Fidelity vs Coinbase vs Robinhood: Comparing Fees & Features – Full Analysis

The landscape of cryptocurrency trading is dominated by several major platforms, each offering distinct advantages and trade-offs. Fidelity, Coinbase, and Robinhood represent three of the most notable options, catering to both retail and institutional investors. Understanding their fee structures, features, security measures, and usability is essential for making informed investment decisions.

Overview of Each Platform

Fidelity Digital Assets

Fidelity offers a secure, regulated environment primarily targeting institutional investors. Key features include cold storage, comprehensive reporting, and advanced custody solutions. Its platform emphasizes regulatory compliance, transparency, and integration with broader financial portfolios.

Coinbase

Coinbase is a leading retail-friendly crypto exchange. It provides a wide range of cryptocurrencies, educational resources, and an easy-to-use interface. Coinbase Pro targets more advanced traders with lower fees and professional-grade charts.

Robinhood Crypto

Robinhood is best known for commission-free trading of stocks and crypto. It prioritizes simplicity and accessibility, making it appealing for new investors. However, it lacks custody options and some advanced trading features found on specialized crypto platforms.

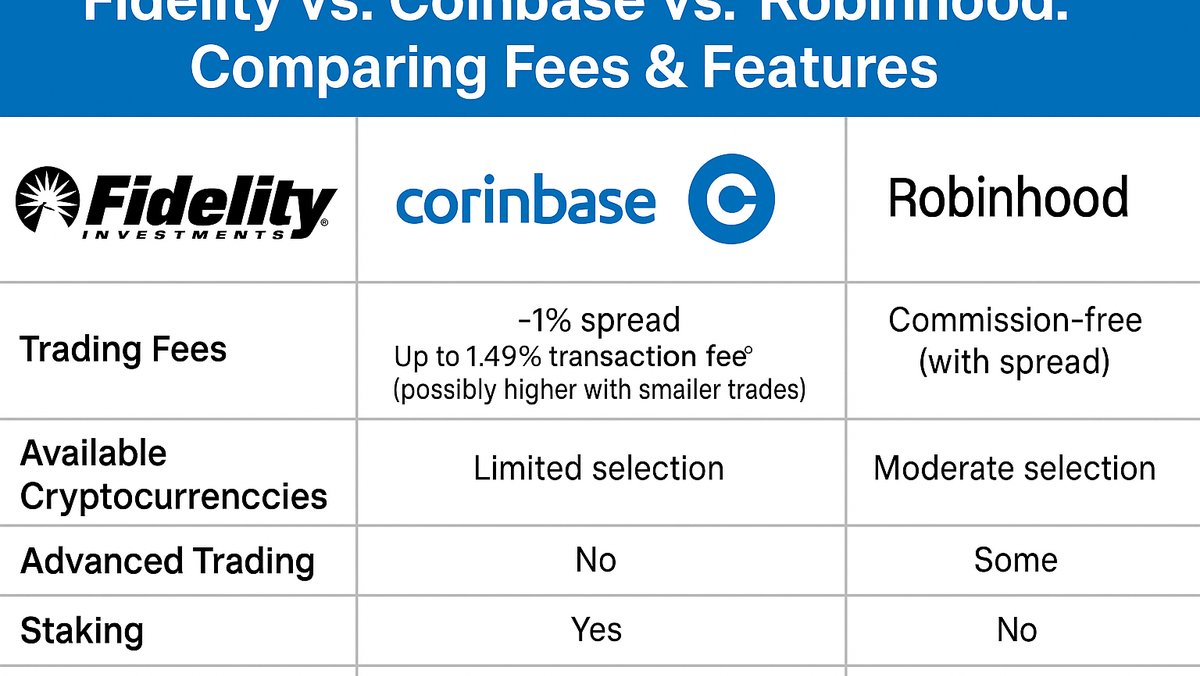

Fees Comparison

Understanding the fee structure is critical as it directly affects net returns:

- Fidelity: Charges a small percentage for transactions, typically lower for institutional clients. There are no hidden spreads, and custody fees are transparent.

- Coinbase: Standard trading fees range from 0.50% to 1.49%, with Coinbase Pro offering reduced fees based on volume. Spreads may also apply.

- Robinhood: Commission-free trades, but spreads may be wider than traditional exchanges. Lack of custody services can incur implicit opportunity costs.

Key Features and Capabilities

Security

Fidelity provides institutional-grade security with multi-signature wallets and insured custody. Coinbase employs similar measures, including cold storage and insurance coverage for online assets. Robinhood, while secure, offers fewer advanced custody solutions.

Asset Variety

Coinbase offers the widest selection of cryptocurrencies, including DeFi tokens and NFTs. Fidelity focuses on major coins like Bitcoin and Ethereum but provides better reporting and institutional tools. Robinhood offers a limited selection but is improving accessibility for mainstream investors.

Regulatory Compliance

Fidelity and Coinbase maintain high compliance standards, with regular audits and adherence to SEC and FinCEN guidelines. Robinhood is regulated as a broker-dealer but offers less granular reporting for crypto holdings.

Use Cases and Investor Profiles

Investors should choose a platform based on their needs:

- Institutional investors: Fidelity excels due to compliance, custody, and reporting features.

- Retail beginners: Robinhood offers a low-barrier entry with easy-to-understand interfaces.

- Active traders: Coinbase Pro provides low fees, advanced charts, and liquidity.

Comparisons with Other Platforms

Compared to Bitcoin-only custody solutions, Fidelity offers regulatory assurance and integration with broader financial portfolios. Coinbase excels in ecosystem support and liquidity, while Robinhood prioritizes simplicity over depth. Investors should weigh factors like fees, custody, asset range, and usability.

Risks and Considerations

Investing in cryptocurrencies carries inherent risks including volatility, regulatory changes, and technological vulnerabilities. Each platform has unique risk exposures: Fidelity has minimal counterparty risk due to institutional safeguards, Coinbase may face operational or exchange-based risks, and Robinhood’s lack of custody may be a concern for long-term holdings.

Investment Outlook

Looking forward, increasing institutional adoption, DeFi integration, and NFT expansion may influence platform choice. Fidelity is poised for institutional growth, Coinbase continues to expand its token offerings, and Robinhood targets the retail segment. Diversification and strategic platform selection remain key to risk management.

Further Reading and Resources

Crypto Insurance | Market | SEC Coin

Frequently Asked Questions

Which platform is best for beginners? Robinhood is the most user-friendly, but Coinbase provides more educational resources.

Which platform is best for institutions? Fidelity is designed for institutional investors, offering custody, compliance, and advanced reporting.

How do fees compare? Fidelity offers low fees for institutional accounts; Coinbase has moderate trading fees; Robinhood is commission-free but may have wider spreads.