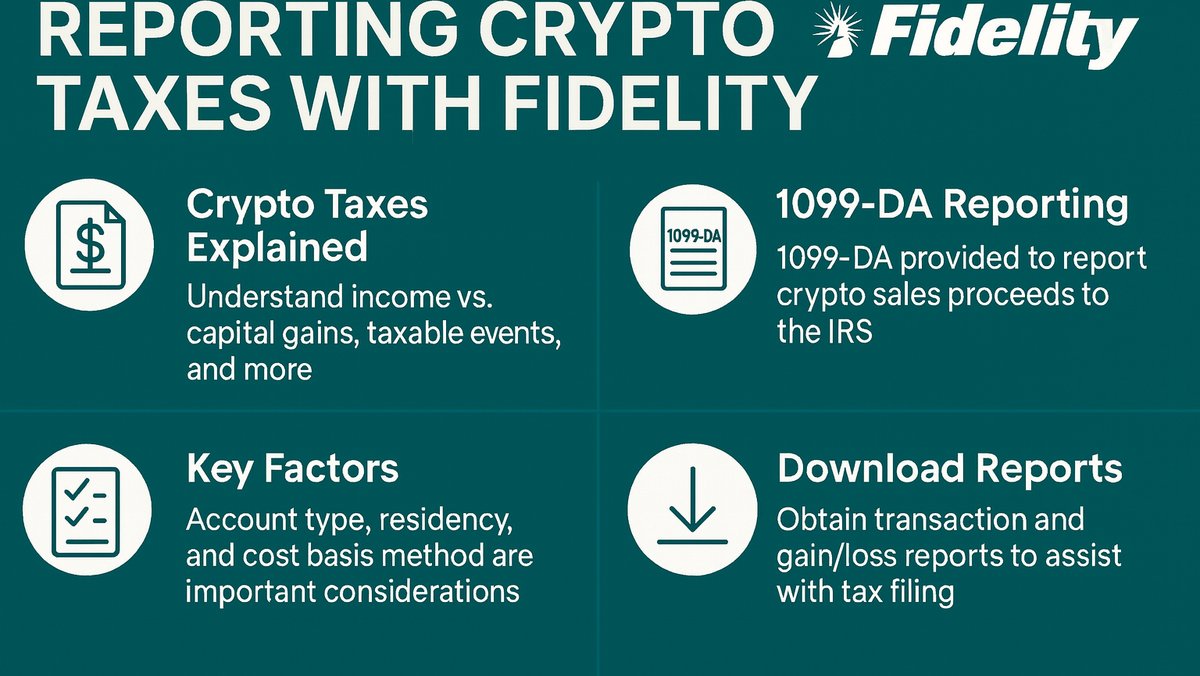

Overview of Reporting Crypto Taxes with Fidelity

Fidelity provides a comprehensive ecosystem for cryptocurrency investors to manage their holdings, including wallets, trading accounts, and tax reporting tools. The system is designed to track each transaction, categorize it appropriately (capital gains, income from staking, airdrops, or mining rewards), and produce IRS-compliant reports. This functionality is crucial given the high volatility of digital assets and the frequency of trades in active portfolios.

Historically, crypto tax reporting has been challenging due to inconsistent transaction records and the lack of standardized reporting formats. Fidelity addresses these challenges by providing automated tracking, data export options, and integrations with third-party tax software. The platform's scalability and security features ensure that investors can manage large volumes of transactions without compromising data integrity.

Key Features and Use Cases

Transaction Tracking and Reporting

Fidelity’s reporting tools automatically aggregate trade data, converting it into a standardized format that includes acquisition cost, holding period, and realized gains or losses. Investors can generate summary reports or detailed transaction-level statements to support tax filings. This feature is particularly valuable for high-frequency traders and institutional investors who conduct hundreds or thousands of transactions annually.

Cost Basis Calculations

Understanding the cost basis is fundamental for calculating capital gains taxes. Fidelity supports multiple methods, including FIFO (First In, First Out), LIFO (Last In, First Out), and specific identification. These options allow investors to optimize tax outcomes based on their trading strategies and regulatory allowances.

DeFi and Staking Considerations

Fidelity’s platform recognizes that income derived from staking, lending, or liquidity provision constitutes taxable events in most jurisdictions. The reporting system captures these events, classifying them appropriately and providing the necessary documentation to ensure compliance. This level of automation reduces errors and simplifies the complexity of decentralized finance transactions.

Comparisons with Other Platforms

When comparing Fidelity’s tax reporting tools to competitors, several strengths emerge. Fidelity integrates seamlessly with brokerage accounts and wallets, offering a unified view of an investor’s holdings. While standalone services may provide similar reporting features, they often lack interoperability with broader investment accounts. Platforms like Coinbase Tax or TurboTax support cryptocurrency reporting but may require manual data uploads, increasing the risk of discrepancies.

Fidelity also emphasizes institutional-grade security and audit readiness, making it an attractive option for high-net-worth investors and organizations managing crypto portfolios.

Risks and Considerations

Investors must remain vigilant regarding regulatory changes. Tax laws regarding cryptocurrency are evolving rapidly, and misreporting can result in penalties, interest, or legal exposure. Fidelity mitigates some of these risks through automated reporting and continuous updates to reflect the latest IRS guidance. However, users are encouraged to consult with tax professionals to ensure comprehensive compliance, especially when dealing with cross-border transactions or complex DeFi activities.

Best Practices for Accurate Reporting

- Maintain thorough records of all crypto transactions, including wallets and exchange statements.

- Select an appropriate cost basis method aligned with your investment strategy.

- Leverage Fidelity’s automated tools to reduce errors in categorizing taxable events.

- Stay informed about changes in tax regulations related to digital assets.

- Engage qualified tax professionals for complex transactions and cross-jurisdiction reporting.

Investment Outlook

Accurate tax reporting not only ensures compliance but also supports strategic investment planning. Investors who maintain precise records and utilize tools like Fidelity’s reporting system can make informed decisions on portfolio rebalancing, tax-loss harvesting, and reinvestment strategies. As institutional adoption of cryptocurrency grows, having robust reporting mechanisms in place will become increasingly critical.

Further Reading and Resources

Crypto Tax | Market | Crypto Exchanges

Frequently Asked Questions

What is Reporting Crypto Taxes with Fidelity? It is Fidelity’s structured approach to managing crypto tax obligations, offering automated tools and integrations to ensure compliance.

How does it compare to manual reporting? Fidelity automates most processes, reducing errors and saving time compared to manual spreadsheets and forms.

Is it suitable for complex portfolios? Yes, the system is designed to handle high-frequency trading, multiple wallets, and DeFi transactions.

Where can I learn more? Additional resources are available in Fidelity’s guides, crypto tax articles, and market analysis sections.