New altcoins arrive every week. Good projects can deliver outsized returns. Bad ones can lose all value. This guide gives a structured, repeatable checklist and concrete metrics you can use before allocating capital. It ends with two short case studies that show the evaluation applied in practice.

Why a framework matters

Investing in token projects is multi-dimensional: technical risk, economic design, team execution, adoption, and regulator exposure all matter. A checklist reduces bias and helps you compare projects objectively.

Core evaluation pillars (what to check)

1. Team & governance

- Identity & track record: Are founders public? Check LinkedIn, GitHub, prior exits or contributions to major projects.

- Team depth: Look for engineers, product people, marketing, and advisors. One-person teams are higher risk.

- Token ownership & governance: Who controls admin keys, multisigs, and treasury wallets? Is governance on-chain and meaningful?

- Transparency: Regular public updates, clear legal entity, and accessible communications are positive signals.

2. Technology & product

- Working product: Mainnet deploy? Beta users? A whitepaper alone is insufficient.

- Code quality: Is the code open-source and verified on Etherscan/GitLab/GitHub? Look at commit history and issue backlog.

- Architecture fit: Does the technical approach solve the stated problem more effectively than incumbents?

- Partnerships & integrations: Real integrations (exchanges, wallets, bridges) show adoption traction.

3. Tokenomics & incentives

- Total vs circulating supply: High inflation or huge future unlocks dilute holders.

- Vesting schedules: Team/advisor allocations should be time-locked and on-chain if possible.

- Utility & demand drivers: Is token needed for protocol use, fees, staking, or governance? Tokens with revenue-capture mechanics tend to create clearer valuation links.

- Treasury design: Is there a protocol treasury to fund growth? How is it governed?

- Inflation model: Fixed supply, scheduled emission, or algorithmic? Assess long-term dilution effects.

4. Security & audits

- Audits: Who audited the protocol? Read the auditor’s findings and remediation steps, not just the headline.

- Multisig & timelocks: Admin privileges should be protected by multisig, timelocks and ideally community oversight.

- Bug bounty & monitoring: A responsible program and active monitoring increase resilience.

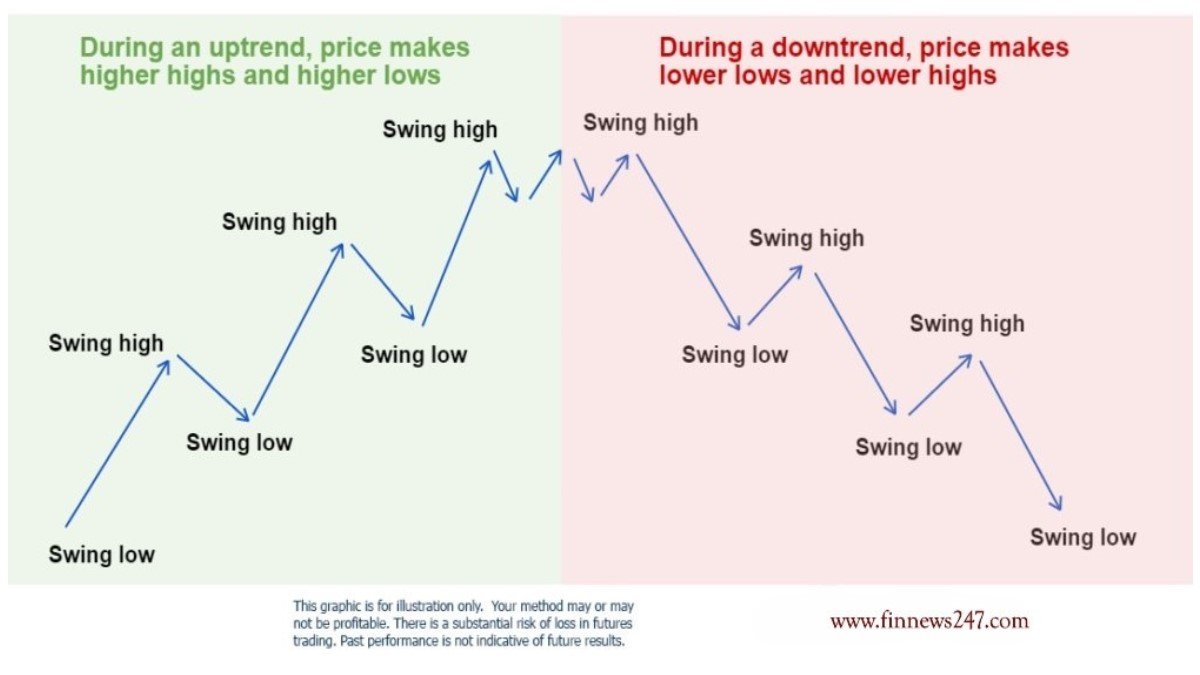

5. On-chain & product traction

- TVL / Active users: TVL, daily active addresses, volume and retained users measure real adoption.

- Growth quality: Organic growth (organic wallet growth, developer activity) beats paid or bot-driven spikes.

