ZEC/USDT — Long

2025-10-03 01:31

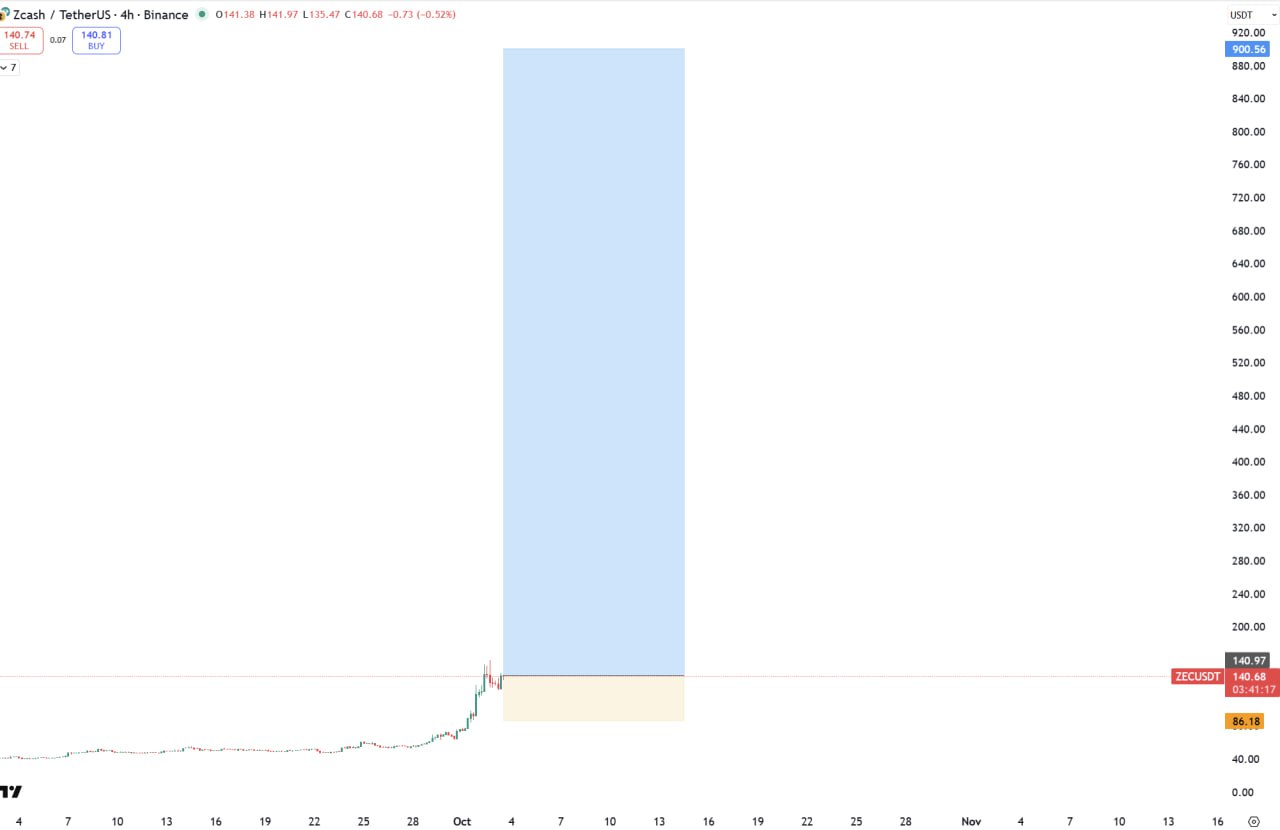

Long ZEC at 143.4, targets 160.61 | 179.25 | 229.44, stoploss 86.16.

If the TradingView symbol is unavailable, use the annotated image as reference for target zones & invalidation.

ZEC/USDT Long Setup — October 03, 2025

Developer momentum and DeFi interest in ZEC remain elevated. Plan is to go long from 143.4 with tiered targets at 160.61, 179.25 and 229.44, and a protective stop at 86.16. A sustained reclaim of former supply and consecutive constructive weekly closes argue for a multi-week continuation; an outsized stretch objective near 1000 would require material cyclical expansion and should be treated as a long-term scenario rather than a base case.

Market Context

Ongoing ecosystem growth and DeFi adoption keep ZEC in the mix among leading L1s. Developer participation continues to be strong.

In the current cycle, ZEC acts as a barometer for speculative appetite; a privacy-focused coin using zero-knowledge proofs; policy narratives and listings drive liquidity surges.

We avoid prediction contests: define risk at 86.16, let price prove itself above the most recent cap, then trail into strength toward the mapped numeric targets as liquidity confirms.

This pair trades on perpetual futures (.spot/linear) with funding as a positioning tell. Watch for spot volume to lead and for funding to cool on pullbacks — that is where higher-low entries carry best.

Technical Analysis

- Support: The 143.3 area has repeatedly acted as a floor.

- Pattern: An ascending triangle suggests an upside break.

- Projection: Measured short-to-medium term targets at ~160–230; a longer-term stretch objective near 1000 requires broad market expansion.

Key Levels

- Entry: 143.4

- Targets: 160.61 → 179.25 → 229.44 (stretch ~1000)

- Stoploss: 86.16

Risk Management

Size positions moderately. Long-horizon holders can maintain exposure; active traders might trim 20–30% into early targets and trail remainder toward higher objectives.

Position & Risk Notes — ZEC:

- Treat 86.16 as a circuit breaker, not a suggestion; capital preserved > perfect entries.

- If perp funding spikes while price stalls under resistance, trim exposure and wait for mean reversion.

- Cap daily loss at −2R and stop for the day; discipline compounds better than hero trades.

- ZEC can gap on news; avoid averaging into clear breaks of structure.

Medium-term investment idea. Not financial advice.