Trading Signals – September 19, 2025 Market Summary

The September 19 session reflected a tight link between traditional markets and crypto assets. The expiration of multi-billion-dollar options contracts, regulatory shifts, and market milestones created a highly volatile environment.

Traditional Market Influence

- [04:11 AM] S&P 500 closes at new all-time high of 6,631, reinforcing bullish sentiment across risk assets.

- [05:30 AM] $4.35B worth of BTC & ETH options expire today, driving extreme volatility in crypto.

Institutional and Crypto Highlights

- [06:10 AM] Grayscale Digital Large Cap Fund officially live – immediate inflows observed (BTC / ETH / XRP / SOL / ADA).

- [07:25 AM] MetaMask launches in-wallet perpetuals trading via Hyperliquid – boosting DeFi accessibility.

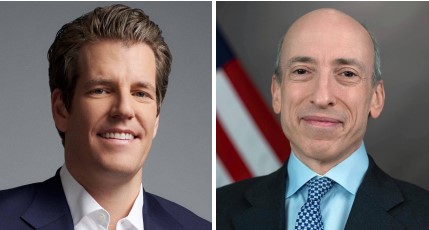

- [07:56 AM] Gemini's Tyler Winklevoss criticizes SEC Chair Gary Gensler for slowing innovation.

- [08:00 AM] Fed Governor Stephen Miran states: 'no evidence tariffs caused inflation', calming macro concerns.

Geopolitical Events

- [08:11 AM] Trump confirms TikTok deal approved with Xi Jinping – easing tech tensions.

- [08:30 AM] $100M crypto longs liquidated in past 60 minutes – highlighting leverage risk.

- [09:11 AM] Russia announces seizure of international financial assets linked to 'Satanists'.

Conclusion

September 19 underscored the interplay between macroeconomic events and crypto markets. While equities soared, crypto faced heavy liquidation pressure due to options expiry. Regulatory progress and DeFi launches remain strong tailwinds for long-term adoption.