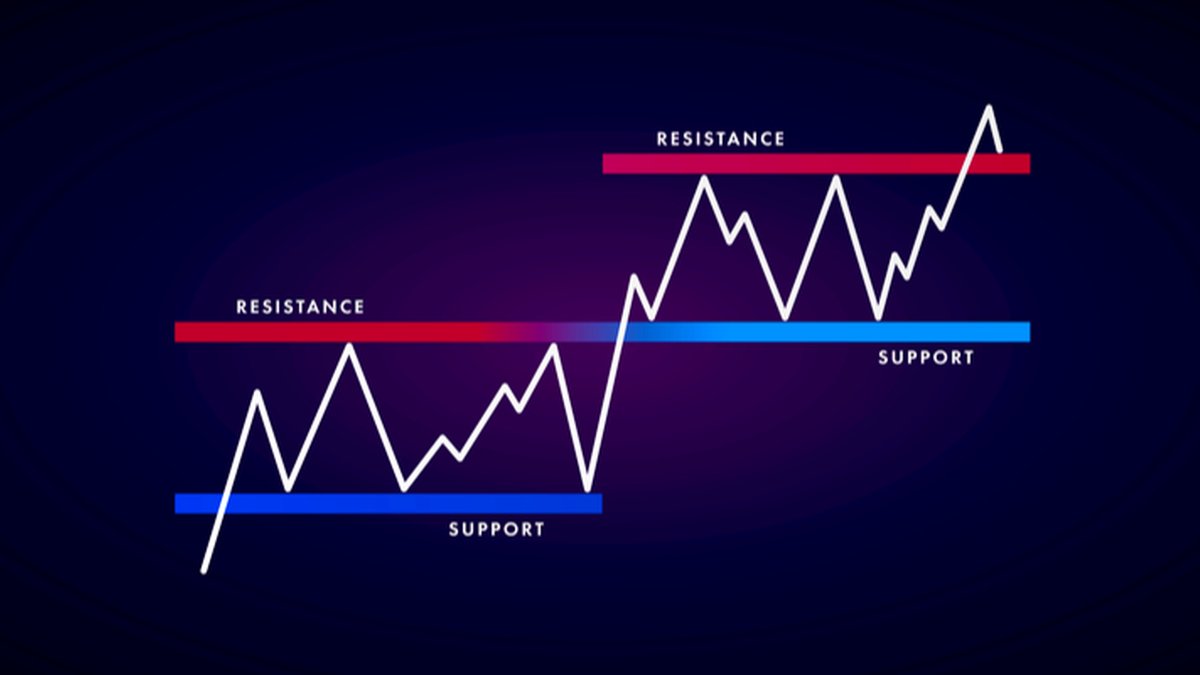

- Liquidity & market depth: Check DEX/CEX orderbooks, slippage and presence of locked liquidity.

6. Market & competition

- Addressable market: How big is the real market the protocol targets?

- Competition: Who are incumbents? What is the project’s defensible advantage?

- Regulatory exposure: Does the token or business model raise securities, money transmitter, or consumer protection issues?

Quantitative checks & scoring

Use a simple 0–5 scoring for each pillar and weight them to produce an overall score. Example weights: Team 20%, Tech 20%, Tokenomics 20%, Security 15%, Adoption 15%, Market 10%. A repeatable numeric score helps compare across projects.

Practical tools & commands

- Etherscan / BscScan: Verify contract source, token holders, transfers and contract creation.

- Dune / Nansen / DappRadar: User & TVL dashboards and wallet cohorts.

- Token Sniffer / RugDoc / DeFiSafety: Quick heuristics (use as signal, not final verdict).

- GitHub: Check contributors, commit frequency and open issues.

Red flags (stop if you see these)

