Open a Fidelity Crypto Account: Step-by-Step Guide

Fidelity is one of the most trusted names in traditional finance, and its crypto division, Fidelity Digital Assets, is becoming a go-to gateway for U.S. investors. This step-by-step guide walks you through opening a Fidelity Crypto account, highlighting requirements, security checks, and key features for both beginners and institutions.

Why Choose Fidelity for Crypto?

Unlike many newer exchanges, Fidelity brings decades of regulatory compliance and investor trust. With insured custody, institutional partnerships, and transparent oversight, Fidelity bridges the gap between Wall Street and digital assets.

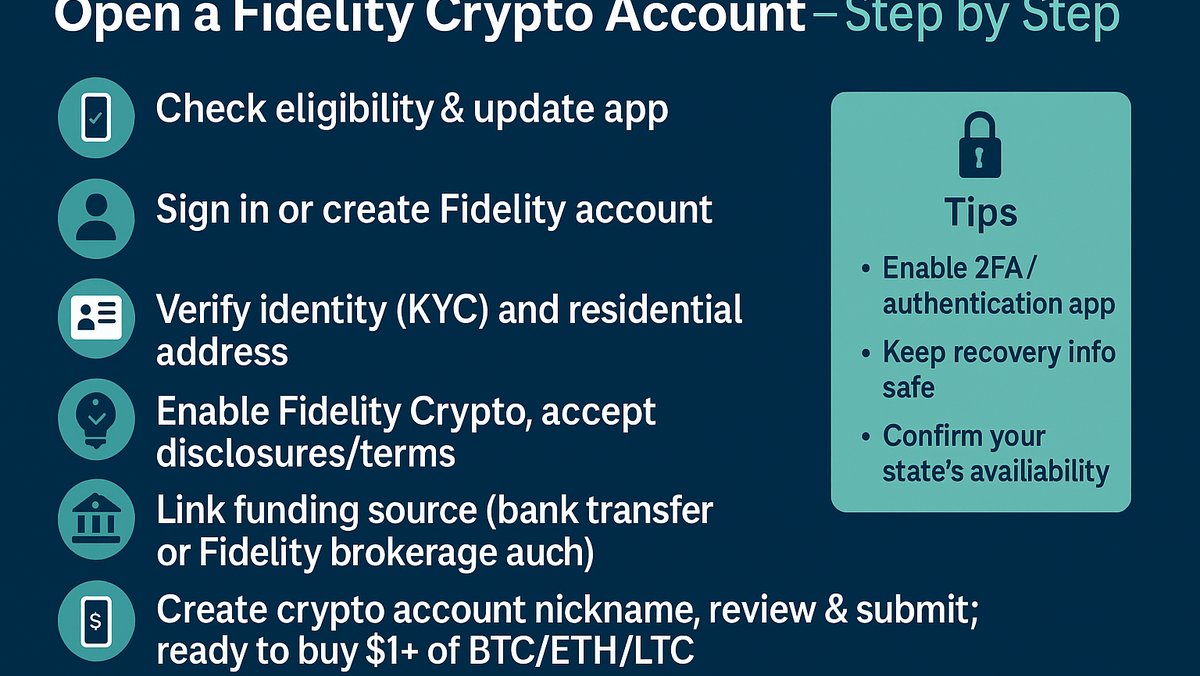

Step-by-Step Guide to Opening an Account

Step 1: Confirm Eligibility

You must be a U.S. resident over 18 years old with a valid Social Security Number (SSN). Fidelity may restrict access in certain states due to local regulations.

Step 2: Register Online

Visit Fidelity’s website and navigate to the crypto section. Select “Open an Account” and provide your personal information, including SSN and government-issued ID.

Step 3: Identity Verification (KYC)

Upload required documents such as a driver’s license or passport. Fidelity uses advanced verification tools to comply with AML/KYC regulations. Verification usually takes minutes but may extend to 24 hours.

Step 4: Link a Bank Account

Connect a U.S. bank account to deposit funds. ACH transfers are free, but wire transfers may carry fees. Fidelity ensures bank-level encryption for financial data.

Step 5: Fund Your Account

Deposit USD into your Fidelity account. Minimums may vary, but most accounts require at least $10 to start trading.

Step 6: Start Trading

Once funds clear, you can trade supported cryptocurrencies such as Bitcoin and Ethereum. Fidelity currently offers a limited range of assets but prioritizes compliance and liquidity.

Features of Fidelity Crypto

- Secure Custody: Institutional-grade cold storage with insurance coverage.

- Integration with Fidelity Brokerage: Manage stocks, ETFs, and crypto in one place.

- Educational Tools: Fidelity provides tutorials, research reports, and market insights.

Risks and Considerations

- Limited Asset Selection: Fidelity only offers major coins, unlike Binance or Kraken.

- Regulatory Uncertainty: Crypto regulations continue to evolve and could affect services.

- No DeFi or Staking: Unlike competitors, Fidelity does not yet support staking or yield products.

Investment Outlook

Fidelity’s entry into crypto signals mainstream acceptance. For conservative investors, its regulated environment provides a safe entry point, though advanced traders may seek broader platforms. Long-term, Fidelity could expand its services as regulation stabilizes.

Frequently Asked Questions

Does Fidelity Crypto charge fees? Fidelity offers commission-free trading but includes a spread in buy/sell prices.

How long does account approval take? Most accounts are approved within 24 hours.

Can I transfer crypto in and out? Yes, Fidelity supports withdrawals and deposits for supported assets.

Is Fidelity Crypto safe? With insured custody and strict compliance, Fidelity is among the most secure options for U.S. investors.