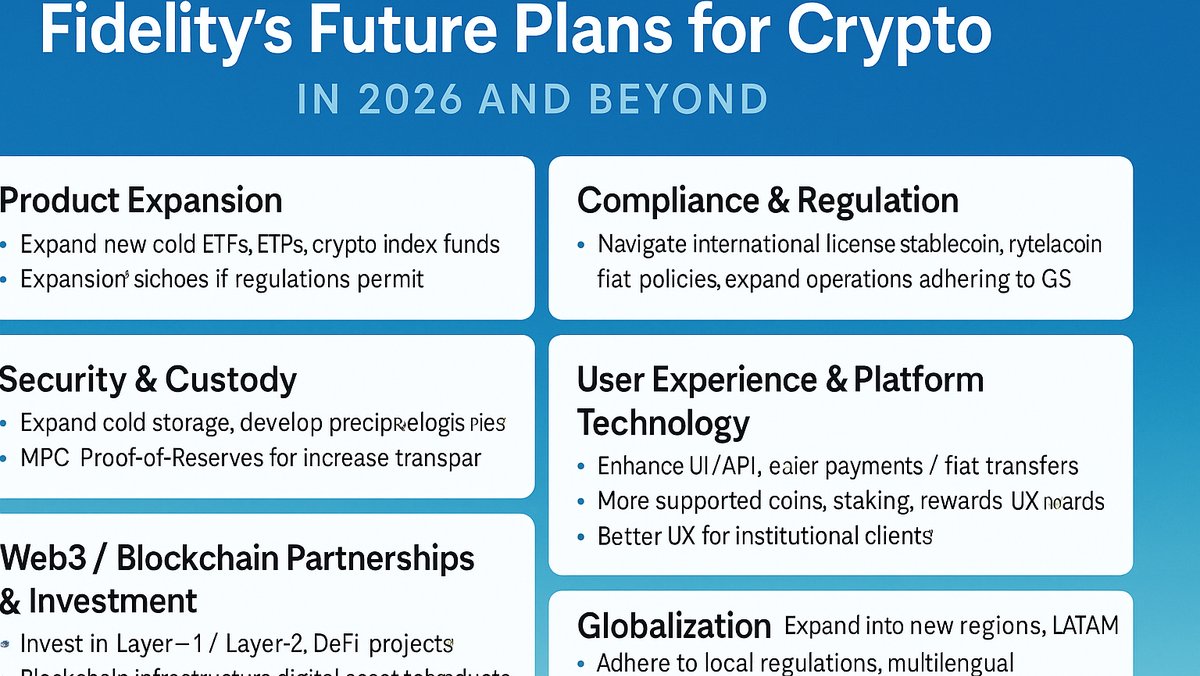

Fidelity’s vision for cryptocurrency in 2026 and beyond signals a transformative phase in the integration of digital assets with mainstream finance. As blockchain technology continues to evolve, Fidelity is exploring strategic initiatives that encompass regulatory engagement, technological innovation, and institutional adoption, positioning itself as a key player in shaping the future of the crypto ecosystem.

Overview of Fidelity's Future Plans for Crypto in 2026 and Beyond

Fidelity aims to expand its crypto offerings beyond ETFs, potentially incorporating advanced investment vehicles such as tokenized securities, decentralized finance (DeFi) products, and blockchain-enabled banking services. These initiatives reflect Fidelity's commitment to leveraging regulatory-compliant frameworks while fostering innovation. By aligning with evolving financial standards, Fidelity intends to bridge the gap between conventional finance and digital assets, offering secure, transparent, and efficient solutions for investors.

The adoption of advanced blockchain protocols, including scalable smart contract platforms and interoperable networks, underpins Fidelity’s roadmap. These technologies are designed to enhance transaction efficiency, reduce settlement times, and enable secure cross-border operations. Additionally, Fidelity is likely to invest in education and research initiatives to equip both retail and institutional clients with the knowledge necessary to navigate complex crypto markets.

Key Features and Use Cases

Fidelity’s future crypto products will likely integrate governance mechanisms that balance decentralization with institutional oversight, tokenomics that incentivize long-term participation, and comprehensive auditing to ensure security. These features collectively support a robust and transparent investment environment, fostering confidence among diverse investor segments.

Use cases envisioned for 2026 and beyond include participation in DeFi ecosystems, issuance of digital bonds, programmable assets for automated compliance, and tokenized real-world assets. NFTs and other digital collectibles may also be incorporated into investment portfolios, allowing for innovative asset classes while maintaining regulatory adherence.

Comparisons with Other Projects

When compared with Ethereum, Fidelity’s initiatives may emphasize institutional-grade compliance, operational scalability, and integration with traditional financial services. While Ethereum provides a decentralized application ecosystem, Fidelity aims to combine decentralization with rigorous governance, reducing systemic risk for institutional clients. Bitcoin remains the standard for digital gold, but lacks programmability; Fidelity’s roadmap addresses this by incorporating smart contract capabilities while maintaining security and compliance standards. SEC Coin and other compliance-focused platforms may offer similar regulatory alignment, but Fidelity’s scale and integration potential provide a competitive advantage.

Risks and Considerations

Despite ambitious plans, several risks exist. Market volatility, evolving regulatory frameworks, and technology adoption challenges could impact execution. Investors should recognize that emerging products may face liquidity constraints and operational hurdles. Additionally, the interplay between decentralized networks and institutional compliance introduces complexity in governance, requiring careful management to maintain stability and trust.

Mitigating these risks involves diversification, diligent research, and continuous monitoring of Fidelity’s development milestones. Understanding the technical architecture, consensus protocols, and ecosystem dynamics will be critical for informed decision-making. Fidelity’s commitment to transparency and auditing can help reduce risk, but market exposure remains inherently volatile.

Investment Outlook

Fidelity’s roadmap suggests that institutional adoption will accelerate, supported by technological upgrades, regulatory clarity, and growing client confidence. Short-term investors may capitalize on strategic product launches, while long-term participants can benefit from the broader integration of blockchain into mainstream finance. Strategies such as token staking, governance participation, and portfolio diversification remain key to optimizing returns while managing exposure.

Overall, Fidelity is positioning itself to not only offer investment products but also shape the infrastructure and standards for crypto adoption in the coming decade. This vision may redefine how traditional finance engages with blockchain technology, setting the stage for a more integrated and resilient digital economy.

Further Reading and Resources

Crypto Tax | Fidelity Crypto | Crypto Exchanges

Frequently Asked Questions

What are Fidelity's plans for crypto in 2026 and beyond? Fidelity plans to expand its crypto offerings, integrate blockchain technology with institutional finance, and provide regulatory-compliant investment vehicles and innovative financial products.

How do these plans compare to existing crypto projects? Fidelity emphasizes compliance, operational scalability, and integration with traditional finance, differing from Ethereum’s decentralized ecosystem and Bitcoin’s digital gold focus.

Is investing in Fidelity’s future crypto products safe? While regulated and secure, market and technological risks persist. Investors should consider diversification, risk tolerance, and ongoing monitoring.

Where can I learn more? Explore our articles on SEC Coin, Fidelity Crypto, and blockchain investment guides for additional insights.