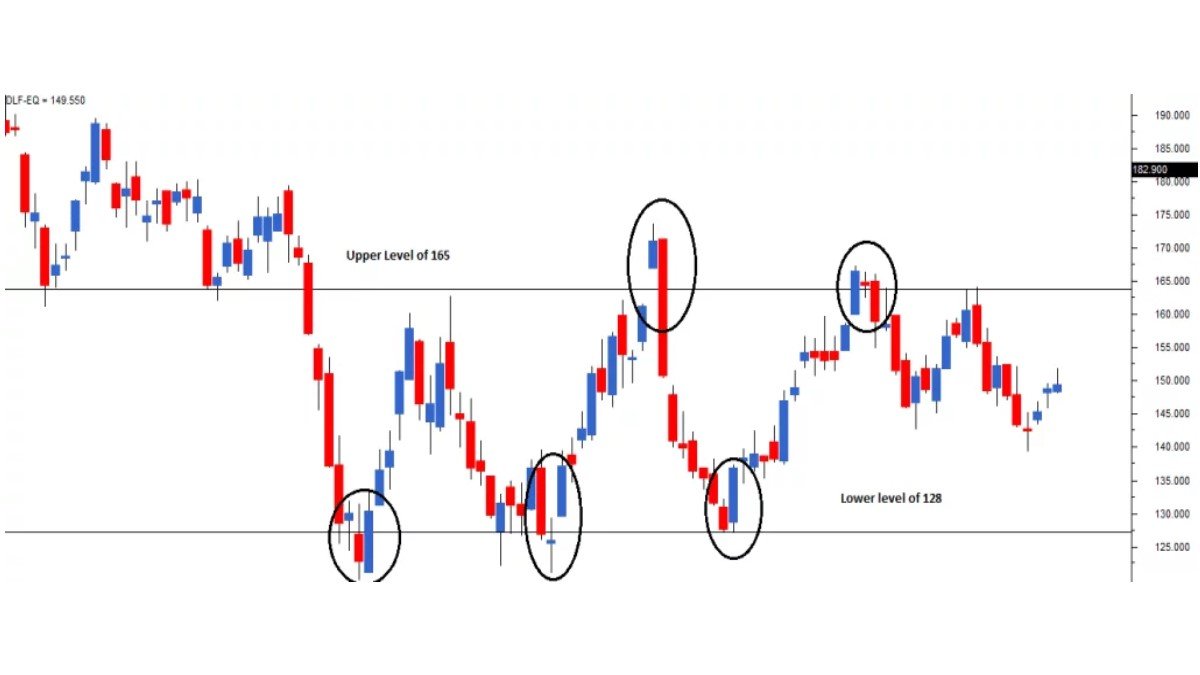

• Anonymous team with no verifiable history and high centralization of tokens.

• Unverified contract code, or the contract source is removed/obfuscated.

• Large immediate unlocks (e.g., team vested tokens unlocked within months).

• Liquidity that can be removed by a single wallet (no timelock or lock contract).

• ‘Copy-paste’ whitepapers that replicate other projects without technical substance.

• Overreliance on celebrity endorsements or paid influencers instead of organic adoption.

Valuation approaches (practical)

- Revenue / fee capture: If the protocol earns fees, value token as a claim on future fees (discounted cash flows or fee-to-token ratio).

- TVL multiples: For lending/DEX, relate token valuation to TVL and protocol fees. Example: token market cap / TVL ratio as a quick sanity check.

- Comparables: Compare to similar, established protocols (e.g., market cap / active users).

Case study — Project Atlas (hypothetical successful evaluation)

Summary: Atlas is a Layer-2 data marketplace. Why it passed:

- Team: Core engineers from known L2 projects; public GitHub with steady commits.

- Product: Working mainnet beta, initial customers (two analytics platforms) and measurable revenue from indexing fees.

- Tokenomics: 30% circulating, team allocation vested 4 years with cliff; on-chain timelocked liquidity.

- Security: Two audits by reputable firms; bounty program active.

- Metrics: TVL growing 10% monthly, healthy user retention and low churn.

Decision: Score 4.2/5. Allocate a small initial position and DCA into milestone-driven increases (e.g., when audited product reaches 10k DAU).

Case study — TokenZ (hypothetical failure / sudden project collapse)

Summary: TokenZ launched with heavy hype and anonymous founders.

- Red flags observed: contract not fully verified, top 3 wallets control 70% supply, LP tokens not locked publicly, and marketing focused on paid influencers.

- Within 48 hours of listing, a large wallet removed liquidity and dumped tokens.

Lesson: supply concentration + removable liquidity + anonymous team = high rug risk. Avoid or only trade tiny sizes with predetermined stop-loss and quick exit rules.

Step-by-step due diligence checklist (ready-to-use)

1. Open the contract on Etherscan. Is the source verified? Check top 20 holders and liquidity contracts.

2. Inspect GitHub for active contributors and recent commits.

3. Find audit reports. Read critical findings and remediation notes.

4. Check token unlock schedule and team vesting on-chain or in the docs.

5. Measure early product signals: testnet/mainnet product, integrations, and first users.

6. Run on-chain checks for wash trading, bot-driven volume, or sudden liquidity moves.

7. Score each pillar 0–5 and compute weighted average. Define an entry rule (score threshold) and position sizing rule.

Practical rules for execution

- Start small and DCA: initial allocation 0.5–2% of portfolio for speculative new tokens, increase only after objective milestones.

- Use staggered sell targets and stop-loss: predefine exit rules to remove emotional decision-making.

- Custody: move core holdings to hardware wallets; use multisig for pooled funds.

Final checklist before allocating capital

• Team verified and public?

• Contract audited and verified?

• Token distribution reasonable and vested?

• Working product or credible roadmap with real integrations?

• Adoption metrics trending up (TVL, users, revenue)?

• Regulatory or legal risk manageable?

Conclusion

Evaluating altcoins requires combining qualitative judgment and objective on-chain checks. Use the pillars above as a repeatable checklist, assign numeric scores, and always size positions to protect capital. Case studies show the difference between evidence-backed investment and hype-driven losses. For complex or large allocations, consider expert audits and legal review before committing capital.

Disclaimer: this guide is educational and not investment advice. Always perform your own due diligence and consult professionals for legal or tax questions.

Further reading & tools

Etherscan, Dune, Nansen, CertiK, OpenZeppelin, RugDoc, Token Sniffer.