Crypto Apps vs Traditional Brokers: Pros and Cons

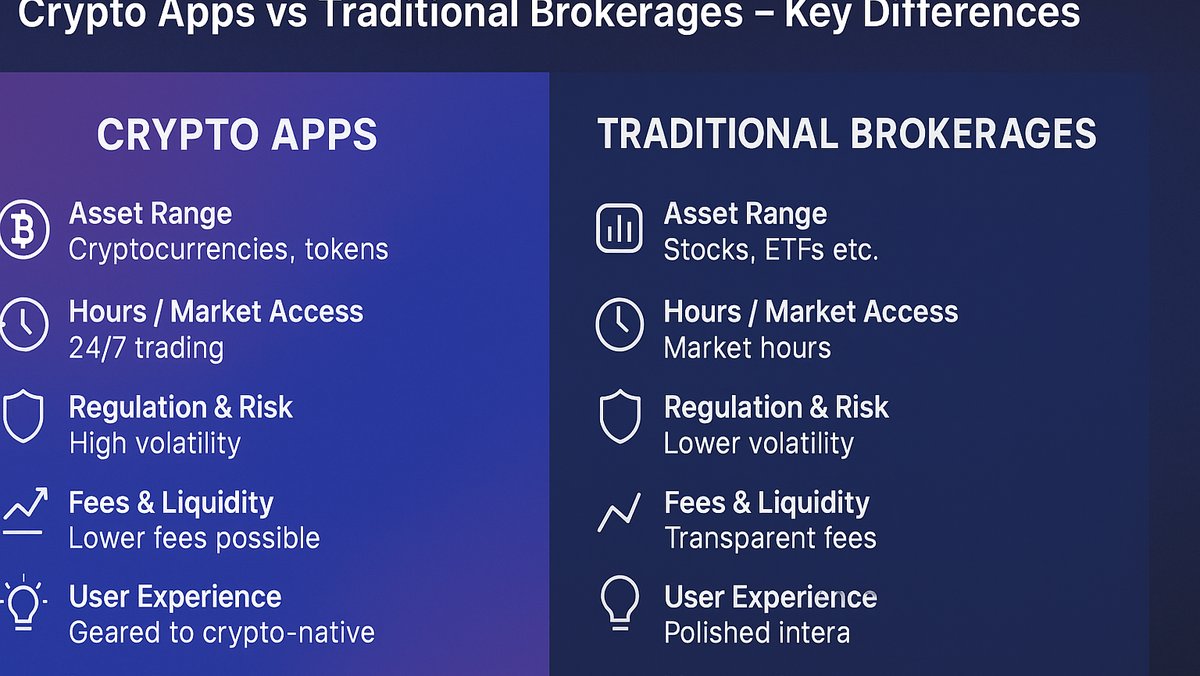

As cryptocurrencies mature, investors increasingly face a decision: should they manage their digital assets using dedicated crypto apps, or rely on traditional brokers that have added crypto to their service portfolios? Both options have distinct advantages and drawbacks, and the choice depends on one’s investment goals, risk tolerance, and level of familiarity with digital assets. This article examines the differences between crypto apps and traditional brokers, highlights their respective strengths and weaknesses, and provides insights to help you choose the right platform for your needs.

Understanding the Two Models

What Are Crypto Apps?

Crypto apps are platforms designed specifically for buying, selling, staking, and managing cryptocurrencies. They include wallets, decentralized exchange (DEX) interfaces, and centralized exchanges (CEX) like Coinbase, Binance, or Kraken. Many crypto apps also integrate features such as staking, yield farming, NFT trading, and peer-to-peer transactions.

What Are Traditional Brokers?

Traditional brokers are established financial intermediaries that allow users to invest in stocks, ETFs, bonds, and more. In recent years, platforms like Fidelity, Robinhood, and Charles Schwab have integrated crypto services, giving investors the ability to access both traditional and digital assets from a single account.

Advantages of Crypto Apps

• Crypto-Native Functionality: Apps like MetaMask and Binance offer direct access to DeFi protocols, staking, and token launches that traditional brokers cannot match.

• 24/7 Market Access: Crypto apps operate without the time constraints of traditional markets, allowing trading at any time, including weekends and holidays.

