Comparing Fiat On-Ramps: Bank Transfers, Credit Cards & More

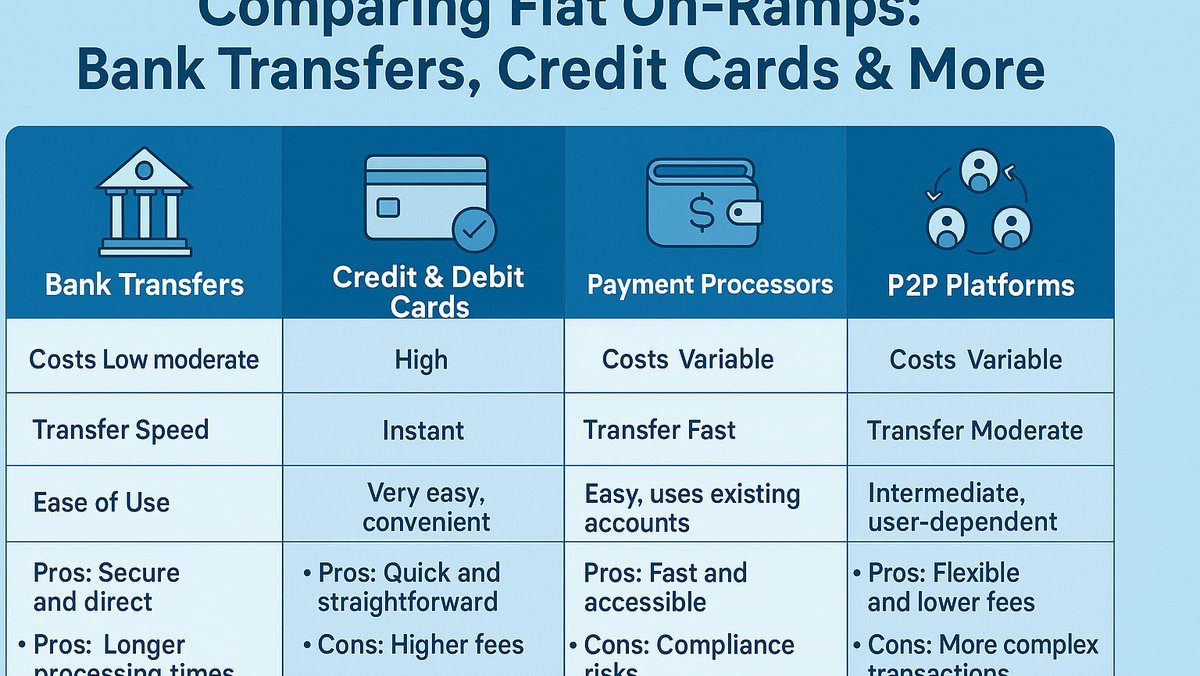

Fiat on-ramps are the gateways between traditional money and cryptocurrencies. Choosing the right on-ramp determines how quickly, cheaply, and securely you can start investing in digital assets. In this article, we compare the main options—bank transfers, credit/debit cards, and third-party providers—highlighting their pros, cons, and trends shaping the future of fiat-to-crypto conversions.

Bank Transfers

Bank transfers are the most common method, often supporting large amounts with lower fees. They integrate with exchanges via ACH (U.S.), SEPA (Europe), or SWIFT (international).

Pros:

- Low fees compared to cards.

- Suitable for large transfers.

- Direct link to verified bank accounts adds security.

Cons:

- Slower settlement (1–5 business days).

- May require strict KYC and banking compliance.

Credit and Debit Cards

Cards provide near-instant deposits, making them ideal for beginners who want fast access to crypto. However, they often come with higher fees (2–5%) and purchase limits.

Pros:

- Instant access to funds.

- User-friendly and widely accepted.

Cons:

- High fees.

- Risk of chargebacks or declined transactions.

- Spending limits.

Third-Party Payment Providers

Services like PayPal, Revolut, and fintech wallets have entered the crypto on-ramp space. They offer convenience but may limit withdrawals to external wallets.

Future Trends

By 2025, regulators are encouraging standardized KYC processes, while blockchain-based payment rails are enabling instant settlement. Stablecoins are increasingly being used as a fiat alternative, bridging gaps in underbanked regions.

Frequently Asked Questions

Which fiat on-ramp is cheapest? Bank transfers generally have the lowest fees, though they are slower.

Are credit cards safe for buying crypto? Yes, but they involve higher costs and may restrict withdrawals depending on the exchange.

What’s the best option in 2025? For speed, cards win. For cost efficiency, bank transfers are superior. Many traders use both depending on circumstances.