Fed Signals Caution as Inflation Cools: Policy Path, Market Implications, and the Data That Matters Next

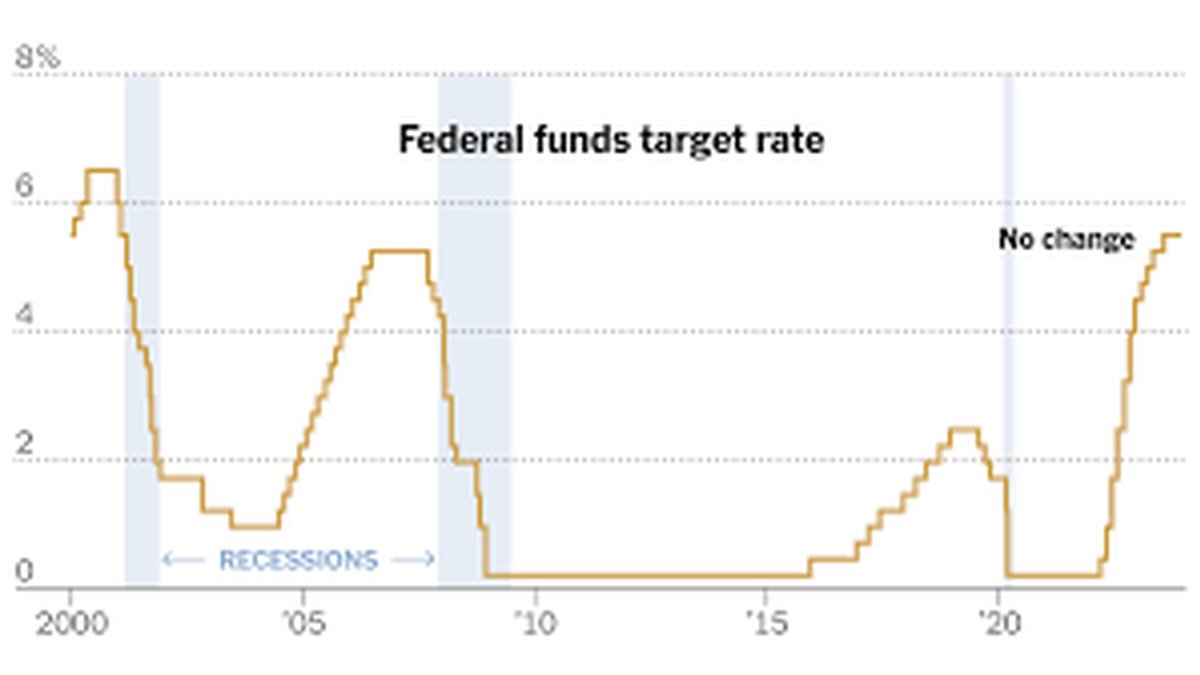

The Federal Reserve struck a measured tone, signaling it will maintain a patient stance on interest rates even as headline and core inflation drift lower. Chair Jerome Powell emphasized that policymakers want more evidence that price pressures are on a durable glide path toward target, and that labor-market conditions are normalizing without flashing stress. Markets interpreted the remarks as a modestly dovish turn—Treasury yields eased, equities firmed—yet the Fed stopped well short of pre-committing to near-term cuts. This deep dive unpacks the policy calculus beneath the rhetoric, how the balance between inflation, employment, and financial conditions shapes the reaction function, and what investors should watch as the next wave of data lands.

Inside the Fed’s Reaction Function

Inflation: Level, Trend, and Composition

Cooling inflation is a necessary but not sufficient condition for policy easing. The Fed cares about (1) the level of inflation, (2) the trend or momentum over multiple months, and (3) the composition—specifically, progress in core services ex-housing, a category closely linked to wages. Goods disinflation has been persistent thanks to normalized supply chains and inventory discipline. Shelter inflation is slowing with a lag as new-lease dynamics filter into official measures. The wild card remains services, where wage growth and productivity determine whether price pressures continue to ebb or re-accelerate.

Labor Market: Tight but Less Hot

Powell’s comments highlighted a labor market that is no longer overheating but remains healthy. Job openings have eased, quits have normalized, and payroll growth has cooled to a more sustainable cadence. The Fed’s challenge is to judge whether slack is increasing orderly or whether a sharper slowdown could be brewing beneath benign aggregates. A steady deceleration in wage growth, combined with better productivity, is the ideal recipe for disinflation without recession.

