Fidelity Ether ETF Launch Explained: Comprehensive Analysis for Investors

The launch of a Fidelity Ether ETF represents a pivotal moment in cryptocurrency investment, especially for institutional and retail investors seeking regulated exposure to Ethereum. This article explores the technical, regulatory, and market implications of the ETF, equipping investors with a holistic understanding of its significance within the broader crypto ecosystem.

Introduction to Ether ETFs

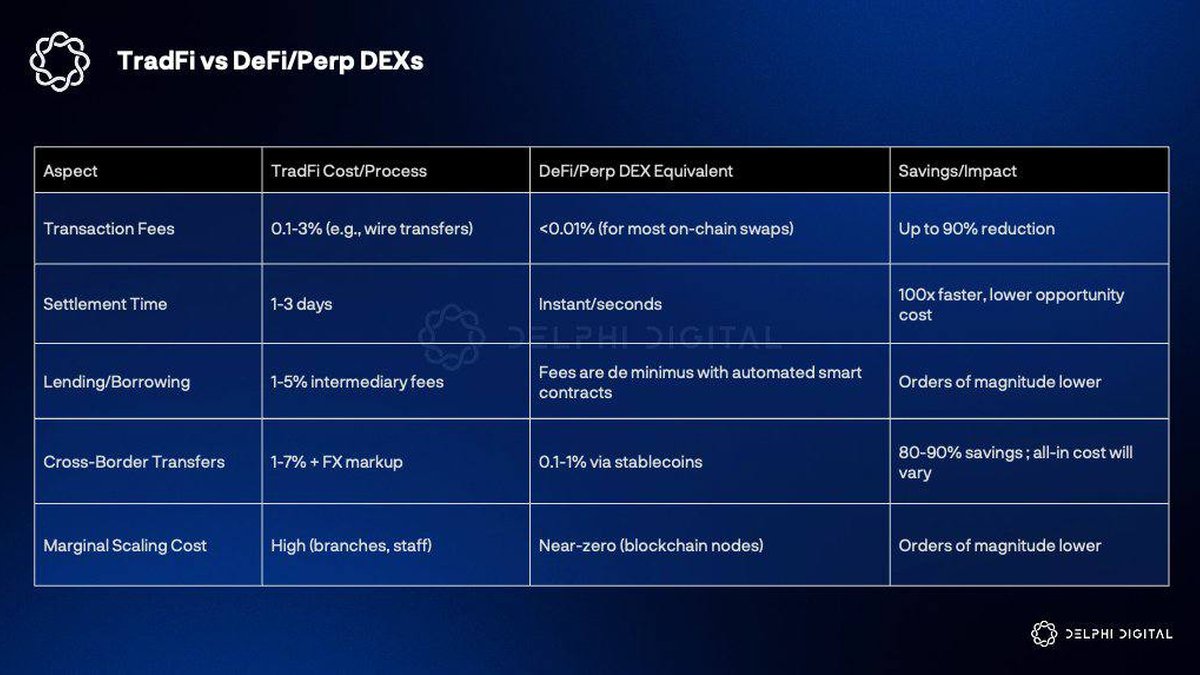

An Exchange-Traded Fund (ETF) allows investors to gain exposure to an underlying asset without directly holding it. Fidelity’s Ether ETF combines the benefits of traditional ETFs—liquidity, transparency, and regulatory oversight—with the growing prominence of Ethereum as a foundational blockchain platform. Investors can gain exposure to Ether’s price movements through a familiar investment vehicle, mitigating operational complexities of wallet management and custody.

Historical Context and Industry Trends

Fidelity’s entry into Ether ETFs follows the success of its Bitcoin ETF and reflects the broader institutional adoption of cryptocurrency. Ethereum’s unique characteristics—such as smart contracts, decentralized finance (DeFi) applications, and NFTs—position it as a critical layer-one blockchain network. Fidelity’s approach is designed to balance innovation with regulatory compliance, addressing challenges like scalability, network security, and custodial integrity.

Key Features of Fidelity Ether ETF

- Regulated Exposure: The ETF operates under SEC guidelines, offering investors a compliant avenue to Ethereum exposure.

- Institutional-Grade Custody: Assets are securely held with insurance and multi-layered security protocols.

- Market Accessibility: Traded on major exchanges, providing liquidity similar to traditional ETFs.

- Integration with Portfolios: Can be included in retirement accounts and diversified investment strategies.

Use Cases and Investor Strategies

Fidelity Ether ETF can be utilized for:

- Long-Term Holding: Simplifies Ether exposure for risk-averse investors.

- Portfolio Diversification: Provides crypto allocation without self-custody risks.

- Tactical Trading: Investors can implement ETF-specific strategies, including dollar-cost averaging, rebalancing, and derivatives hedging.

- Institutional Adoption: Enables pension funds, endowments, and asset managers to allocate Ether within regulatory frameworks.

Comparisons with Other Crypto Investment Vehicles

Comparing Fidelity Ether ETF with alternatives:

- Direct Ether Holdings: Provides direct control but requires secure wallets, keys, and compliance diligence.

- Ethereum Futures: Offers leverage but exposes traders to higher volatility and margin requirements.

- Competitor ETFs: Some platforms offer Ether ETFs, but Fidelity emphasizes institutional-grade security and integration with traditional portfolios.

Risks and Considerations

While ETFs reduce operational risks, investors face:

- Market Volatility: Ethereum price swings can impact ETF performance.

- Regulatory Uncertainty: Changes in SEC or global regulations may affect trading or ETF structure.

- Counterparty Risk: Custodial failures or operational lapses, though mitigated by Fidelity’s insurance and security protocols.

- Technological Risk: Network congestion or blockchain vulnerabilities could indirectly impact ETF liquidity or valuation.

Investment Outlook

Institutional interest in Ether is growing due to DeFi, NFTs, and Ethereum’s upcoming technical upgrades (e.g., Ethereum 2.0 improvements). Fidelity’s ETF simplifies participation, potentially increasing mainstream adoption. Investors can consider:

- Dollar-Cost Averaging: Reduces exposure to short-term volatility.

- Staking Exposure via ETFs: Indirectly benefits from Ethereum staking yields.

- Portfolio Allocation: Combine Ether ETFs with traditional assets for balanced risk-reward.

Further Reading and Resources

Crypto | Crypto Insurance | Guides

Frequently Asked Questions

What is Fidelity Ether ETF? A regulated ETF offering exposure to Ether without requiring direct cryptocurrency ownership.

How does it compare to Bitcoin ETFs? Ether ETFs focus on Ethereum’s ecosystem and smart contract use cases, while Bitcoin ETFs target store-of-value exposure.

Is it suitable for all investors? Ideal for risk-tolerant and institutional investors seeking regulated crypto exposure.

Where can I learn more? Explore our Fidelity Crypto and SEC Coin categories for deeper insights.