CHESS/USDT — Long

2025-09-24 19:14

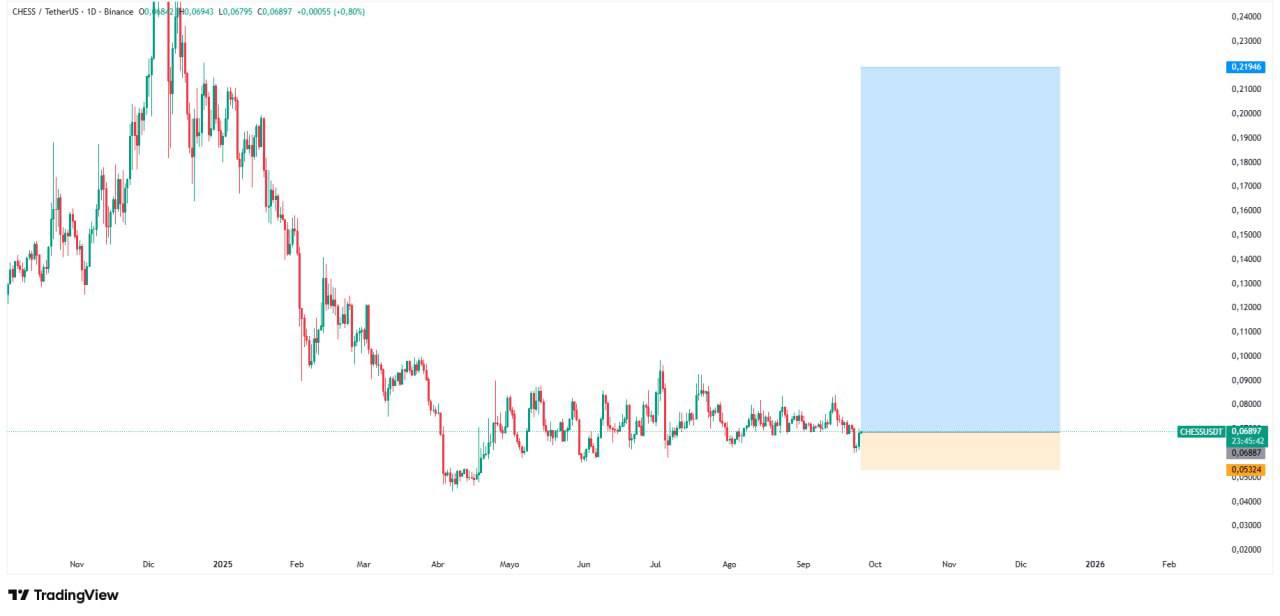

Long CHESS at 0.0682, targets 0.07638400 | 0.08525000 | 0.10912000, stoploss 0.0532.

If the TradingView symbol is unavailable, use the annotated image as reference for target zones & invalidation.

CHESS/USDT Long Trade Signal – September 24, 2025

CHESS reversed off 0.055 and is probing supply overhead. Long interest at 0.0682 with stop at 0.0532. Suggested tiered take-profits are 0.07638400, 0.08525000 and 0.10912000. A 4H body close through nearby resistance would increase conviction for extension toward these levels.

Market Context

CHESS, part of the DeFi ecosystem, is gaining attention as liquidity rotates back into altcoins while Bitcoin stabilizes above $112K.

In the current cycle, CHESS acts as a barometer for speculative appetite; a DeFi-adjacent governance token; on-chain yields and integrations matter.

For this setup we focus on structure over slogans: entries around 0.0682 with a hard invalidation near 0.0532. Acceptance above reclaimed supply should transition flows toward mapped resistances; failure to hold the breakout argues for a time-based rebuild instead of chasing wicks.

This pair trades on perpetual futures (.spot/linear) with funding as a positioning tell. Watch for spot volume to lead and for funding to cool on pullbacks — that is where higher-low entries carry best.

Technical Analysis

- Trend: Reversal from 0.055 created a bullish base.

- Volume: Spikes show renewed investor interest.

- Resistance: Next test lies near 0.08.

Key Levels

- Entry: 0.0682

- Targets: 0.07638400 | 0.08525000 | 0.10912000

- Stoploss: 0.0532

Risk Management

Allocate small size due to volatility. Consider scaling profits around 0.075–0.08 and trim into extended targets.

Risk playbook (token-specific) for CHESS:

- Define risk at 0.0532 and do not average below it; a clean reclaim is the only valid re-entry signal.

- Prefer adds on higher-lows after acceptance; avoid adding into resistance with hot funding.

- Position size so a wick through support does not exceed your daily risk budget.

- CHESS tends to overshoot during squeezes; avoid adding above resistance after vertical candles.

This CHESS signal is informational only, not financial advice.