• Lower Barriers to Entry: Many apps let users start with small amounts, making crypto accessible to retail investors globally.

• Ownership of Assets: With non-custodial wallets, investors maintain control of their private keys, ensuring full ownership of assets without intermediaries.

Advantages of Traditional Brokers

- Regulatory Oversight: Traditional brokers are heavily regulated, offering a layer of protection and credibility.

- Diversification Options: Investors can manage crypto alongside equities, ETFs, and bonds in a single portfolio.

- Integrated Tax Reporting: Brokers often provide simplified tax statements, which is still a challenge for many crypto apps.

- Customer Support: Established brokers tend to have more robust customer service compared to newer crypto platforms.

Drawbacks of Crypto Apps

- Security Risks: Security Incidents, deceptive credential-stealing scheme, and sudden project collapses remain persistent risks, particularly for decentralized apps.

- Complexity: DeFi protocols and wallets require technical literacy, which can be intimidating for newcomers.

- Regulatory Uncertainty: Some apps may face restrictions or shutdowns depending on changing laws in different jurisdictions.

- Volatility Exposure: Many crypto apps emphasize high-yield opportunities that may carry excessive risk.

Drawbacks of Traditional Brokers

- Limited Crypto Selection: Most brokers offer only a handful of major coins like Bitcoin and Ethereum, while crypto apps provide access to thousands of tokens.

- Lack of DeFi Access: Features like staking, yield farming, and governance participation are generally absent from broker platforms.

- Custodial Model: Investors do not own the private keys when using brokers, meaning they rely entirely on the institution’s custody solutions.

- Higher Fees in Some Cases: While brokers may offer commission-free stock trades, crypto transaction fees can be higher compared to dedicated apps.

Comparisons and Use Cases

Crypto apps are ideal for users who want direct exposure to the crypto ecosystem, experiment with new tokens, or participate in decentralized finance. In contrast, traditional brokers appeal to investors who prioritize safety, regulatory clarity, and the convenience of managing all investments under one roof. Some hybrid investors use both—brokers for long-term holdings and apps for more experimental strategies.

Risks and Considerations

Choosing between crypto apps and brokers involves weighing risks such as:

- Market Volatility: Both avenues expose investors to the inherent price swings of crypto.

- Counterparty Risk: Brokers can freeze assets during market stress, while crypto apps can be abused a security vulnerability by hackers.

- Regulatory Impact: Governments may impose stricter laws on either sector, influencing accessibility.

- Learning Curve: New investors may find crypto apps too complex, while brokers may feel too restrictive for advanced users.

Investment Outlook

The future will likely see increasing convergence between the two models. Brokers are gradually expanding crypto offerings, while crypto apps are becoming more regulated and user-friendly. By 2026, we may see platforms that seamlessly integrate both traditional finance (TradFi) and decentralized finance (DeFi), offering investors the best of both worlds.

Conclusion

The choice between crypto apps and traditional brokers depends on your investment priorities. If you value innovation, asset ownership, and access to DeFi, crypto apps may be the better choice. If you prefer regulatory protection, simplicity, and portfolio diversification, traditional brokers are more suitable. Ultimately, a balanced strategy that combines both may provide the best results, blending the security of brokers with the innovation of crypto-native platforms.

Further Reading and Resources

Crypto Exchanges | Signals | Market

Frequently Asked Questions

1. Are crypto apps safer than brokers? Not necessarily. Crypto apps can offer more control but carry higher conducting a security breach risks, while brokers provide stronger regulatory oversight but less autonomy.

2. Can I diversify better with brokers? Yes. Brokers allow exposure to stocks, ETFs, bonds, and crypto, making diversification easier compared to crypto-only apps.

3. Do crypto apps offer better returns? Potentially, yes. Apps with DeFi and staking can generate higher yields, but these come with higher risks compared to broker-managed investments.

4. Which is better for beginners? Traditional brokers are generally more beginner-friendly, though crypto apps are improving with simplified interfaces and educational tools.

5. Will brokers eventually replace crypto apps? Unlikely. Instead, the future points to coexistence and convergence, with each serving different investor needs.