Fidelity’s launch of a Bitcoin Spot ETF represents a landmark moment for institutional and retail participation in the cryptocurrency market. Unlike futures-based ETFs, a spot ETF directly holds Bitcoin, providing investors with precise exposure to the asset without derivatives-related tracking error. This product bridges traditional financial markets with the rapidly evolving crypto ecosystem, enabling regulated and transparent investment while maintaining compliance with SEC standards.

Overview of Fidelity Bitcoin Spot ETF

The concept of a Bitcoin Spot ETF emerged in response to increasing institutional demand for regulated, secure, and direct exposure to Bitcoin. By holding physical Bitcoin in custody, the ETF offers investors a more accurate reflection of the market price and reduces the risk of contango or backwardation often seen in futures-based products. Fidelity’s ETF leverages its proprietary custody solutions to safeguard assets, integrating multi-signature wallets, cold storage, and insurance coverage to mitigate operational risks.

This ETF also aligns with global regulatory frameworks, providing transparency and audit trails necessary for institutional adoption. Compared to direct crypto exchange trading, investors benefit from the familiarity of brokerage accounts, tax reporting ease, and access through retirement or investment accounts.

Key Features and Use Cases

Fidelity’s Bitcoin Spot ETF includes several critical features:

- Direct Bitcoin Exposure: The ETF holds actual Bitcoin in custody, ensuring tracking accuracy.

- Institutional-Grade Security: Custody infrastructure reduces risk of theft and mismanagement.

- Regulatory Compliance: SEC oversight ensures reporting transparency and adherence to financial regulations.

- Liquidity: Shares can be bought and sold on public exchanges, offering flexibility for investors.

- Integration with Financial Accounts: Enables participation through IRAs, 401(k)s, and brokerage accounts.

Use cases span both institutional and retail investors seeking exposure to Bitcoin without self-custody complexities, including portfolio diversification, tactical trading, and participation in long-term macro trends favoring digital assets. Compared to direct Bitcoin purchases, the ETF reduces operational burden and legal uncertainty.

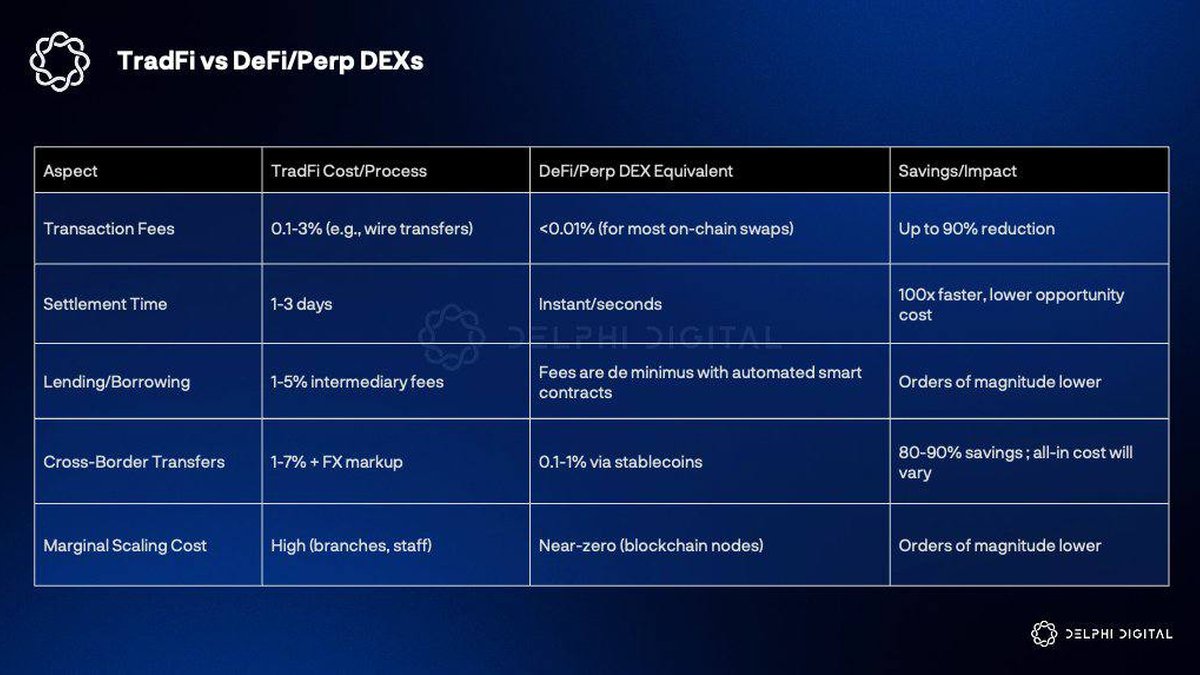

Comparisons with Other Products

Compared to futures-based ETFs, the spot ETF avoids derivative tracking errors and provides a purer investment tied to Bitcoin’s actual market price. Bitcoin itself offers decentralized control but requires private key management, which carries operational and security risks. Ethereum enables DeFi and smart contract exposure but lacks the “digital gold” narrative of Bitcoin. Competitors like Grayscale Bitcoin Trust offer regulated access but may trade at premiums or discounts relative to underlying assets. Fidelity’s ETF combines regulatory compliance, institutional-grade custody, and transparent pricing.

Risks and Considerations

Investing in a Bitcoin Spot ETF carries several risks:

- Market Volatility: Bitcoin is inherently volatile; ETF values fluctuate accordingly.

- Regulatory Risks: Changes in SEC rules or taxation policies can affect performance and liquidity.

- Custody and Operational Risks: While mitigated by institutional-grade security, potential risks remain from conducting a security breach, mismanagement, or third-party failures.

- Liquidity Risk: ETF shares depend on market liquidity, which can vary during extreme market conditions.

Investors should evaluate their risk tolerance, diversify portfolios, and consider complementary strategies such as dollar-cost averaging or allocation to other asset classes to mitigate volatility.

Investment Outlook

The Fidelity Bitcoin Spot ETF is positioned to capitalize on institutional inflows, broader adoption of digital assets, and macroeconomic trends favoring risk-on assets. As Bitcoin adoption grows, the ETF provides a regulated and transparent vehicle to participate in market gains. Investors can integrate the ETF into diversified portfolios, use tactical trading strategies, or participate in retirement accounts.

Long-term outlook depends on Bitcoin’s market performance, regulatory developments, and competition from other ETFs and custody solutions. Investors should consider a combination of short-term trading and long-term holding to optimize risk-adjusted returns.

Further Reading and Resources

Best Crypto Apps | Crypto Tax | Market | Fidelity Crypto

Frequently Asked Questions

What is a Bitcoin Spot ETF? A Bitcoin Spot ETF directly holds Bitcoin, allowing investors to gain exposure to the asset without owning or managing private keys.

How does it compare to Bitcoin futures ETFs? Spot ETFs track the actual market price, avoiding derivative-related tracking errors found in futures ETFs.

Is it safer than direct Bitcoin ownership? While it reduces operational and compliance risks, market volatility remains; investors should consider diversification.

Who can invest? Both retail and institutional investors with brokerage accounts or access to retirement accounts can invest in Fidelity’s Bitcoin Spot ETF.