Financial Conditions: The Third Rail

Even without a rate move, financial conditions—yields, credit spreads, equity levels, the dollar—can tighten or loosen policy de facto. Recent moves have modestly eased conditions as yields dipped and equities advanced. The Committee will weigh whether that easing is consistent with continued disinflation or risks re-stoking demand. The balance sheet also matters: ongoing quantitative tightening (QT) and reserve dynamics interact with rates to set the overall stance.

What “Cautious” Really Means

Data Dependence Over Date Dependence

Rather than telegraphing a calendar for cuts, the Fed is emphasizing data dependence. Officials want a sequence of benign monthly prints in core inflation, a convincing downshift in services prices, and continued evidence that the labor market is rebalancing without breaking. The rhetoric intentionally avoids promises that could corner policy if the data surprise hot.

Symmetric Risks: Cutting Too Soon vs. Too Late

Two policy errors loom: cutting too early, risking a second inflation flare, or staying restrictive too long, risking an unnecessary growth downshift. A cautious stance keeps both options open. If inflation progress stalls, restrictive policy remains in place. If disinflation persists and labor slack builds, the Fed can move toward gradual easing with less risk of credibility loss.

Communication Strategy: Optionality as a Tool

Forward guidance is deliberately conditional. By avoiding strong pre-commitments, the Fed preserves optionality and reduces the odds of destabilizing repricings in rates. The trade-off: markets will oscillate more with each data print, but longer-run expectations stay anchored if the reaction function is clear.

Market Read-Through

Rates: Term Structure and the Belly of the Curve

Following the remarks, the 10-year Treasury yield edged lower as investors marked down the probability of additional hikes and modestly pulled forward the odds of late-cycle cuts. The belly of the curve (5–7 years), which best reflects the market’s guess at the average policy rate over the next cycle, often rallies most on dovish signals. A sustained decline in term premiums would further compress long yields, but the Fed will watch that easing for any signs of policy slippage.

Equities: Duration and Quality Leadership

Equities typically favor a benign-disinflation narrative. Duration-sensitive sectors (technology, software, select growth franchises) benefit as discount-rate volatility falls, while quality factors with strong free cash flow and pricing power remain in demand. Cyclicals participate if the soft-landing story holds; defensives lag if real yields drift down and risk appetite broadens.

Credit and the Dollar

Investment-grade spreads remain tight on solid balance sheets and contained default risk; high yield benefits from lower rates but remains more sensitive to growth. The dollar’s path hinges on relative-rate expectations: a modestly dovish Fed can soften the dollar at the margins, aiding multinational earnings and dollar-priced commodities, but persistent growth differentials could keep FX range-bound.

Decomposing Inflation: The Three Pillars

Goods Disinflation: The Easy Part

Freight costs, supplier delivery times, and inventories point to continued goods-price restraint. With demand rotating toward services and durable-goods backlogs cleared, this pillar looks durable absent a supply shock. The Fed will not rely solely on goods; it’s necessary, not sufficient.

Shelter: The Lagged Giant

Shelter components (rent and owners’ equivalent rent) are the largest CPI weight and move with long lags. Private new-lease data cooled earlier; those trends are filtering into official measures. As older leases reset, shelter disinflation should continue, but the glide path is slow and can be noisy month to month.

Core Services ex-Housing: The Heart of the Debate

Here, wages and productivity do battle. If unit labor costs decelerate—because nominal pay growth eases and productivity improves—firms can maintain margins without passing through price increases. Health care, insurance, and other administered or actuarial categories can be idiosyncratic; the Fed will look past one-offs and focus on broad momentum.

Balance Sheet and Market Plumbing

QT, Reserves, and Money Markets

Beyond the policy rate, the Fed’s balance sheet runoff continues to drain reserves gradually. Money-market rates, reverse repo balances, and bill supply influence how tight liquidity truly feels. If money markets show strain or reserves approach levels that risk volatility, the Fed could adjust QT before or alongside rate moves, all while keeping inflation objectives intact.

