Top DeFi Apps: Exploring the Future of Decentralized Finance

Decentralized Finance (DeFi) is evolving from an early-adopter experiment into a core pillar of the crypto economy. In 2025, a new wave of applications delivers yield farming and staking opportunities with improved security assumptions, multi-chain reach, and institutional-grade liquidity. This guide maps out the main categories, highlights leading apps, and shows how to evaluate opportunities while managing risk.

How DeFi Generates Yield

Most sustainable DeFi yields come from a few primitives. Understanding these helps you choose the right apps and avoid unsound returns.

1) AMM liquidity & trading fees

Automated market makers (AMMs) like Uniswap and Curve route swaps through liquidity pools. Liquidity providers (LPs) earn a share of trading fees and, in some pools, additional incentives. Returns depend on volume, fee tier, and impermanent loss dynamics.

2) Over-collateralized lending

Protocols such as Aave and Compound pay lenders a variable rate funded by borrowers. Rates adjust with supply/demand and can be boosted by protocol incentives during growth phases.

3) Staking & liquid staking

Network staking (e.g., ETH) pays a native yield for securing the chain. Liquid staking providers (LSPs) like Lido or Rocket Pool issue a receipt token you can use as collateral or to earn layered yields elsewhere.

4) Vaults & structured yield

Aggregators like Yearn and yield marketplaces like Pendle package strategies or let you separate yield from principal, enabling targeted exposures (e.g., fixed-yield vs. leveraged yield).

Top DeFi Apps to Watch in 2025

Below are widely used apps across key categories, with a yield/staking lens. Always verify the current version, audits, and chain deployment before allocating capital.

DEX & Liquidity

Uniswap

A flagship AMM with concentrated liquidity and multiple fee tiers. Great for blue-chip pairs and for LPs who can actively manage price ranges. Multi-chain support and rich tooling make it a backbone for on-chain trading.

Curve Finance

Specialized in like-kind assets (stablecoin-to-stablecoin, liquid staking tokens to ETH). Low slippage and stables-centric design make Curve a core venue for stablecoin and LST liquidity, often used by other protocols.

Balancer

Supports multi-asset pools and custom weights. Useful for index-like exposure and boosted pools that integrate yield-bearing tokens under the hood.

Lending & Collateral

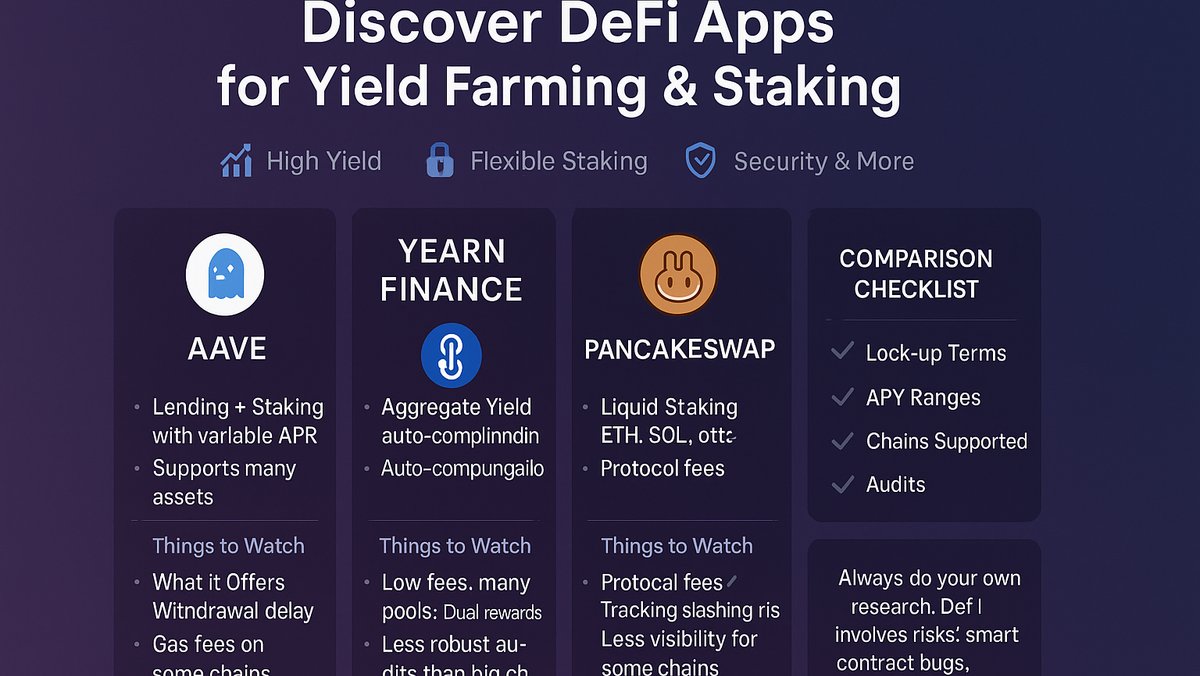

Aave

Institutional-friendly money market with risk frameworks, isolation modes, and efficient markets for liquid staking tokens. Lenders earn variable interest; stakers in the safety module support protocol resilience.

Compound

Pioneer of algorithmic money markets. Clean risk surface and conservative listings appeal to users who prefer simpler rate markets over heavy incentives.

