Exchange Fees Comparison: 2025 Guide

Trading fees are one of the most important factors when choosing a crypto exchange. Even small differences in fee structures can significantly impact profitability, especially for frequent traders. In this guide, we’ll compare the exchange fees in 2025 across leading platforms, highlight hidden costs, and explore strategies for minimizing expenses.

Types of Exchange Fees

- Trading Fees: Typically charged as maker/taker fees when buying or selling crypto.

- Withdrawal Fees: Costs for moving funds off an exchange to a wallet.

- Deposit Fees: Some exchanges charge for fiat deposits, though most are free.

- Spread Fees: Built into the price difference between buy and sell orders, common in beginner-friendly platforms.

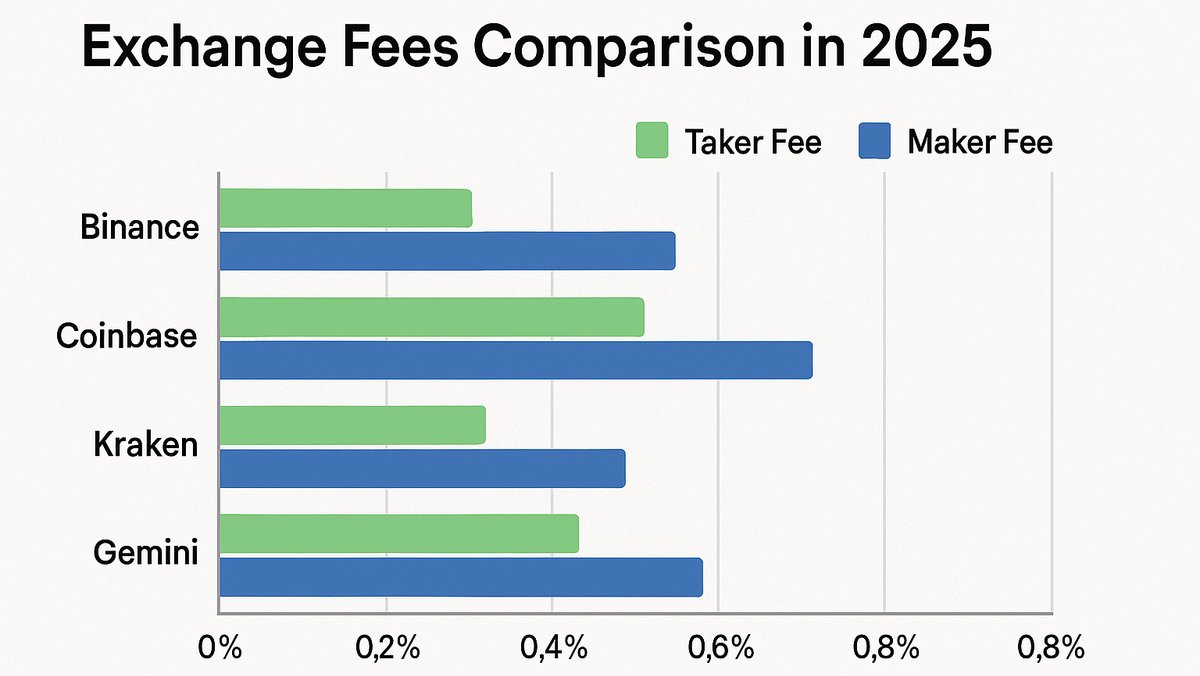

Fee Comparison in 2025

Here’s a snapshot of popular exchanges and their average fee ranges:

- Binance: Maker/Taker starts at 0.1% (discounts for BNB use).

- Coinbase: 0.5% spread fee plus service charges, making it one of the most expensive for retail users.

- OKX: Maker/Taker starts at 0.08%, with discounts for OKB holders.

- Kraken: 0.16% maker / 0.26% taker fees, competitive for advanced traders.

- Bybit: 0.1% spot trading fee, with derivatives at 0.01% maker / 0.06% taker.

Hidden Costs to Consider

- Network Fees: Blockchain gas fees apply for withdrawals, especially on Ethereum.

- Conversion Fees: Exchanging fiat or stablecoins may involve additional charges.

- Inactivity Fees: Rare, but some exchanges penalize dormant accounts.

Strategies to Minimize Fees

- Use native tokens like BNB (Binance) or OKB (OKX) for fee discounts.

- Consolidate trades to reduce frequent small transactions.

- Consider exchanges with zero-fee promotions for specific pairs.

- Withdraw using cheaper networks (e.g., USDT on TRON instead of Ethereum).

Which Exchange is Best for Low Fees?

For 2025, Binance, OKX, and Bybit remain leaders in low-cost trading. Coinbase, while beginner-friendly, is significantly more expensive. Kraken balances affordability with strong compliance, making it attractive for U.S. traders.

Conclusion

Exchange fees may seem small per trade, but over time they greatly impact net returns. Traders in 2025 should carefully compare platforms, use native token discounts, and explore alternative networks to cut costs. Choosing the right exchange isn’t just about low fees—it’s about finding the right balance between affordability, security, and available features.

Further Reading and Resources

Frequently Asked Questions

Which exchange has the lowest fees? Binance and OKX typically have the lowest fees, especially when using their native tokens for discounts.

Why is Coinbase more expensive? Coinbase includes higher spread and service fees in exchange for simplicity and regulatory compliance.

How do withdrawal fees work? Withdrawal fees are set by exchanges but influenced by blockchain network costs (gas fees).

Is it worth paying higher fees for safety? Sometimes. Regulated exchanges like Coinbase may be worth the extra cost for beginners who value security and ease of use.