MUBARAK/USDT.P — Long

2025-09-17 01:30

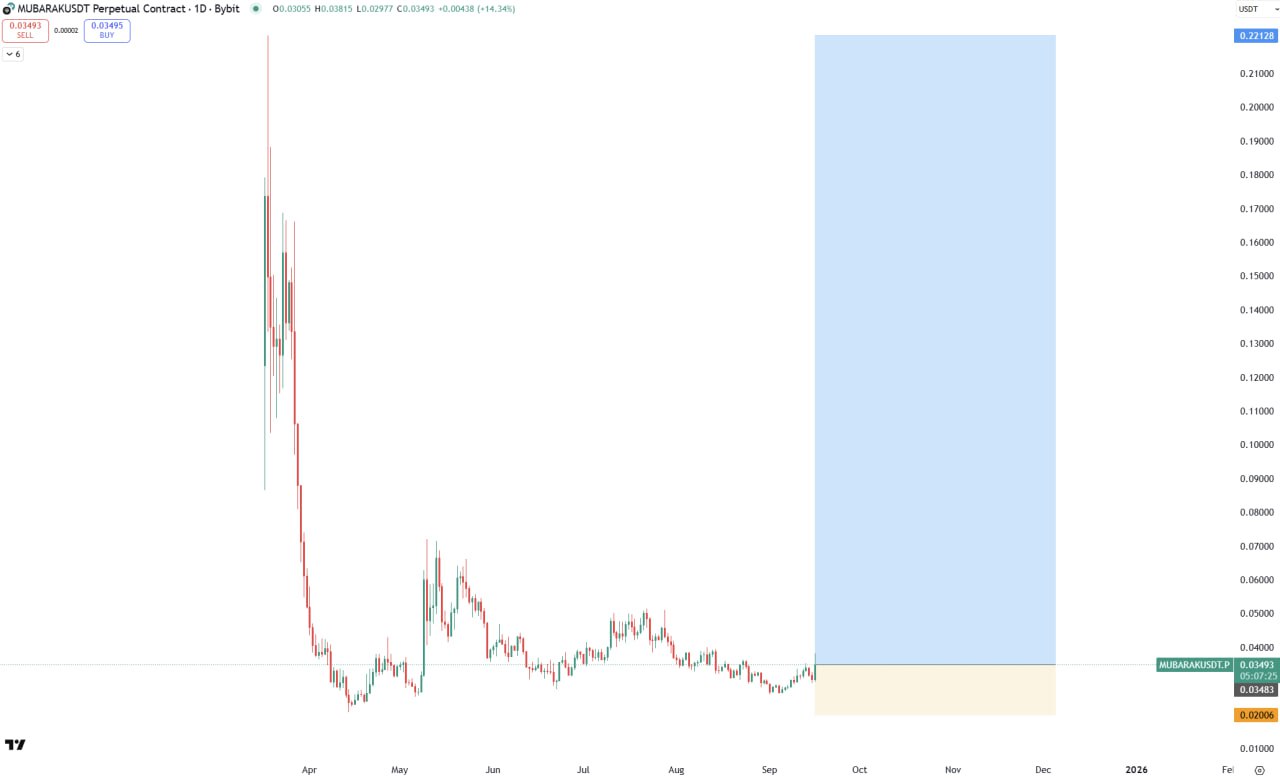

Long MUBARAK at 0.0349, target 0.038 - 0.07 - 0.1 - 0.12 - 0.3, stoploss 0.02.

If the TradingView symbol is unavailable, use the annotated image as reference for target zones & invalidation.

MUBARAK/USDT Long Trade Signal – September 17, 2025

The MUBARAK token enters focus with a speculative long at 0.0349, targeting multiple upside levels from 0.038 to 0.3. The stoploss is placed at 0.02 for downside protection.

Market Context

Micro-cap altcoins with community backing often spike during speculative phases of the market.

MUBARAK sits at the intersection of narrative and liquidity — an emerging altcoin with cyclical liquidity; listings, partnerships and macro risk steer demand.

The trading plan is deliberately level‑driven: respect 0.0349 as the risk anchor and keep the stop at 0.02. Continuation signals are clean closes above prior supply and rotation toward 0.038.

This pair trades on perpetual futures (.P) with funding as a positioning tell. Watch for spot volume to lead and for funding to cool on pullbacks — that is where higher‑low entries carry best.

Technical Analysis

- Accumulation seen around 0.03.

- Breakout levels identified toward 0.07 and 0.1.

- Tiered targets allow scaling profits.

Key Levels

- Entry: 0.0349

- Targets: 0.038 → 0.07 → 0.1 → 0.12 → 0.3

- Stoploss: 0.02

Risk Management

Allocate very small capital. Take profits quickly on spikes. Maintain hard stoploss at 0.02.

Position & Risk Notes — MUBARAK:

- Hard invalidation: a closing loss of the risk anchor near 0.02 ends the idea; re‑enter only after structure repairs.

- When open interest balloons into a cap, derisk — liquidation cascades cut both ways.

- Position size so a wick through support does not exceed your daily risk budget.

- MUBARAK tends to overshoot during squeezes; avoid adding above resistance after vertical candles.

Not financial advice. High-risk micro-cap trade idea only.