SYN/USDT.P — Long

2025-09-16 23:30

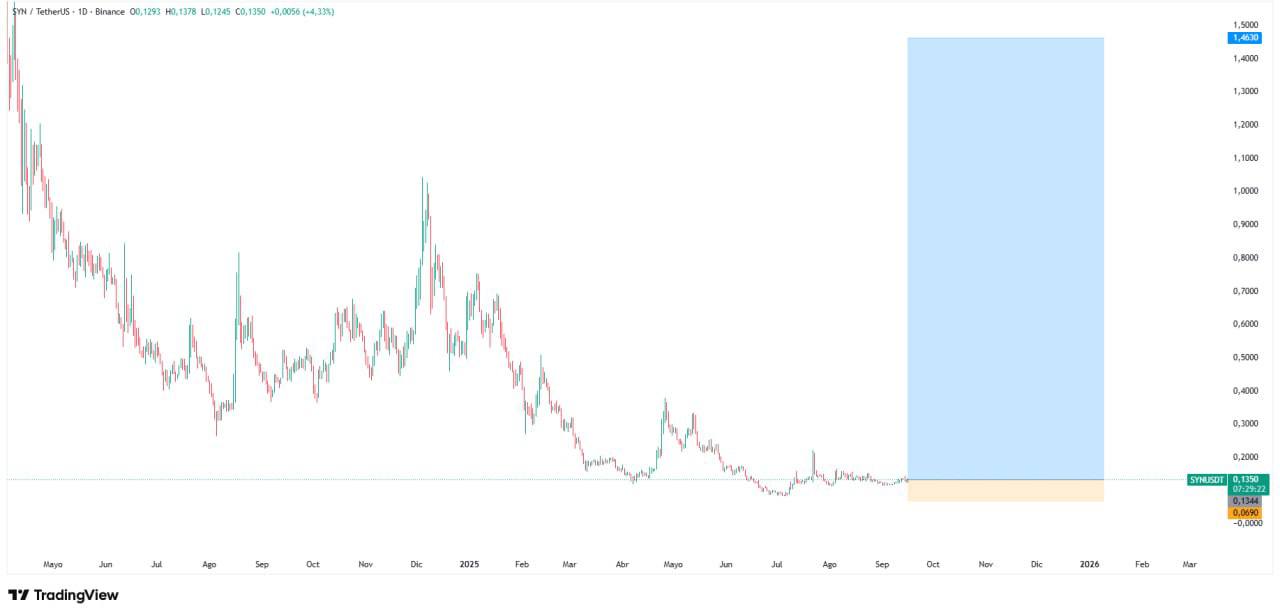

Long SYN at 0.135, target 0.3 - 0.5 - 0.75 - 1 - 1.46, stoploss 0.069.

If the TradingView symbol is unavailable, use the annotated image as reference for target zones & invalidation.

SYN/USDT Long Trade Signal – September 16, 2025

SYN, associated with cross-chain liquidity protocols, offers a long setup at 0.135 with targets up to 1.46 and stoploss at 0.069. Traders see this as a high-beta play on cross-chain adoption narratives.

Market Context

Cross-chain liquidity is a key theme in DeFi 2025. SYN benefits from growing demand for interoperability.

In the current cycle, SYN acts as a barometer for speculative appetite; an emerging altcoin with cyclical liquidity; listings, partnerships and macro risk steer demand.

We avoid prediction contests: define risk at 0.0690, let price prove itself above the most recent cap, then trail into strength toward 0.3 and 0.5.

This pair trades on perpetual futures (.P) with funding as a positioning tell. Watch for spot volume to lead and for funding to cool on pullbacks — that is where higher-low entries carry best.

Technical Analysis

- Breakout confirmed above 0.12.

- Buy-side flows signal accumulation.

- Targets reflect historical resistances and Fibonacci projections.

Key Levels

- Entry: 0.135

- Targets: 0.3 → 0.5 → 0.75 → 1 → 1.46

- Stoploss: 0.069

Risk Management

Volatile asset — risk small. Consider taking profits at 0.3 and 0.5 before extended levels.

Risk playbook (token-specific) for SYN:

- Define risk at 0.0690 and do not average below it; a clean reclaim is the only valid re-entry signal.

- When open interest balloons into a cap, derisk — liquidation cascades cut both ways.

- Cap daily loss at −2R and stop for the day; discipline compounds better than hero trades.

- SYN reacts strongly to headlines; size positions assuming gaps through levels are possible.

Educational purpose only. Not financial advice.