Inside Fidelity’s Blockchain Research: In-Depth Insights

Fidelity’s foray into blockchain research represents a deliberate and strategic approach to digital assets. As cryptocurrencies mature, institutional adoption depends not just on price speculation but on rigorous evaluation of technology, security, regulatory compliance, and market potential. This article delves into Fidelity’s methodology for assessing blockchain projects and how it informs product offerings.

Fidelity’s Research Philosophy

Fidelity approaches blockchain research with a multi-dimensional perspective:

- Technological Assessment: Evaluates scalability, consensus mechanisms, interoperability, and smart contract functionality.

- Regulatory Compliance: Projects must adhere to global legal frameworks, mitigating risks for institutional investors.

- Market Potential: Analysis of network adoption, tokenomics, and competitive positioning.

- Security Protocols: Assessment of network resilience, auditing practices, and custodial integrity.

- Long-term Viability: Projects are scored on sustainability, developer activity, and governance structures.

This rigorous approach ensures Fidelity’s crypto products are built on projects that balance innovation with prudence.

Evaluation Process and Methodology

The research team uses a combination of quantitative and qualitative analysis:

- On-chain Data Analytics: Transaction volume, active addresses, and liquidity metrics.

- Code Audits: Review of smart contract security, bug bounty programs, and upgrade paths.

- Market and Competitive Analysis: Comparing project adoption against competitors and identifying differentiation points.

- Regulatory Alignment: Ensuring projects comply with SEC, CFTC, and international regulatory guidelines.

- Community Engagement: Evaluating developer participation, social sentiment, and governance involvement.

By combining these factors, Fidelity builds a holistic understanding of project risks, potential rewards, and alignment with institutional standards.

Key Findings and Insights

Fidelity’s blockchain research highlights several industry trends:

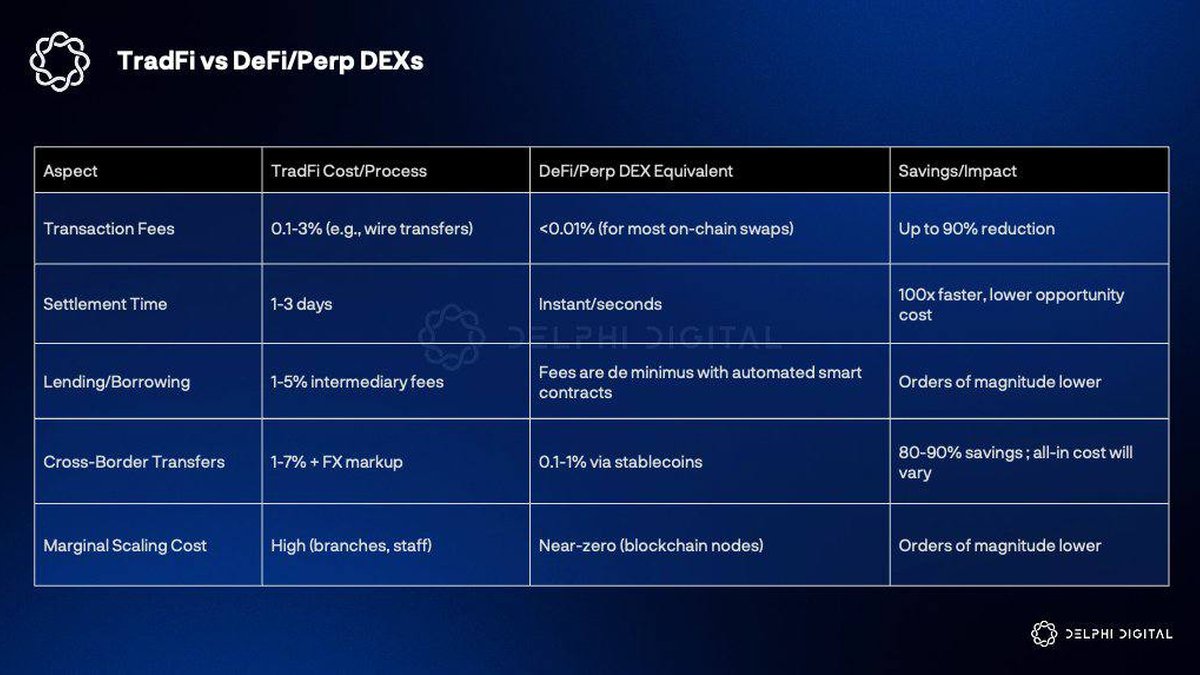

- Decentralized Finance (DeFi) continues to drive innovation but requires careful risk assessment due to smart contract vulnerabilities.

- Layer-2 scaling solutions are essential to mitigate congestion on networks like Ethereum.

- Security tokens and regulated digital assets are gaining traction, providing more predictable compliance pathways.

- Cross-chain interoperability and bridges are becoming crucial for multi-chain strategies.

Investors leveraging Fidelity’s research gain exposure to projects with validated security, growth potential, and regulatory alignment.

Comparisons with Other Blockchain Research Approaches

While independent research firms focus on market sentiment and price analytics, Fidelity emphasizes:

- Institutional-grade security assessments.

- Long-term viability over short-term speculation.

- Integration potential with traditional financial products.

Compared to academia or venture capital research, Fidelity blends regulatory oversight, security assessment, and market analysis to create actionable insights for a broad investor base.

Risks and Considerations

Even with comprehensive research, blockchain investments carry inherent risks:

- Technological Risk: Software bugs, protocol failures, and security breaches can undermine asset value.

- Regulatory Risk: Changes in law can affect adoption, trading, or custody availability.

- Market Volatility: Rapid price movements can offset structural advantages.

- Liquidity Risk: Limited adoption or network usage may hinder asset mobility.

Fidelity mitigates these through diversification, custodial security, and continuous monitoring of market and legal developments.

Investment Outlook

Fidelity’s blockchain research serves as a blueprint for prudent institutional adoption. Key takeaways for investors include:

- Long-term adoption is likely in regulated, interoperable projects with strong governance.

- DeFi and NFTs provide strategic opportunities but require careful risk management.

- Institutional-grade custodial services, like those offered by Fidelity, reduce counterparty and operational risk.

- Dollar-cost averaging, staking, and governance participation can enhance returns while controlling exposure.

By aligning investment strategy with Fidelity’s research, investors can optimize exposure to high-quality blockchain assets.

Further Reading and Resources

Crypto Insurance | Crypto Tax | Altcoins

Frequently Asked Questions

What is Inside Fidelity’s Blockchain Research? A systematic approach to evaluate blockchain projects based on technology, security, compliance, and market potential.

How does it differ from Bitcoin or Ethereum evaluation? Focuses on institutional-grade security and compliance, whereas Bitcoin emphasizes digital gold and Ethereum focuses on smart contracts.

Is it a good investment? Fidelity research identifies suitable projects, but investment suitability depends on personal risk tolerance and time horizon.

Where to learn more? Explore our articles on crypto insurance, altcoins, and market trends for additional insights.