MakerDAO (DAI)

Collateralized debt positions power the decentralized stablecoin DAI. Vault strategies can unlock basis trades (borrow DAI against collateral, deploy into yield) but require careful liquidation management.

Liquid Staking & Vaults

Lido

The largest ETH liquid staking provider. stETH offers staking yield while remaining liquid for DeFi. Useful as collateral or for pairing in LST-ETH pools; monitor peg dynamics and staking queue conditions.

Rocket Pool

Decentralized ETH staking with permissionless node operators. rETH tracks staked ETH plus rewards; often favored by users who value decentralized operator sets.

Yearn

Aggregator that routes deposits into strategy vaults (e.g., stablecoin optimization, LST strategies). Good for hands-off users; review strategy descriptions, caps, and historical performance with caution.

Pendle

Separates principal from yield into tradeable tokens (PT/YT). Lets you lock in fixed yields, speculate on forward yields, or construct carry strategies across stablecoins and LSTs.

Staking, Payments & Derivatives

PancakeSwap

Multi-chain DEX with farming programs and staking for governance/utility tokens. Appeals to retail users and offers broad token coverage beyond Ethereum mainnet.

dYdX / GMX (Perp DEXs)

On-chain derivatives with funding-rate dynamics. Liquidity providers and token stakers can earn protocol fees, but risk is tied to trader P&L and oracle integrity; treat these as advanced strategies.

How to Choose a DeFi App (Checklist)

• Security: audits, formal verification, bug bounties, time-tested contracts, admin key status, pause/guardian mechanics.

• Liquidity depth: slippage for your trade size; for LPs, utilization and volume per TVL.

• Yield quality: organic fees vs. short-lived incentives; can the return persist without emissions?

• Collateral design: oracle sources, LTV, liquidation penalties, bad-debt backstops (insurance funds, safety modules).

• Chain & bridging: native deployments vs. bridged assets; bridge risk and withdrawal timelines.

• Tokenomics & governance: value capture, emissions schedule, vote-escrow mechanics, treasury transparency.

• UX & ops: wallet support, helpful docs, analytics dashboards, support response.

Risk Management for Yield & Staking

Impermanent loss (IL)

LPs in volatile pairs may underperform simple holding when prices diverge. Concentrated liquidity can amplify returns or IL if ranges are mis-set. Hedge, use correlated pairs, or prefer stable/LST pools to reduce IL.

Smart-contract & governance risk

Even audited protocols can fail. Avoid unaudited forks; favor programs with bug bounties and transparent upgrade paths. Check emergency powers and multisig compositions.

Liquidation & leverage

Borrows against volatile collateral can liquidate fast during drawdowns. Keep conservative LTVs, monitor oracles, and automate alerts. Understand partial vs. full liquidation rules.

Stablecoin and LST de-pegs

Watch for liquidity depth around pegs (1.00 for stables, 1:1 stETH:ETH). Use diversified venues and avoid thin pools during stress.

Oracle, MEV, and bridge risks

Manipulable oracles, heavy MEV environments, and insecure bridges can erode yield or cause losses. Prefer robust oracle feeds and native assets on the target chain whenever possible.

Playbooks by Experience Level

Beginner (low touch)

- Stake via reputable LSP (e.g., Lido or Rocket Pool) and hold the LST.

- Supply stablecoins to a major money market (Aave/Compound) with low LTV or no borrow.

Intermediate (balanced)

- Pair LST with ETH in a deep pool (Uniswap/Curve) and reinvest fees; monitor IL and ranges.

- Use Yearn/Pendle for structured yield (e.g., fixed-yield on stablecoins) with defined maturity dates.

Advanced (active)

- Deploy covered-range LPs across chains, hedge deltas, and rotate incentives opportunistically.

- Construct basis trades with Maker/Aave plus Pendle to lock carry; automate health checks.

Multi-Chain in 2025

DeFi is increasingly chain-agnostic. Ethereum L2s (Arbitrum, Optimism, Base) handle high-throughput strategies at low fees; Solana offers monolithic performance for perp DEXs and consumer apps. Use native bridges or reputable third-party bridges with caution, and track where real liquidity lives for your target pools.

Compliance & Practicalities

Yields are typically taxable. Track deposits, withdrawals, fees, and token rewards with timestamps and local-currency fair-market values. Separate wallets by strategy to simplify bookkeeping and audits.

Frequently Asked Questions

Where do sustainable DeFi yields come from? Mostly from trading fees, borrow demand, and network staking rewards. Incentives can boost returns but rarely last forever.

Is liquid staking safer than lending? They are different risks: validator performance and LST peg risk vs. borrower defaults and liquidation mechanics. Diversify across primitives.

How do I limit impermanent loss? Favor correlated pairs (e.g., LST/ETH, stable/stable), use wider ranges, or choose single-asset lending/staking instead of volatile LPing.

What APY is realistic? Market-rate fees or staking yields are usually single-digit to low double-digit. Very high APYs often rely on emissions or leverage—treat with caution.

Which app is best for beginners? Aave/Compound for simple lending, Lido/Rocket Pool for staking, and Uniswap/Curve for deep, low-slippage pools.

Further Reading and Resources

Conclusion

DeFi yield and staking opportunities are abundant, but the best results come from disciplined selection and risk controls. Start with proven apps, size positions conservatively, and favor yields grounded in authentic economic activity. Over time, stacking small, repeatable edges beats chasing the highest APY on the screen.