Smart Contract Risk: Understanding Vulnerabilities

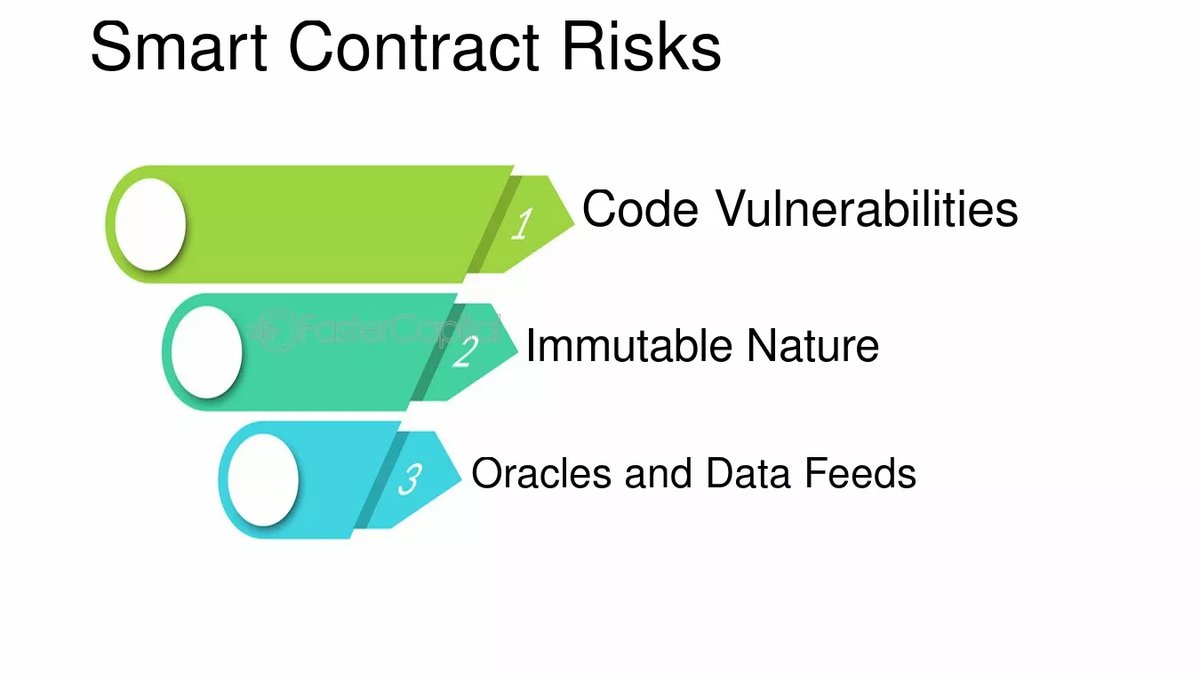

Smart contracts are self-executing agreements coded directly onto blockchains. They power decentralized finance (DeFi), non-fungible tokens (NFTs), and countless other innovations. But despite their automation, smart contracts are not infallible. Bugs, design flaws, and malicious exploitation can cause millions in losses overnight. Understanding these risks is essential for both developers and investors.

Common Vulnerabilities

Reentrancy Attacks

This occurs when a contract repeatedly calls an external function before updating its state. The infamous DAO security incident in 2016 abused a security vulnerability this vulnerability, draining millions of dollars in ETH.

Oracle Manipulation

Smart contracts often rely on external data feeds (oracles). If these oracles are compromised, attackers can manipulate contract outcomes, leading to massive arbitrage or liquidation events.

Integer Overflow/Underflow

Improper handling of numerical values can result in overflow or underflow errors, enabling attackers to bypass contract limits and drain funds.

Logic Flaws

Even without malicious code, poorly designed logic can expose contracts to unintended outcomes. These risks are magnified in complex multi-contract ecosystems.

Mitigation Strategies

Developers must prioritize rigorous auditing, formal verification, and bug bounties. Security firms like CertiK and Trail of Bits specialize in uncovering vulnerabilities before launch. Layered testing environments can also replicate real-world scenarios to identify hidden risks.

Insurance and Smart Contracts

DeFi insurance protocols offer protection against losses from smart contract failures. Nexus Mutual, for example, allows users to purchase coverage for specific protocols. However, claims depend on community governance votes, raising questions about objectivity and timeliness.

Future Trends

As DeFi expands, we can expect growth in both attack sophistication and defense mechanisms. AI-powered auditing tools and standardized coding frameworks will enhance resilience. Regulators may also step in, mandating certain security standards before public launches.

Conclusion

Smart contracts unlock unprecedented innovation but also introduce systemic risks. Investors and developers alike must balance opportunity with caution. By combining preventive measures, third-party audits, and insurance coverage, the ecosystem can achieve sustainable growth without compromising security.