MIRA/USDT — Long

2025-09-26 17:36

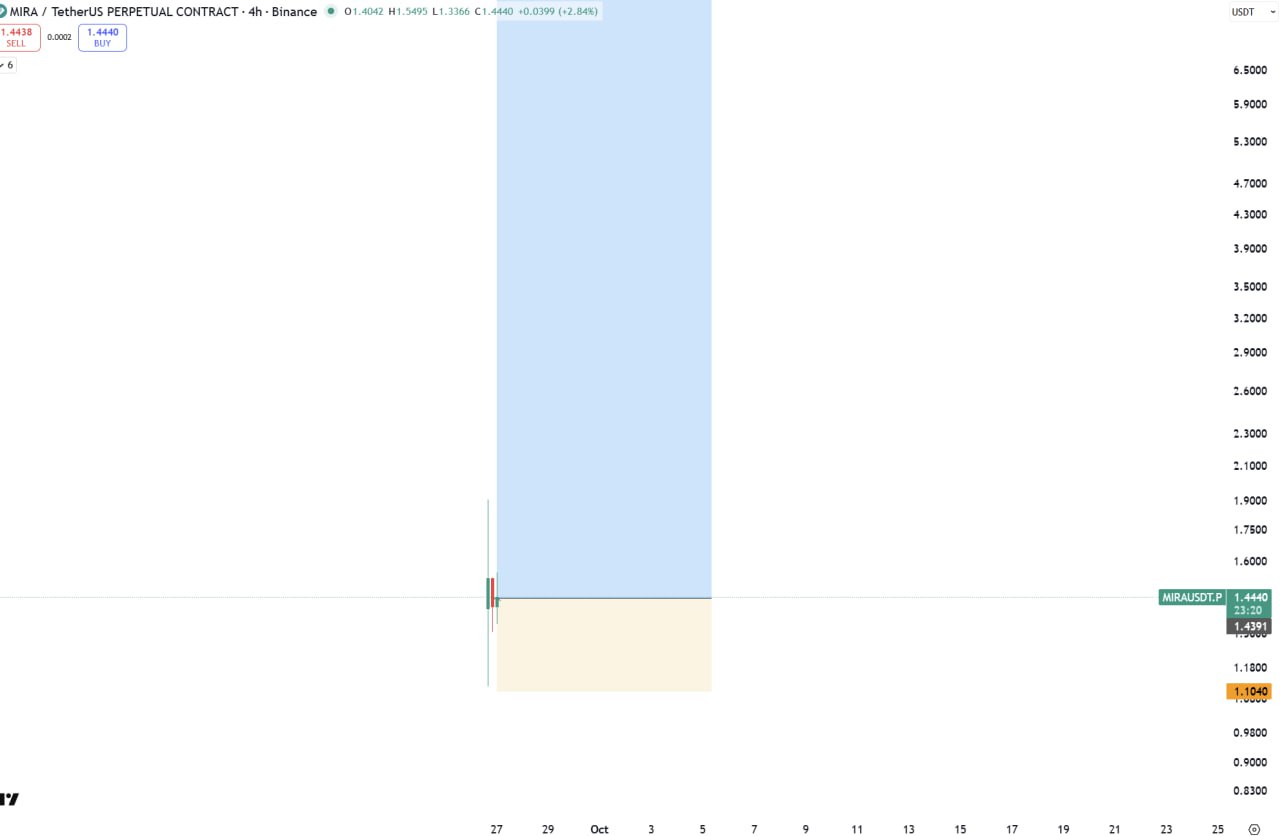

Long MIRA at 1.444, targets 1.6173 | 1.8050 | 2.3104, stoploss 1.104.

If the TradingView symbol is unavailable, use the annotated image as reference for target zones & invalidation.

MIRA/USDT Long Trade Signal – September 26, 2025

MIRA maintains a constructive uptrend from 1.10 with rising turnover. Long bias at 1.444, stop 1.104. Suggested tiered take-profits are 1.6173, 1.8050 and 2.3104. Partials on the way up help derisk while allowing participation in a potential extension.

Market Context

MIRA adoption grows with early partnerships. Altcoin investors are noticing its potential.

MIRA sits at the intersection of narrative and liquidity — an emerging alt with growing turnover; sustainability depends on listings and integrations.

For this setup we focus on structure over slogans: entries around 1.444 with a hard invalidation near 1.104. Acceptance above reclaimed supply should transition flows toward the mapped numeric targets; failure to hold the breakout argues for a time-based rebuild instead of chasing wicks.

This pair trades on perpetual futures (.spot/linear) with funding as a positioning tell. Preference is spot-led impulses with flat-to-mild funding; if funding overheats into resistance, step aside and wait for a reset.

Technical Analysis

- Trend: Uptrend intact since 1.10 rebound.

- Resistance: Key level at 1.60.

- Volume: Rising turnover supports buyers.

Key Levels

- Entry: 1.444

- Targets: 1.6173 → 1.8050 → 2.3104

- Stoploss: 1.104

Risk Management

Moderate allocation only. Consider trailing stop once above 1.55.

Position & Risk Notes — MIRA:

- Define risk at 1.104 and do not average below it; a clean reclaim is the only valid re-entry signal.

- Prefer adds on higher-lows after acceptance; avoid adding into resistance with hot funding.

- Use staggered take-profits at mapped resistances to pay yourself while keeping a runner for trend extension.

- Liquidity on MIRA can thin out during off-hours; prefer limit orders and avoid market orders in rotations.

This signal is educational, not financial advice.