OPEN/USDT.P — Long

2025-10-05 01:47

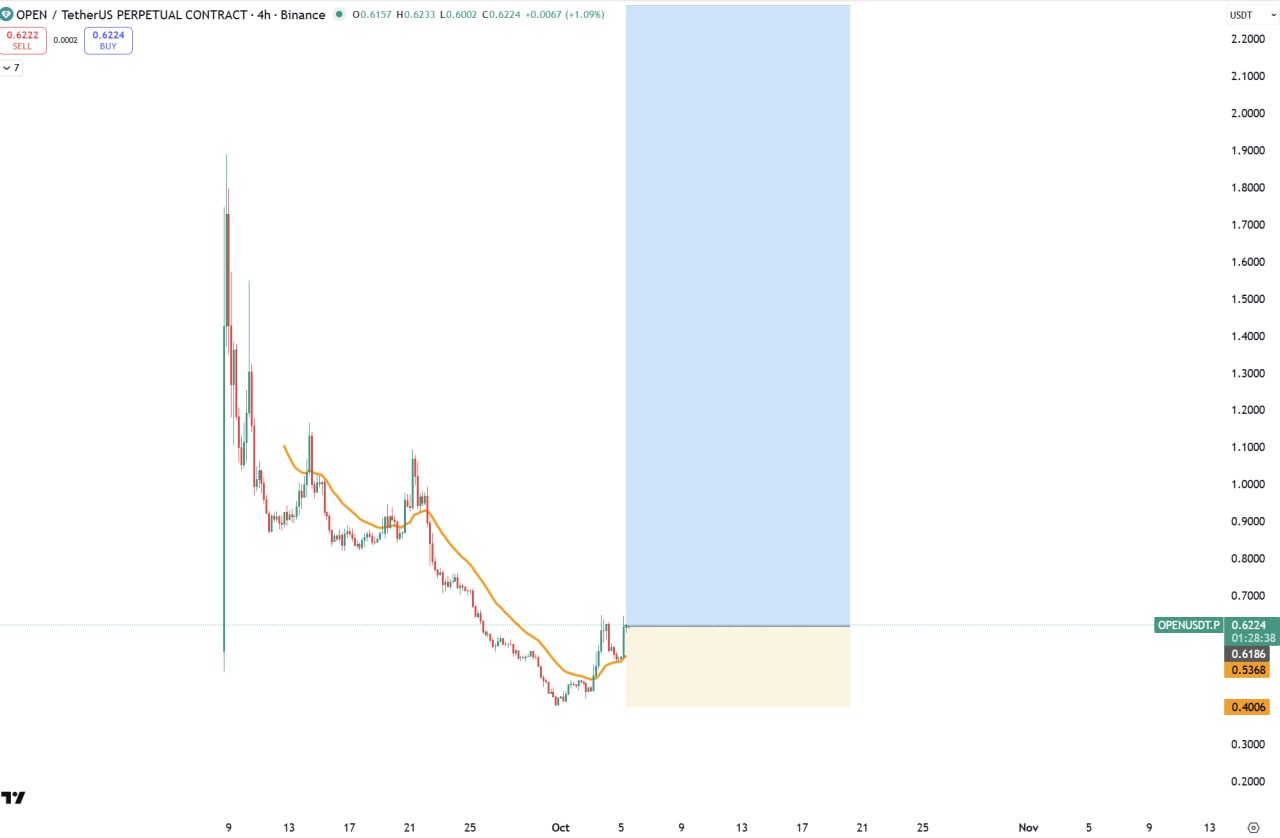

Long OPEN at 0.5585, targets 0.62552000 | 0.69812500 | 0.89360000, stoploss 0.4006.

If the TradingView symbol is unavailable, use the annotated image as reference for target zones & invalidation.

OPEN/USDT.P Long — October 5, 2025

DXY bid returns, UST 10Y pushing higher, real yields ticking up. ETF net-inflows persist. Base case: go long 0.5585. Suggested tiered take-profits are 0.62552000, 0.69812500 and 0.89360000. Protect the position with a stop at 0.4006.

Macro Context

DXY bid returns; UST 10Y pushing higher; tightening odds fade. Risk tone fragile but improving.

Context for OPEN: an emerging altcoin with cyclical liquidity; listings, partnerships and macro risk steer demand.

The trading plan is deliberately level-driven: respect 0.5585 as the risk anchor and keep the stop at 0.4006. Continuation signals are clean closes above prior supply and rotation toward the first resistance cluster.

This pair trades on perpetual futures (.P) with funding as a positioning tell. Watch for spot volume to lead and for funding to cool on pullbacks — that is where higher-low entries carry best.

Technical

Macro tailwinds plus reclaim-and-hold keep OPEN biased to the numeric targets. EMAs align and momentum confirms early advantage to buyers.

Key Levels

- Entry: 0.5585

- Targets: 0.62552000 → 0.69812500 → 0.89360000

- Stoploss: 0.4006

Risk

Respect event risk (CPI/NFP/FOMC). Reduce size into macro prints.

Risk playbook (token-specific) for OPEN:

- Define risk at 0.4006 and do not average below it; a clean reclaim is the only valid re-entry signal.

- When open interest balloons into a cap, derisk — liquidation cascades cut both ways.

- Cap daily loss at −2R and stop for the day; discipline compounds better than hero trades.

- Liquidity on OPEN can thin out during off-hours; prefer limit orders and avoid market orders in rotations.

Macro commentary. Not financial advice.