Term Premium and Long-End Volatility

Shifts in term premium—investors’ compensation for holding longer maturities—can move long yields independent of expected policy rates. Macro uncertainty, fiscal dynamics, and global demand for duration all play roles. A calmer policy path typically compresses the premium; fiscal or geopolitical shocks can widen it abruptly.

Scenario Map: Paths From Here

Bull Case: Smooth Disinflation, Soft Landing

Core inflation continues to print benignly; services ex-housing eases; wage growth cools without job losses. The Fed begins gradual cuts, perhaps later than markets hope but earlier than hawks fear. Yields drift down, equities broaden, credit stays resilient. Volatility falls across assets.

Base Case: Choppy Progress, Data-By-Data Fed

Inflation improves in fits and starts. The Fed stays patient, insisting on a string of good prints before easing. Markets trade ranges: rates rally on cool inflation, back up on hot services or strong labor. Equities grind higher with factor rotations; quality growth and balance-sheet strength lead.

Bear Case: Sticky Services or Growth Air Pocket

Services inflation re-firms, or growth slips meaningfully. In the former, the Fed stays higher for longer; real yields rise, equities derate. In the latter, the Fed cuts to cushion growth, but spreads widen and risk assets wobble if the slowdown outpaces easing.

Investor Playbook

For Long-Term Allocators

Emphasize quality compounders with pricing power and clean balance sheets that benefit from lower rate volatility. Balance with cyclicals that can outperform if a soft landing solidifies. In fixed income, laddered investment-grade exposure can lock in carry while preserving optionality if the path to cuts is uneven.

For Tactical Traders

Trade the data cadence. Into CPI/PCE and jobs reports, consider defined-risk options (call spreads for benign prints, put spreads for upside surprises in services inflation). In rates, belly steepeners can work into an easing cycle; fade moves when term premium—not policy expectations—does the heavy lifting.

For Risk Managers

Stress portfolios for joint shocks: a term-premium spike plus sticky services, or a growth wobble that widens credit spreads. Monitor liquidity metrics (bid-ask, market depth) around data releases. Ensure hedges cover both direction and vol-of-vol risk.

Data to Watch Over the Next Few Prints

Inflation Suite

- Core PCE and supercore (services ex-housing) for policy relevance.

- Shelter momentum in CPI vs. private rent trackers for confirmation of lags.

- Goods prices and import price indexes for signs of re-acceleration or renewed disinflation.

Labor and Wages

- Nonfarm payrolls, unemployment rate, and participation.

- Average hourly earnings and the Employment Cost Index for wage momentum.

- JOLTS: openings, quits, and hiring rates to gauge tightness.

Activity and Housing

- ISM PMIs (manufacturing and services) with focus on prices-paid and employment.

- Retail sales and card-spend trackers for demand resilience.

- Housing: starts, permits, mortgage rates, and affordability to assess interest-rate sensitivity.

Frequently Asked Questions

Does softer inflation mean rate cuts are imminent? Not necessarily. The Fed wants a pattern of benign data across multiple months and categories, especially services ex-housing, before easing. A single cool print is encouraging but insufficient.

Why are markets rallying if the Fed is only cautiously dovish? Optionality itself is supportive. Lower uncertainty around the policy path reduces discount-rate volatility. Even modestly dovish shifts can compress risk premiums if growth remains intact.

Could the Fed resume hikes? It’s not the base case, but officials keep the option open. A sustained re-acceleration in services inflation, renewed wage pressure, or an expectations drift could force a rethink.

How do balance-sheet decisions play into this? QT sets the liquidity backdrop. If reserves tighten too much or money markets wobble, the Fed could slow runoff independent of the rate path, fine-tuning the stance without sending mixed signals on inflation.

Bottom Line

The Fed’s message is clear: progress, not victory. Inflation is cooling, the labor market is rebalancing, and financial conditions are manageable—but policymakers want sustained confirmation before pivoting decisively. For markets, that means living with data-by-data swings while the medium-term skew shifts toward eventual easing. The investment roadmap favors quality, duration-sensitive winners and disciplined risk management in case services inflation or term premium surprises challenge today’s calm. If the data cooperate, patience now sets the stage for a smoother transition to a lower-rate regime later—on the Fed’s timeline, not the market’s wish list.