Fidelity's involvement in Bitcoin ETFs represents a pivotal development in the maturation of the cryptocurrency market. As one of the leading financial institutions to bridge traditional finance with digital assets, Fidelity has leveraged its expertise to offer products that not only attract institutional capital but also foster a more stable trading environment for retail investors. This article delves deeply into the mechanisms by which Fidelity’s Bitcoin ETFs interact with market dynamics, the potential risks involved, and the broader implications for crypto adoption.

Overview of Fidelity's Role in Bitcoin ETFs and Market Stability

Fidelity's Bitcoin ETFs emerged against the backdrop of increasing institutional interest in cryptocurrency assets, combined with the growing demand for regulated investment vehicles. Unlike direct cryptocurrency holdings, ETFs provide exposure to digital assets through a familiar financial instrument, mitigating some of the operational and security risks associated with wallets and private keys. These ETFs are structured to comply with regulatory frameworks, which is a critical factor in instilling confidence among conservative investors.

By offering ETFs, Fidelity contributes to market liquidity and price discovery. ETFs aggregate investor capital and transact in large blocks, reducing the impact of high-frequency trading on market volatility. Moreover, the oversight and reporting requirements imposed on ETFs create a framework for greater transparency, which can help temper extreme market swings. Over time, this structure encourages institutional adoption, which historically has a stabilizing effect due to the longer investment horizons of these participants.

Key Features and Use Cases

Fidelity's ETFs are characterized by several defining features. Firstly, the underlying assets are backed by audited holdings of Bitcoin, ensuring integrity and accountability. Secondly, the products include mechanisms to track net asset value (NAV) closely, providing investors with a reliable reference point for valuation. Thirdly, risk management is embedded in fund operations, such as hedging strategies and daily reporting on performance metrics.

The practical use cases for these ETFs extend beyond portfolio diversification. Institutional investors can incorporate Bitcoin exposure without holding the asset directly, while financial advisors can provide clients with a regulated investment option. Retail investors gain the advantage of market participation through standard brokerage accounts. Additionally, these ETFs may serve as vehicles for arbitrage opportunities, connecting derivatives markets with spot Bitcoin prices and enhancing overall market efficiency.

Comparisons with Other Crypto Investment Vehicles

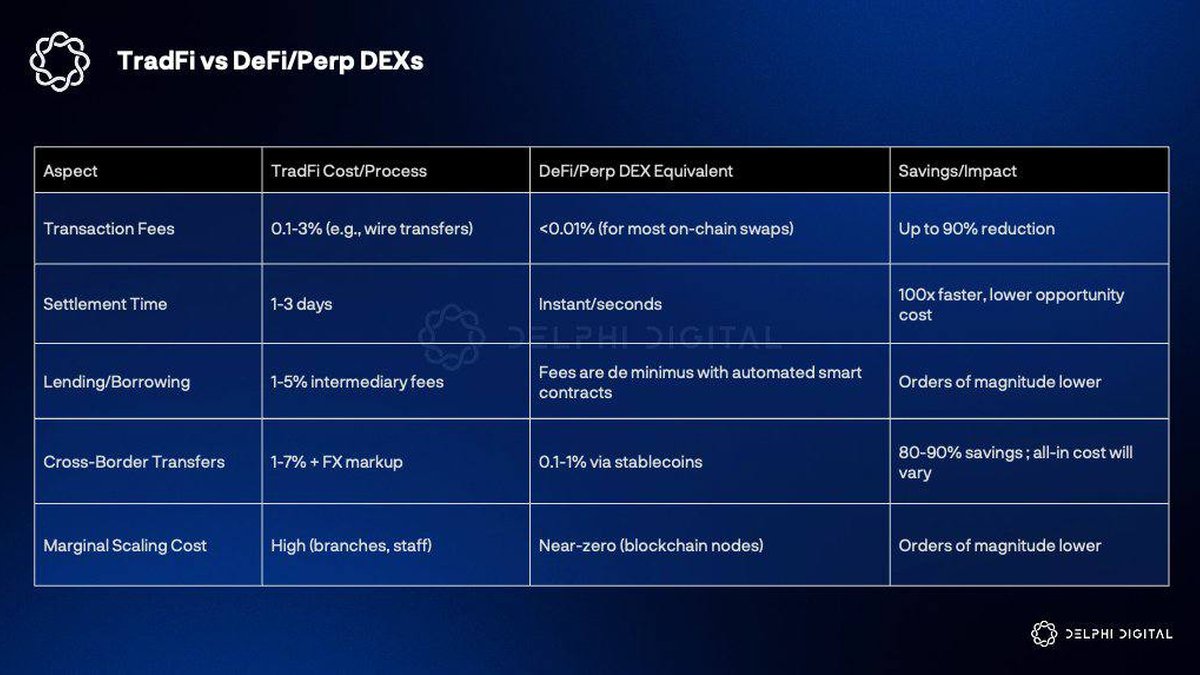

When compared with direct Bitcoin holdings, Fidelity's ETFs offer greater regulatory oversight and reduced operational risk, but at the cost of potential management fees. Compared to other crypto funds, such as those tracking Ethereum or diversified crypto indices, Fidelity's products prioritize stability and institutional compliance over speculative growth. Platforms like SEC Coin emphasize regulatory adherence but may lack Fidelity's market reach and infrastructure. Understanding these distinctions is crucial for aligning investment strategy with risk tolerance and desired exposure.

Risks and Considerations

While ETFs mitigate certain risks, they do not eliminate inherent cryptocurrency market volatility. Sudden macroeconomic events, changes in regulatory policy, or systemic technical failures can affect ETF performance. Investors should also be aware of liquidity constraints, especially in periods of market stress when ETF redemptions could exacerbate price fluctuations. Moreover, counterparty risk and custodial security remain important considerations, although Fidelity's established protocols significantly reduce these threats.

Another layer of risk comes from the correlation between ETFs and spot markets. During extreme bull or bear cycles, ETFs may experience deviations from actual Bitcoin price movements, impacting investor returns. A comprehensive risk assessment involves understanding market cycles, ETF mechanics, and macroeconomic factors influencing crypto prices.

Investment Outlook

Looking forward, Fidelity’s Bitcoin ETFs are positioned to benefit from increasing institutional participation, enhanced regulatory clarity, and the integration of blockchain technology into traditional finance. Technological innovations such as improved custody solutions, automated settlement, and enhanced tracking algorithms are likely to further stabilize ETF operations. Additionally, macroeconomic trends favoring risk-on assets could provide an environment conducive to price appreciation.

For investors, strategies such as dollar-cost averaging, portfolio diversification, and combining ETFs with other digital assets can optimize long-term returns while managing volatility. Fidelity’s role is likely to grow as more traditional finance participants recognize the utility of regulated exposure to digital assets, potentially establishing ETFs as a cornerstone of mainstream crypto investment.

Further Reading and Resources

Crypto Exchanges | Guides | Fidelity Crypto

Frequently Asked Questions

What is Fidelity's Role in Bitcoin ETFs and Market Stability? Fidelity provides regulated investment vehicles that allow investors to gain exposure to Bitcoin without directly holding the asset, contributing to market transparency and liquidity.

How does Fidelity's Role in Bitcoin ETFs compare to other crypto assets? ETFs prioritize regulatory compliance and market stability over speculative growth, differing from direct cryptocurrency holdings and other crypto funds.

Is Fidelity's Bitcoin ETF a good investment? It can be suitable for investors seeking regulated exposure to Bitcoin with lower operational risk, though market volatility remains a consideration.

Where can I learn more? Explore additional insights on crypto exchanges, trading guides, and Fidelity Crypto products.